1.

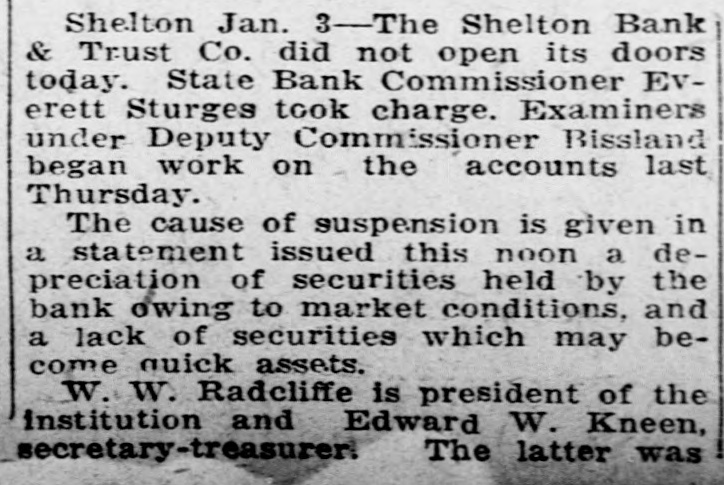

January 3, 1921

The Bridgeport Times and Evening Farmer

Bridgeport, CT

Click image to open full size in new tab

Article Text

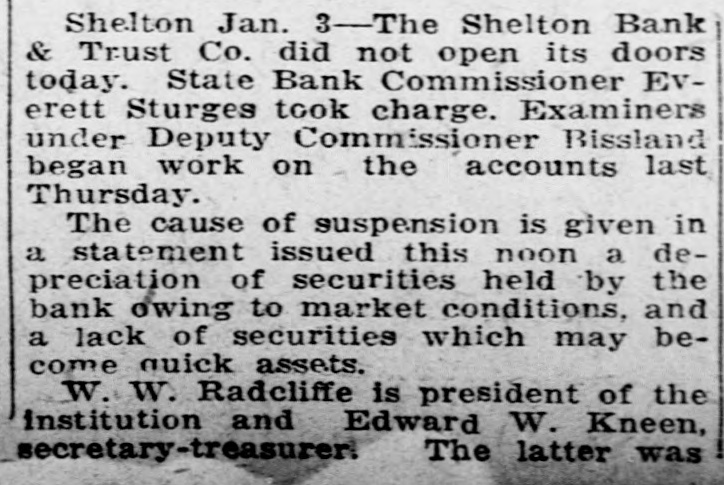

Shelton Jan. 3-The Shelton Bank & Trust Co. did not open its doors today. State Bank Commissioner Everett Sturges took charge. Examiners under Deputy Commissioner Bissland began work on the accounts last Thursday. The cause of suspension is given in a statement issued this noon a depreciation of securities held by the bank owing to market conditions, and a lack of securities which may become quick assets. W. W. Radcliffe is president of the institution and Edward W. Kneen, secretary-treasurer The latter was

2.

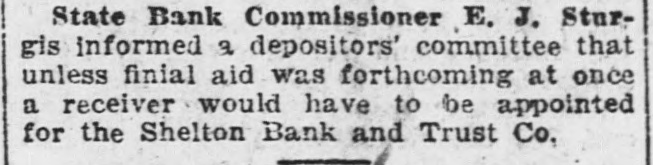

January 10, 1921

Norwich Bulletin

Norwich, CT

Click image to open full size in new tab

Article Text

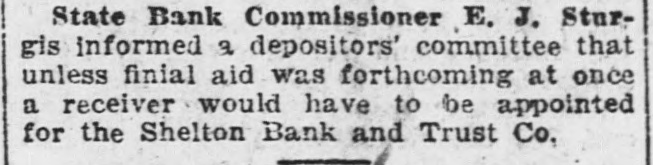

State Bank Commissioner E. J. Sturgis informed a depositors' committee that unless finial aid was forthcoming at once a receiver would have to be appointed for the Shelton Bank and Trust Co.

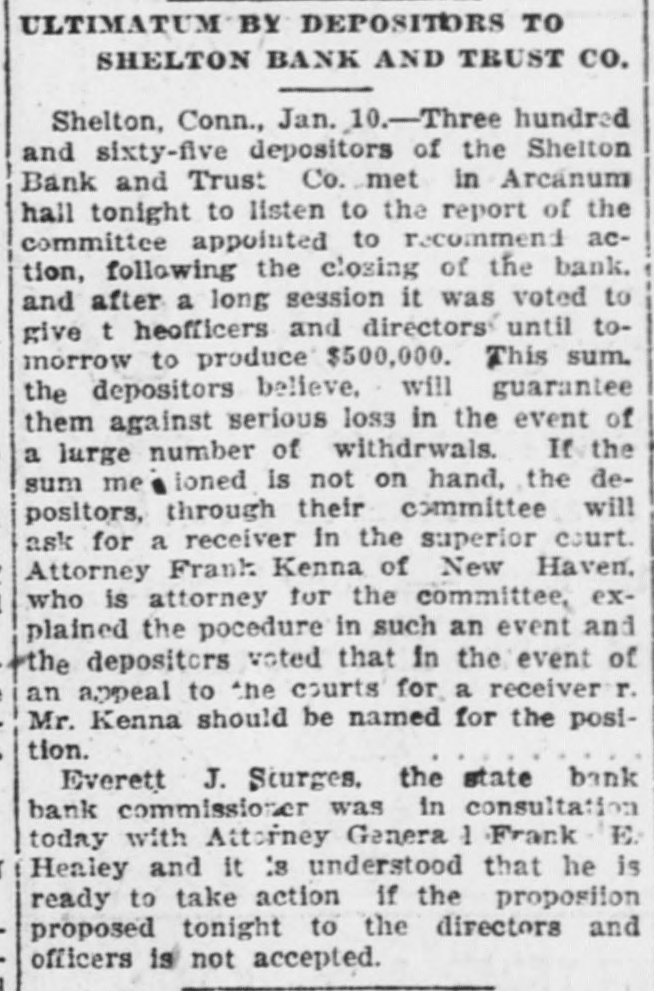

3.

