Click image to open full size in new tab

Article Text

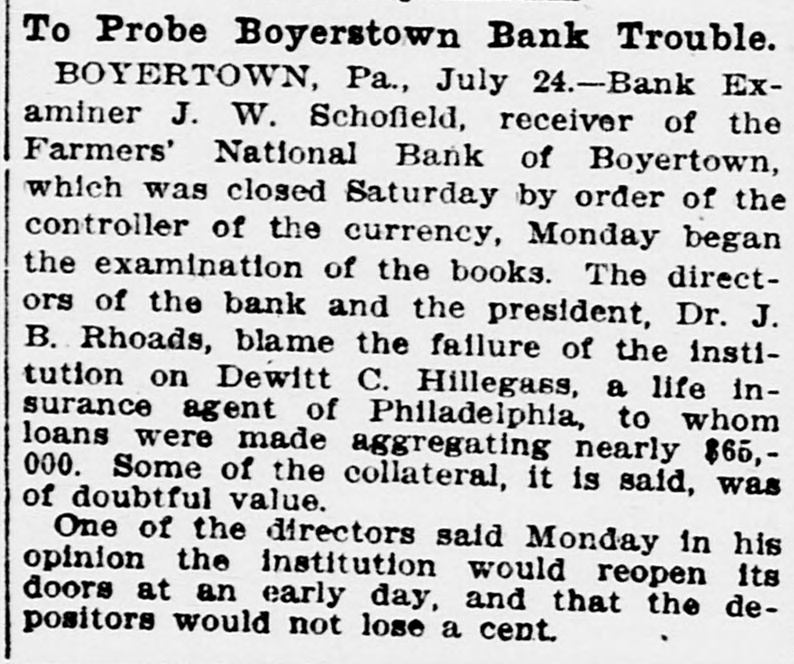

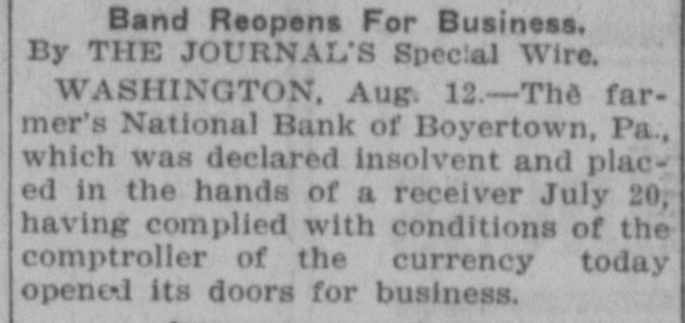

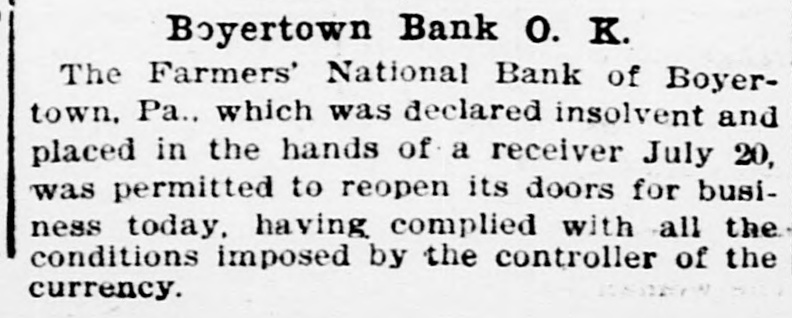

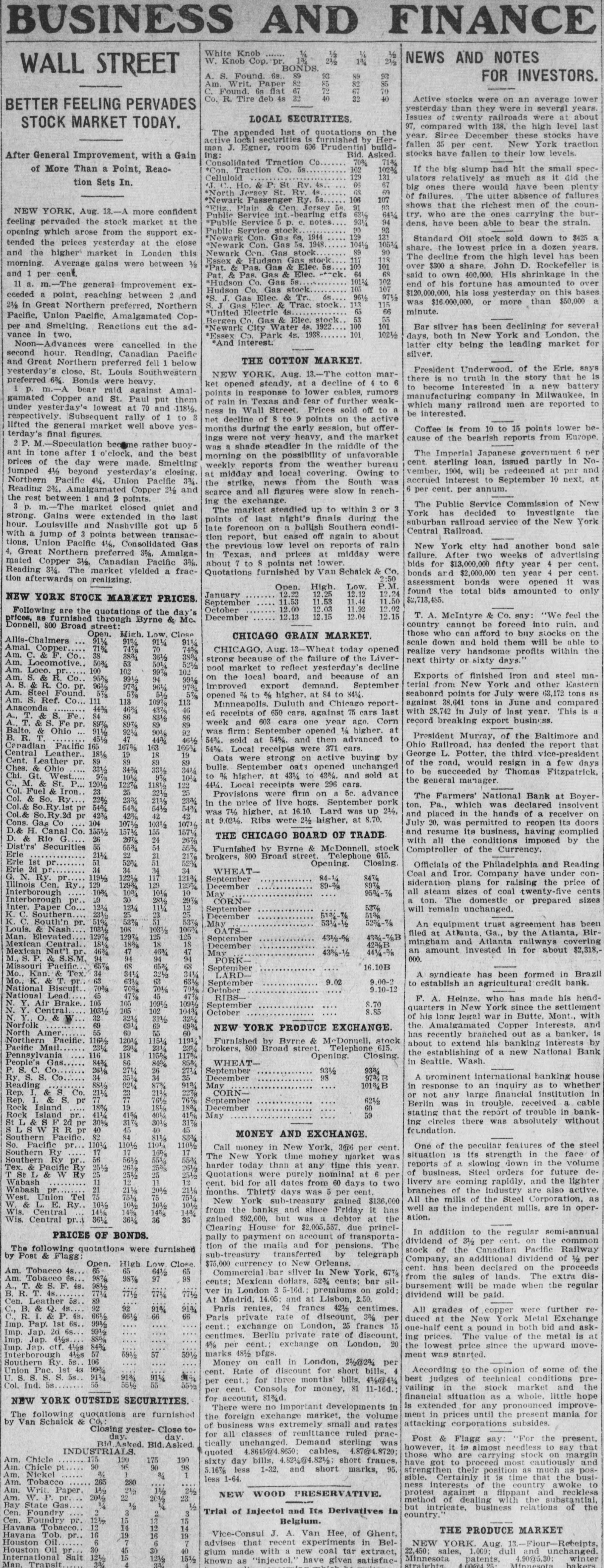

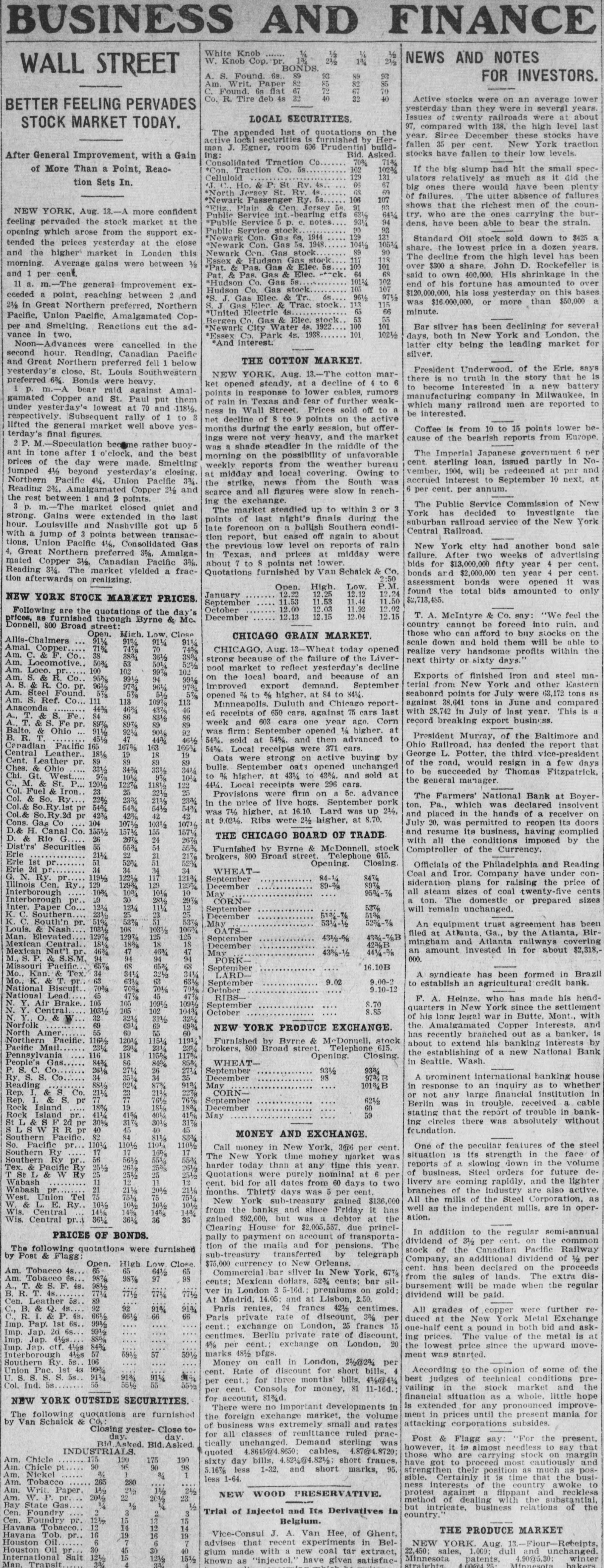

BUSINESS AND FINANCE White Knob 1/4 ....... ½ NEWS AND NOTES 13/4 1% 2½ W. Knob Cop. pr 2½ BONDS. WALL STREET 93 89 93 A. S. Found. 6s. 89 FOR INVESTORS. 82 85 85 Am Writ. Paper 82 67 Found. 6g flat 67 40 40 32 Co. R. Tire deb 4s 32 Active stocks were on an average lower BETTER FEELING PERVADES yesterday than they were in several years. Issues of twenty railroads were at about LOCAL SECURITIES. STOCK MARKET TODAY. 97, compared with 138. the high level last The appended hst of quotations on the year. Sirce December these stocks have active local is furnished by Herfallen 35 per cent. New York traction man J. Egner, room 606 Prudentis buildstocks have fallen to their low levels. Bid. Asked. Ing: After General Improvement, with a Gain Consolidated Traction Co 71% 70% 102 If the big slump had hit the small spec*Con. Traction Co. 5s of More Than a Point, Reac1023/4 131 129 Celluloid ulators relatively as much as it did the tion Sets In. 66 67 'J. Ho. & P. St Rv. 4s. big ones there would have been plenty 68 69 *North Jersey St. Rv. 4s of failures. The utter absence of failures 106 107 *Newark Passenger Ry. 5s shows that the richest men of the coun"Eliz. Plain & Cen Jersey 5s NEW YORK, Aug. 13.-A more confident 631/2 try. who are the ones carrying the burPublic Service int bearing etfs 641/4 94 feeling pervaded the stock market at the *Publie Service 5 p. e. notes. 931/4 dens, have been able to bear the strain. 90 93 Public Service stock opening which arose from the support ex129 131 *Newark Con. Gas 6s. 1944 Standard Oil stock sold down to $425 a tended the prices yesterday at the close "Newark Con. Gas 5s. 1948 1041/2 1051/4 share. the lowest price in a dozen years. 90 89 and the higher market in London this Newark Con. Gas stock The decline from the high level has been 118 117 Essex & Hudson Gas stock morning. Average gains were between ½ over $300 a share. John D. Rockefeller is 100 101 Pat. & Pas. Gas & Elec. 5s 64 68 and per cent. said to own 400,000. His shrinkage in the Pat. & Pas. Gas & Elec. -t~ck. 102 1011/4 *Hudson Co. Gas 5s end of his fortune has amounted to over 11 a. m.