Article Text

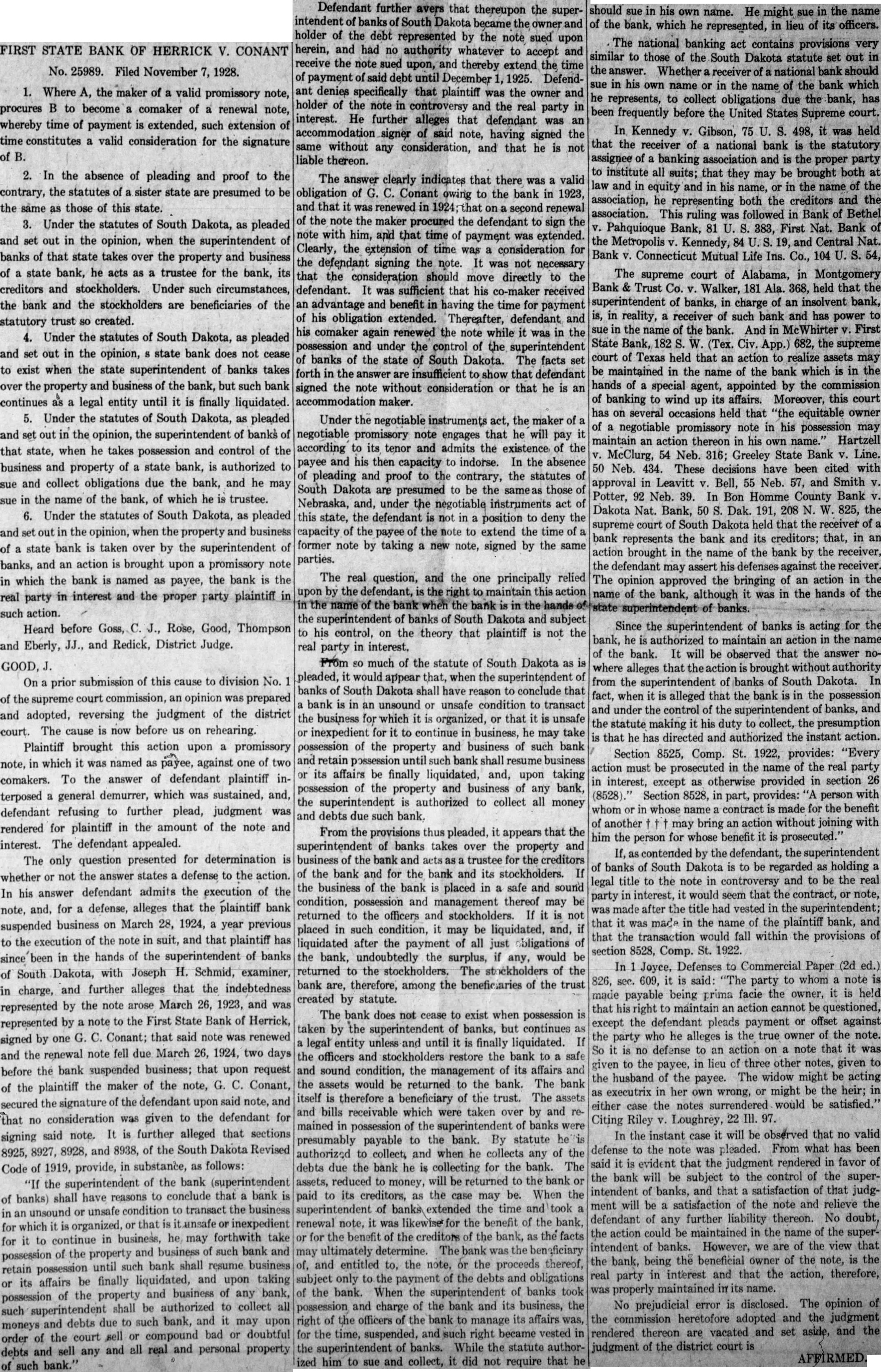

FIRST STATE BANK OF HERRICK V. CONANT No. 25989. Filed November 7, 1928. 1. Where A, the maker of a valid promissory note, procures B to become a comaker of a renewal note, whereby time of payment is extended, such extension of time constitutes a valid consideration for the signature of B. 2. In the absence of pleading and proof to the contrary, the statutes of a sister state are presumed to be the same as those of this state. 3. Under the statutes of South Dakota, as pleaded and set out in the opinion, when the superintendent of banks of that state takes over the property and business of a state bank, he acts as a trustee for the bank, its creditors and stockholders. Under such circumstances, the bank and the stockholders are beneficiaries of the statutory trust SO created. 4. Under the statutes of South Dakota, as pleaded and set out in the opinion, S state bank does not cease to exist when the state superintendent of banks takes over the property and business of the bank, but such bank continues as a legal entity until it is finally liquidated. 5. Under the statutes of South Dakota, as pleaded and set out in the opinion, the superintendent of banks of that state, when he takes possession and control of the business and property of a state bank, is authorized to sue and collect obligations due the bank, and he may sue in the name of the bank, of which he is trustee. 6. Under the statutes of South Dakota, as pleaded and set out in the opinion, when the property and business of a state bank is taken over by the superintendent of banks, and an action is brought upon a promissory note in which the bank is named as payee, the bank is the real party in interest and the proper party plaintiff in such action. Heard before Goss, C. J., Rose, Good, Thompson and Eberly, JJ., and Redick, District Judge. GOOD, J. On a prior submission of this cause to division No. 1 of the supreme court commission, an opinion was prepared and adopted, reversing the judgment of the district court. The cause is now before us on rehearing. Plaintiff brought this action upon a promissory 'note, in which it was named as payee, against one of two comakers. To the answer of defendant plaintiff interposed a general demurrer, which was sustained, and, defendant refusing to further plead, judgment was rendered for plaintiff in the amount of the note and interest. The defendant appealed. The only question presented for determination is whether or not the answer states a defense to the action. In his answer defendant admits the execution of the note, and, for a defense, alleges that the plaintiff bank suspended business on March 28, 1924, a year previous to the execution of the note in suit, and that plaintiff has since been in the hands of the superintendent of banks of South Dakota, with Joseph H. Schmid, examiner, in charge, and further alleges that the indebtedness represented by the note arose March 26, 1923, and was represented by a note to the First State Bank of Herrick, signed by one G. C. Conant; that said note was renewed and the renewal note fell due March 26, 1924, two days before the bank suspended business; that upon request of the plaintiff the maker of the note, G. C. Conant, secured the signature of the defendant upon said note, and that no consideration was given to the defendant for signing said note. It is further alleged that sections 8925, 8927, 8928, and 8938, of the South Dakota Revised Code of 1919, provide, in substance, as follows: "If the superintendent of the bank (superintendent of banks) shall have reasons to conclude that a bank is in an unsound or unsafe condition to transact the business for which it is organized, or that is it unsafe or inexpedient for it to continue in business, he, may forthwith take possession of the property and business of such bank and retain possession until such bank shall resume business or its affairs be finally liquidated, and upon taking possession of the property and business of any bank, such superintendent shall be authorized to collect all moneys and debts due to such bank, and it may upon order of the court sell or compound bad or doubtful debts and sell any and all real and personal property of such bank." Defendant further avers that thereupon the superintendent of banks of South Dakota became the owner and holder of the debt represented by the note sued upon herein, and had no authority whatever to accept and receive the note sued upon, and thereby extend the time of payment of said debt until December 1, 1925. Defendant denies specifically that plaintiff was the owner and holder of the note in controversy and the real party in interest. He further alleges that defendant was an accommodation signer of said note, having signed the same without any consideration, and