Click image to open full size in new tab

Article Text

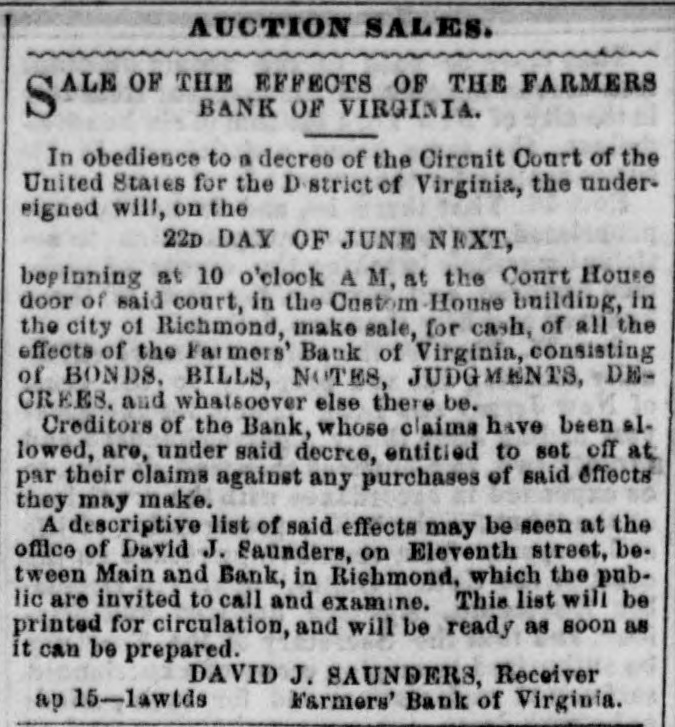

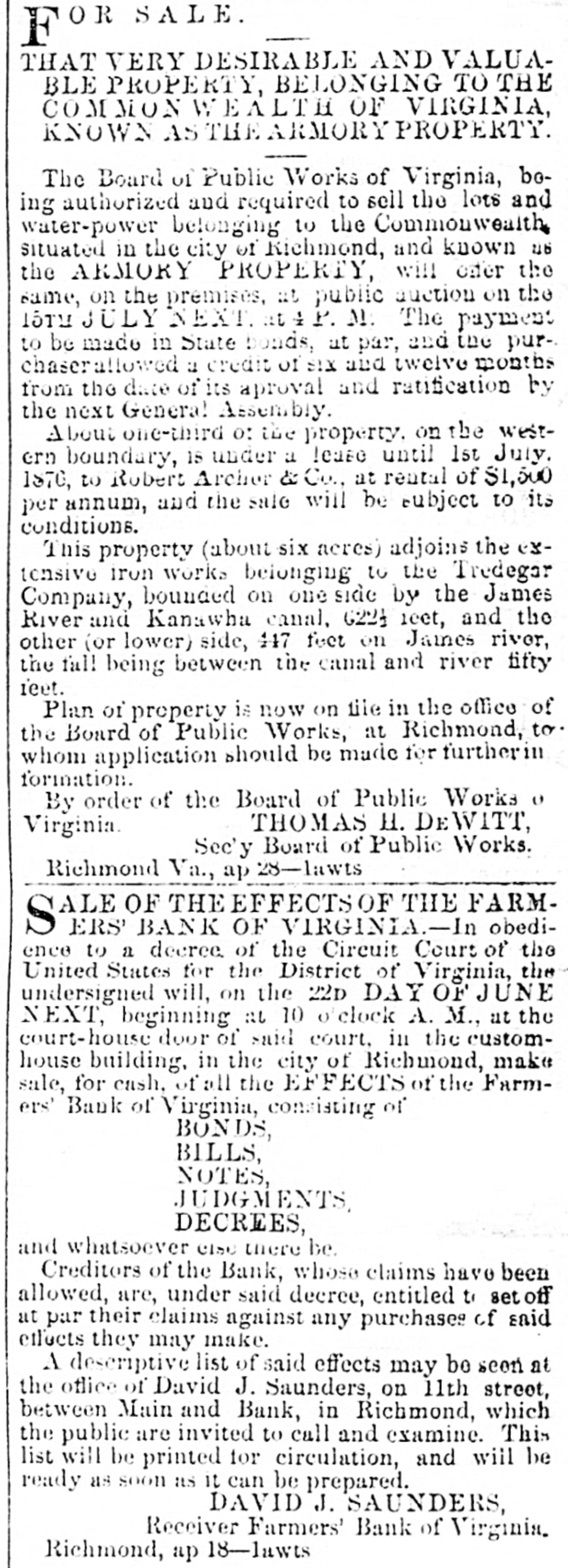

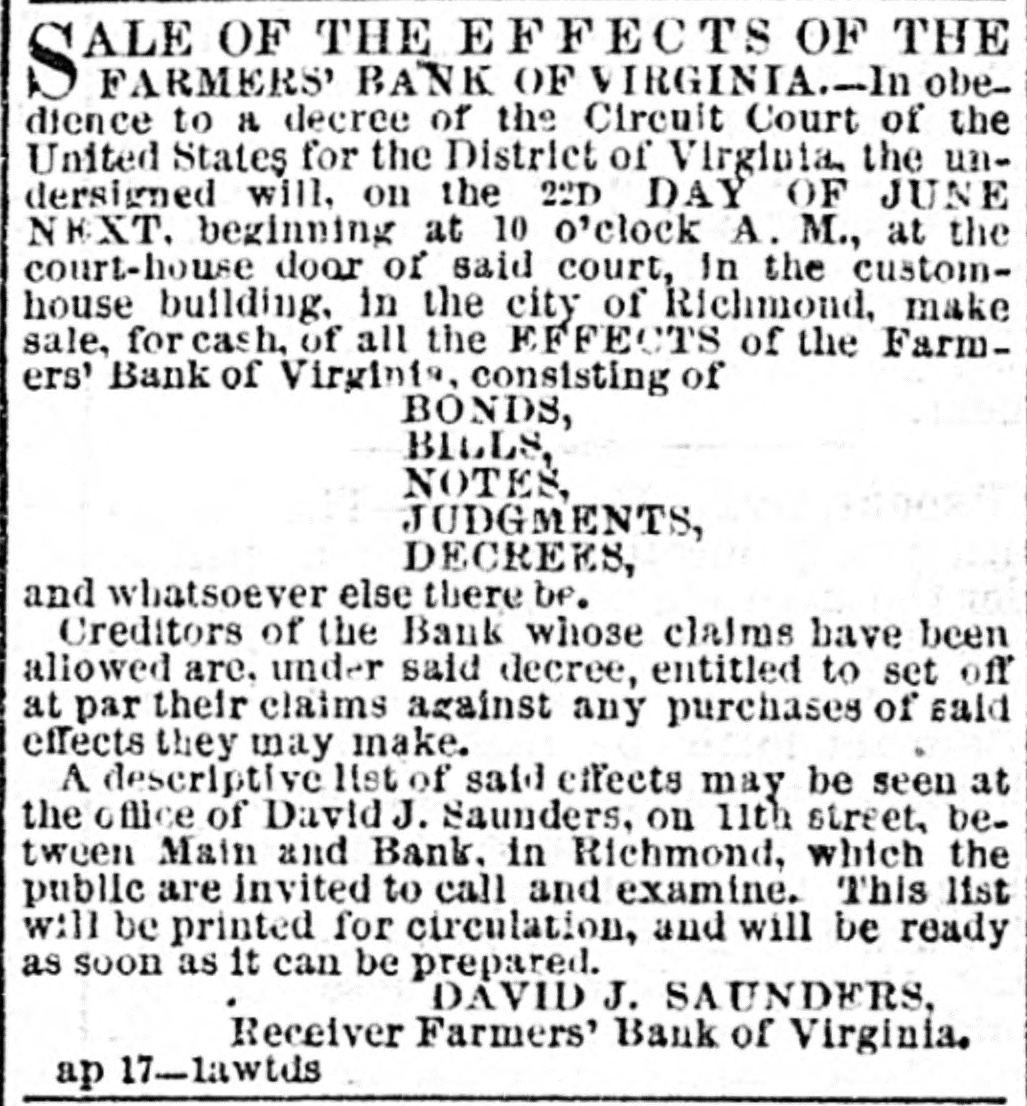

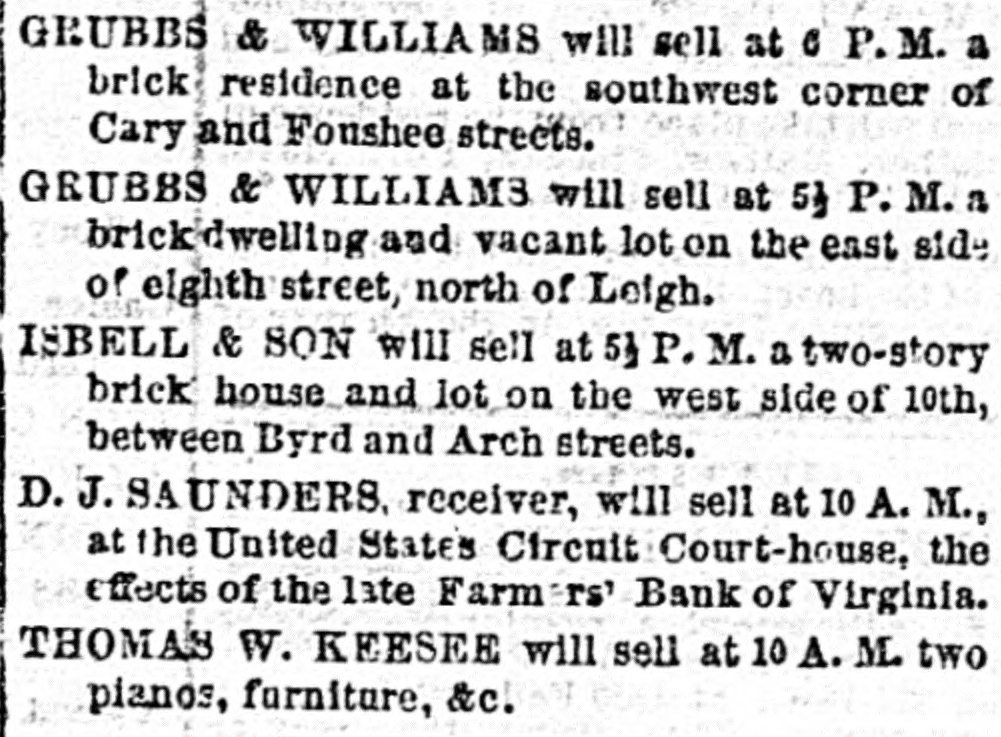

Sale of the Effects of the Farmers' Bank of Virginia. This sale commenced, according to appointment, on the steps of the Custom-bouse building, yesterday morning. It was attended by many moneyed men and other interested parties from abroad, as well as by a large number of Richmond bankers, lawyers and merchants. The sale was conducted by Messrs. Isaac Davenport and Chas. E. Wortham, of Davenport & Co., under the direction of Messrs. D. J. Saunders and C. Tardy, the receivers of the bank. Bidding was quite spirited, and the prices brought for the claims were really very good. although they may have seemed small to the casual spectator. Thousands of dollars were frequently knocked down for as many cents, while in many cases the claims were sold for double the amount named on the face of the notes. The largest sum realized by the sale of any one item was that for which the gold claim was knocked down. Just after the breaking up of the Southern Confederacy the United States Government seized $100,000 in gold belonging to the Bank of Virginia