-The general improvement ex105 107 Hudson Co. Gas stock $120,000,000. his loss yesterday on this bases ceeded a point, reaching between 2 and 68 961/2 9732 S. J. Gas Elec. & Tr. was $16,000,000, or more than $50,000 a 115 113 Gas Elec & Trac. stock 2½ In Great Northern preferred, Northern 65 66 minute. *United Electric 4s. Pacific, Union Pacific, Amalgamated Cop53 55 Bergen Gas & Elec. stock 100 101 Bar silver has been declining for several per and Smelting. Reactions cut the ad*Newark City Water 4s. 1922 vance in two. 101 1021/2 *Essex Park 4s. 1938 days, both in New York and London, the *And interest. Noon-Advances were cancelled in the latter city being the leading market for silver. second hour. Reading. Canadian Pacific THE COTTON MARKET. and Great Northern preferred fell 1 below President Underwood. of the Erie. says yesterday's close, St. Louis Southwestern NEW YORK, Aug. 13.-The cotton marthere is no truth in the story that he is preferred 6%. Bonds were heavy. ket opened steady, at a decline of 4 to 6 to become interested in a new battery 1 p. m.-A bear raid against Amalpoints in response to lower cables, rumors manufacturing company in Milwaukee, in gamated Copper and St. Paul put them of rain in Texas and fear of further weakwhich many railroad men are reported to under yesterday's lowest at 70 and 118½, ness in Wall Street. Prices sold off to a be interested. respectively. Subsequent rally of 1 to 3 net decline of 8 to 9 points on the active lifted the general market well above yesmonths during the early session, but offerCoffee is from 10 to 15 points lower beterday's final figures. ings were not very heavy, and the market cause of the bearish reports from Europe. 2P. M.-Speculation become rather buoywas a shade steadier in the middle of the The Imperial Japanese government 6 per ant in tone after 1 o'clock, and the best morning on the possibility of unfavorable cent. sterling loan, issued partly in Noprices of the day were made. Smelting weekly reports from the weather bureau vember. 1904, will be redeemed at par and jumped 41/2 beyond yesterday's closing, at midday and local covering. Owing to accrued interest to September 10 next, at Northern Pacific 4½, Union Pacific 3%. the strike, news from the South was 6 per cent. per annum. Reading 2%. Amalgamated Copper 21/2 and scarce and all figures were slow in reachthe rest between and 2 points. ing the exchange. The Public Service Commission of New 3 p. m.