Article Text

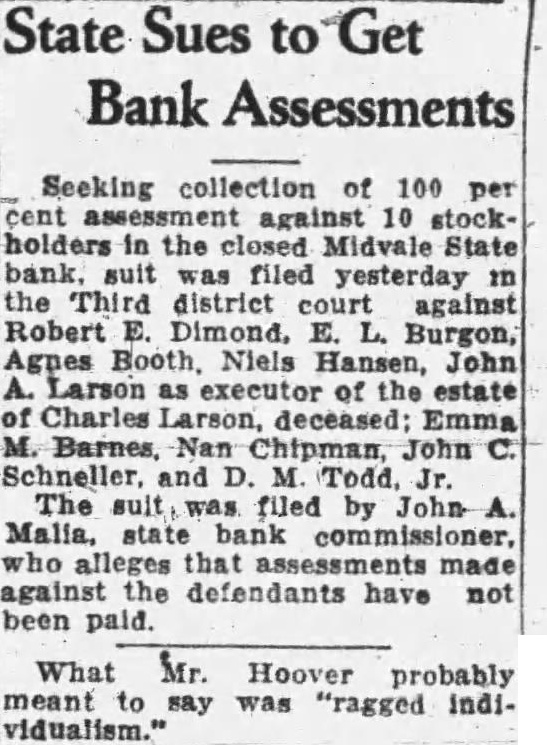

State Sues to Get Bank Assessments Seeking collection of 100 per cent assessment against 10 stockholders in the closed Midvale State bank. suit was filed yesterday in the Third district court against Robert E. Dimond, E. L. Burgon, Agnes Booth. Niels Hansen, John A. Larson as executor of the estate of Charles Larson, deceased: Emma M. Barnes, Nan Chipman, John C. Schneller, and D. Todd. Jr. The suit, was filed by John A. Malia, state bank commissioner. who alleges that assessments made against the defendants have not been paid. What Mr. Hoover probably meant to say was "ragged individualism."