Article Text

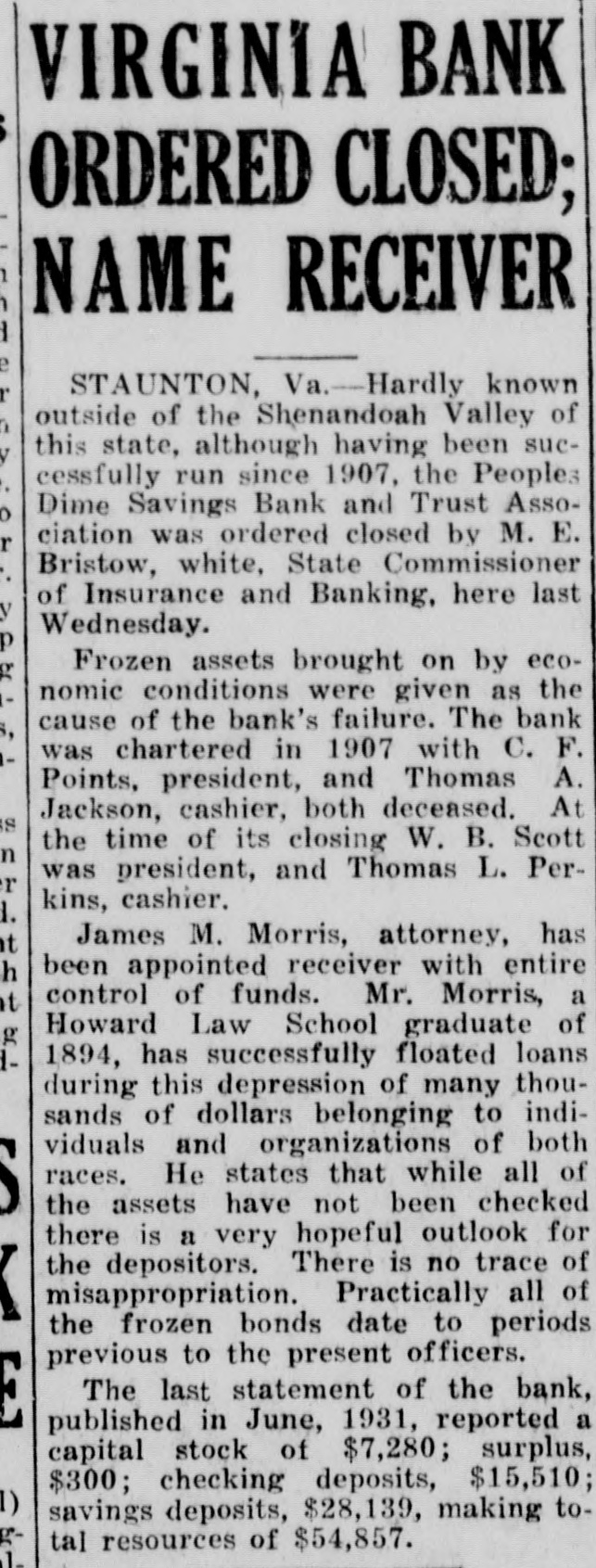

VIRGINIA BANK ORDERED CLOSED; NAME RECEIVER STAUNTON, Va.-Hardly known outside of the Shenandoah Valley of this state, although having been successfully run since 1907, the Peoples Dime Savings Bank and Trust Association was ordered closed by M. E. Bristow, white, State Commissioner of Insurance and Banking, here last Wednesday. Frozen assets brought on by economic conditions were given as the cause of the bank's failure. The bank was chartered in 1907 with C. F. Points, president, and Thomas A. Jackson, cashier, both deceased. At the time of its closing W. B. Scott was president, and Thomas L. Perkins, cashier. James M. Morris, attorney, has been appointed receiver with entire control of funds. Mr. Morris, a Howard Law School graduate of 1894, has successfully floated loans during this depression of many thousands of dollars belonging to individuals and organizations of both races. He states that while all of the assets have not been checked there is a very hopeful outlook for the depositors. There is no trace of misappropriation. Practically all of the frozen bonds date to periods previous to the present officers. The last statement of the bank, published in June, 1931, reported a capital stock of $7,280; surplus, $300; checking deposits, $15,510; savings deposits, $28,139, making total resources of $54,857.