-The market closed quiet and The market steadied up to within 2 or 3 York has decided to investigate the strong. Gains were extended in the last points of last night's finals during the suburban railroad service of the New York hour. Louisville and Nashville got up 5 late forenoon on a bullish Southern condiCentral Railroad. with a jump of 3 points between transaction report, but eased off again to about tions, Union Pacific 41/8, Consolidated Gas the previous low level on reports of rain New York city had another bond sale 4, Great Northern preferred 3%, Amalgain Texas. and prices at midday were failure. After two weeks of advertising mated Copper 31/2, Canadian Pacific 3%. about 7 to 8 points net lower bids for $13,000,000 fifty year 4 per cent. Reading 31/4. The market vielded a fracQuotations furnished by Van Schaick & Co. bonds ard $2,000,000 ten year 4 per cent. 2:50 tion afterwards on realizing. assessment bonds were opened it was Open. High. Low. P.M. found the total bids amounted to only 12.22 12.25 12.12 12.24 January NEW YORK STOCK MARKET PRICES. $2,713,485. 11.50 11.53 11.53 11.44 September 12.02 12.03 12.00 11.92 October Following are the quotations of the day's T. A. McIntyre & Co. any: "We feel the 12.04 12.15 12.15 12.13 December prices, as furnished through Byrne & Mc. country cannot be forced into ruin. and Donnell, 800 Broad street: those who can afford to buy stocks on the Open. High. Low. Close CHICAGO GRAIN MARKET. Allis-Chalmers 911/4 91% 911/4 911/4 scale down and hold them will be able to Amal. Copper 747/8 70 718/4 74% CHICAGO. Aug. 13-Wheat today opened realize very handsome profits within the Am. C. & F. Co., 38% 361/2 38% strong because of the failure of the Livernext thirty or sixty days." Am. Locomotive.. 50% 501/4 521/2 pool market to reflect yesterday's decline Am. Loco. pr. 100 102 102 997/8 Exports of finished iron and steel maon the local board. and because of an Am. S. & R. Co. 95% 94 99½ 991/8 terial from New York and other Eastern S. R. Co. improved export demand. September 961/2 pr. 97% 961/4 97% Am. Steel Found. seaboard points for July were 68,172 tons as 57/8 57/8 51/2 opened 3/A to % higher, at S4 to 841/4. 