Article Text

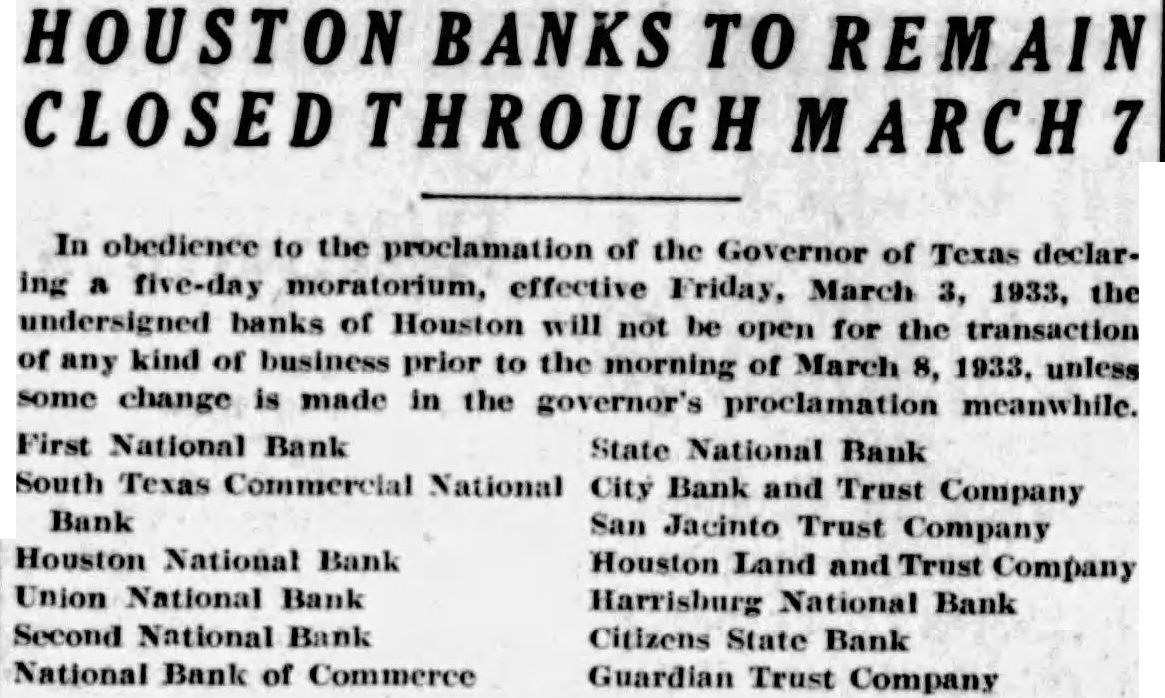

BANKS TO First National Bank State National Bank South Texas Commercial National City Bank Trust Company Bank Jacinto Trust Company In obedience to the proclamation of the Governor of Texas declaring five-day moratorium, effective Friday, March 3, 1933, the undersigned banks of Houston will not be open for the transaction of any kind of business prior the of March morning unless some change is made in the governor's proclamation meanwhile. Houston National Bank Houston Land Company Union National Bank Harrisburg National Bank Second National Citizens State Bank National Bank of Commerce Guardian Trust Company