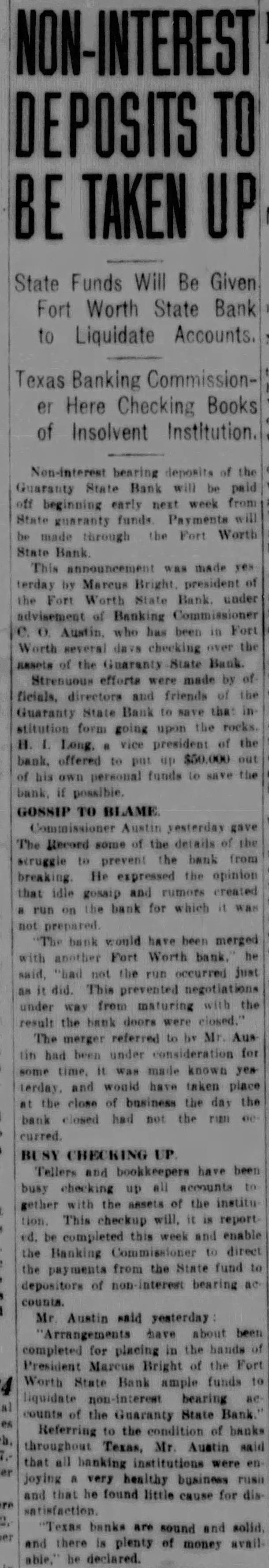

Article Text

FORT WORTH STATE BANK CLOSES DOORS Fort Worth Texas, March 16. The Guaranty State Bank Main and Eighth streets, closed its doors this morning On the front door appeared the following notice "Affairs of this bank are in the hands of the banking commissioner of the State R. J. Rhome is president of the urday that the State Bank was to be consolidated with another the deal was not completed. "The bank opened usual today Williams small on the bank the board of of this run they decided that in the interest of the bank should be placed in the hands of state The did not know what caused Todd residing Sunday as the of fall in the Port where he Death due to Internal caused by accidental fall from an the result of an made who The negro died in amon the GRAY WINS ON FOUL Texas March Gray of San Antonio was fouled in the fourth round the over "Tiger" Joe company scheduled for athletic fair