Article Text

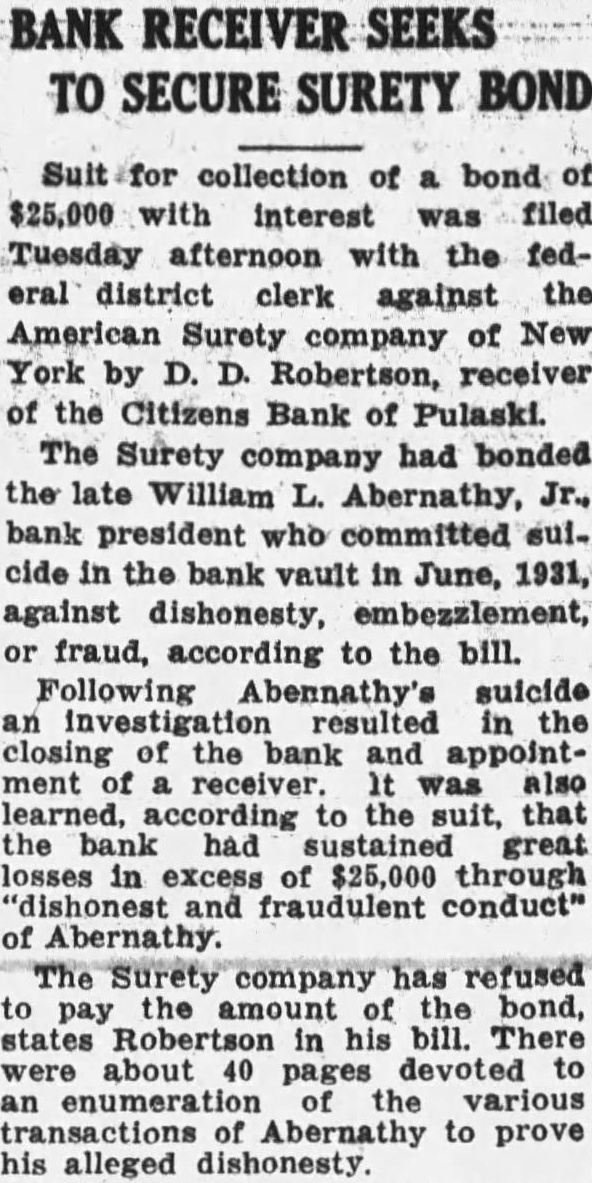

BANK RECEIVER SEEKS TO SECURE SURETY BOND Suit for collection of a bond of $25,000 with interest was filed Tuesday afternoon with the federal district clerk against the American Surety company of New York by D. D. Robertson, receiver of the Citizens Bank of Pulaski. The Surety company had bonded the late William L. Abernathy, Jr., bank president who committed sulcide in the bank vault in June, 1931, against dishonesty, embezzlement, or fraud, according to the bill. Following Abennathy's suicide an investigation resulted in the closing of the bank and appointment of receiver. It was also learned, according to the suit, that the bank had sustained great losses in excess of $25,000 through "dishonest and fraudulent conduct" of Abernathy. The Surety company has refused to pay the amount of the bond, states Robertson in his bill. There were about pages devoted to an enumeration of the various transactions of Abernathy to prove his alleged dishonesty