Article Text

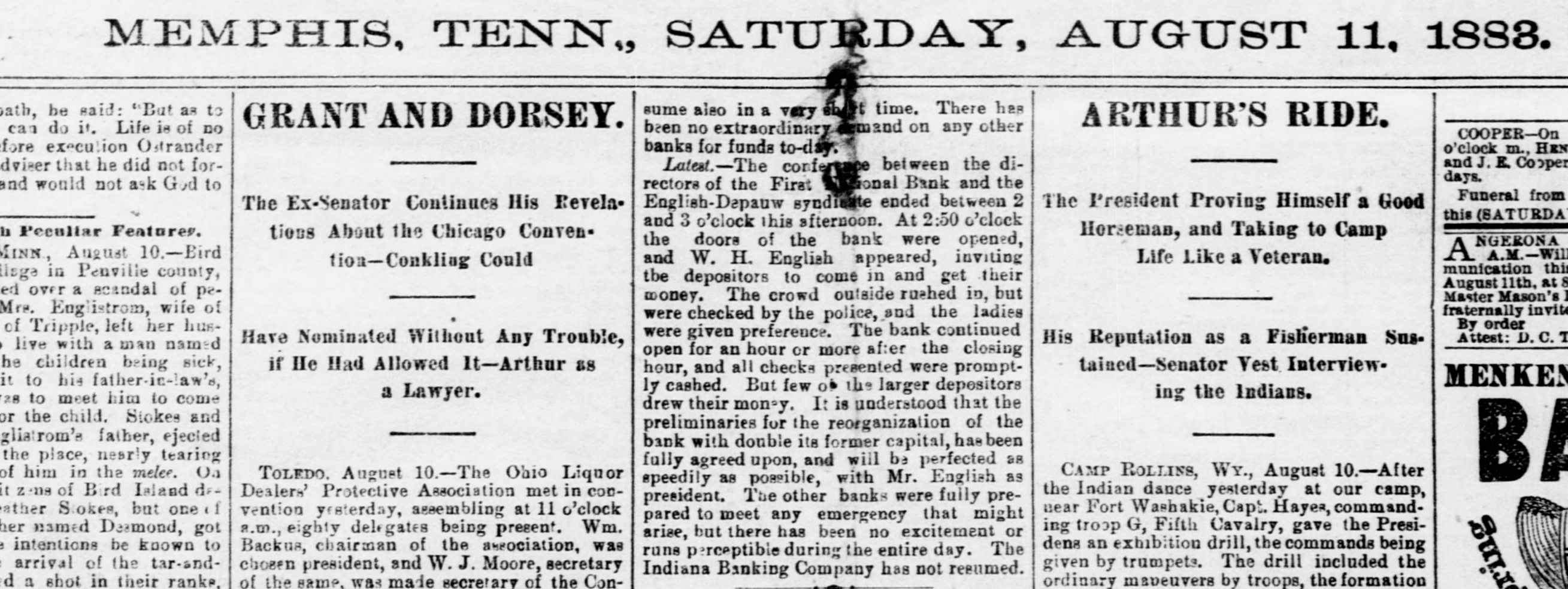

MEMPHIS, TENN " SATURDAY, AUGUST 11, 1883. sume also in a very shirt time. There has path, be said: "But as to ARTHUR'S RIDE. GRANT AND DORSEY. can do it. Life is of DO been no extraordinary demand on any other COOPER-0 fore execution Ostrander o'clock m., H banks for funds to-day. and J. E. Co dviser that he did not forLatest.-The confertace between the didays. and would not ask God to rectors of the First ional Bank and the Funeral fro The President Proving Himself a Good The Ex-Senator Continues His RevelaEnglish-Depauw syndicate ended between 2 this (SATURE and 3 o'clock this afternoon. At 2:50 o'clock is Peculiar Features. tiess About the Chicago Conven Herseman, and Taking to Camp NGERON the doors of the bank were opened, A A.M.MINN, August 10.-Bird Life Like a Veteran. and W. H. English appeared, inviting tion-Conkling Could munication dage in Penville county, tbe depositors to come in and get their August 11th, , ed over a scandal of peMaster Mason money. The crowd outside ruched in, but Mrs. Englistrom, wife of fraternally in were checked by the police, and the ladies By order of Tripple, left her huswere given preference. The bank continued Attest: D.C His Reputation as a Fisherman Sus. Have Nominated Without Any Trouble, s live with a man named open for an hour or more after the closing he children being sick, if He Had Allowed It-Arthur as tained-Senator Vest Interview. hour, and all checks presented were promptMENK it to his father-in-law's, ly cashed. But few 06 the larger depositors a Lawyer. ing the Indians. 28 to meet him to come drew their money. It is understood that the or the child. Stokes and preliminaries for the reorganization of the glistrom's father, ejected bank with double its former capital, has been the place, nearly tearing fully agreed upon, and will be perfected as CAMP ROLLINS, Wy., August 10.-After of him in the melee. Oa B TOLEDO. August 10.-The Ohio Liquor speedily as possible, with Mr. English as It zens of Bird Island deDealers' Protective Association met in conthe Indian dance yesterday at our camp, president. The other banks were fully prenear Fort Washakie, Capt. Hayes, commandeather Stokes, but one vention yesterday, assembling at 11 o'clock pared to meet any emergency that might ing troop G, Fifth Cavalry, gave the Presiher named Deamond, got a.m., eighty delegates being present. Wm. arise, but there has been no excitement or e intentions be known to dens an exhibition drill, the commands being Backus, chairman of the association, was runs perceptible during the entire day. The arrival of the tar-andgiven by trumpets. The drill included the chosen president, and W. J. Moore, secretary Indiana Banking Company has not reemmed. d a shot in their ranke, of the same, was made secretary of the Conordinary maneuvers by troops, the formation