Article Text

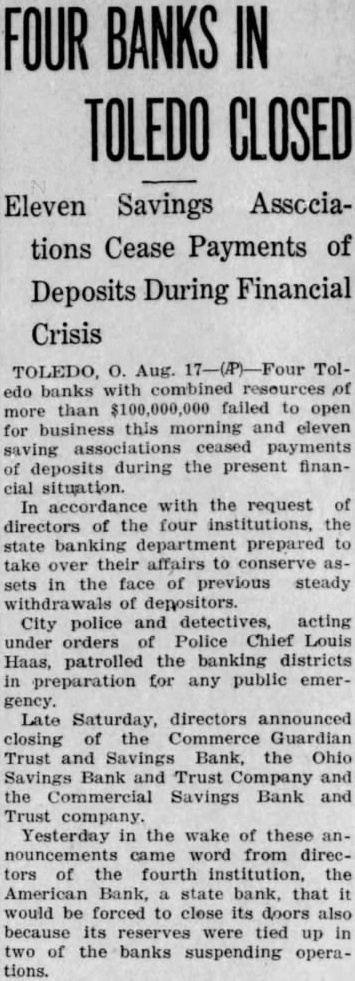

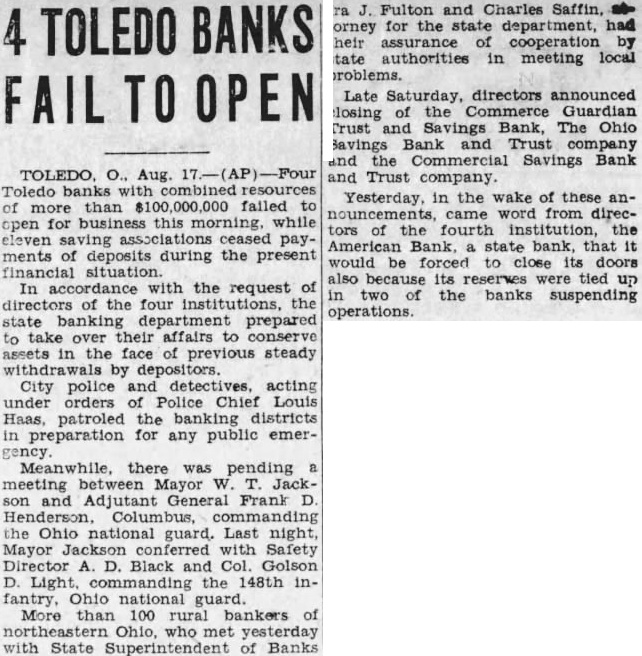

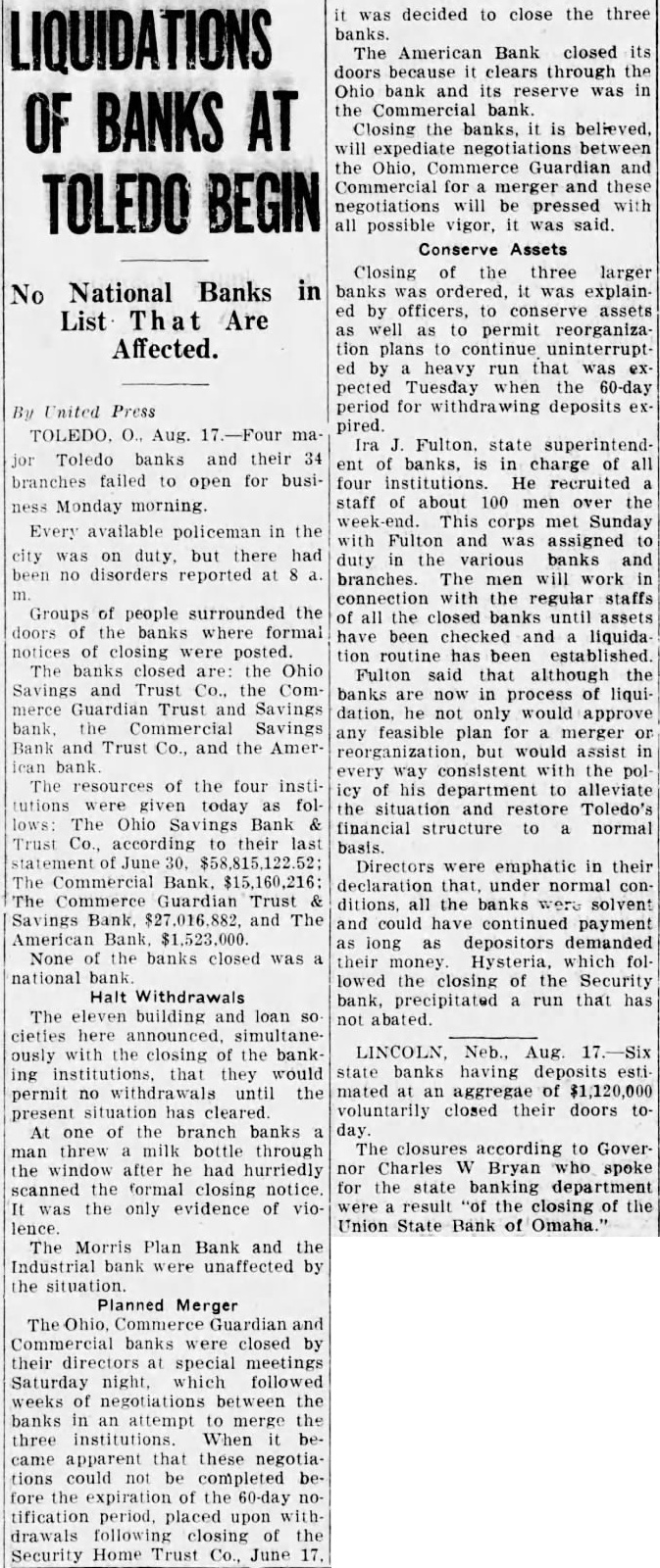

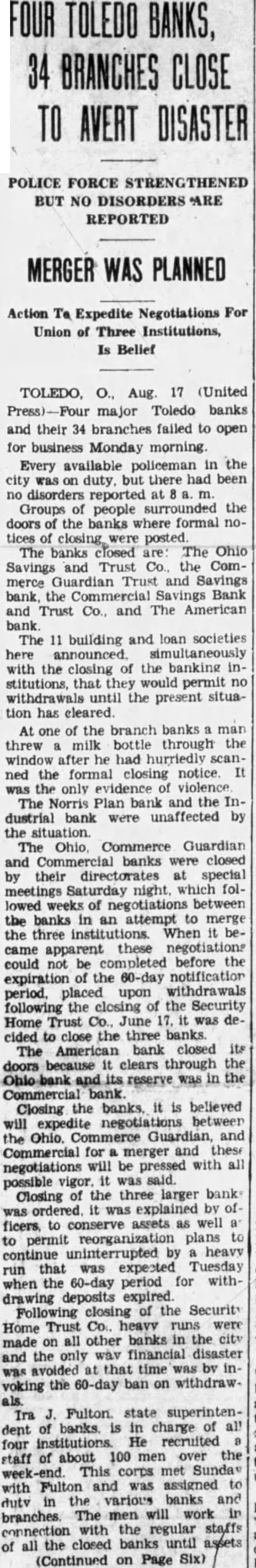

3RD LARGEST BANK IN TOLEDO CLOSES All Banks Now Ask for Sixty Days' Notice Before Money May Be Withdrawn. Toledo, Ohio.-The third largest bank in this city has closed its doors and three other banks have announced that 60 days' written notice would be required for withdrawals of savings deposits. The Security Home Trust Co., with resources alleged to exceed 36 million dollars, failed to open the doors of its main office and 11 branches, tying up abut $20,000,000 in deposits. Heavy withdrawals from other banks followed, and as a result, the Commerce-Guardian Trust and Savings Bank, the Ohio Savings and Trust Co. announced that no one could get any money from them unless 60 days' written notice were given. The Security Home Trust Co. issued a statement saying that it had closed its doors to conserve the assets and protect stockholders, creditors and depositors. WithS drawals amounting to $7,000,000 in the last few months was said to have been the chief cause for the closing order. The city of Toledo had about $1,500,000 in general revenue and tax funds on deposit in the bank when it closed; the Board of Education had over a million dollars and Lucas county $200,000 on de posit. All these are secured by bonds. Other depositors, mostly workers and small business men d are protected by nothing.