January 11, 1921

Norwich Bulletin

Norwich, CT

Click image to open full size in new tab

Article Text

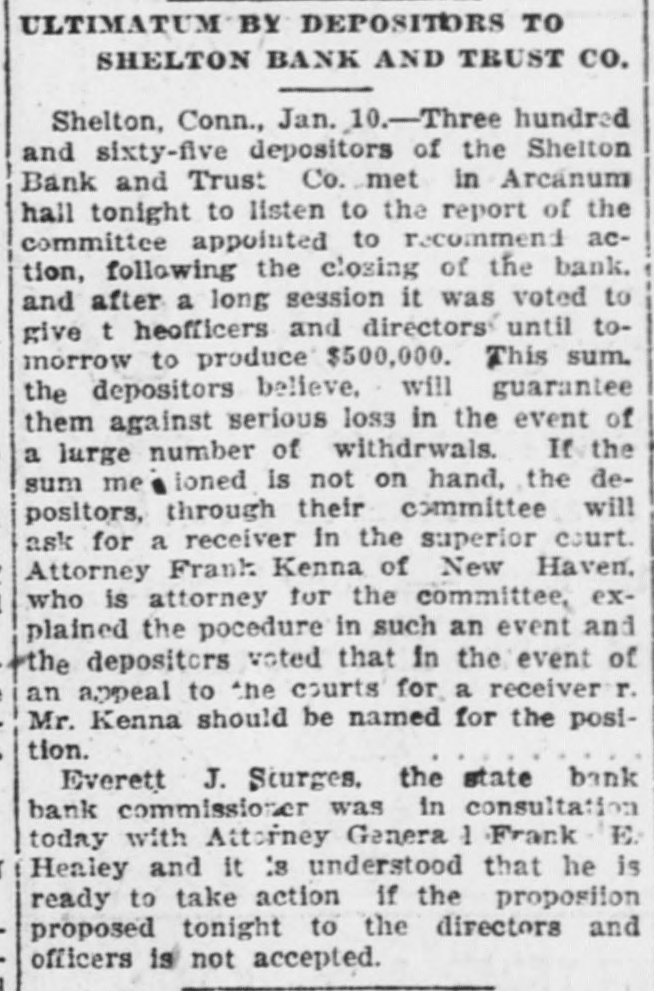

ULTIMATUM BY DEPOSITORS TO SHELTON BANK AND TRUST CO. Shelton, Conn., Jan. 10.-Three hundred and sixty-five depositors of the Shelton Bank and Trust Co. met in Arcanum hall tonight to listen to the report of the committee appointed to recommend action, following the closing of the bank. and after a long session it was voted to give t heofficers and directors until tomorrow to produce $500,000. This sum. the depositors believe, will guarantee them against serious loss in the event of a large number of withdrwals. If the sum me ioned is not on hand, the depositors, through their committee will ask for a receiver in the superior court. Attorney Frank Kenna of New Haven, who is attorney for the committee, explained the pocedure in such an event and the depositors voted that in the event of an appeal to the courts for a receiver r. Mr. Kenna should be named for the position. Everett J. Sturges. the state bank bank commissioner was in consultation today with Attorney General 1 Frank E. Healey and it is understood that he is ready to take action if the proposition proposed tonight to the directors and officers is not accepted.

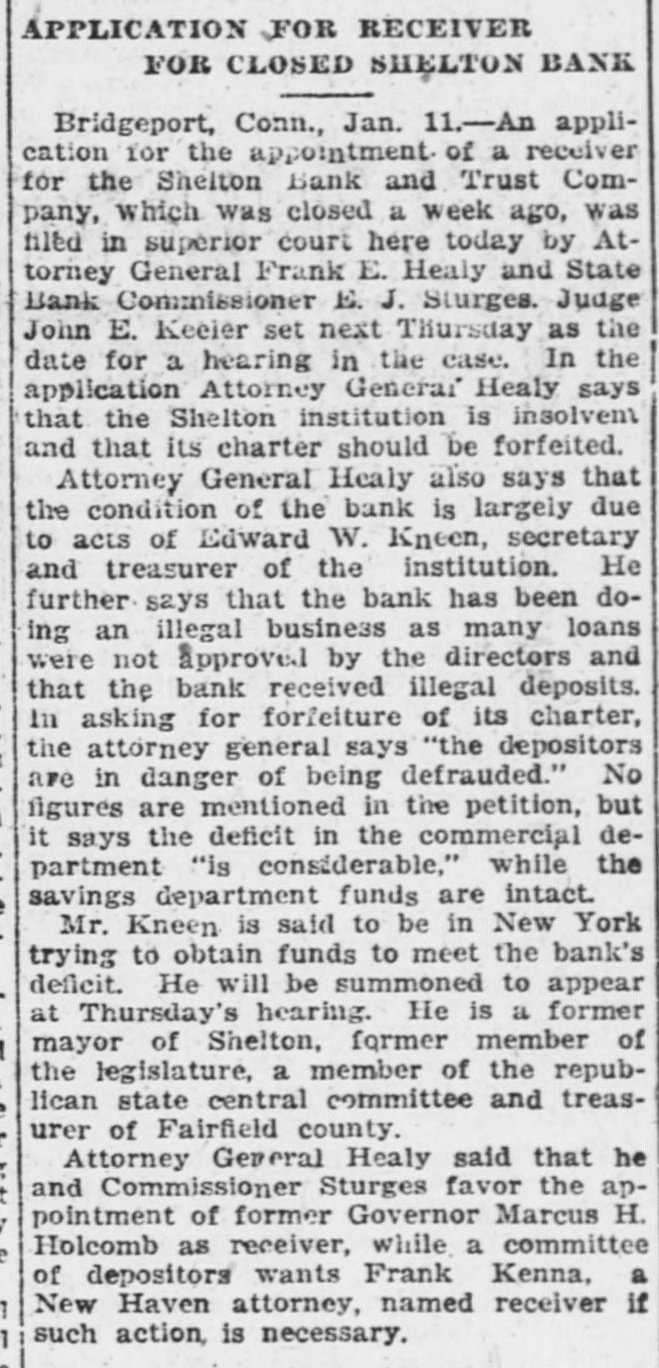

4.

