Article Text

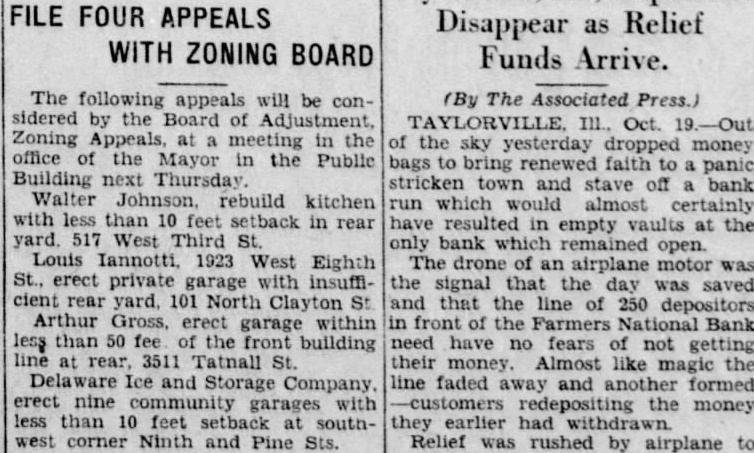

FILE FOUR APPEALS WITH ZONING The following appeals will be con- The Associated sidered by the Adjustment, Zoning meeting the the yesterday dropped money office the Mayor Public bags faith panic Building next Thursday stricken town and stave off bank Walter rebuild kitchen which almost with less than 10 feet setback in rear have resulted empty vaults at the yard. 517 West Third bank which Louis Iannotti, 1923 West Eighth drone of an airplane motor erect private garage insuffi- signal the day was saved cient rear yard, 101 North that the line of 250 depositors Arthur erect within garage in front Farmers Bank than 50 fee the building need have no fears getting rear, 3511 Tatnall their money. Almost like magic the Ice and Company, line faded away and formed erect nine community -customers the money less than feet southcorner Ninth and Pine Sts. Relief rushed airplane