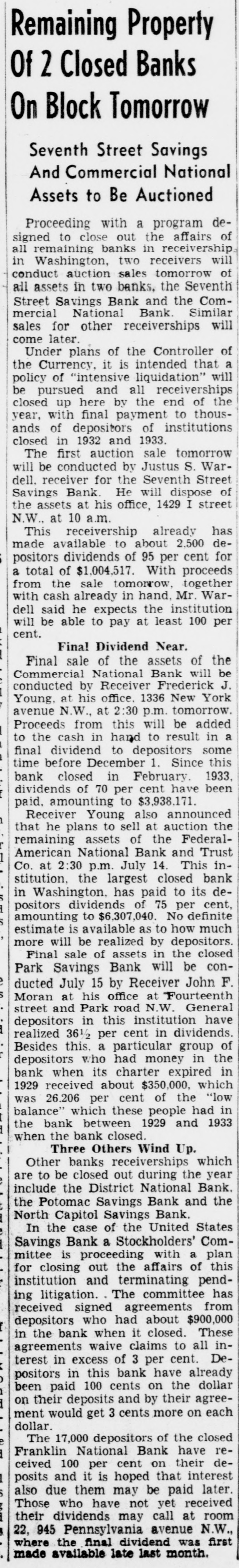

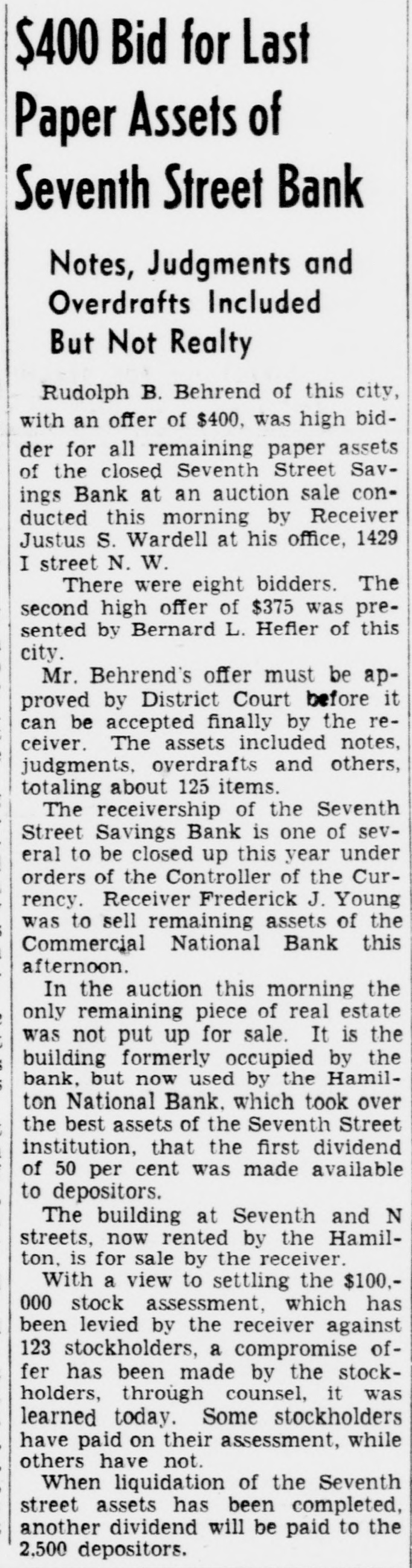

Article Text

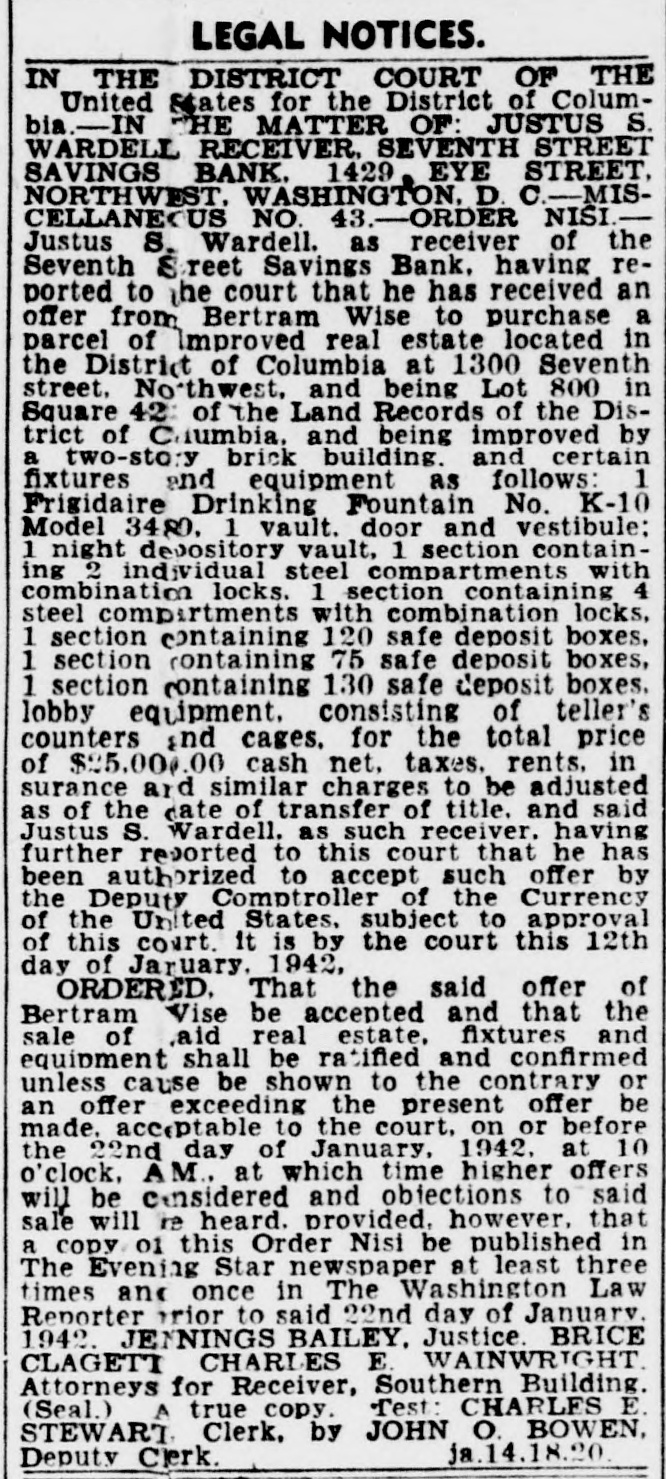

LEGAL NOTICES. BRICE CLAGETT CHARLES F WAINWRIGHT. Southern Bldg. N THE DISTRICT COURT OF THE United States for the District of Colum- S -IN THE MATTER OF JUSTUS VARDEIL RECEIVER SEVENTH STREET AVINGS BANK WASHINGTON D NISI C MISCELLANEOUS NO. 43 -ORDER Justus S Wardell as Receiver of the eventh Street Savings Bank having reorted to the Court that be has received a offer from M Bevans to purchase arcel n of improved real estate located venth in District of Columbia at 1300 S soo in he Northwest and being Lot street 423 of the land records of the by Dis- a quare of Columbia and being improved fixwo-story rict brick building and certain and equipment as follows 1 Frigidures Drinking Fountain No K-19 Model ire 480 1 Vault door and vestibule 1 Night depository vault 1 Section containing individual steel compartments with combiation locks 1 Section containing 4 steel 1 compartment with combination locks Section containing 120 safe deposit boxes: Section containing 75 safe deposit boxes: Section containing 130 safe deposit boxes: obby equipment consisting of Teller's ounters and cages: for the total price of 35,000.00 cash subject to a real estate broker's commission of $1.150.00 taxes, be ents. insurance and similar charges to of duusted as of the date of transfer title. and said Jus us S Wardell as such this having further reported to Receiver that he has been authorized to Court accept such offer by the Deputy Comptroller the Currency of the United States subect f to approval by this Court as is shown v A true copy of a letter containing such authority dated November S 1940 signed the Deputy Comptroller of the Cury ency and annexed to the petition herein. is by the Court this 18th day of NoIt rember 1940 ORDFRED That the said of M Bevans be accepted and that the ffer said sale of said real estate fixtures nd equ pment shall be ratified and conArmed unless cause be shown to the conor a higher offer be made on 1940 or before rary the 30th day of November provided however. that 8 copy of this Order Nisi be published in the Washington Evening Star as a legal notice at least three times. the first of said publications be at least ten days prior to the 30th o of November 1940 and once in the Washington day LAW Reporter and provided further that in the event that any higher is to be made the person making offer such increased offer shall be required to submit an offer exceeding the offer set forth in the petition herein by at least ave per cent and that the person making such increased offer be required to submit he same to the office of the Receiver at 614 K Street Northwest on or before welve n'clock noon on the 30th day of November 1940 BOLITHA J LAWS Seal A true copy Test Justice CHARLES F STFWART Clerk By NDREW A HORNER. Asst. Clerk