Article Text

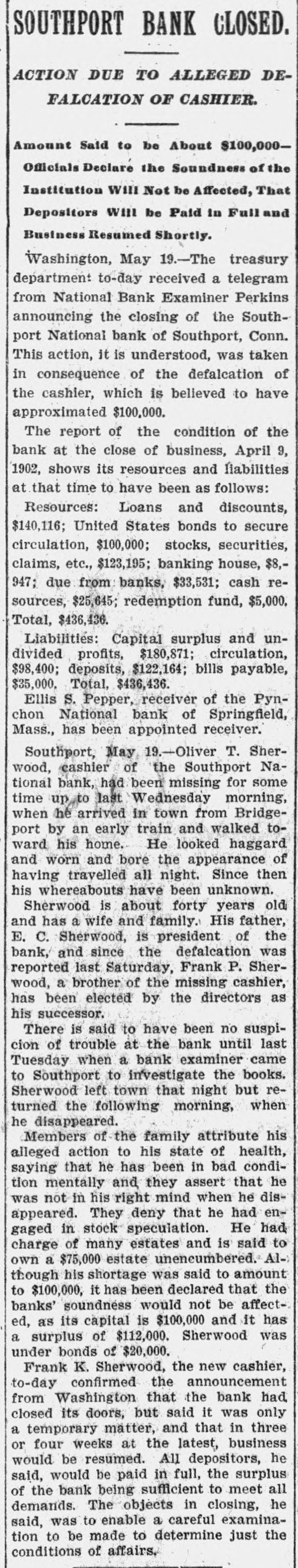

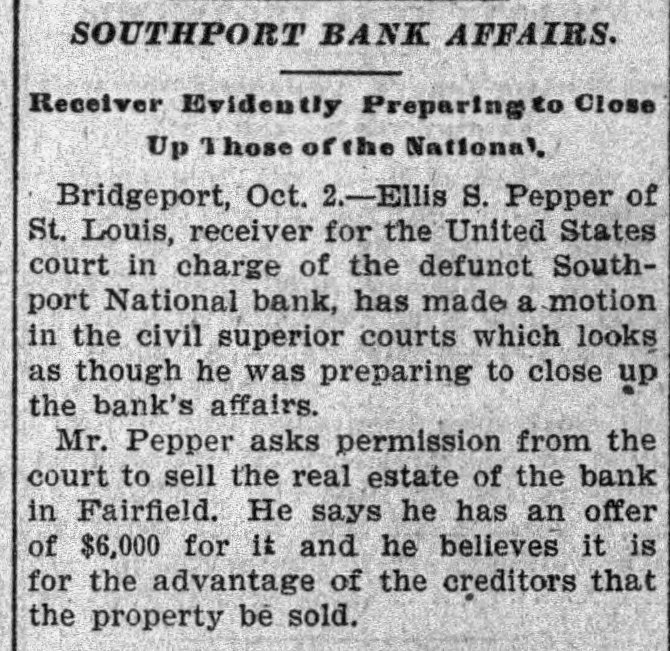

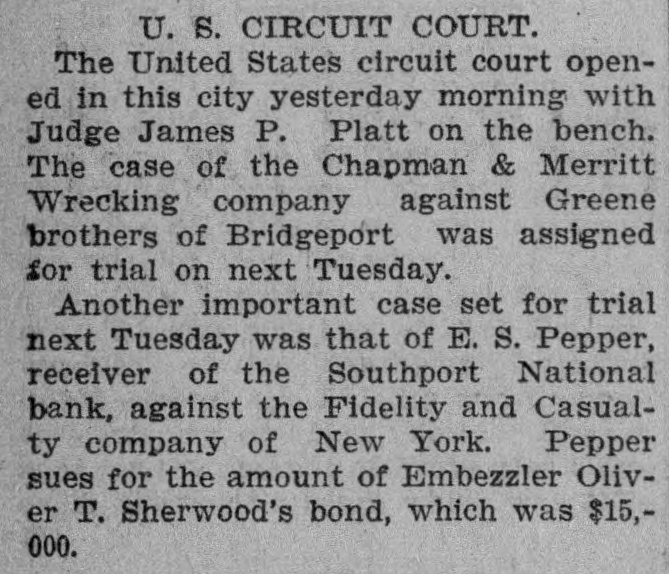

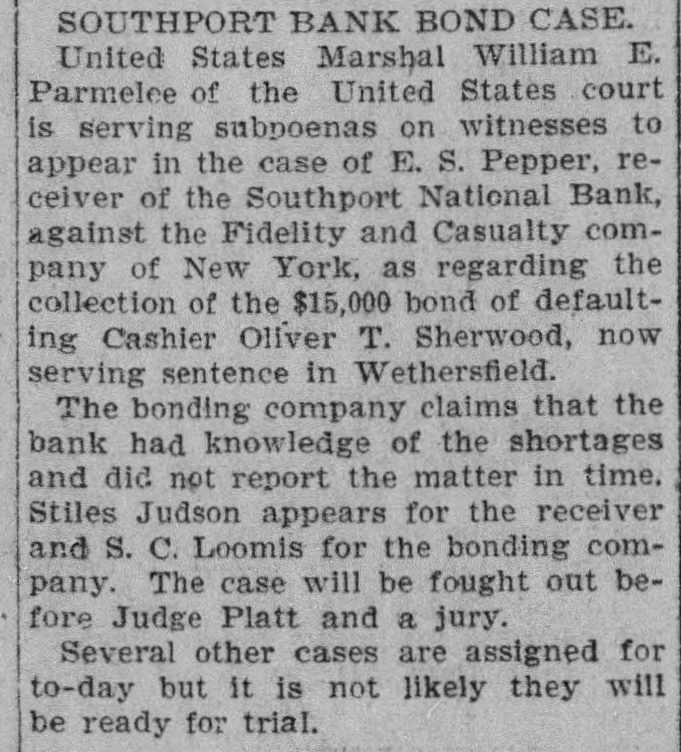

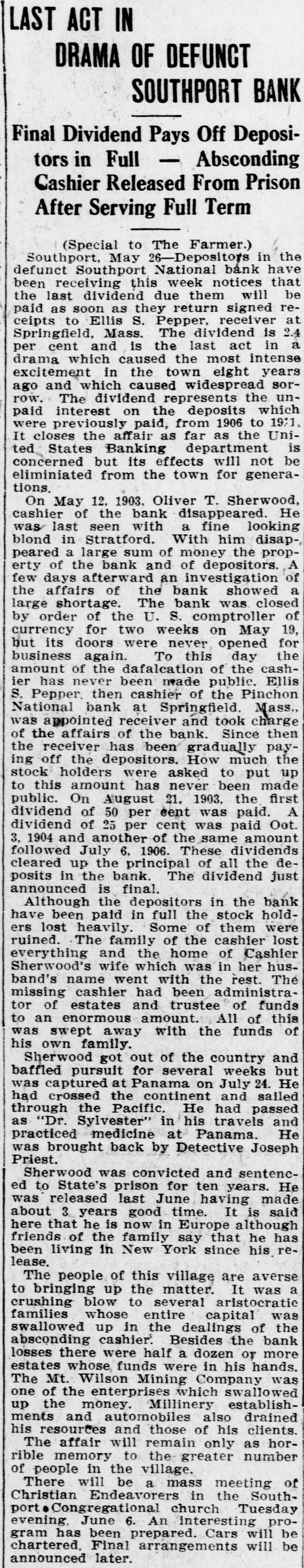

SOUTHPORT BANK CLOSED. ACTION DUE TO ALLEGED DEFALCATION OF CASHIER. Amount Said to be About $100,000Officials Declare the Soundness of the Institution Will Not be Affected, That Depositors will be Paid in Full and Business Resumed Shortly. Washington, May 19.-The treasury department to-day received a telegram from National Bank Examiner Perkins announcing the closing of the Southport National bank of Southport, Conn. This action, it is understood, was taken in consequence of the defalcation of the cashier, which is believed to have approximated $100,000. The report of the condition of the bank at the close of business, April 9, 1902, shows its resources and liabilities at that time to have been as follows: Resources: Loans and discounts, $140,116; United States bonds to secure circulation, $100,000; stocks, securities, claims, etc., $123,195; banking house, $8,947; due from banks, $33,531; cash resources, $25,645; redemption fund, $5,000. Total, $436,436. Liabilities: Capital surplus and undivided profits, $180,871; circulation, $98,400; deposits, $122,164; bills payable, $35,000. Total, $436,436. Ellis S. Pepper, receiver of the Pynchon National bank of Springfield, Mass., has been appointed receiver. Southport, May 19.