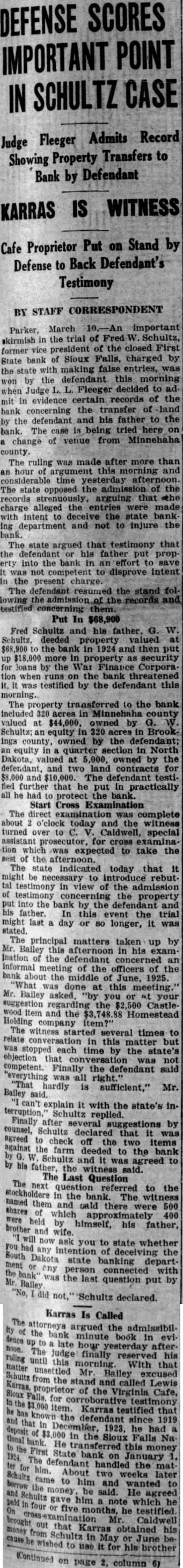

Article Text

DEFENSE SCORES IMPORTANT POINT IN SCHULTZ CASE Admits Record Fleeger Judge Showing Property Transfers to Bank by Defendant IS WITNESS KARRAS Cafe Proprietor Put on Stand by Defense to Back Defendant's Testimony March skirmish Parker, in the trial of W. Schultz, president of the closed First former vice bank of Falls, charged by State with making false entries, the the defendant this morning won when Fleeger decided to Judge evidence certain records of the mit concerning the transfer of land defendant and his father to the the bank. The case is being tried here on change of venue from Minnehaha county. The ruling was made after more than an hour argument this morning and time yesterday afternoon. The state opposed admission of the records strenuously. arguing that charge alleged the entries were made with intent the state bank Ing department and not to injure the The state argued that testimony that the defendant his father property into the bank in an effort to save was not competent to disprove intent the present charge. The defendant resumed the stand fol. lowing the records and testified them. Put In $68,900 Fred Schultz and his father, G. W. Schultz, deeded valued the bank in 1924 and then put $18,000 more in property security for loans by the War Finance tion when runs on the bank threatened was testified by the defendant this The to the bank 320 valued at $44,000. owned by Schultz: equity 320 Brook. ings county, owned by the defendant; equity in quarter section in North Dakota, valued at 5,000, owned by the defendant, two land contracts for and $10,000. The he put practically he the bank. Start Cross Examination The examination was complete about o'clock today and the witness turned over to Caldwell, special assistant prosecutor, for examina-tion expected to take the of the afternoon. The state indicated today that might be to rebuttestimony in view of the admission testimony the property into the bank by the defendant and his father. In this trial event the might stated. last day or so longer, it was The principal matters taken up by Mr. this afternoon in his exam Ination the of the officers of the about the middle of June, 1925. "What was at done this Mr asked, "by you at your regarding the $2,500 CastleHolding item and the Homestead The witness several times to relate this matter but was stopped each time by the state's objection that conversation competent. Finally the defendant said all right. "That hardly sufficient," Mr. said. terruption, explain it with the state's inSchultz replied. Finally after by several suggestions Schultz declared that it agreed check off the two against farm deeded to the bank his Schultz the and It was agreed to witness The Last Question The next question referred to the stockholders in the bank. The witness named shares them of and cald there were 500 which were held by himself, his father, and wife. now ask you to state whether any intention Dakota state banking depart- the ment any person connected with Balley was the last question put by "No, I did Schultz declared. Karras Is Called The attorneys argued the the bank minute book in dence yesterday The judge finally reserved his ruling until this morning With that unsettled from the stand and Bailey called excused Lewis Sloux Falls, proprietor for the Virginia Cafe, item. Karras testified that has the defendant since 1919 that he had in the Sioux Falls Na He this First State bank on January The defendant handled the him. About two weeks later Schultz to him and wanted said. He agreed Schultz gave him note which he five he testified. brought out that Mr. obtained Caldwell his from wished Schultz to In May or June beuse it for his brother (Continued on page 2, column 6)