that he is not liable thereon. The answer clearly indicates that there was a valid obligation of G. C. Conant owing to the bank in 1923, and that it was renewed in 1924; that on a second renewal of the note the maker procured the defendant to sign the note with him, and that time of payment was extended. Clearly, the extension of time was a consideration for the defendant signing the note. It was not necessary that the consideration should move directly to the defendant. It was sufficient that his co-maker received an advantage and benefit in having the time for payment of his obligation extended. Thereafter, defendant and his comaker again renewed the note while it was in the possession and under the control of the superintendent of banks of the state of South Dakota. The facts set forth in the answer are insufficient to show that defendant signed the note without consideration or that he is an accommodation maker. Under the negotiable instruments act, the maker of a negotiable promissory note engages that he will pay it according to its tenor and admits the existence of the payee and his then capacity to indorse. In the absence of pleading and proof to the contrary, the statutes of South Dakota are presumed to be the same as those of Nebraska, and, under the negotiable instruments act of this state, the defendant is not in a position to deny the capacity of the payee of the note to extend the time of a former note by taking a new note, signed by the same parties. The real question, and the one principally relied upon by the defendant, is the right to maintain this action in the name of the bank when the bank is in the hands of the superintendent of banks of South Dakota and subject to his control, on the theory that plaintiff is not the real party in interest. From SO much of the statute of South Dakota as is pleaded, it would appear that, when the superintendent of banks of South Dakota shall have reason to conclude that a bank is in an unsound or unsafe condition to transact the business for which it is organized, or that it is unsafe or inexpedient for it to continue in business, he may take possession of the property and business of such bank and retain possession until such bank shall resume business or its affairs be finally liquidated, and, upon taking possession of the property and business of any bank, the superintendent is authorized to collect all money and debts due such bank. From the provisions thus pleaded, it appears that the superintendent of banks takes over the property and business of the bank and acts as a trustee for the creditors of the bank and for the bank and its stockholders. If the business of the bank is placed in a safe and sound condition, possession and management thereof may be returned to the officers and stockholders. If it is not placed in such condition, it may be liquidated, and, if liquidated after the payment of all just obligations of the bank, undoubtedly the surplus, if any, would be returned to the stockholders. The ckholders of the bank are, therefore, among the beneficiaries of the trust created by statute. The bank does not cease to exist when possession is taken by the superintendent of banks, but continues as a legal entity unless and until it is finally liquidated. If the officers and stockholders restore the bank to a safe and sound condition, the management of its affairs and the assets would be returned to the bank. The bank itself is therefore a beneficiary of the trust. The assets and bills receivable which were taken over by and remained in possession of the superintendent of banks were presumably payable to the bank. By statute he is authorized to collect, and when he collects any of the debts due the bank he is collecting for the bank. The assets, reduced to money, will be returned to the bank or paid to its creditors, as the case may be. When the superintendent of banks extended the time and took a renewal note, it was likewise for the benefit of the bank, or for the benefit of the creditors of the bank, as the facts may ultimately determine. The bank was the beneficiary of, and entitled to, the note, or the proceeds thereof, subject only to the payment of the debts and obligations of the bank. When the superintendent of banks took possession and charge of the bank and its business, the right of the officers of the bank to manage its affairs was, for the time, suspended, and such right became vested in the superintendent of banks. While the statute authorized him to sue and collect, it did not require that he should sue in his own name. He might sue in the name of the bank, which he represented, in lieu of its officers. The national banking act contains provisions very similar to those of the South Dakota statute set out in the answer. Whether a receiver of a national bank should sue in