57/8 Am. S. Ref. Co... 111 113 113 109% against 38,641 tons in June and compared Minneapolis. Duluth and Chicago reportAnaconda 443/3 46% with 28,742 in July of last year. This is a ed receipts of 650 cars. against 75 cars last A., S. & Fe. 84 86 831/2 record breaking export business. week and 603 cars one year ago. Corn 897/8 89 89 T. & S. Fe pr. 897/8 Balto. & Ohio was firm: September opened 1/8 higher. at 911/2 921/4 92 901/8 President Murray, of the Baltimore and R. 451/2 461/2 443/4 54%. sold at 54%. and then advanced to Ohio Railroad. has denied the report that Canadian Pacific 165 163 167% 166% 54%. Local receipts were 371 cars. 19 George L. Potter. the third vice-president 18 Central Leather.. 18½ 19 Oats were strong on active buying by 89 89 89 Cent. Leather pr. 89 of the road, would resign in a few days bulls. September oats opened unchanged Ches. & Ohio 331/2 343/4 331/2 341/4 to be succeeded by Thomas Fitzpatrick, Chi. Gt. West to % higher. at 431/4 to 43%. and sold at 97/3 101/4 9% 101/4 the general manager. M. St. & P... 1181/2 1201/2 441/4. Local receipts were 296 cars. 122 1227/8 Col. Fuel & Iron. 25 221/2 Provisions were firm on a 5c. advance The Farmers' National Bank at BoyerCol. & So. Ry 22% 23% 23% 211/2 in the price of live hogs. September pork ton. Pa., which was declared insolvent 54% Col.& So. Ry. 1st pr 54% 541/2 54% was 7½ higher, at 16.10. Lard was up 21/2, and placed in the hands of a receiver on 42% 42 42 42% Col.& So. Ry pr at 9.021/2. Ribs were 21/2 higher, at 8.70. Cons. Gas Co 104 July 20, was permitted to reopen its doors 1071/2 10716 10316 155 1571/4 D.& H. Canal Co. 1551/2 1571/4 and resume its business, having complied THE CHICAGO BOARD OF TRADE D. & Rio G 24 267/8 267/3 with all the conditions imposed by the Dist'rs' Securities 55% 55% Furnished by Byrne & McDonnell, stock Comptroller of the Currency. Erie 22 211/4 21% brokers, 800 Broad street Telephone 615. 51 Erie 1st pr Closing. Opening. 