Article Text

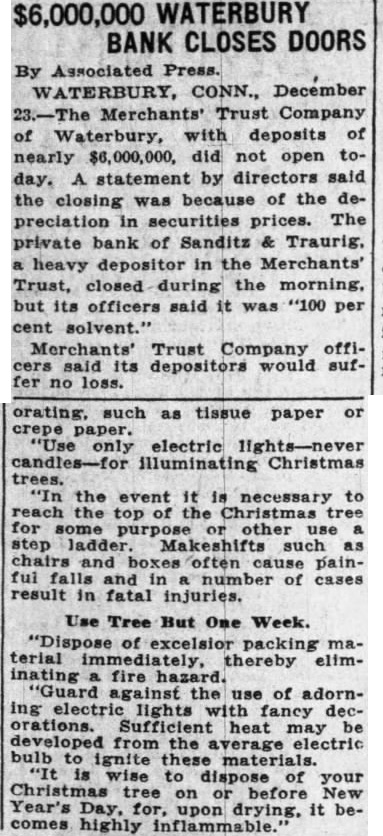

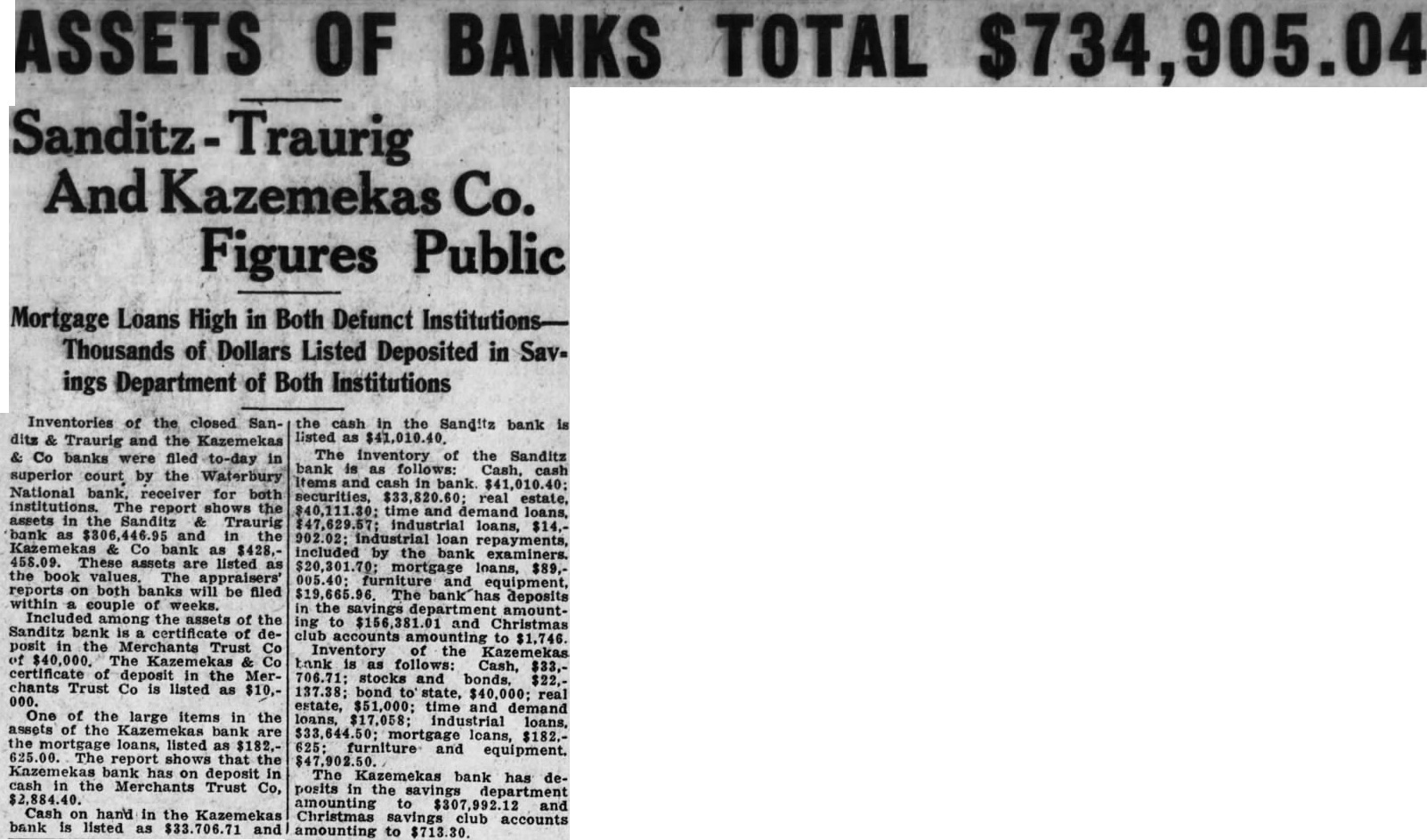

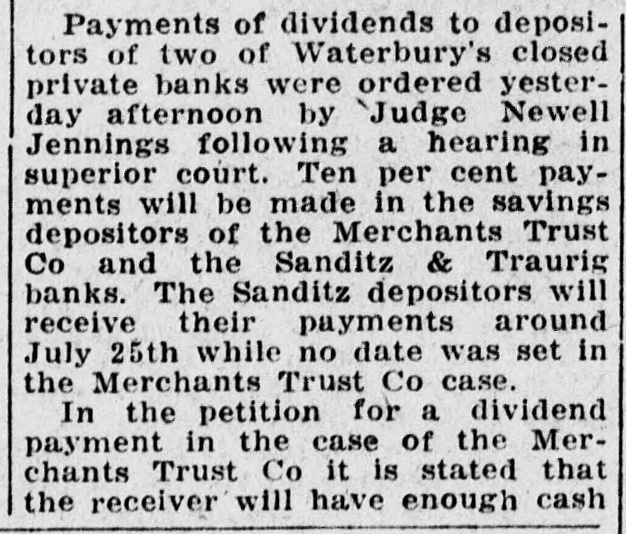

$6,000,000 WATERBURY BANK CLOSES DOORS By Associated Press. WATERBURY, CONN., December 23.-The Merchants' Trust Company of Waterbury, with deposits of nearly $6,000,000, did not open today. A statement by directors said the closing was because of the depreciation in securities prices. The private bank of Sanditz & Traurig. a heavy depositor in the Merchants' Trust, closed during the morning. but its officers said it was "100 per cent solvent." Merchants' Trust Company officers said its depositors would suffer no loss. orating. such as tissue paper or crepe paper. "Use only electric lights-never candles- illuminating Christmas trees. "In the event it in necessary to reach the top the Christmas tree for some purpose other use step ladder. Makeshifts such as chairs and often painful falls and in number of cases result in fatal injuries. Use Tree But One Week. "Dispose of packing material immediately, thereby eliminating fire hazard. "Guard against the use of adorning electric lights with fancy decorations. Sufficient heat may be developed from the average electric bulb to ignite these materials. "It is wise to dispose of your Christmas tree on or before New Year's Day. upon drying, it becomes highly inflammable.