Article Text

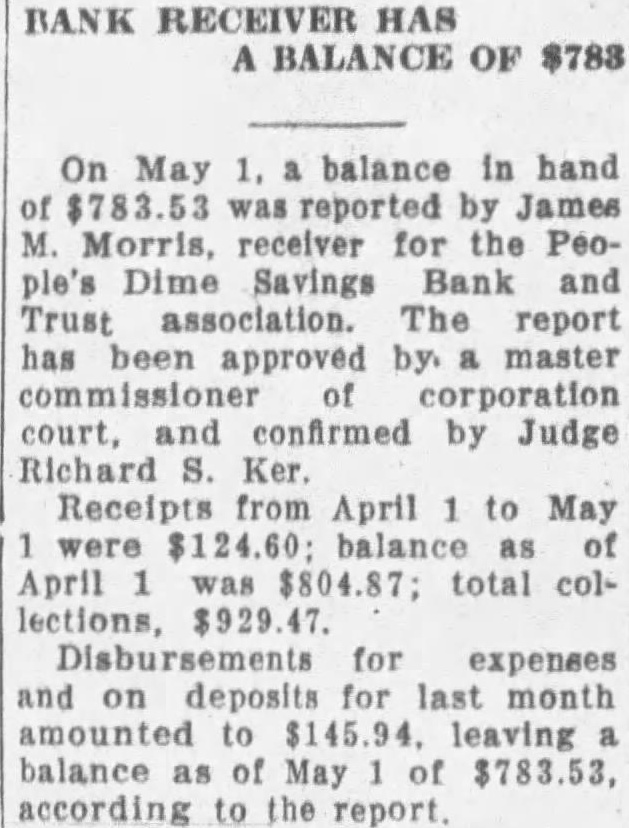

BANK RECEIVER HAS BALANCE OF On May balance in hand reported by James Morris, receiver for the People's Dime Savings Bank and Trust association. The report has been approved by. master corporation court, and confirmed by Judge Richard Ker. Receipts from April to May were balance of April was $804.87; total col$929.47. Disbursements for expenses and deposits for last month amounted to leaving balance of May of $783.53, according to the report.