January 12, 1921

Norwich Bulletin

Norwich, CT

Click image to open full size in new tab

Article Text

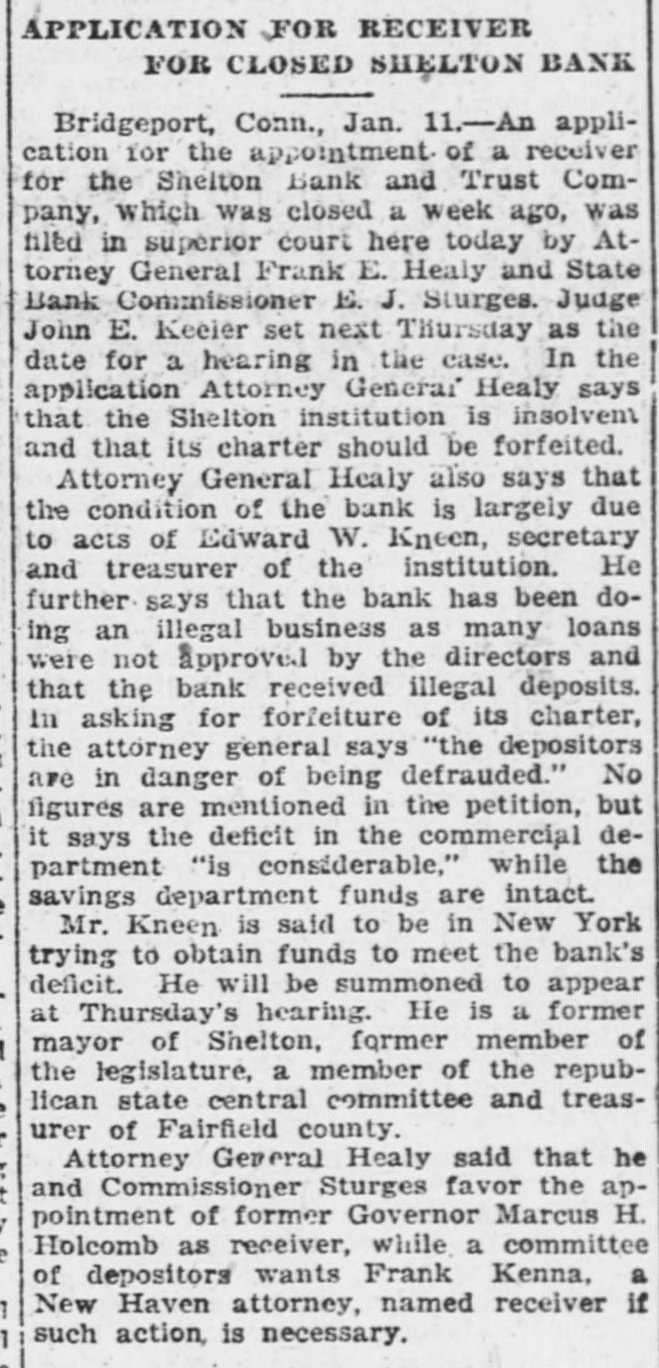

APPLICATION FOR RECEIVER FOR CLOSED SHELTON BANK Bridgeport, Conn., Jan. -An application for the appointment. of a receiver for the Shelton Bank and Trust Company, which was closed a week ago, was filed in superior court here today by Attorney General Frank E. Healy and State Bank Commissioner E. J. Sturges. Judge John E. Keeier set next Thursday as the date for a hearing in the case. In the application Attorney General Healy says that the Shelton institution is insolvent and that its charter should be forfeited. Attorney General Healy also says that the condition of the bank is largely due to acts of Edward W. Kneen, secretary and treasurer of the institution. He further says that the bank has been doing an illegal business as many loans were not approved by the directors and that the bank received illegal deposits. In asking for forfeiture of its charter, the attorney general says "the depositors are in danger of being defrauded." No figures are mentioned in the petition, but it says the deficit in the commercial department "is considerable," while the savings department funds are intact. Mr. Kneen is said to be in New York trying to obtain funds to meet the bank's deficit. He will be summoned to appear at Thursday's hearing. He is a former mayor of Shelton, former member of the legislature, a member of the republican state central committee and treasurer of Fairfield county. Attorney General Healy said that he and Commissioner Sturges favor the appointment of former Governor Marcus H. Holcomb as receiver, while a committee of depositors wants Frank Kenna, a New Haven attorney, named receiver if such action, is necessary.

