Article Text

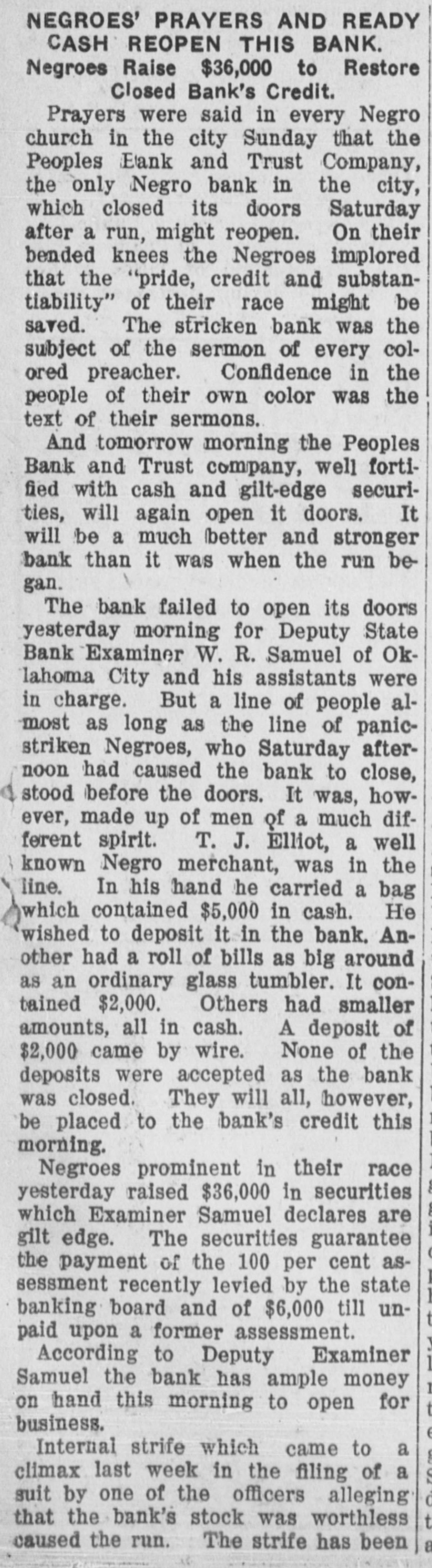

NEGROES' PRAYERS AND READY CASH REOPEN THIS BANK. Negroes Raise $36,000 to Restore Closed Bank's Credit. Prayers were said in every Negro church in the city Sunday that the Peoples Bank and Trust Company, the only Negro bank in the city, which closed its doors Saturday after a run, might reopen. On their bended knees the Negroes implored that the "pride, credit and substantiability" of their race might be saved. The stricken bank was the subject of the sermon of every colored preacher. Confidence in the people of their own color was the text of their sermons. And tomorrow morning the Peoples Bank and Trust company, well fortified with cash and gilt-edge securities, will again open it doors. It will be a much better and stronger bank than it was when the run began. The bank failed to open its doors yesterday morning for Deputy State Bank Examiner W. R. Samuel of Oklahoma City and his assistants were in charge. But a line of people almost as long as the line of panicstriken Negroes, who Saturday afternoon had caused the bank to close, stood before the doors. It was, however, made up of men of a much different spirit. T. J. Elliot, a well known Negro merchant, was in the line. In his hand he carried a bag which contained $5,000 in cash. He wished to deposit it in the bank. Another had a roll of bills as big around as an ordinary glass tumbler. It contained $2,000. Others had smaller amounts, all in cash. A deposit of $2,000 came by wire. None of the deposits were accepted as the bank was closed. They will all, however, be placed to the bank's credit this morning. Negroes prominent in their race yesterday raised $36,000 in securities which Examiner Samuel declares are gilt edge. The securities guarantee ( the payment of the 100 per cent assessment recently levied by the state banking board and of $6,000 till unt paid upon a former assessment. According to Deputy Examiner } Samuel the bank has ample money 1 on hand this morning to open for t business. e Internal strife which came to a E climax last week in the filing of a s suit by one of the officers alleging 0 that the bank's stock was worthless t caused the run. The strife has been