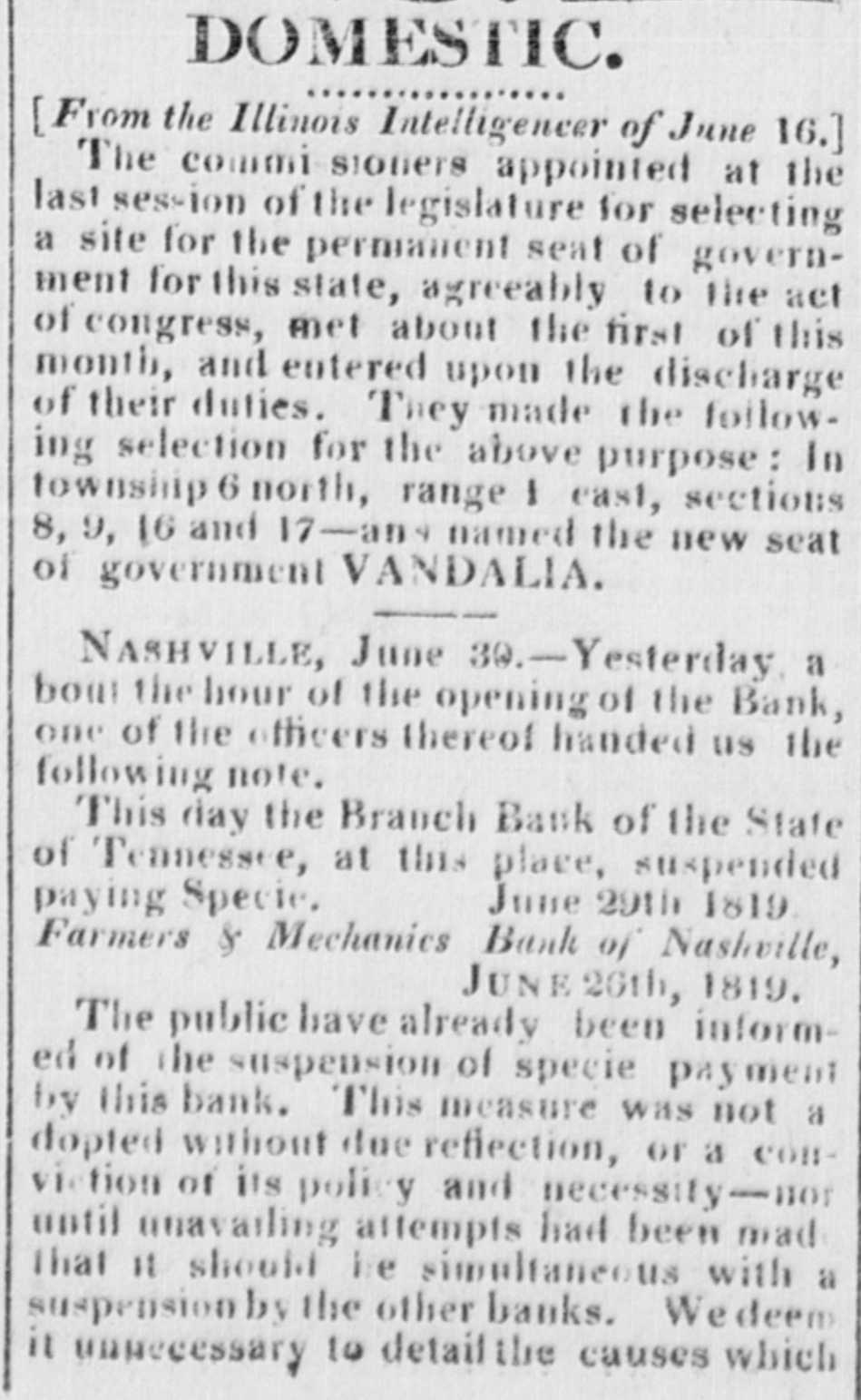

Article Text

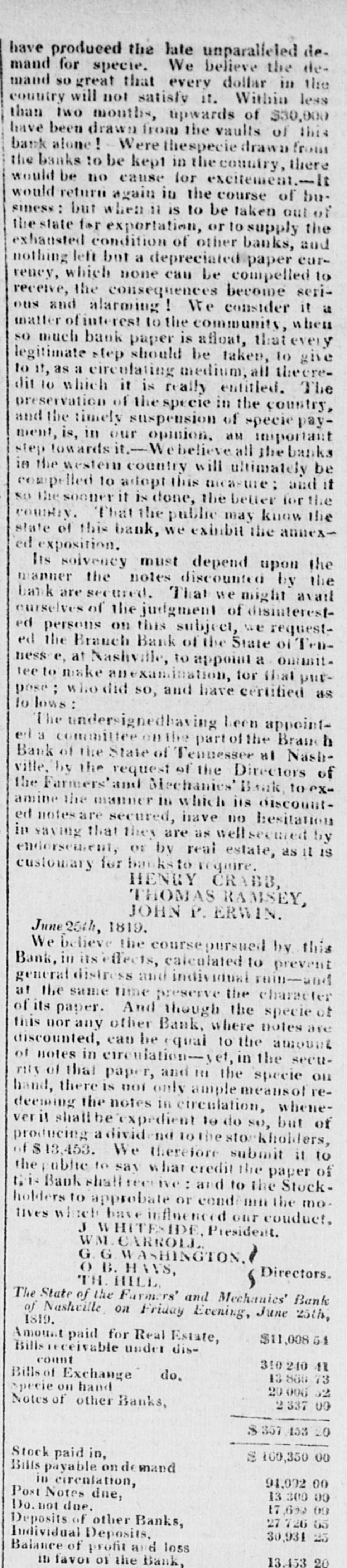

as said what the Exto the change Bank. know how goodness to estimate of JACOB the notes BARKER. of York S. BANK STOCK In New offers U. this torenoon. were soki at91 pay- the able July 1, the book vesterday, No 200 and shares 50 at 91, payable Little will on be next, Monday opening this of stock antil dividend is 10 be it done in dividend or no on Saturday, declared. when a A1 Boston, Phil. Frank. Gaz. stood at 89 COMMERCIAL 90. Saturday under state of the exevening, says as 10 Mr. Degrand, that the date render supply sales market the in Boston difficult, except Salesof coffee, tremely is such moment. to almost invaof the articles are is and after a down the offers circumstances is riably sugar demands knocked stopped off, other This small going quantity of things. is- reslead of rising. indicative of thestate at 12 5-8 to 12 sugars white 17 to 82 to 85 7-8 cents per hyson tea, 30 to 10 26 130; flour, 4 1251 $7 to 714 rye 4: flour, bbl. $3 3-4 to Havana ported gunpowder, as young lb. were : sold bohea, 18 macka- coffee, cent 31; to advance 434, rel, 7 to 11. ; exchange Spanish on in London, January, at coust states par. the crop a from had been who superfine that letter herrings Bombay of indigo but dollars, gentleman, says 2 per that the erably injured: in Bengal, until Feis not put into so that the letter brwary or must be have fallen in has seed been much March, incorrect. the ground from New adYork Bombay Spanish ; they dollars are to 1.4 per cent vance. noticed, the currency other day, this a report Wes- city, which We had obtained credited, that some the IIIand was generally had experienced at St. Louis, causes in the nature of Nor is it it would terruption tern from not precisely Expedition its understand. progress if, as at which present inform- report we like- did itLetters ed, incorrect. ly that we should, appear, that the from the prinand expedition, self was cipal ticer now with the both of the date no al- of St. Louis received newspapers, yesterday, which make have June 2d, to the circumstances which, it is therefore we are lusion been reported, and In any event, have hoped, some 100 persuaded, permitted. are untrue. no long The delay letters would will state be been that the waters in which appellension for steam boat navigation be immediately sublow keel beats will delay or obstruction case No other anticipated. Int. stituted. appears to have been [Nat. buzz the Among the