Click image to open full size in new tab

Article Text

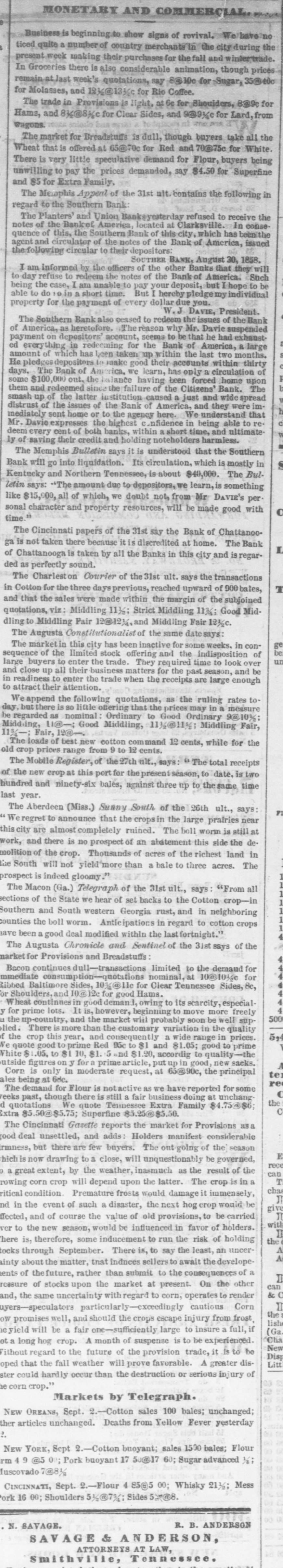

There is very little speculative demand for Flour, buyers being unwilling to pay the prices demanded, say $4.50 for Superfine and @5 for Extra Family, The Memphis Appeal of the 31st contains the following in regard to the Southern Bank: boad The Planters' and Union Banksyesterday refused to receive the notes of the Banket America, located at Clarksville. In consequence of this, the Southern Bank of this city, which has been the agent and circulator of the notes of the Bank of America, issued the following circular to their depositors: SOUTHER BANK, August 30, 1858. I am informed by the officers of the other Banks that they will to day refuse to redeem the notes of the Bank of America. Such being the case, I am unable to pay your deposit, but hope to be able to do 10 in a short time. But I hereby pledgemy individual property for the payment of every dollar due you. W.J. DAVIE, President. The Southern Bank also ceased to redeem the issues of the Bank of America, as heretofore. The reason why Mr. Davie suspended payment on depositors' account, seems to be that he had exhausted everything in redeeming for the Bank of America, & large amount of which has been taken up within the last two months. He pledges depositors to make good their accounts within thirty days. The Bank of America. we learn, has only a circulation of I some $100,000 out, the balance having been forced home upon b them and redeemed since the failure of the Citizens' Bank. The smash up of the latter institution caused a just and wide spread distrust of the issues of the Bank of America, and they were imh mediately sent home or to the agency here. We understand that c Mr. Davie expresses the highest confidence in being able to re. deem every cent of both banks, within a short time, and ultimately of saving their credit and holding noteholders harmless. The Memphis Bulletin says it is understood that the Southern Bank will go into liquidation. Its circulation, which is mostly in in Kentucky and Northern Tennessee, is about $40,000. The Bulletin says: "The amount due to depositors, learn, is something like $15,000, all of which, we doubt not, from Mr. DAVIE'S per. sonal character and property resources, will be made good with o time The Cincinnati papers of the 31st say the Bank of Chattanooga is not taken there because it is discredited at home. The Bank L of Chattanooga is taken by all the Banks in this city and is regarded as perfectly sound. The Charleston Courier of the 31st ult. says the transactions T in Cotton for the three days previous, reached upward of 900 bales, and that the sales were made within the margin of the subjoined quotations, viz: Middling 11½; Strict Middling 11%; Good Middling to Middling Fair 12@12½, and Middling Fair 12½c. The Augusta Constitutionalist of the same date says: ge The market in this city has been inactive for some weeks. in conbe sequence of the limited stock offering and the indisposition of un large buyers to enter the trade. They required time to look over and close up all their business matters for the past season, and be in readiness to enter the trade when the receipts are large enough to attract their attention. We append the following quotations, as the ruling rates today, but there is 80 little offering that the prices may in a measure be regarded as nominal: Ordinary to Good Ordinary 9@10%; Midding, 11@-; Good Middling, 11%@11%; Middling Fair, II%-; Fair, 12@-. The loads of best new cotton command 12 cents, while for the old crop prices range from 9 to 12 cents. The Mobile Register, of the 27th ult., says The total receipts of the new crop at this port for the present season, to date, is two hundred and ninety-six bales, against three up to the same time last year. The