Article Text

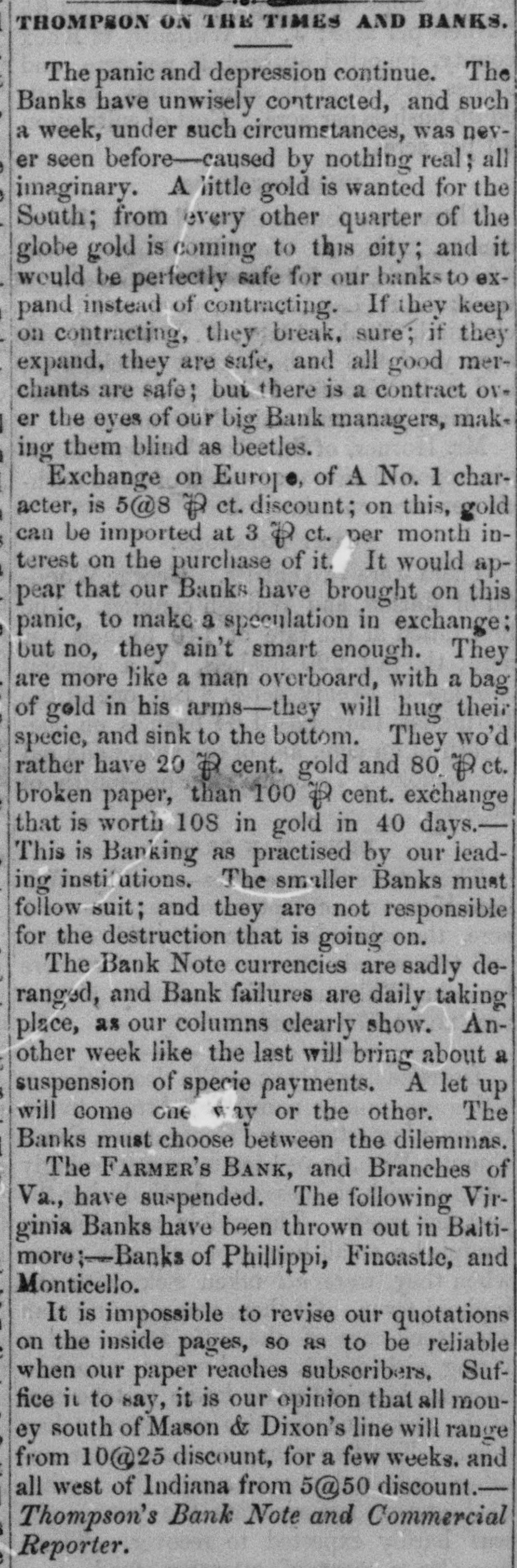

THOMPSON ON THE TIMES AND BANKS. The panic and depression continue. The Banks have unwisely contracted, and such a week, under such circumstances, was never seen before-caused by nothing real; all imaginary. A little gold is wanted for the South; from every other quarter of the globe gold is coming to this city; and it would be perfectly safe for our banks to expand instead of contracting. If they keep on contracting, they break, sure; if they expand, they are safe, and all good merchants are safe; but there is a contract OV= er the eyes of our big Bank managers, making them blind as beetles. Exchange on Europe of A No. 1 character, is 5@8 P ct. discount; on this, gold can be imported at 3 P ct. per month interest on the purchase of it. It would appear that our Banks have brought on this panic, to make a speculation in exchange; but no, they ain't smart enough. They are more like a man overboard, with a bag of gold in his arms-they will hug their specie, and sink to the bottom. They wo'd rather have 20 P cent. gold and 80. P ct. broken paper, than 100 if cent. exchange that is worth 108 in gold in 40 days.This is Banking as practised by our leading insti utions. The smaller Banks must follow suit; and they are not responsible for the destruction that is going on. The Bank Note currencies are sadly deranged, and Bank failures are daily taking place, as our columns clearly show. Another week like the last will bring about a suspension of specie payments. A let up will come one ay or the other. The Banks must choose between the dilemmas. The FARMER'S BANK, and Branches of Va., have suspended. The following Virginia Banks have been thrown out in Baltimore;-Banks of Phillippi, Finoastle, and Monticello. It is impossible to revise our quotations on the inside pages, so as to be reliable when our paper reaches subsoribers, Suffice it to say, it is our opinion that all money south of Mason & Dixon's line will range from 10@25 discount, for a few weeks. and all west of Indiana from 5@50 discount.Thompson's Bank Note and Commercial Reporter.