his own name or in the name of the bank which he represents, to collect obligations due the bank, has been frequently before the United States Supreme court. In Kennedy V. Gibson, 75 U. S. 498, it was held that the receiver of a national bank is the statutory assignee of a banking association and is the proper party to institute all suits; that they may be brought both at law and in equity and in his name, or in the name of the association, he representing both the creditors and the association. This ruling was followed in Bank of Bethel V. Pahquioque Bank, 81 U. S. 383, First Nat. Bank of the Metropolis V. Kennedy, 84 U.S. 19, and Central Nat. Bank V. Connecticut Mutual Life Ins. Co., 104 U. S. 54, The supreme court of Alabama, in Montgomery Bank & Trust Co. V. Walker, 181 Ala. 368, held that the superintendent of banks, in charge of an insolvent bank, is, in reality, a receiver of such bank and has power to sue in the name of the bank. And in McWhirter V. First State Bank, 182 S. W. (Tex. Civ. App.) 682, the supreme court of Texas held that an action to realize assets may be maintained in the name of the bank which is in the hands of a special agent, appointed by the commission of banking to wind up its affairs. Moreover, this court has on several occasions held that "the equitable owner of a negotiable promissory note in his possession may maintain an action thereon in his own name." Hartzell V. McClurg, 54 Neb. 316; Greeley State Bank V. Line. 50 Neb. 434. These decisions have been cited with approval in Leavitt V. Bell, 55 Neb. 57, and Smith V. Potter, 92 Neb. 39. In Bon Homme County Bank V. Dakota Nat. Bank, 50 S. Dak. 191, 208 N. W. 825, the supreme court of South Dakota held that the receiver of a bank represents the bank and its creditors; that, in an action brought in the name of the bank by the receiver, the defendant may assert his defenses against the receiver. The opinion approved the bringing of an action in the name of the bank, although it was in the hands of the state superintendent of banks. Since the superintendent of banks is acting for the bank, he is authorized to maintain an action in the name of the bank. It will be observed that the answer nowhere alleges that theaction is brought without authority from the superintendent of banks of South Dakota. In fact, when it is alleged that the bank is in the possession and under the control of the superintendent of banks, and the statute making it his duty to collect, the presumption is that he has directed and authorized the instant action. Section 8525, Comp. St. 1922, provides: "Every action must be prosecuted in the name of the real party in interest, except as otherwise provided in section 26 (8528)." Section 8528, in part, provides: "A person with whom or in whose name a contract is made for the benefit of another may bring an action without joining with him the person for whose benefit it is prosecuted.' If, as contended by the defendant, the superintendent of banks of South Dakota is to be regarded as holding a legal title to the note in controversy and to be the real party in interest, it would seem that the contract, or note, was made after the title had vested in the superintendent; that it was made in the name of the plaintiff bank, and that the transaction would fall within the provisions of section 8528, Comp. St. 1922. In 1 Joyce, Defenses to Commercial Paper (2d ed.) 826, sec. 609, it is said: "The party to whom a note is made payable being prima facie the owner, it is held that his right to maintain an action cannot be questioned, except the defendant pleads payment or offset against the party who he alleges is the true owner of the note. So it is no defense to an action on a note that it was given to the payee, in lieu of three other notes, given to the husband of the payee. The widow might be acting as executrix in her own wrong, or might be the heir; in either case the notes surrendered would be satisfied." Citing Riley V. Loughrey, 22 III. 97. In the instant case it will be observed that no valid defense to the note was pleaded. From what has been said it is evident that the judgment rendered in favor of the bank will be subject to the control of the superintendent of banks, and that a satisfaction of that judgment will be a satisfaction of the note and relieve the defendant of any further liability thereon. No doubt, the action could be maintained in the name of the superintendent of banks. However, we are of the view that the bank, being the beneficial owner of the note, is the real party in interest and that the action, therefore, was properly maintained in its name. No prejudicial error is disclosed. The opinion of the commission heretofore adopted and the judgment rendered thereon are vacated and set aside, and the judgment of the district court is AFFIRMED.