52% 52% Officials of the Philadelphia and Reading 34 34 Erie 2d pr 34 WHEATCoal and Iron Company have under con847/4 84-1/4 117 121% 1221/8 1191/2 G.N. Ry. pr September sideration plans for raising the price of 897/A Illinois Cen. Ry., 129 1294 129 December 89-3/8 120% all steam sizes of coal twenty-five cents Interborough 10 10% 1034 101/8 95%-7/7/8 May 29 30 Interborough pr 281/2 CORN297/8 a ton. The domestic or prepared sizes Inter. Paper Co... 121/4 537/8 111/4 121/4 September will remain unchanged. Southern 5134-7/8 23½ 51% December 537/8 53% 51% C. South'n pr. 52%-7/7/8 53½-1/1/2 May An equipment trust agreement has been Louis. & Nash 108 1031/2 10634 1031/2 OATSfiled at Atlanta. Ga., by the Atlanta, BirMan. Elevated 125 1297/A 125 1297/8 431/2-5/8 September mingham and Atlanta railways covering Mexican Central. 18 42%B 183/8 181/4 December an amount invested in for about $2,318,Mexican Nat'l pr. 47 463/4 46% May 43%-1/2 441/4-3/8 94 94 94 000. P. & S.S.M. 94 PORK68 Missouri Pacific 68 65% 65% 16.10B September Mo., Kan. & Tex. 341/4 A syndicate has been formed in Brazil 341/4 32½ LARDMo., T. pr 9.00-2 6316 631/8 9.02 September to establish an agricultural credit bank. National Biscuit 70% 70% 701/8 701/8 9.10-12 October National Lead 45 47% 47% RIBSF. A. Heinze. who has made his head105 105 Y. Air Brake. 1091/2 8.70 1091/2 September quarters in New York since the settlement Central 105 102 10434 8.85 1031/2 October of his long legal war in Butte. Mont., with 321/4 32½ 31% N.Y.,O.& 69 Norfolk the Amalgamated Copper interests. and 69 6914 69% NEW YORK PRODUCE EXCHANGE. 55 North Amer 60 has recently branched out as a banker, is Northern Pacific. 116½ 1151/4 11914 1201/4 Furnished by Byrne & McDonnell, stock about to extend his banking interests by Pacific Mail. 231/4 231/4 23% 23½ brokers, 800 Broad street Telephone 615. the establishing of a new National Bank 116 118 Pennsylvania 117% 116% Closing Opening. in Seattle. Wash. People's Gas 85% 843/4 WHEAT843/4 S. C. Co. 93% 26 93½ September 261/8 271/4 271/4 A prominent international banking house 97%B 34 34 Ry. S. S. Co 98 December 35 Reading 91% 87% 88½ May 921/4 in response an inquiry as to whether 1013/B S Co. Rep. 211/8 227/8 211/4 CORNor not any large financial institution in 76% September 621/2 Rep. I. & S. pr Berlin was in trouble. received a cable 19 60 Rock Island 18% 18% December stating that the report of trouble in bank59 41% 41% 401/4 Rock Island pr. 411/4 May F ing circles there was absolutely without S 2d St 31% 30% pr 317/3 301/8 45 45 40 S S W R R pr foundation. MONEY AND EXCHANGE. 