Article Text

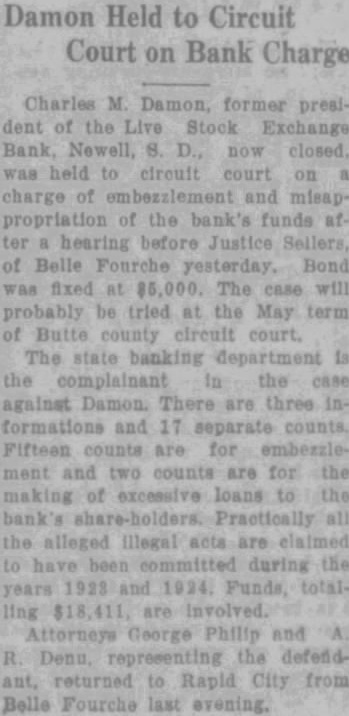

Damon Held to Circuit Court on Bank Charge Charles M. Damon, former president of the Live Stock Exchange Bank, Newell, S. D., now closed. was held to circuit court on charge of embezzlement and misappropriation of the bank's funds ter hearing before Justice Sellers, of Belle Fourche yesterday. Bond was fixed At 85,000. The case will probably be tried at the May term of Butte county circuit court, The state banking department the complainant In the case against Damon. There are three formations and 17 separate counts. Fifteen counts are for embezzlement and two counts are for the making of excessive loans to the bank share-holders. Practically the alleged Illegal acts are claimed have been committed during the years 1928 and 1924, Funds, totalling $18,411, are involved. Attorneys George Philip and Denu, representing the defendant, returned to Rapid City from Belle Fourche last evening.