Article Text

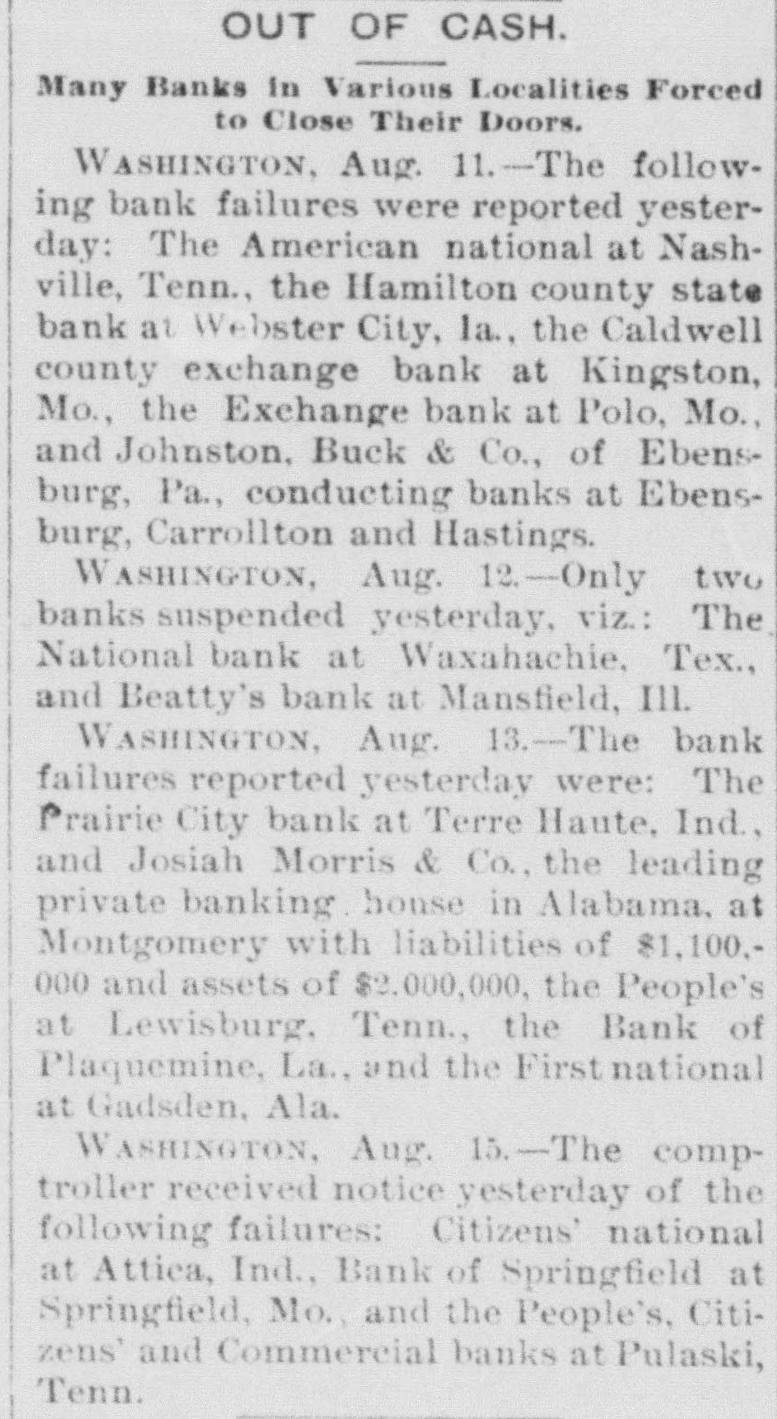

OUT OF CASH. Many Banks in Various Localities Forced to Close Their Doors. WASHINGTON, Aug. 11.-The following bank failures were reported yesterday: The American national at Nashville, Tenn., the Hamilton county state bank at Webster City, la., the Caldwell county exchange bank at Kingston, Mo., the Exchange bank at Polo, Mo., and Johnston, Buck & Co., of Ebensburg, Pa., conducting banks at Ebensburg, Carrollton and Hastings. WASHINGTON, Aug. 12.-Only two banks suspended yesterday, viz.: The National bank at Waxahachie, Tex., and Beatty's bank at Mansfield, III. WASHINGTON, Aug. 13.-The bank failures reported yesterday were: The Prairie City bank at Terre Haute, Ind., and Josiah Morris & Co., the leading private banking. house in Alabama, at Montgomery with liabilities of $1,100,000 and assets of $2.000,000, the People's at Lewisburg, Tenn., the Bank of Plaquemine, La., and the Firstnational at Gadsden, Ala. WASHINGTON, Aug. 15.-The comptroller received notice yesterday of the following failures: Citizens' national at Attica, Ind., Bank of Springfield at Springfield, Mo., and the People's, Citizens' and Commercial banks at Pulaski, Tenn.