and Farmers' Bank of Virginiamoney which had been taken away from Richmond by agents of those banks at the time of the evacuation of the city to prevent its falling into the hands of the enemy. The seizure was made in Georgia, and the money, having been converted into about $130,000 in greenbacks, was deposited in the United States Treasury Department at Washington. Heretofore all efforts for the restitution of the whole or any part of it have proved unavailing, but it was stated yesterday that a prominent lawyer of Washington had offered to collect it for 12 per cent. The share of the Farmers' Bank is, in round numbers. about $65,000. It was started at $1,500, Mr. Davenport being the bidder. It was then run up first by hundreds, and then by thousands, until it was cried for $40,000; hung a long while between $40,000 and $50,000; passed $50,000 by $100; and was finally knocked down to Terry & Co. for $52,800. The purchasers seemed satisfied with the price paid. The sale proceeded as expeditiously as possible, but it was apparent early in the day that it could not be finished before night. The claims of the mother bank and of the branches at Petersburg, Charlottesville. Winchester, Fredericksburg, Alexandria, and Danville, were all disposed of, the best price being paid for the Winchester paper. Of the latter a note for $900, with two endorsers, which fell due in 1861, was sold for $3,000; another for $906 brought $2,800 and still another, calling for $807. brought $1,500. The Charlottesville and Petersburg claims also sold remarkably well, and those due the Fredericksburg branch, owing to peculiar circumstances, generally understood, seemed to be the least in demand. The sale will be resumed at the same place this morning at 10 o'clock, about half of the effects still remaining unsold. We should remark that it is conducted against a protest formally entered yesterday. Before the first item was cried Mr. Wm. H. Ryan, of Baltimore, desired to know of the receivers whether the printed list distributed among the crowd was full and accurate, embracing all the claims due the bank. Gen. B. T. Johnson, counsel for the receivers, replied that the gentleman must apply to the court for an answer to that question. Mr. Ryan then protested in writing against the sale going on, not only because there was no evidence that the above-named list was full and accurate, but because the creditors of the bank had not received proper notice. Mr. J. L. Williams, of the firm of Lancaster & Co., brokers, of this city, united in this protest.