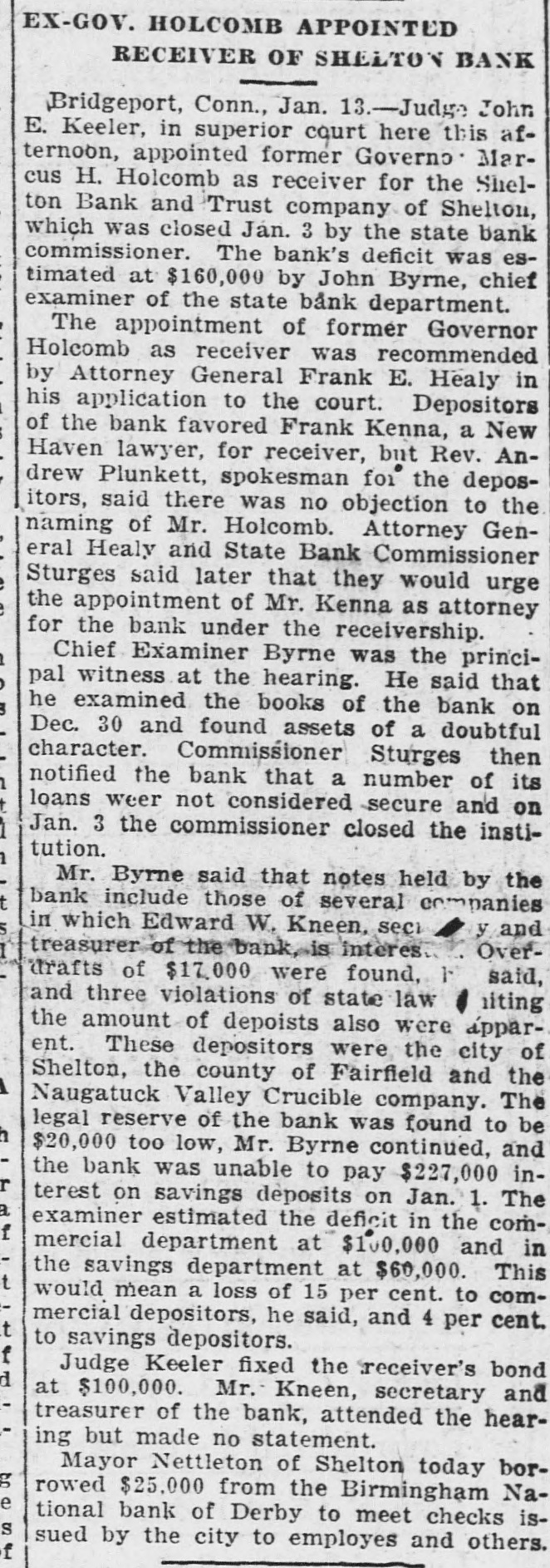

5.

January 14, 1921

Norwich Bulletin

Norwich, CT

Click image to open full size in new tab

Article Text

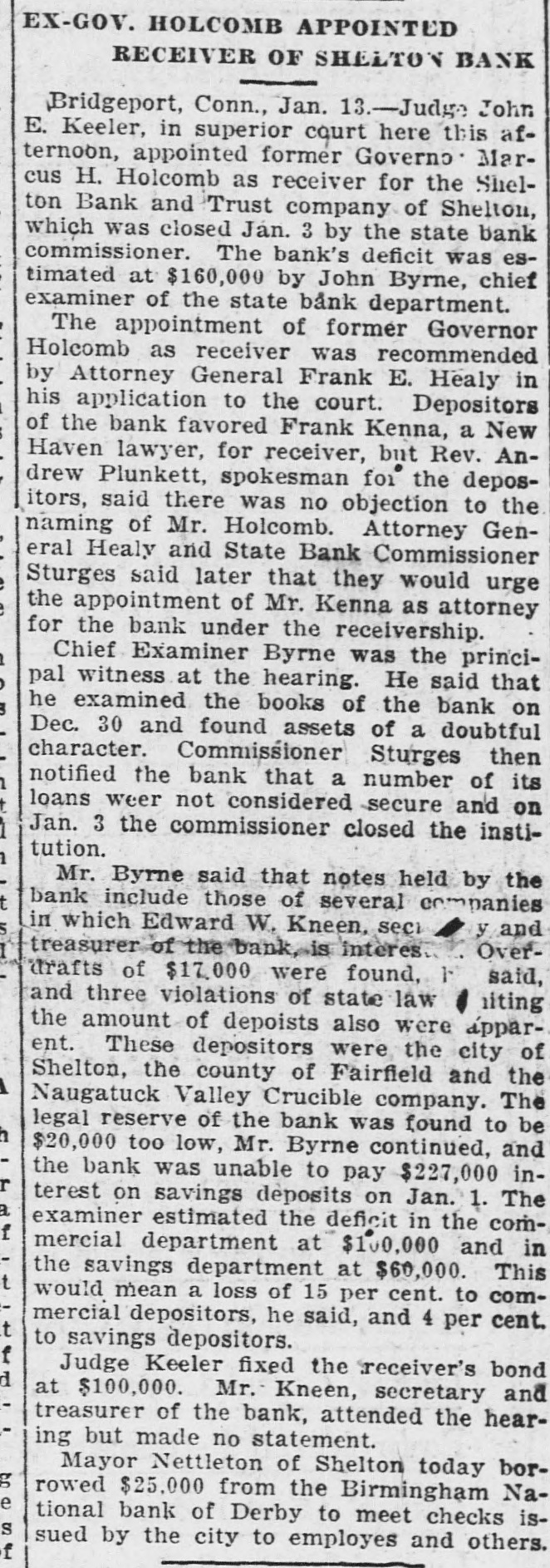

EX-GOV. HOLCOMB APPOINTED RECEIVER OF SHELTON BANK Bridgeport, Conn., Jan. 13.-Judge John E. Keeler, in superior court here this afternoon, appointed former Governo Marcus H. Holcomb as receiver for the Shelton Bank and Trust company of Shelton, which was closed Jan. 3 by the state bank commissioner. The bank's deficit was estimated at $160,000 by John Byrne, chief examiner of the state bank department. The appointment of former Governor Holcomb as receiver was recommended by Attorney General Frank E. Healy in his application to the court. Depositors of the bank favored Frank Kenna, a New Haven lawyer, for receiver, but Rev. Andrew Plunkett, spokesman foi the depositors, said there was no objection to the naming of Mr. Holcomb. Attorney General Healy and State Bank Commissioner Sturges said later that they would urge the appointment of Mr. Kenna as attorney for the bank under the receivership. Chief Examiner Byrne was the principal witness at the hearing. He said that he examined the books of the bank on Dec. 30 and found assets of a doubtful character. Commissioner Sturges then notified the bank that a number of its loans weer not considered secure and on Jan. 3 the commissioner closed the institution. Mr. Byrne said that notes held by the bank include those of several companies in which Edward W. Kneen, seci y and treasurer of the bank is intères Overdrafts of $17,000 were found, 1 said, and three violations of state law iting the amount of depoists also were apparent. These depositors were the city of Shelton, the county of Fairfield and the Naugatuck Valley Crucible company. The legal reserve of the bank was found to be $20,000 too low, Mr. Byrne continued, and the bank was unable to pay $227,000 interest on savings deposits on Jan. 1. The examiner estimated the deficit in the commercial department at $100.000 and in the savings department at $60,000. This would mean a loss of 15 per cent. to commercial depositors, he said, and 4 per cent. to savings depositors. Judge Keeler fixed the :receiver's bond at $100,000. Mr. Kneen, secretary and treasurer of the bank, attended the hearing but made no statement. Mayor Nettleton of Shelton today borrowed $25.000 from the Birmingham National bank of Derby to meet checks issued by the city to employes and others.

