Article Text

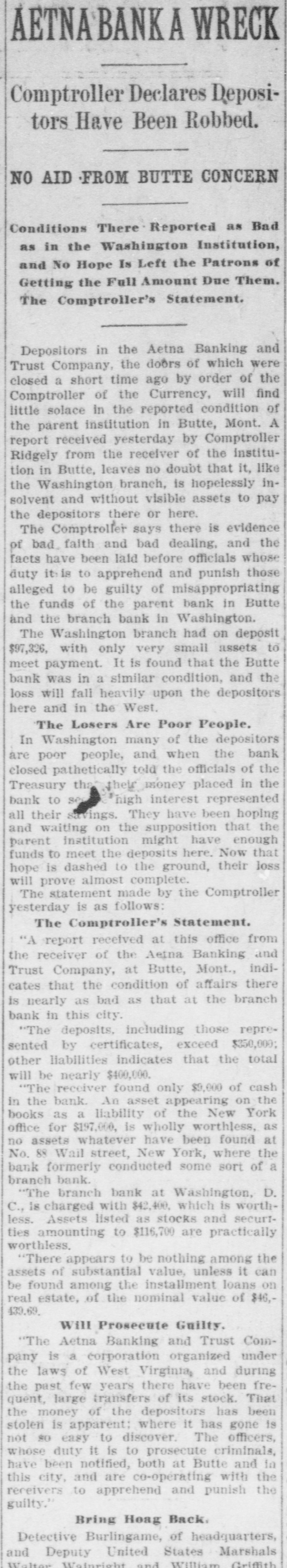

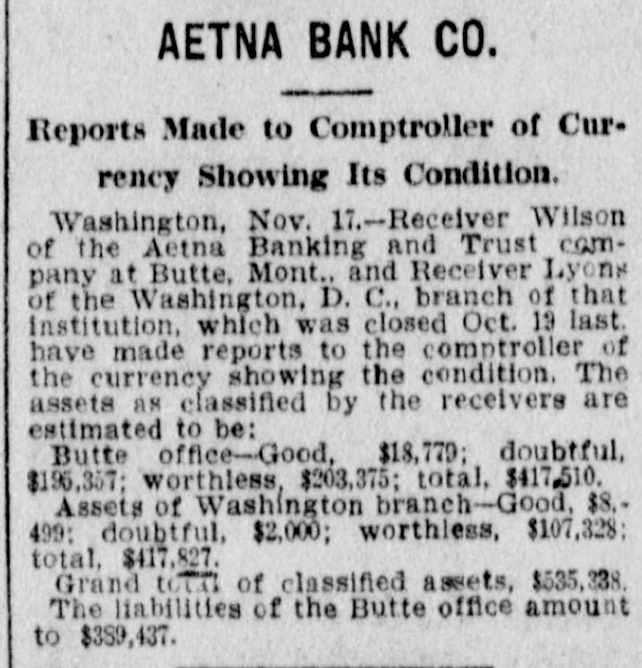

Receiver in Charge of Local Branch of Montana Institution on Order Comptroller. MOST OF DEPOSITORS WERE POORER CLASS Investments of Institution Were of Speculative Class and Made in Western Mines. The Washington branch of the Aetna Banking and Trust Company of Butte, Mon., was closed this morning by direction of T. T. Kane, acting comptrole ler of the currency The Washington branch is at 1222 F street northwest. The branch made a showing on Sep= tember 4, in its report to the comptrol1er, of assets and liabilities each figuring $123,942.04 of the liabilities, $42,000 is savings deposits, $38,000 individual deposits, and $40,000 represented advances from the head institution in Butte. The opinion of Acting Comptroller Kane is that the losses of the depositors will be heavy. The collaterals represent unknown Western ventures of doubtful value. Little is known in Washington about the parent concern. It is credited with $100,000 capital and is incorporated in West Virginia. The comptroller, under the authority given him by the new banking law for the District, approved June 25 last. examined the local institution and found its condition so unsatisfactory that the decision to close it was reached late yesterday afternoon, and promptly acted upon this morning. Heinze Formerly President. F. Augustus Heinze young Napoleon of copper finance, politics ritative candidate for Senato in Montana, ao prince of mining mipulators, was president of the Aetna Banking and Trust Company un= til a little over a year ago, when the management was reorganized and he retired from the presidency but still retained his interests in the concern. Last December it is stated at the comp troller's office. Heinze disposed of his holdings in the institution to Fred B. Street, a New Haven, Conn. man, who in turn, in August last sold out. The present head at Butte is C. W. Dodson, of Boston In accordance with the decision of the acting comptroller, the Washington branch was placed in the hands of Robert Lyons as receiver He took pos= session of the banking office and aconce at counts Neither at the comptroller's office nor in banking circles of Washington is much known about either the local branch OF the parent concern. he impression has said a prominent banker 'that the Institution secured deposits in Washington to use in invest= ments in the West. Local banks have had little to do with them Occasionally checks on them have come to us, and they have been cashed when there was cash on deposit. Investments Were Speculative. That the institution made investments chiefly in Western concerns, and that these were mainly speculative, was borne out by Acting Comptroller Kane. He said: "The list of collateral in possession of the branch includes the Canon City, Florence and Royal Gorge International Railroad Company's paper. We understand the road is unfinished. Also, there is collateral of the Dividend Mining and Milling Company, of Arizona, the Osage Consolidated Oil and Gas Company, also of Arizona: and the Helena and Dillon Gold Mining Company. I don't care to give the amounts of the different items held, however They all seem to be unknown, and of doubtful value, and should say that the depositors will likely lose a large share of their money. "The concern has an agency in New York, though we do not stand that it did banking usiness there. Whether it had branches in other cities we have not yet learned "The savings deposits represented generally poor people, whose money was in small mounts. The bank bad savings bank lock boxes ttered all over town, through which the money of the poorest class of depositors had been gathered in. Uncertainty as to Outcome. Mr. Kane was asked about the legal status of depositors in the Washington branch, as against the assets of the Butte, or parent, establishment "I suppose," he replied "that if the bank at Butte is solvent it will make good the claims of depositors in the Washington branch. But as to the legal status, or as to our power to investigate and take charge of the institution at Butte, I can't make statement at this time. This is the first experience we have had under the new law. and, while that law gives as ample powers over institutions in the District, the extent of our powers as against related institutio outside the District is a matter for the lawyers to advise us about If the parent institution does not make good any deficit here, the question of holding assets there to meet It would have to be settled later Mr. Kane was unable to tell anything about the status of the Butte bank, aside from the fact that It was organized under West Virginia law I don't know whether it has been subject to examination by the Montana banking authorities or not he said, "or whether the State of West Virginia has attempted to maintain any supervision over it. Under our new District law the comptrolle has authority over all institutions in the District wherein they have been orporated John T Hoag, assistant cashier in charge of the Washington branch, was found at the banking house assisting Bank Examiner Owen T. Reeves, jr., (Continued on Ninth Page.)