Article Text

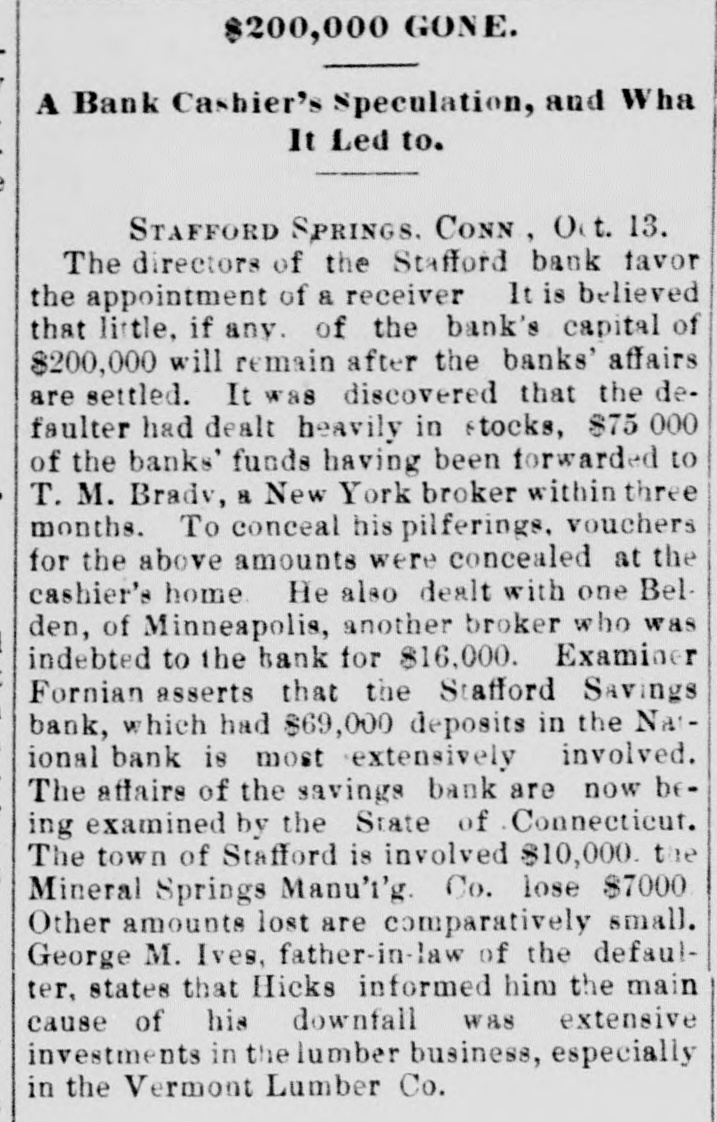

$200,000 GONE. A Bank Cashier's Speculation, and Wha It Led to. STAFFORD SPRINGS. CONN, Oct. 13. The directors of the Stafford bank favor the appointment of a receiver It is believed that little, if any. of the bank's capital of $200,000 will remain after the banks' affairs are settled. It was discovered that the defaulter had dealt heavily in stocks, $75 000 of the banks' funds having been forwarded to T. M. Bradv, a New York broker within three months. To conceal his pilferings, vouchers for the above amounts were concealed at the cashier's home. He also dealt with one Belden, of Minneapolis, another broker who was indebted to the bank for $16,000. Examiner Fornian asserts that the Stafford Savings bank, which had $69,000 deposits in the National bank is most extensively involved. The affairs of the savings bank are now being examined by the State of Connecticut. The town of Stafford is involved $10,000. the Mineral Springs Manu't'g. Co. lose $7000 Other amounts lost are comparatively small. George M. Ives, father-in-law of the defaulter, states that Hicks informed him the main cause of his downfall was extensive investments in the lumber business, especially in the Vermont Lumber Co.