Aberdeen (Miss.) Sunny South of the 26th ult., says: FI We regret to announce that the crops the large prairies near this city are almost completely ruined. The boll worm is still at work, and there is no prospect of an abatement this side the de. molition of the crop. Thousands of acres of the richest land in the South will not yield more than a bale to three acres. The prospect is indeed gloomy The Macon (Ga.) Telegraph of the 31st ult., says: "From all sections of the State we hear of set backs to the Cotton crop-in Southern and South western Georgia rust, and in neighboring counties the boll worm. Anticipations in regard to cotton crops have been a good deal modified within the last fortnight." The Augusta Chronicle and Sentinel of the 31st says of the market for Provisions and Breadstuffs: 4 Bacon continues dull-transactions limited to the demand for mmediate consumption-quotations nominal, at 10@10kc for 4 Ribbed Baltimore Sides, for Clear Tennessee Sides, 8c, 4 or Shoulders, and 10@ 12c for good Hams. 4 Theat continues in good deman. owing to its scarcity, especial4 for prime lots. It is, however, beginning to move more freely 500 the up-country, and the market will probably soon be well suplied. There is more than the customary variation in the quality 5,4 the crop this year, and consequently a wide range in prices. We quote good to prime Red 95c to $1 and $1.05; good to prime White $ .05, to $1 10, $1. 5 and $1.20, accordig to quality-the utside figures on y for a prime article, put up in good, new sacks. Corn is only in moderate request, at 65@90c, the principal te ales being at 6dc. re The demand for Flour is notactive as we have reported for some o feeks past, though there is still a fair business doing at unchangthe quotations We quote Tennessee Extra Family $4.75@$6; C ixtra 5.50@$5.75; Superfine $5.25@$5.50. The Cincinnati Gazette reports the market for Provisions as a ood deal unsettled, and adds: Holders manifest considerable irmness, but there are few buyers. The out going of the) season E hich is now drawing to a close, will unquestionably be governed, rece can a great extent, by the weather, inasmuch as the result of the T rowing corn crop will depend upon the latter. The crop is in a chas ritical condition Premature frosts would damage it immensely, JI nd in the event of such a disaster, the next hog crop would be git ffected, and of course the value of old provisions, to be carried with ver to the new season, would be influenced in favor of holders. II the here is, therefore, some inducement to run the risk of holding A tocks through September. There is, to say the least, an uncerA inty about the matter, tnat indnces sellers to await the developeents of the future, rather than submit to the consequences of a II can ressure of stocks upon the market at present. On the other & and, the same uncertainty with regard to corn, operates to render II uyers-speculators particularly-exceedingly cautious Corn the ow promises well, and should the crops escape injury from frost. lish (Ga. eyield will be a fair one-sufficiently large to insure a full, if "Cha a long hog crop. A month of suspense is to be experienced. New (ithout regard to the future of the provision trade, it is to be Disp Litt oped that the fall weather will prove favorable. A greater disster could hardly occur than the destruction or serious injury of he corn crop." Markets by Telegraph. NEW OREANS, Sept. 2.-Cotton sales 100 bales; unchanged; ther articles unchanged. Deaths from Yellow Fever yesterday ?. NEW YORK, Sept 2.-Cotton buoyant; sales 1500 bales; Flour rm 4 9 @5 00; Pork buoyant 17 50@17 60; Sugar advanced %; Inscovado 7@8% CINCINNATI, Sept. 2.-Flour 8505 00; Whisky 21½; Mess ork 16 00; Shoulders 5%@7%; Sides 5X@8. R. B. ANDERSON N. SAVAGE. SAVAGE & ANDERSON, ATTORNEYS AT LAW, Smithville, Tennessee.