Click image to open full size in new tab

Article Text

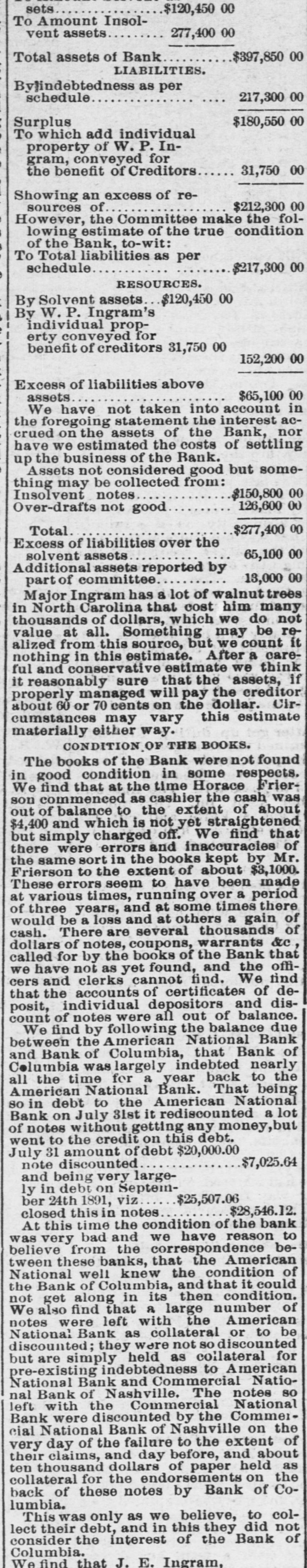

II NEWSY NOTES. -A thousand bales of cotton on the r railroad platform at Hope, Ark., burned. -Brakeman John Welsh was cut in g two by a Louisville Southern train at 11 Versailles. -The Bank of Columbia, Tenn., has failed, but it is claimed that depositors will be paid in full. d -It is officially announced that the harvests have been complete failures in 13 of the provinces of Russia. -Democrats still hold three presidential post-offices in Kentucky-Carlisle, Eminence and Flemingsburg. -The Pulaskicounty grand jury found 16 indictments against alleged members of the Gilliland gang of robbers. -Dr. Baker, sentenced to death at Abingdon, Va., for the poisoning of his wife, has been granted a new trial. -Eight prisoners, including 8 desper ate murderers, made a successful break from the Bowles county jail in Texas. -Capt. Leathers, the Louisville bankhas sued Madam Lang, the milliner, f er, r $10,000, because her dog bit his wife. -The severest hail storm in twenty yearscovered the ground about Seymour, Ind., with ice half an inch thick, Sunday. -Perry Carden, under sentence of death at Cleveland, Tenn., for raping a six-year-old child, broke jail and is still at large. -Harrison, Loring & Co., the Boston liaship-builders, have assigned. The bilities are $375,000, with nominal assets of $800,000. -Since the stockholders have voted that $1,200,000 to improve Middlesboro, it is reported that the Daily Herald will start up again. -The rope broke when Wm. Rose was launched off at Redwood Falls, Minn., Friday, and the job had to be done over again. -The boiler of the steamer Evangel exploded, at Port Townsend, Wash. Three people were instantly killed and 5 others were badly scalded. -Gen. W. H. F. Lee,familiarly known Rooney, Congressman from the 8th as Virginia district, and son of Gen. Robert E. Lee, died Thursday night. -Josie Mansfield, over whom Edward S. Stokes killed James Fisk, Jr., 20 years ago in New York, comes into notice again by marrying Robert Read in London. -Robert Charlton, colored, who killed his mistress Minnie Haskins. at Henderson, three weeks ago, has been found guilty and his punishment fixed at death. -George Martin, of Woodford, has sued C. W. Williams, owner of Allerton, for $25,000 damages. because his grandstand at Independence, Ia., fell and injured him. - A bold attempt was made to rob the National Bank at Cynthiana, Saturday, while all the:officers were out, but the teller gave the alarm and one of themen was captured. -J. F. Smith, lat Tole do, broke the record for type setting on a Mergenthaler linotype macbine, setting 47,900 ems, corrected matter, in 8 hours. This is more than four times the average setting by hand. -Dr. Lyman Ware, of Chicago, tells his fellow-citizensthat high buildings result in impure air, which, in turn, results pox, scrofula and other indesirable.conditions of the human frame. -Mrs. Archie: W. Overton, member of I prominent Tennessee family, threw of vitrol into the eyes of S. R. Elliott, Gallatin, because she thought him guil( ty of the ruin of her daughter. He will lose his sight. -In a fight between five negroes and the police force of Clifton Forge, Va. II one officer was killed and another dangerously wounded. Four of the negroes e were captured by a posse and three of them were lynched. to -W. P. Myers, of Lebanon, has been in appointed deputy collector of internal j revenue in place of E. F. Tucker removO ed, and Judge J.D. Belden, recently act quitted of violating the pension laws, has been appointed stamp deputy. a -The friends of William Noe, of Harlan county, are urging the Governor to T pardon him. Noe is serving a three years' sentence forthouse-breaking. His W wife died recently, leaving tweive helpT less children, @the oldest only twelve years of age. A -The Rev.I.Dr. John Hall, of New York, pastor of the wealthiest Presbyterian church in America, has resigned from the directory of Union Theological Seminary. His step is a result of the prosecution of Dr. Briggs, the alleged