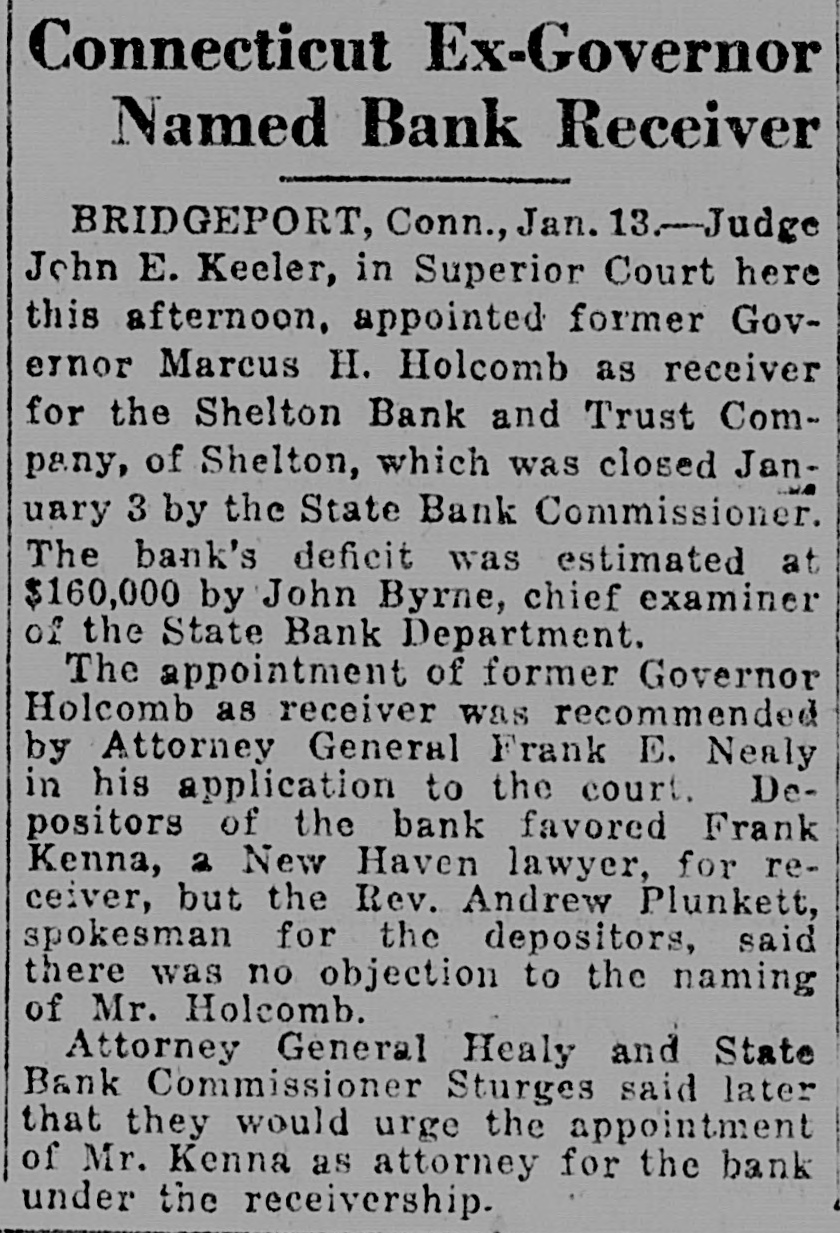

6.

