Click image to open full size in new tab

Article Text

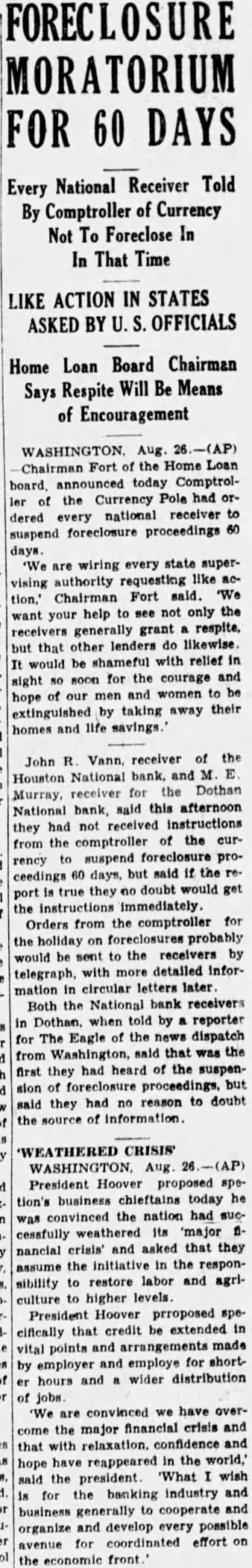

FOR 60

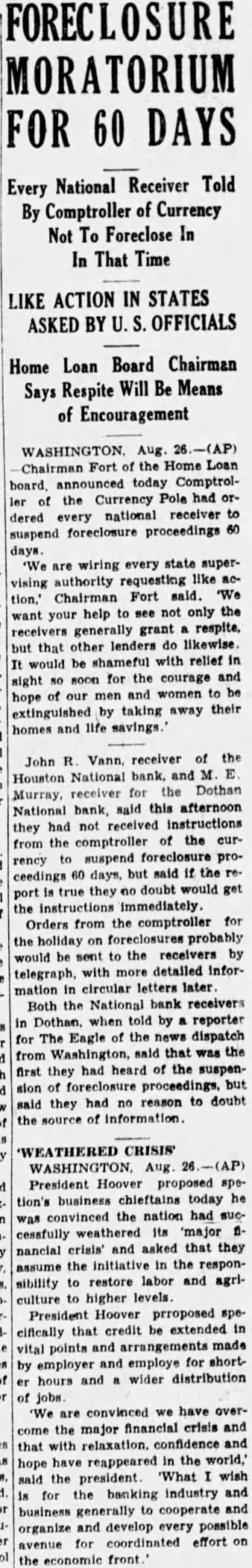

National Receiver Told Every By Comptroller of Currency Not To Foreclose In That Time

LIKE ACTION IN STATES OFFICIALS ASKED

Loan Board Chairman Home Says Respite Will Means of Encouragement

Aug. Fort of the Home Loan Chairman announced today ComptrolPole had orof the Currency national receiver dered every suspend foreclosure proceedings days. 'We are wiring every state supervising authority requesting like Chairman Fort said. tion,' see not only the want your help generally grant respite, receivers but that other lenders do likewise. would be shameful with relief for the courage and sight soon and women to be hope of our by taking away their extinguished homes and life

John Vann, receiver the Houston National bank. and the Dothan Murray, receiver for said this afternoon National bank, they had not received instructions comptroller of the curfrom the suspend foreclosure prorency ceedings days, but said if the doubt would get port true they the instructions immediately. Orders from the comptroller for the holiday on foreclosures be sent to the receivers by would with more detailed infortelegraph, mation in circular letters later. Both the National bank receivers in Dothan. when told by reporter The Eagle of the news dispatch from Washington, said that the first they had heard of the suspension of foreclosure proceedings, but said they had no reason to doubt the source of

Aug. President Hoover proposed spetion's business chieftains today he was convinced the nation had weathered its major cessfully nancial crisis' and asked that they assume the initiative in the responto restore labor and agrisibility culture to higher levels. President Hoover prroposed speeifically that credit be extended vital points and arrangements made by employer and employe for shorthours and wider distribution jobs. We convinced have overcome the major financial crisis and that with relaxation, confidence in the world,' hope have reappeared the president. What wish said the banking industry and for business generally cooperate and organize and develop every possible avenue for coordinated effort on the economic