multitude their of hour ephemeral.ru- and eastern are formours which has been a report of the in PRESIDENT, Cengotten, states, is of thus the noticed death in the Boston tinel which A of report the 26th United of instant: the States, death of of the fever, the Presi- pub- in of the spread a gloom on over Wednesday for a short was found Tennessee, dent lic mind examination, time it advices from to last. On We BOW health be incorrect. to the 3d inst. when his was sound," Tennessee &c. the reader accounts, We have still via later Lexington, of the Kv President which will perceive, the progress westward as Frankfort, reannounce in his tour as far surprising that such a the It is not a gloom over the port We the which the munity, public deep Ky. should gloom mind." " particularly spread overspread well remember distinction Congress com- of then at a and without the in session, time that party spirit late was life of illness. by a Jess dear Mr. MONROE of his was the venomous- party valuable threatened when, during President severe is no MADISON friends most war, The to country whether it put to the at this southern President of to life been have his summer. of doubted miles : The sun and least to some hazard travel advanced ought government has by by land, exposure yet to stage near- have be" a thousand he reaches the seat not of aware of any though we has occurred to return which his absence, and and, lice fore prejudice from are his the pub- well service be looked for with interest, [Ib. comed will with pl asure. Farmers' NASHVILLE, June Bank 19.-The of this place yester- We and Mechanics specie of the ments. directors, by one that are whom we have all its day informed suspended conversed, engage- the with well able to meet the Board the present the ments deemed Bank is in specie, interests but that step of adviseable, community, had as as well for for the the int. rest of the 10 institution. state positively, We are authorised of this State, and the are that the Bank Bank, and their Brauches, pay" in specie as usual. resolved Nashville to continue their Gazette. three Tuesday the 8th. from inst. the U. waggons On loaded with in specie, Cincinnati, pas Phila- ed S. Branch Bank on their way to bethrough Chilicothe said to contain delphia. They are and $150,000. transported The total tween $120,000 and silver, twelve of gold the last amount of the state, within about $800,000 out months, is estimated (Chilicothe at Gazette. loaded hoard the Pike, This and is delivered the money by her at Maysville.