January 14, 1921

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

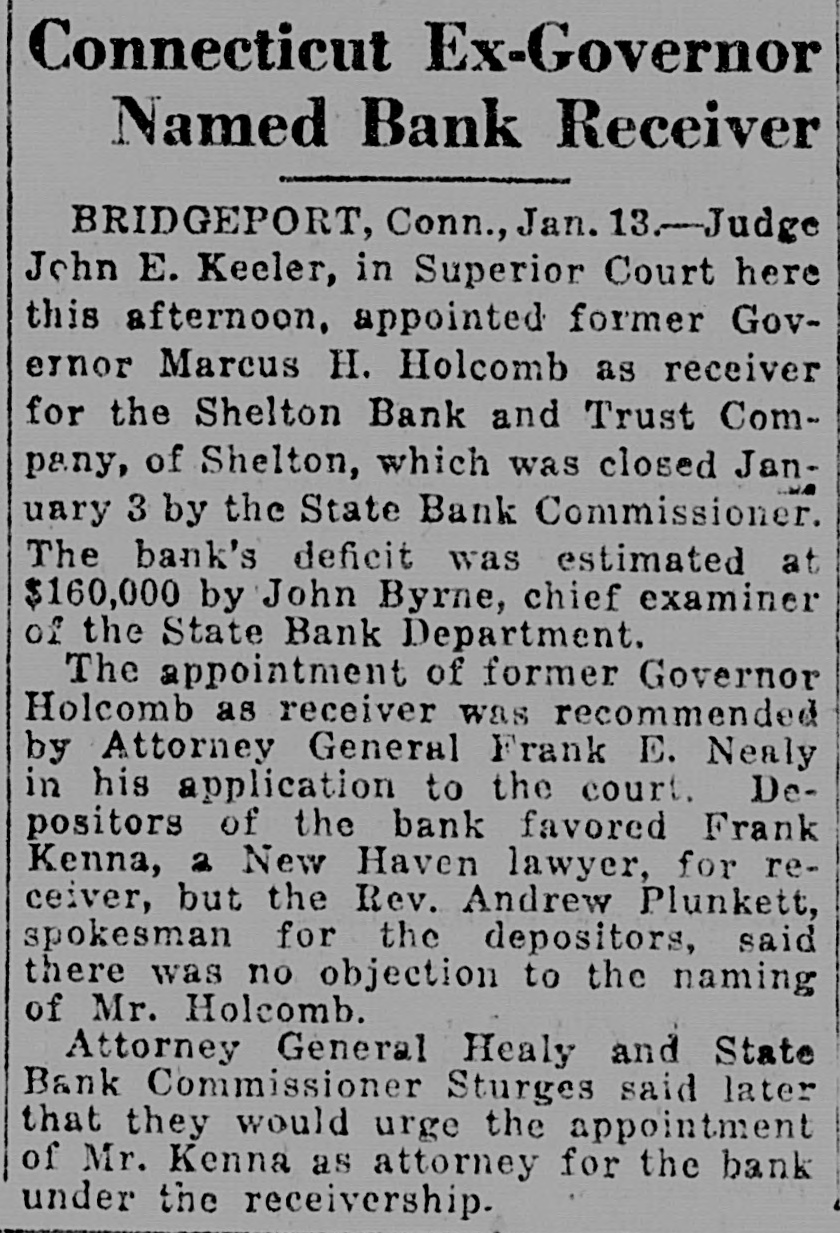

Connecticut Ex-Governor Named Bank Receiver BRIDGEPORT, Conn., Jan. 13.-Judge John E. Keeler, in Superior Court here this afternoon, appointed former Governor Marcus H. Holcomb as receiver for the Shelton Bank and Trust Company, of Shelton, which was closed January 3 by the State Bank Commissioner. The bank's deficit was estimated at $160,000 by John Byrne, chief examiner of the State Bank Department. The appointment of former Governor Holcomb as receiver was recommended by Attorney General Frank E. Nealy in his application to the court. Depositors of the bank favored Frank Kenna, a New Haven lawyer, for receiver, but the Rev. Andrew Plunkett, spokesman for the depositors, said there was no objection to the naming of Mr. Holcomb. Attorney General Healy and State Bank Commissioner Sturges said later that they would urge the appointment of Mr. Kenna as attorney for the bank under the receivership.

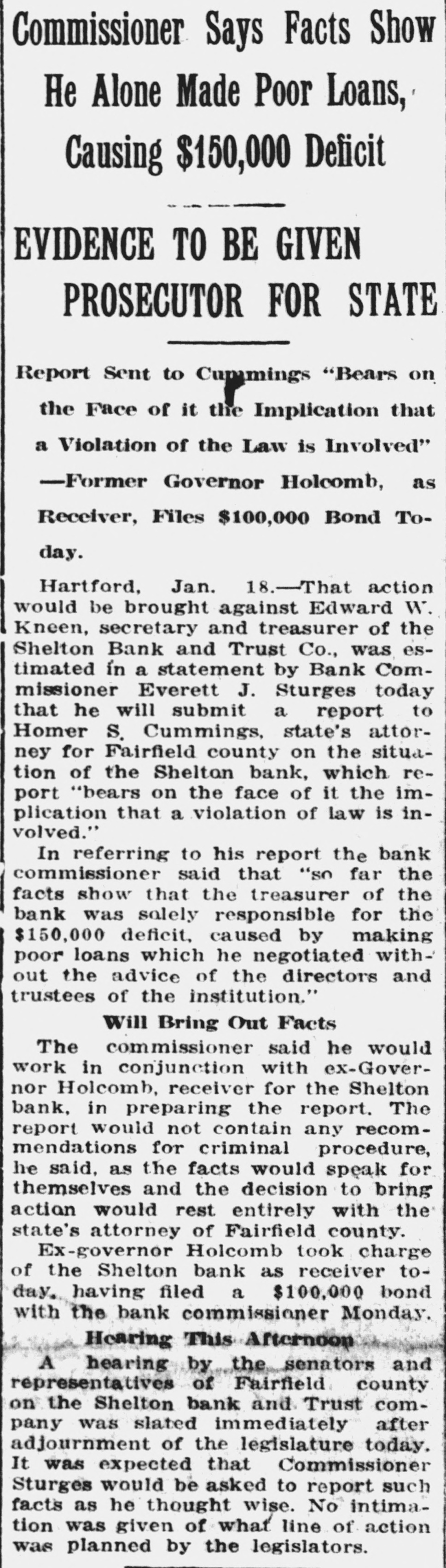

7.

