Article Text

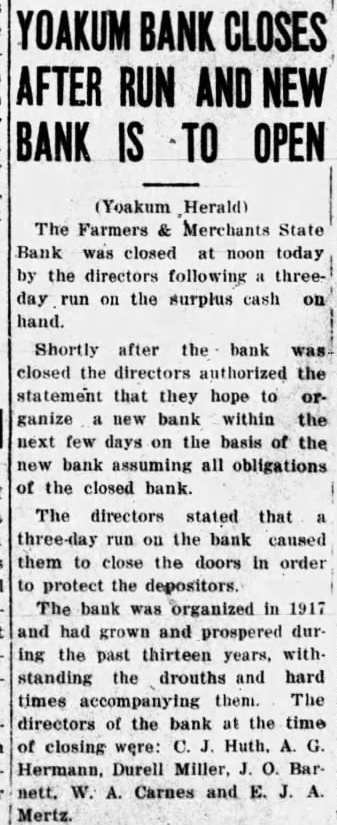

CLOSES AFTER RUN AND NEW BANK IS TO OPEN (Yoakum Herald) The Farmers & Merchants State Bank was closed at noon today by the directors following threeday run on the surplus cash on hand. Shortly after the bank was closed the directors authorized the statement that they hope to organize new bank within the next few days on the basis of the new bank assuming all obligations of the closed bank. The directors stated that three-day run on the bank caused them to close the doors in order to protect the depositors. The bank was organized in 1917 and had grown and prospered ing the past thirteen years, standing the drouths and hard times accompanying them. The nett. W. A. Carnes and E. Mertz.