Article Text

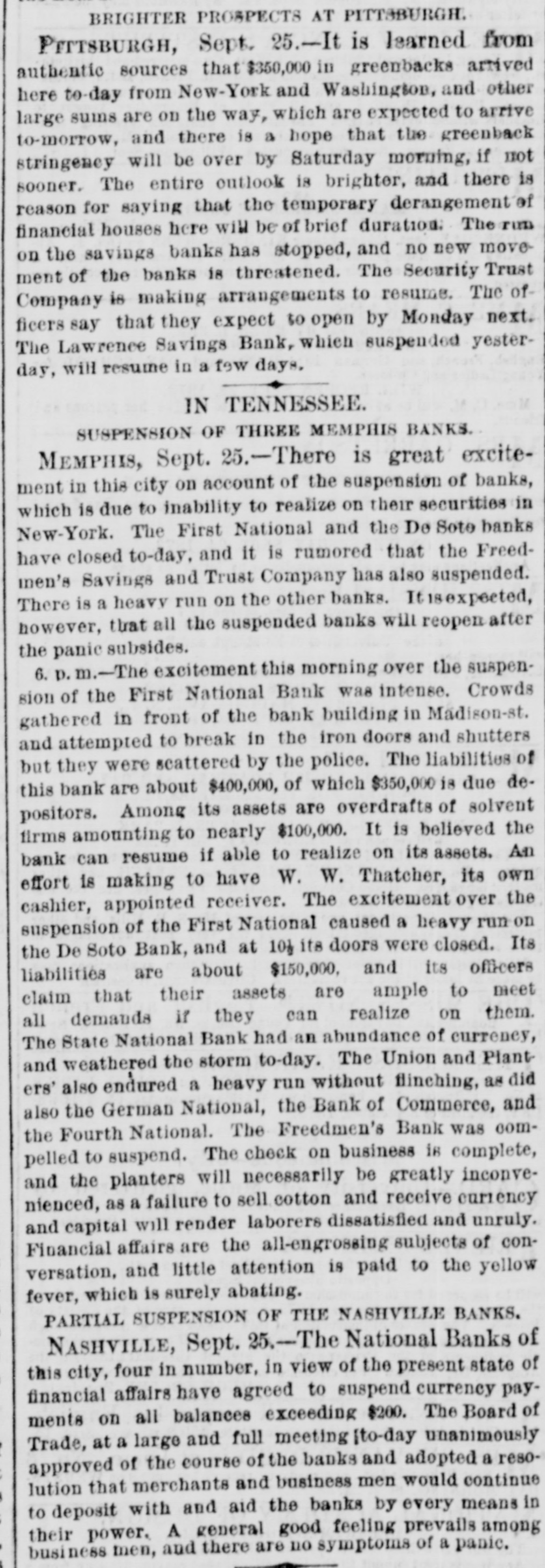

BRIGHTER PROSPECTS AT PITTABURGH PITTSBURGH, Sept. 25.-It is learned from authentic sources that $350,000 in greenbacks arrived here to-day from New-York and Washington, and other large sums are on the way, which are expected to arrive to-morrow, and there is a hope that the greenback stringency will be over by Saturday morning, if not sooner. The entire outlook is brighter, and there is reason for saying that the temporary derangement of financial houses here wild be of brief duration. The run on the savings banks has stopped, and no new move ment of the banks is threatened. The Security Trust Company is making arrangements to resume. The of ficers say that they expect to open by Monday next. The Lawrence Savings Bank, which suspended yesterday, will resume in a few days. IN TENNESSEE. SUSPENSION OF THREE MEMPHIS BANKS. MEMPHIS, Sept. 25.-There is great excitement in this city on account of the suspension of banks, which is due to inability to realize on their securities in New-York. The First National and the Do Sote banks have closed to-day. and it is rumored that the Freedmen's Savings and Trust Company has also suspended. There is a heavy run on the other banks. Itisexpected, however, that all the suspended banks will reopen after the panic subsides. 6. p.m.-The excitement this morning over the suspension of the First National Bank was intense. Crowds gathered in front of the bank building in Madison-st. and attempted to break in the iron doors and shutters but they were scattered by the police. The liabilities of this bank are about $400,000, of which $350,000 is due depositors. Among its assets are overdrafts of solvent firms amounting to nearly $100,000. It is believed the bank can resume if able to realize on its assets. An effort is making to have W. W. Thatcher, its own cashier, appointed receiver. The excitement over the suspension of the First National caused a heavy run on the De Soto Bank, and at 101 its doors were closed. Its liabilities are about $150,000, and its officers claim that their assets are ample to meet all demands if they can realize on them. The State National Bank had an abundance of currency, and weathered the storm to-day. The Union and Planters' also endured a heavy run without flinching, as did also the German National, the Bank of Commerce, and the Fourth National. The Freedmen's Bank was compelled to suspend. The check on business is complete, and the planters will necessarily be greatly inconvenienced, as a failure to sell cotton and receive currency and capital will render laborers dissatisfied and unruly. Financial affairs are the all-engrossing subjects of conversation, and little attention is paid to the yellow fever, which is surely abating. PARTIAL SUSPENSION OF THE NASHVILLE BANKS. NASHVILLE, Sept. 25.-The National Banks of this city, four in number, in view of the present state of financial affairs have agreed to suspend currency payments on all balances exceeding $200. The Board of Trade, at a large and full meeting [to-day unanimously approved of the course of the banks and adopted a resolution that merchants and business men would continue to deposit with and aid the banks by every means in their power. A general good feeling prevails among business men, and there are no symptoms of a panic.