January 18, 1921

New Britain Herald

New Britain, CT

Click image to open full size in new tab

Article Text

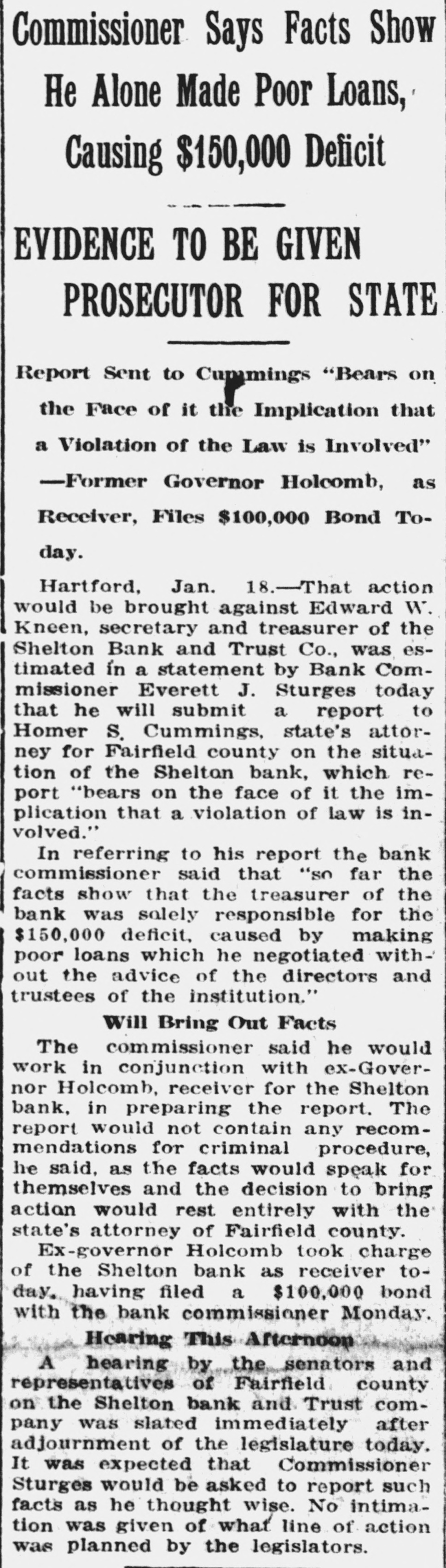

Commissioner Says Facts Show He Alone Made Poor Loans, Causing $150,000 Deficit EVIDENCE TO BE GIVEN PROSECUTOR FOR STATE Report Sent to Cummings "Bears on the Face of it the Implication that a Violation of the Law is Involved" -Former Governor Holcomb, as Receiver, Files $100,000 Bond Today. Hartford, Jan. 18.-That action would be brought against Edward W. Kneen, secretary and treasurer of the Shelton Bank and Trust Co., was estimated in a statement by Bank Commissioner Everett J. Sturges today that he will submit a report to Homer S. Cummings, state's attorney for Fairfield county on the situation of the Shelton bank, which report "bears on the face of it the implication that a violation of law is involved." In referring to his report the bank commissioner said that "so far the facts show that the treasurer of the bank was solely responsible for the $150,000 deficit, caused by making poor loans which he negotiated without the advice of the directors and trustees of the institution." Will Bring Out Facts The commissioner said he would work in conjunction with ex-Governor Holcomb, receiver for the Shelton bank, in preparing the report. The report would not contain any recommendations for criminal procedure, he said, as the facts would speak for themselves and the decision to bring action would rest entirely with the state's attorney of Fairfield county. Ex-governor Holcomb took charge of the Shelton bank as receiver today. having filed a $100,000 bond with the bank commissioner Monday. Hearing This Afternoon A hearing by the senators and representatives of Fairfield county on the Shelton bank and Trust company was slated immediately after adjournment of the legislature today. It was expected that Commissioner Sturges would be asked to report such facts as he thought wise. No intimation was given of what line of action was planned by the legislators.

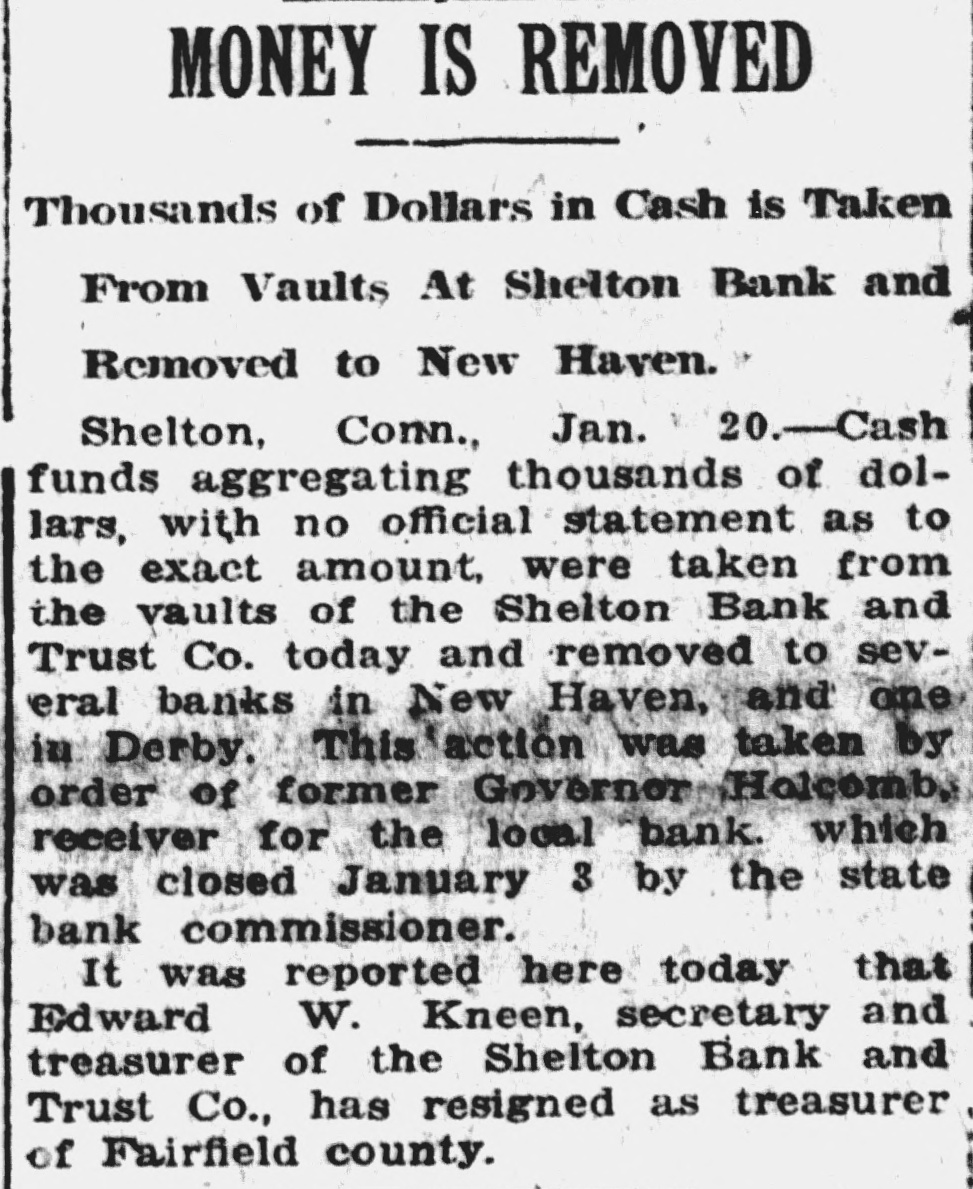

8.

