Article Text

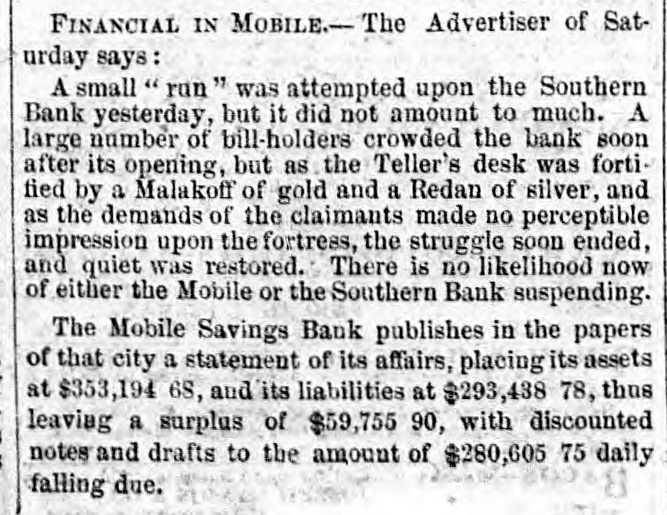

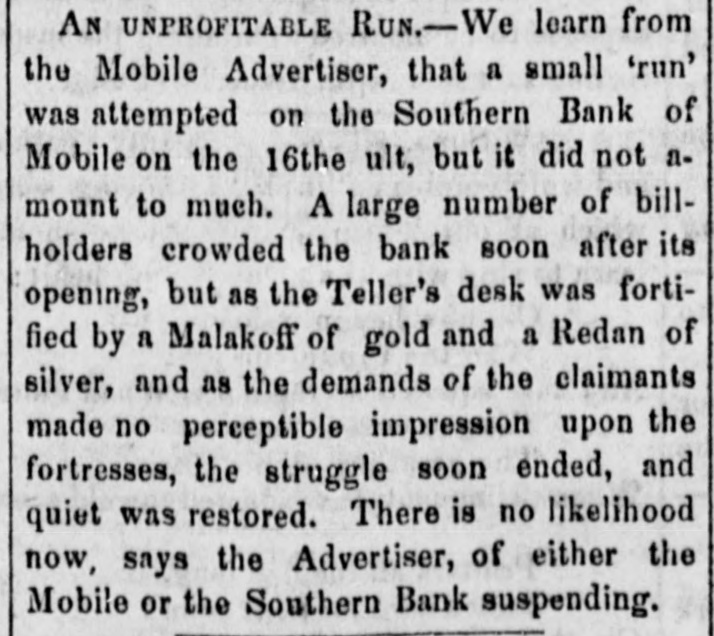

FINANCIAL IN MOBILE.-The Advertiser of Saturday says: A small run" was attempted upon the Southern Bank yesterday, but it did not amount to much. A large number of bill-holders crowded the bank soon after its opening, but as the Teller's desk was fortified by a Malakoff of gold and a Redan of silver, and as the demands of the claimants made no perceptible impression upon the fortress, the struggle soon ended, and quiet was restored. There is no likelihood now of either the Mobile or the Southern Bank suspending. The Mobile Savings Bank publishes in the papers of that city a statement of its affairs, placing its assets at $353,194 6S, and its liabilities at $293,438 78, thus leaving a surplus of $59,755 90, with discounted notes and drafts to the amount of $280,605 75 daily falling due.