Article Text

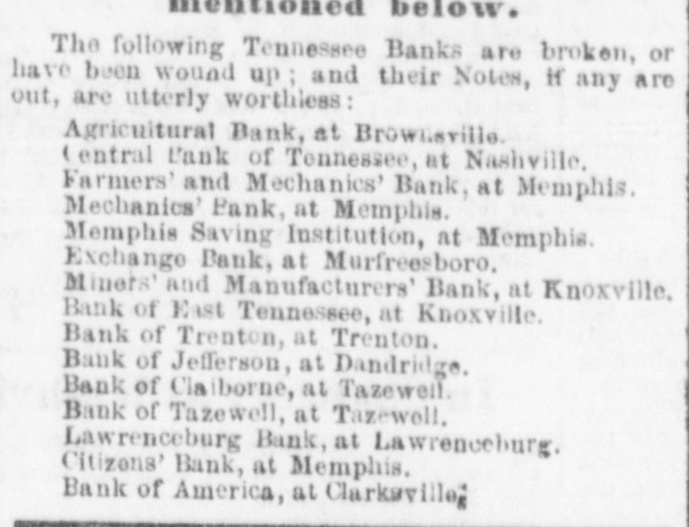

below. The following Tennessee Banks are broken, or have been wound up and their Notes, if any are out, are utterly worthless Agricultural Bank, at Brownsville. ( entral Bank of Tennessee, at Nashville, Farmers' and Mechanics' Bank, at Memphis. Mechanics' Pank, at Memphis. Memphis Saving Institution, at Memphis. Exchange Bank, at Murfreesboro, Miners' and Manufacturers' Bank, at Knoxville, Bank of East Tennessee, at Knoxville. Bank of Trenton, at Trenton. Bank of Jefferson, at Dandridge. Bank of Ciaiborne, at Tazeweil Bank of Tazewell, at Tazewell, Lawrenceburg Bank, at Lawrenceburg. Citizens' Bank, at Memphis. Bank of America, at Clarksvilleg