84 811/8 Southern Pacific. S3% 1101/4 1101/2 So. Pacific pr 1101/4 1101/2 One of the peculiar features of the steel Call money in New York. 3@6 per cent. 17 Southern Ry situation is its strength in the face of The New York time money market was 56 561/2 55% Southern Ry pr.. reports of a slowing down in the volume harder today than at any time this year. 261/2 261/2 Tex. & Pacific Ry 251/2 25% of business. Steel orders for future de25 Quotations were purely nominal at 6 per St & W Ry 251/2 251/2 Wabash livery are coming rapidly, and the lighter 11 12 cent. bid for all dates from 60 days to two Wabash pr 211/8 211/8 branches of the industry are also active. 201/2 months. Thirty days was 5 per cent West. Union Tel 75 751/4 751/4 All the mills of the Steel Corporation. as New York sub-treasury gained $136,000 W. & L. E. 101/2 Ry.. 10½ 101/2 101/2 well as the independent mills, are in operfrom the banks and since Friday it has Wis. Central 14½ 14% 14% 14% ation. gained $92,000. but was a debtor at the 36 36 Wis. Central pr..\ 361/4 361/4 Clearing House for $2,005,557. due princlIn addition to the regular semi-annual PRICES OF BONDS. pally to payment on account of transportadividend of 3½ per cent. on the common tion of the mails and for pensions. The stock of the Canadian Pacific Railway The following quotations were furnished sub-treasury transferred by telegraph by Post & Flagg: Company, an additional dividend of 1/2 per $75,000 currency to New Orleans. Open. High Low Close cent. has been declared on the proceeds 65 Am. Tobacco 4s... 641/2 Commercial bar silver in New York, 677/s from the sales of lands. The extra disAm. Tobacco 98 97 98% 987/8 cents; Mexican dollars, 52% cents; bar silA., T. & S. F. 4s. bursement will be made when the regular 981/2 ver in London 3 5-16d. premiums on gold: B. R. 771/4 771/4 771/2 771/2 dividend will be paid. At Madrid, 14.05: and at Lisbon, 2.50 89 Cen. Leather 5s. 4s. 92 92 Q. Paris rentes, 94 francs 42½ centimes. B. & 91% C., 91% All grades of copper were further re66 66 R. P. 4s. 661/2 661/2 Paris private rate of discount, 3% per duced at the New York Metal Exchange 991/2 Imp. Pap. 1st 6s.. cent.; exchange on London, 25 francs 15 one-half cent pound in both bid and ask991/2 Imp. Jap. 2d 6s. centimes. Berlin private rate of discount. ing prices. The value of the metal is at 88% Imp. Jap. 41/28 1% per cent.; exchange