Article Text

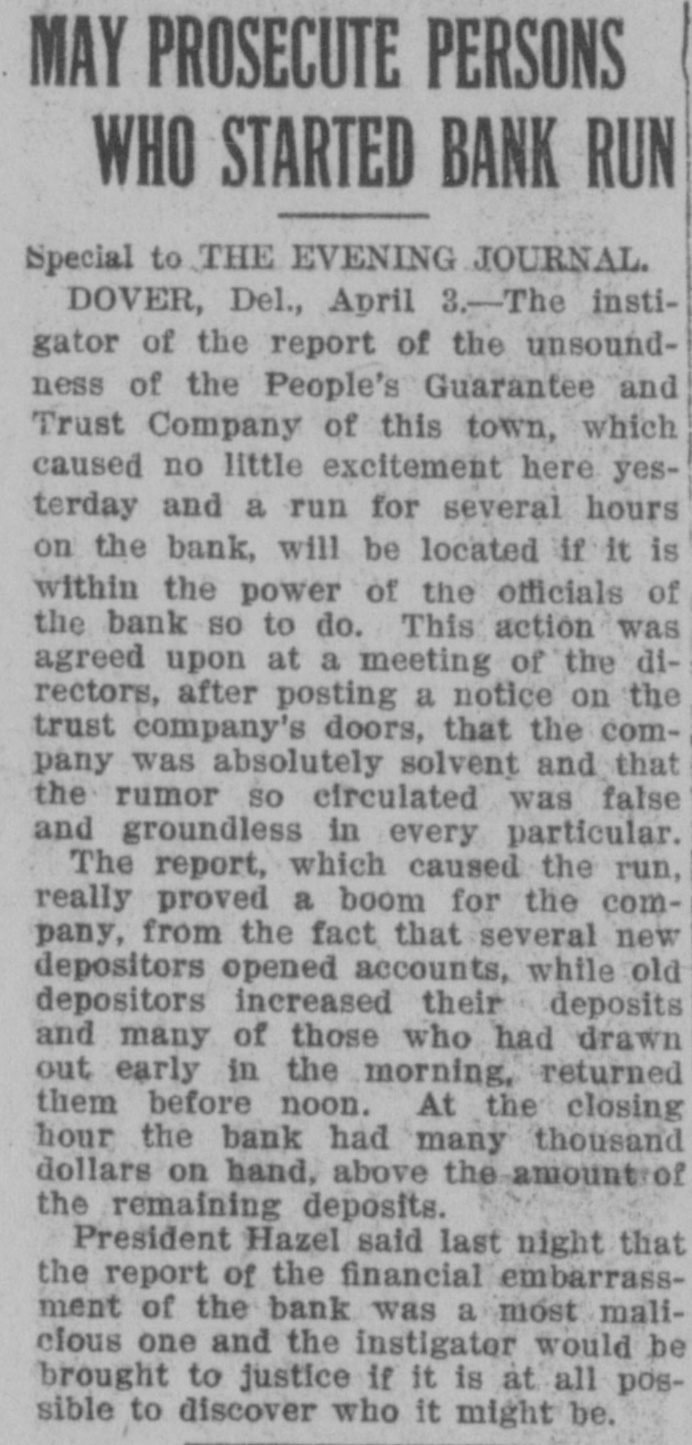

MAY PROSECUTE PERSONS WHO STARTED BANK RUN Special to THE EVENING JOURNAL. DOVER, Del., April 3.-The instigator of the report of the unsoundness of the People's Guarantee and Trust Company of this town, which caused no little excitement here yesterday and a run for several hours on the bank, will be located if it is within the power of the officials of the bank so to do. This action was agreed upon at a meeting of the directors, after posting a notice on the trust company's doors, that the company was absolutely solvent and that the rumor so circulated was false and groundless in every particular. The report, which caused the run, really proved a boom for the company, from the fact that several new depositors opened accounts, while old depositors increased their deposits and many of those who had drawn out early in the morning, returned them before noon. At the closing hour the bank had many thousand dollars on hand, above the amount of the remaining deposits. President Hazel said last night that the report of the financial embarrassment of the bank was a most maliclous one and the instigator would be brought to justice if it is at all possible to discover who it might be.