-Oliver T. Sherwood, cashier of the Southport National bank, had been missing for some time up to last Wednesday morning, when he arrived in town from Bridgeport by an early train and walked toward his home. He looked haggard and worn and bore the appearance of having travelled all night. Since then his whereabouts have been unknown. Sherwood is about forty years old and has a wife and family. His father, E. C. Sherwood, is president of the bank, and since the defalcation was reported last Saturday, Frank P. Sherwood, a brother of the missing cashier, has been elected by the directors as his successor. There is said to have been no suspicion of trouble at the bank until last Tuesday when a bank examiner came to Southport to investigate the books. Sherwood left town that night but returned the following morning, when he disappeared. Members of the family attribute his alleged action to his state of health, that he has been in bad condiand they assert in his right mind They deny that appeared. was saying tion not mentally when he He had that he dis- had en- he in stock speculation. of many estates and estate his was said own though gaged charge a $75,000 shortage uneneumbered. to is that amount said Al- the to to $100,000, it has been declared banks' soundness would not be affected, as its capital is $100,000 and it has a surplus of $112,000. Sherwood was under bonds of $20,000. Frank K. Sherwood, the new cashier, to-day confirmed the announcement Washington that the bank had but said it was a matter, and weeks at the latest, resumed. All closed or from would temporary four its be doors, depositors, that business in surplus three only he said, would be paid in full, the of the bank being sufficient to meet all demands. The objects in closing, he said, was to enable a careful examination to be made to determine just the conditions of affairs,