Article Text

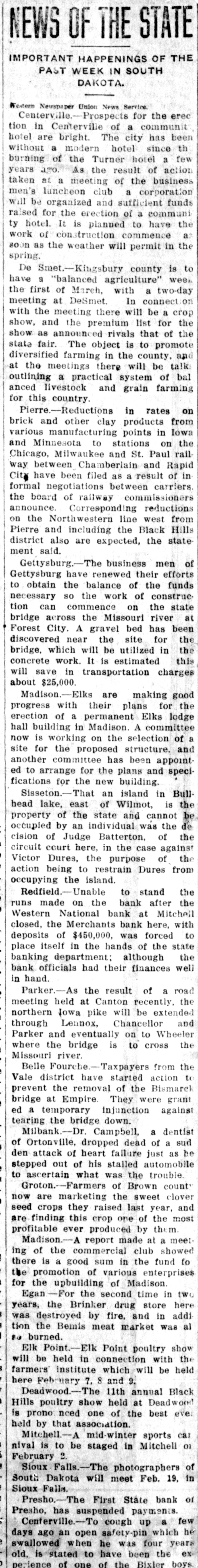

NEWS OF THE STATE IMPORTANT HAPPENINGS OF THE PAST WEEK IN SOUTH DAKOTA. Western Newspaper Union News Service. Centerville.-Prospects for the erec tion in Centerville of a communit hotel are bright. The city has beer without a modern hotel since th burning of the Turner hotel a few years ago. As the result of action taken at a meeting of the business men's luncheon club a corporation will be organized and sufficient funds raised for the erection of a communi ty hotel. It is planned to have the work of construction commence a soon as the weather will permit in the spring. De Smet.-Kingsbury county is to have a "balanced agriculture" week the first of March, with a two-day meeting at DeSmet. In connect 01 with the meeting there will be a cro; show, and the premium list for the show as announced rivals that of the state fair. The object is to promote diversified farming in the county, and at the meetings there will be talk outlining a practical system of bal anced livestock and grain farming for this country. Pierre.-Reductions in rates or brick and other clay products from various manufacturing points in Iowa and Minnesota to stations on the Chicago, Milwaukee and St. Paul rail way between Chamberlain and Rapio City have been filed as a result of in formal negotiations between carriers the board of railway commissioner announce. Corresponding reductions on the Northwestern line west from Pierre and including the Black Hill district also are expected, the state ment said. Gettysburg.-The business men o Gettysburg have renewed their efforts to obtain the balance of the funds necessary so the work of construe tion can commence on the state bridge across the Missouri river a Forest City. A gravel bed has beer discovered near the site for the bridge, which will be utilized in th concrete work. It is estimated this will save in transportation charge about $25,000. Madison.-Elks are making good progress with their plans for the erection of a permanent Elks lodge hall building in Madison. A committe now is working on the selection of : site for the proposed structure, an another committee has been appoint ed to arrange for the plans and speci fications for the new building. Sisseton.-That an island in Bull head lake, east of Wilmot, is the property of the state and cannot b occupied by an individual was the de cision of Judge Batterton, of the circuit court here, in the case agains Victor Dures, the purpose of the action being to restrain Dures fron occupying the island. Redfield.-Unable to stand the runs made on the bank after the Western National bank at Mitchel closed, the Merchants bank here, with deposits of $450,000, was forced t place itself in the hands of the state banking department; although the bank officials had their finances wel in hand. Parker.-As the result of a road meeting held at Canton recently, the northern Iowa pike will be extende through Lennox, Chancellor and Parker and eventually on to Wheele