Article Text

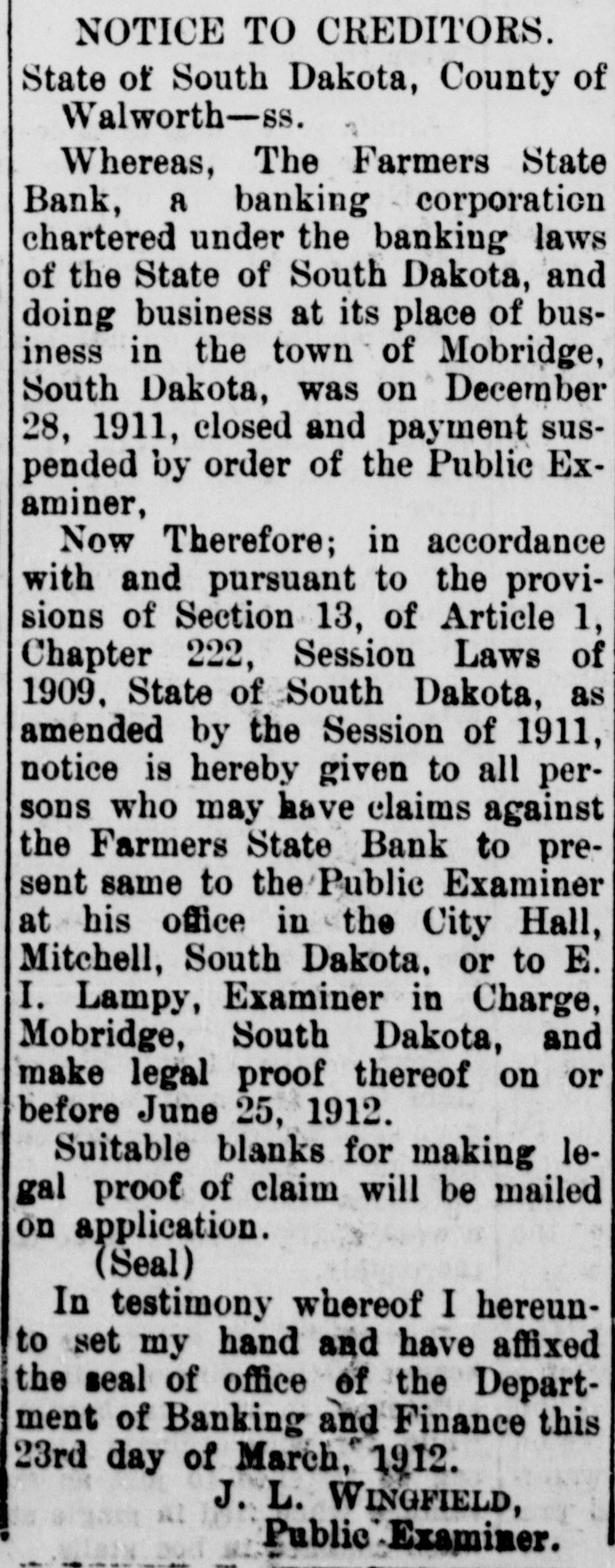

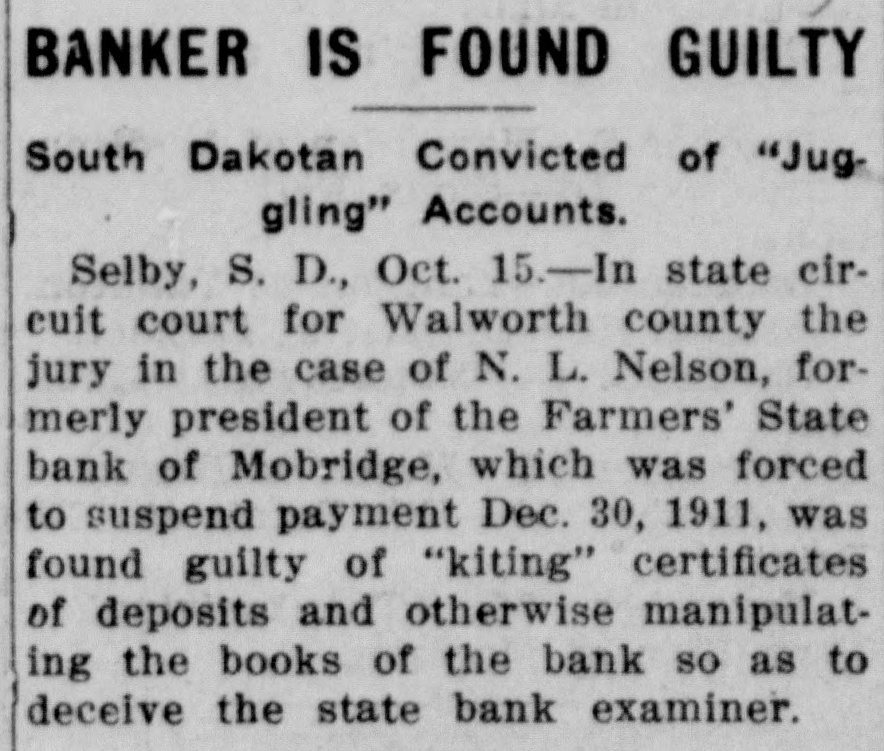

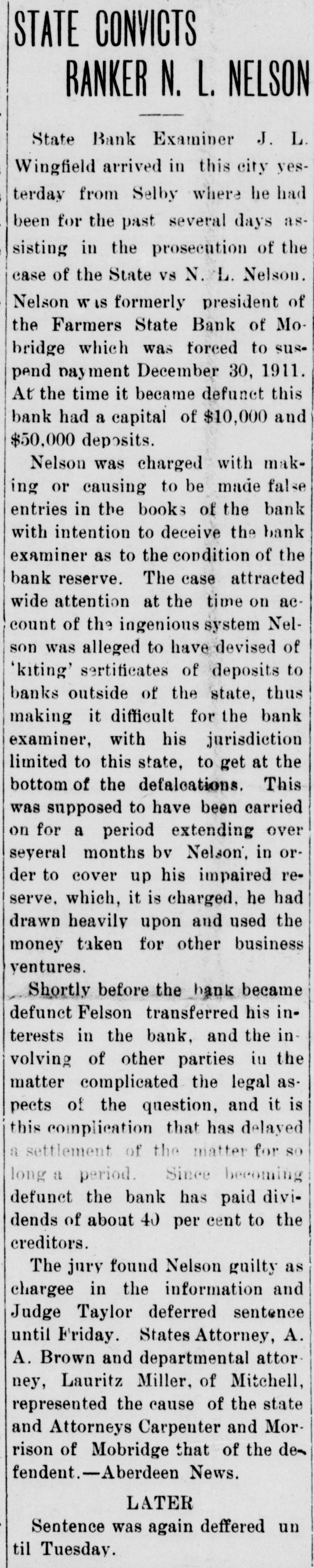

LOCAL NEWS AND COMMENT G. B. Thomas was over from State's Attorney E. B. Adams ranch near Glenham Tuesday. of Java, was a Mobridge visitor Tuesday. Attorney W. M. Potts is absent Anyone wanting washing or from the city on professional busiother housework done by the day, at points east of here. call at James Ritchey's. Hon. Geo. H. Hoffman, of LowJ. W. Harris made a short buswas a Mobridge visitor again iness trip to MeIntosh and MorrisTuesday of this week. town on Wednesday of this week Mrs. A. C. Dykeman has been Mrs. J. F. Comstock returned quite ill for several days, but is Wednesday from a visit with nuch improved at this time. friends at points on the Cheyenne When purchasing coal, rememreservation. we can give you quality in any Mr. and Mrs Harry Hastings quantity. Bright-Webster Lumleft Tuesday night on a somewhat Co. extended trip to Seattle and other Ed Armstrong and Phillip ClayPacific coast points. more, of Cheyenne Junction, spent C. B. Little arrived last week the early part of the week in the from Cottonwood, this state, and e'ty. has accepted a position as pharmaA. H. Brown returned Sunday cist in Thos Church's drug store from an absence of six weeks, I have a number of lots in the which was spent at French Lick Northwest Townsite Company and and other Indiana points. the Main Park addition that I car I am prepared to do all kinds of sell at a bargain. M. T. Woods draying, hauling and moving. AlJohn Cooley, of McLaughlin let riding horses out by the hour or day. L. C. Hollenbeck. engineer on the Standing Rocl branch, was shaking hands with C. W. Boldt, the well-known his many friends in this city Wed Eagle Butte banker, was visiting nesday. with friends and attending to business matters in the city WedFurniture moved, stored o nesday. packed for shipment; empty kegs P. D. Kribs, register of the barrels, etc for sale. In fact United States land office at Timber anything in that line. L. C. Hol lenbeck. Lake, was in the city over last night on his way to Aberdeen for L. E. Pierce came up from Mo visit with his family. bridge Monday to fix up his house For Sale-All my household furand get settled