on London, 20 the lowest price since the upward moveImp. Jap. ctf. 41/28 843/4 marks 481/2 pfgs. 57 59½ 59½ Interborough 41/28 57 ment was started. Southern Ry. 5s.. 106 Money on call in London, 21/2@2% per Union Pac. 1st 43 9934 According to the opinion of some of the cent. Rate of discount for short bills, 4 91% S. S. S. S. 5s. 911/4 911/4 best judges of technical conditions preper cent.: for three months' bills, 41/8@41/4 55 55 Col. Ind. 5s 551/2 0572 vailing in the stock market and the per cent. Consols for money, 81 11-16d.; financial situation as a whole, little hope for account, 81%d. NEW YORK OUTSIDE SECURITIES. is extended for any pronounced improveThere were no important developments in The following quotations are furnished ment in prices until the present mania for the foreign exchange market. the volume by Van Schaick & Co.: attacking corporations subsides. of business was extremely small and rates Closing yester- Close tofor all classes of remittance ruled pracday. day Post & Flagg say "For the present, tically unchanged. Demand sterling was Bid Asked. Bid. Asked however, it is almost needless to say that INDUSTRIALS. quoted 4.8645@4.8650; cables, 4.87@4.8720; those who carrying stock on margin 175 190 190 175 Am. Chicle sixty day bills, 4.82%@4.82%; short francs, have got to proceed most cautiously and 95 90 98 Am. Chicle pt 90 5.16% less 1-32, and short marks, 95, strengthen their position as much as pos% Am. Nickel 1 % sible. Certainly it is time that the busiless 1-64. 265 280 Am. Tobacco ness interests of the country awoke to 2½ 11/2 Am. Writ. Paper. 1½ 21/2 protest against a flippant and reckless NEW WOOD PRESERVATIVE. 22 201/2 Am. W. pr. 201/2 23 method of dealing with the substantial, Bay State Gas 1/4 1/2 ½ but intricate, business relations of the en Trial of Injectol and Its Derivatives in Cen. Foundry 3 country. 15 15 Cen. Foundry pr. 12½ Belgium. Havana Tobacco. 12 14 14 THE PRODUCE MARKET Vice-Consul J. A. Van Hee, of Ghent, 19 Havana Tob. pr.. 16 16 Houston Oil advises that recent experiments in BelNEW YORK. Aug. Flour-Reteipts, 30 Houston Oil pr 30 40 22,450: sales, 1.000: dull and unchanged. gium made with a new coal tar extract, 15 International Salt 121/2 12½ Minnesota patents. 4.90@5.30: winter 151/2 known as "injectol," have given satisfacTransit straights.