Article Text

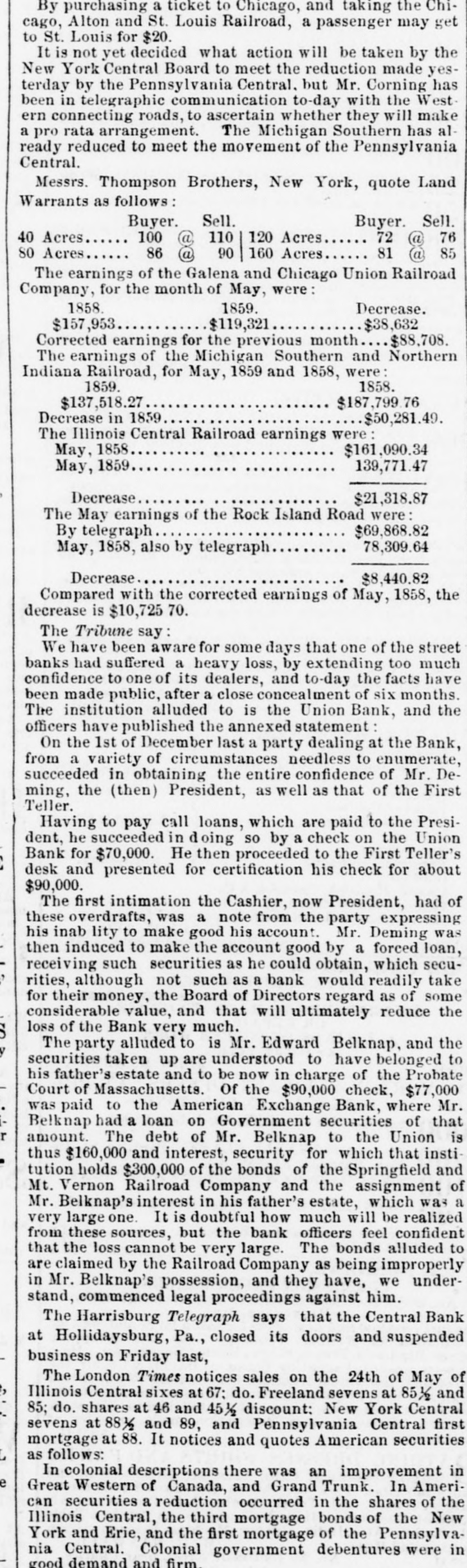

By purchasing a ticket to Chicago, and taking the Chi cago, Alton and St. Louis Railroad, a passenger may get to St. Louis for $20. It is not yet decided what action will be taken by the New York Central Board to meet the reduction made yesterday by the Pennsylvania Central. but Mr. Corning has been in telegraphic communication to-day with the West ern connecting roads, to ascertain whether they will make a pro rata arrangement. The Michigan Southern has already reduced to meet the movement of the Pennsylvania Central. Messrs. Thompson Brothers, New York, quote Land Warrants as follows: Buyer. Sell. Buyer. Sell. 120 Acres 40 Acres 72 @ 76 100 @ 110 86 90 80 Acres 160 Acres @ 81 @ 85 The earnings of the Galena and Chicago Union Railroad Company, for the month of May, were: 1859. 1858. Decrease. $157,953 $38,632 $119,321 $88,708. Corrected earnings for the previous month The earnings of the Michigan Southern and Northern Indiana Railroad, for May, 1859 and 1858, were: 1859. 1858. $187,799.76 $137,518.27 Decrease in 1859 $50,281.49. The Illinois Central Railroad earnings were: $161,090.34 May, 1858 139,771.47 May, 1859 Decrease $21,318.87 The May earnings of the Rock Island Road were: $69,868.82 By telegraph 78,309.64 May, 1858, also by telegraph Decrease $8,440.82 Compared with the corrected earnings of May, 1858, the decrease is $10,725 70. The Tribune say: We have been aware for some days that one of the street banks had suffered a heavy loss, by extending too much confidence to one of its dealers, and to-day the facts have been made public, after a close concealment of six months. The institution alluded to is the Union Bank, and the officers have published the annexed statement: On the 1st of December last a party dealing at the Bank, from a variety of circumstances needless to enumerate, succeeded in obtaining the entire confidence of Mr. Deming, the (then) President, as well as that of the First Teller. Having to pay call loans, which are paid to the President, he succeeded in doing so by a check on the Union Bank for $70,000. He then proceeded to the First Teller's desk and presented for certification his check for about $90,000. The first intimation the Cashier, now President, had of these overdrafts, was a note from the party expressing his inab lity to make good his account. Mr. Deming was then induced to make the account good by a forced loan, : receiving such securities as he could obtain, which securities, although not such as a bank would readily take for their money, the Board of Directors regard as of some considerable value, and that will ultimately reduce the loss of the Bank very much. The party alluded to is Mr. Edward Belknap. and the securities taken up are understood to have belonged to his father's estate and to be now in charge of the Probate Court of Massachusetts. Of the $90,000 check, $77,000 was paid to the American Exchange Bank, where Mr. Belknap had a loan on Government securities of that r amount. The debt of Mr. Belknap to the Union is thus $160,000 and interest, security for which that institution holds $300,000 of the bonds of the Springfield and Mt. Vernon Railroad Company and the assignment of Mr. Belknap's interest in his father's estate, which was a very large one. It is doubtful how much will be realized from these sources, but the bank officers feel confident that the loss cannot be very large. The bonds alluded to are claimed by the Railroad Company as being improperly in Mr. Belknap's possession, and they have, we understand, commenced legal proceedings against him. The Harrisburg Telegraph says that the Central Bank at Hollidaysburg, Pa., closed its doors and suspended business on Friday last, The London Times notices sales on the 24th of May of Illinois Central sixes at 67; do. Freeland sevens at 851/2 and 85; do. shares at 46 and 45 1/2 discount: New York Central sevens at 88 1/2 and 89, and Pennsylvania Central first mortgage at 88. It notices and quotes American securities as follows: In colonial descriptions there was an improvement in e Great Western of Canada, and Grand Trunk. In Amerithe third can Illinois securities Central, a reduction mortgage occurred in bonds the of shares the of New the York and Erie, and the first mortgage of the Pennsylvania Central. Colonial government debentures were in good demand and firm