again on the home niture, including good piano, stead. He found the plumbing stoves and may other articles, all bursted by the frost. -Isabel News first-class condition. Terms to George M. Comstock, of Mc responsible parties. Dr. J. E. Laughlin, visited with his parents Ekrem. in this city early in the week Delbert Gallett went to Mobridge Mr. Comstock was returning home Tuesday on business for the D. G. from a visit with friends nea Gallett Jewelry company, which Mound City. several branch stores at MoFarmers in the vicinity of Mo bridge and the trans-Missouri bridge who have not got their ountry.-Aberdeen News. seed or feed for spring, we would Mr. and Mrs. L. J. Edmundson like to have them call at our bank left last week on a trip to several as we may be of some assistance eastern points. They visited Minto you. Mobridge State Bank. neapolis, Milwaukee and Chicago, E. I. Lampy, receiver of the and at present are visiting with relatives and friends at What Farmers State Bank at Mobridge Cheer, Iowa. Friends in the city returned Saturday night for an have received cards from them over-Sunday visit with his family saying that they are having an inand will return to Mobridge to teresting and enjoyable trip. morrow morning. - Watertown Public Opinion. E. S. Ludlow, proprietor of a hotel at Timber Lake, spent Wed nesday in the Bridge City. Mr Ludlow was on his return home from the baliny climes of Florida where he had been spending the most severe portion of the winter A wild animal of some sort has been causing homesteaders in the vicinity of Skull But'e, Corson county, heavy losses of live stock The tracks of the animal lead to the belief that it is a mountain KODAKS lion, and an expedition will be organized to hunt down the crea $2 to $30 ture. For the information of interest SPRING IS IN THE ed attorneys and others, Clerk of AIR Courts Holley, of Dewey county wishes The News to announce that "Kodak Time" Judge Carpenter will be in Tim ber Lake on Monday. March 4th Start now and let us show you at which time he will take up any the newest Kodaks. court matters which may be presented in chambers. The judge Full Line of Supplies is in a position to spend some AT time at Timber Lake, and is anx ious to get all court matters GALLETT'S cleaned up.