Click image to open full size in new tab

Article Text

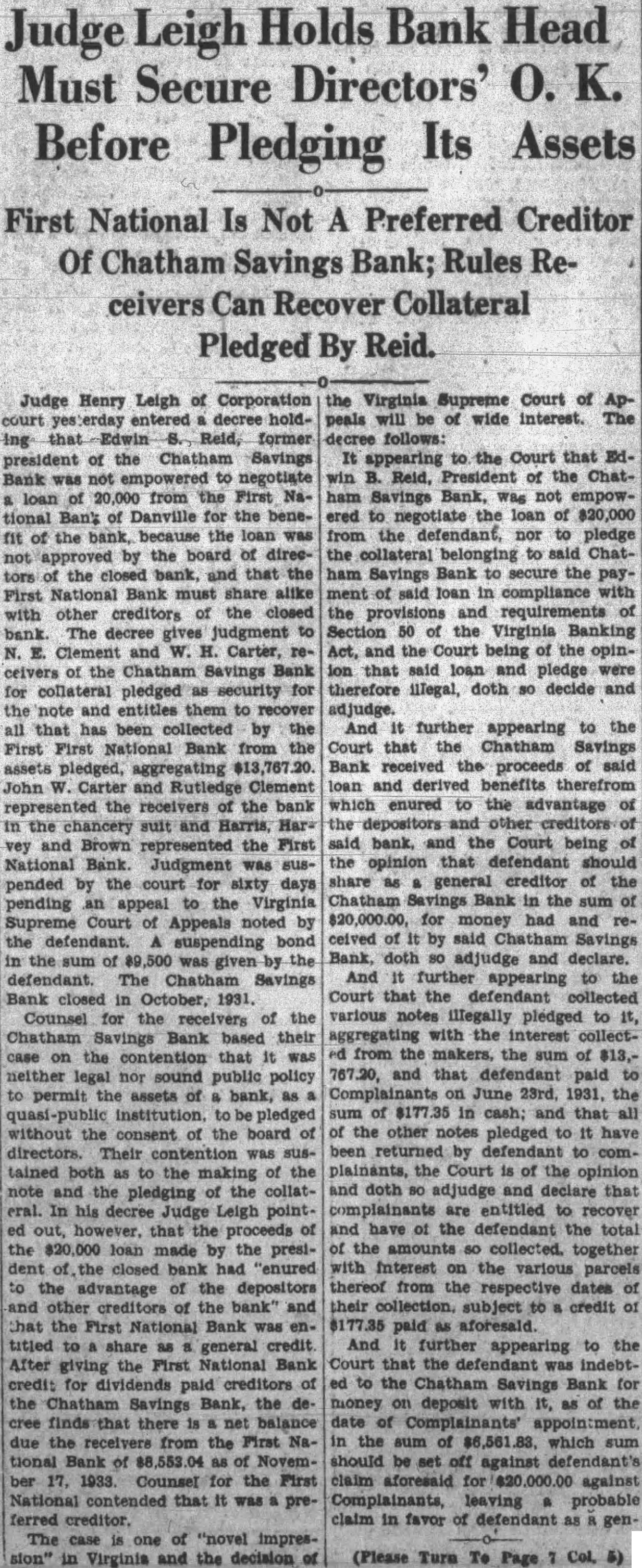

Judge Leigh Holds Bank Head Must Secure Directors' Before Pledging Its Assets

First National Is Not A Preferred Creditor Of Chatham Savings Bank; Rules Receivers Can Recover Collateral Pledged By Reid.

Judge Henry Leigh of Corporation decree holdReid, former president of the Chatham Savings Bank not negotiate loan 20,000 from the First NaBan's Danville for the benefit of the because the loan was by the of directhe bank, and the First Bank alike with creditors the closed decree judgment Clement and W. Carter, ceivers the Chatham Savings pledged for entitles them to that has been collected by the First First National Bank from pledged, aggregating John Carter and Rutledge Clement represented the receivers the bank in the chancery suit and Harris, and Brown represented First National Bank. Judgment was suspended the court for sixty days pending appeal to the Virginia Supreme Court of Appeals noted the defendant. suspending the was given the defendant. Chatham Savings Bank closed in October, Counsel the receivers of the Chatham Savings Bank based their case contention that neither legal sound public policy permit the assets bank, pledged without the consent the board was sustained the making the pledging the collateral. In Judge Leigh point. that the the $20,000 loan made by the presiclosed had "enured the advantage of depositors creditors of the bank" and that the First Bank engeneral After the First National Bank credit for paid creditors the Savings Bank, the dethere balance due the from the First of ber 17, Counsel the First National that ferred "novel impresVirginia and the the Virginia Supreme Court of peals will be wide interest. The follows: appearing the Court that Edwin B. Reid, of the ChatBank, not empowered to the loan $20,000 from the nor to pledge the belonging said Chatham Savings Bank to secure the said loan in compliance with the and requirements Section 50 the Virginia Banking Act, and the the opinion pledge were therefore illegal, doth decide and adjudge. And further appearing to the Court that the Chatham Savings Bank received the proceeds of said loan derived benefits therefrom which enured to advantage the said bank, Court being the opinion that defendant should share general creditor of the Chatham Savings Bank in sum for money had and ceived said Chatham Savings Bank, doth adjudge and declare. And further appearing to the Court that defendant collected various notes illegally pledged to it, aggregating the interest collectfrom the makers, the sum of $13,767.20, and that defendant paid on June 23rd. 1931, of $177.35 in cash; and that all the other pledged have been by complainants, the Court of the opinion and doth adjudge that are entitled and have the defendant the total the together with Interest the various from the dates their subject credit $177.35 paid And appearing to the Court that the to the Bank for money on deposit with of the the sum of which sum off against claim aforesaid against Complainants, leaving probable claim in favor of defendant gen-

(Please