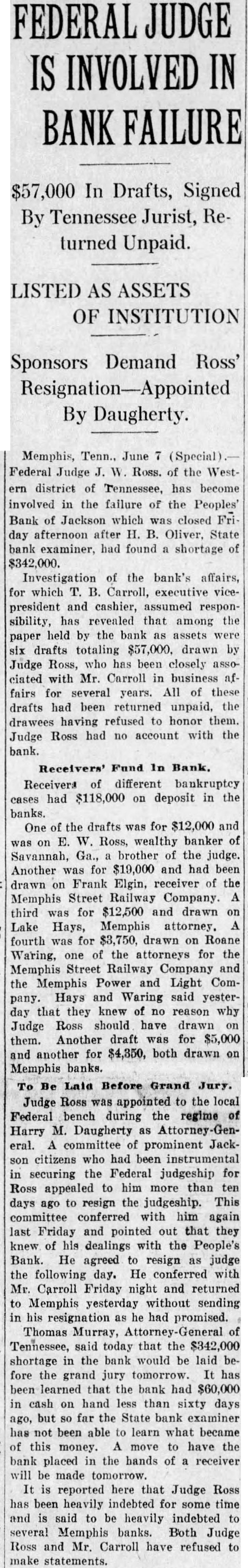

Article Text

INVOLVED In Drafts, Signed By Tennessee Jurist, Returned Unpaid. LISTED AS ASSETS OF INSTITUTION Sponsors Demand Ross' Resignation-Appointed By Daugherty. Memphis, Tenn., June (Special) Federal Judge Ross. of the Westdistrict Tennessee, has become involved in the failure of the Peoples' Bank of which closed afternoon Oliver, State examiner, had found shortage $342,000. Investigation the bank's affairs, for which Carroll, executive vicepresident and cashier, assumed responsibility, has revealed that among the paper held by the bank assets drafts totaling $57,000. drawn Judge Ross, who has been closely ciated Mr. Carroll in business fairs for several years. All drafts had been unpaid, the refused honor them. Judge Ross had account with the bank. Fund In Bank. different bankruptcy had $118,000 on deposit the cases banks. One the drafts for and Ross, wealthy banker on Savannah, brother the judge. Another for $19,000 and had been drawn Frank Elgin. the Memphis Street Railway Company. third for $12,500 drawn Lake Hays, Memphis attorney. fourth was for $3,750. drawn on Roane Waring, the attorneys for the Memphis Street Railway Company and the Memphis Power and Light ComHays and Waring said pany. day that they knew of no reason why Judge Ross should drawn them. Another draft for and another for $4,350, both drawn Memphis To Be Before Grand Jury. Judge Ross appointed to the local Federal bench during regime Harry M. Daugherty eral. committee prominent Jackcitizens had instrumental securing the Federal judgeship Ross appealed him more than ten days resign the judgeship. This committee with him again Friday pointed out that they knew his dealings with the People's Bank. He agreed resign judge the following day. He conferred with Carroll Friday night and returned Memphis yesterday without sending his resignation he had promised. Thomas Murray, Tennessee, today that the shortage in the bank would be laid fore the jury has learned that the bank had $60,000 cash on hand than sixty days but far the State bank has been able learn what became this money. have the bank placed the hands of receiver tomorrow. reported here Judge Ross has been heavily indebted for some time and be heavily indebted several Memphis Both Judge Ross Mr. Carroll have refused make statements.