January 20, 1921

New Britain Herald

New Britain, CT

Click image to open full size in new tab

Article Text

MONEY IS REMOVED Thousands of Dollars in Cash is Taken From Vaults At Shelton Bank and Removed to New Haven. Shelton, Conn., Jan. 20.-Cash funds aggregating thousands of dollars, with no official statement as to the exact amount, were taken from the vaults of the Shelton Bank and Trust Co. today and removed to several banks in New Haven, and one in Derby. This action was taken by order of former Governor Holcomb, receiver for the local bank. which was closed January 3 by the state bank commissioner. It was reported here today that Edward W. Kneen, secretary and treasurer of the Shelton Bank and Trust Co., has resigned as treasurer of Fairfield county.

9.

January 25, 1921

The Bridgeport Times and Evening Farmer

Bridgeport, CT

Click image to open full size in new tab

Article Text

SAY NOTES MAY COVER UP LOSSES (Continued From Page One.) the motion was changed to provide for full powers of investigation and report with recommendations. Just Fishing Trip. The investigation is palpably a fishing expedition with an attached hope that it may "restore confidence." To date there are no developments in the situation created by the closing of the town's one bank other than those already published. The institution which handled practically all of the local financial transactions is closed and one of the popular idols in the person of Kneen has fallenfallen far-and has been considerably shattered by the impact. As a result the business portion of the community is straightened as a result of its deposits being held and the uncertainty of the amount of loss there will eventually be. With commendable patience and quiet, however, the people are waiting for further facts and hoping for the best. There is said to be some possibility that considerable sums may yet be realized on the large notes held against concerns in New York. If this should be done it would reduce the loss to a point where the depositors would get nearly all of their money. The question of criminal responsibility seems to be squarely up to State's Attorney Homer S. Cummings, It is said that all the facts bearing on this point that have come to the knowledge of the state officials and the receiver have been placed in his hands and it is for him to decide how many, if any, can be held for criminal action and to determine what action shall be taken and when. It is thought that a decision will be reached by him within a day or two and action, if determined on, would probably follow at once. City Treasurer George S. Willis in a statement today resented the implication that he was responsible for the deposit of $228,000 of city funds in the closed Shelton Bank and Trust Company, made at last night's meeting of the City Council, when it was made known that this amount of city founds was tied u.p in the institution, when $45,000 was the limit of deposits permitted by law. Willis said that one year ago when the city issued bonds for $80,000 Mayor Nettleton, and Treasurer e Kneen went to Boston with the bonds and returned with the money. Later he said Mr. Kneen handed him a 5 pass book of the bank showing de1 posits of the city for the amount of the bonds. But he never saw the money, Willis declares, and does not consider that he is responsible for el the disposition of the city funds.

10.

January 28, 1921

Norwich Bulletin

Norwich, CT

Click image to open full size in new tab

Article Text

ARE MAKING EFFORT TO REORGANIZE SHELTON BANK Shelton, Conn., Jan. 27.-Steps looking toward a reorganization of the Shelton Bank and Trust Company, in the hands of a receiver, were taken at a meeting of stockholders of the bank here today. W. W. Radcliffe, president of the bank, presided, and all of the directors were present. A financial statement on the bank's condition was presented by Receiver Marcus H. Helcomb and showed that the capital and surplus, amounting to $168,000 was wiped out. The stockholders appointed a committee of five to make an investigation of the financial condition of the bank and to make recommendations for the resumption of business.

11.

January 28, 1921

The Bridgeport Times and Evening Farmer

Bridgeport, CT

Click image to open full size in new tab

Article Text

Would Buy Up Shelton Bank Stock Stamford Man Offers to Purchase Control at $150 a Share President W. W. Radcliffe of the closed Shelton Bank & Trust Co., announced today that he had received an offer from Harry Frost of Sound Beach, Stamford, who is understood to be in business in New York, to buy the stock of the local Trust company at $150 per share if he can secure enough of the stock to obtain control of the bank and its management. (Mr Frost has been asked to go to Shelton and confer with the bank-officials By an order made today in the Superior court by Judge John E. Keeler, deposits in the Shelton Bank and Trust company will be applied by the receiver as credits to all obligations in which the bank has credit and debit accounts of the same person. The effect of the order will be to permit the credit of large sums on deposit by the Shelton Lumber company against notes of the company held by the bank. The rule of course will follow in all other similar cases, but the amounts in other instances are much smaller. Receiver Marcus H. Holcomb was in court when the order was made and immediately left for Shelton to start the next step in untangling the bank's afairs. So far as could be learned today Treasurer Edward W. Kneen has not yet raised the amount he had hopes of getting.

12.

February 3, 1921

The Bridgeport Times and Evening Farmer

Bridgeport, CT

Click image to open full size in new tab

Article Text

Discover Big Overdraft On Sheltnn Bank Holcomb's Supplemental Report Shows $11,230.29 Wasn't Turned In In a supplemental report of the Shelton Bank and Trust Company filed in the Superior Court today by Receiver Marcus H. Holcomb, overdrafts of $11,203.29, not previously reported, are shown as assets. Of this amount $10,276.28 were overdrawn assets. Of this amount $10.276.28 was overdrawn by Charles H. Davis, of 1188 Main street, Bridgeport, well known as treasurer of the Wilkenda Land Company and president of the Dace Auto Wheel Equipment Co. The report also shows an item of $14,000 in French government bonds previously reported as having been an error and the amount is changed to $2,000. Employes of the county paid by the County Commissioners and County Sheriff Pease with checks drawn upon the Shelton Bank just prior to the disclosure of the bank's condition, were inconvenienced by having the cashed checks returned with the notice that the bank had closed. In all instances employes were immediately given new checks on other banks in which county funds were deposited. Some of the checks went to the New York Clearing House for collection and as a result of the Shelton bank's closing were returned to original endorsers with protest fees. All such fees have been made good by county officials. The valuation of New York securities on loans made by former Treasurer Kneen is expected to be determined tomorrow, according to the committee in charge of this phase of the investigation. Meanwhile the committee is continuing its work of probing other loans which were made in Shelton and nearby cities. TODAY'S PROFILE.

13.

February 4, 1921

The Bridgeport Times and Evening Farmer

Bridgeport, CT

Click image to open full size in new tab

Article Text

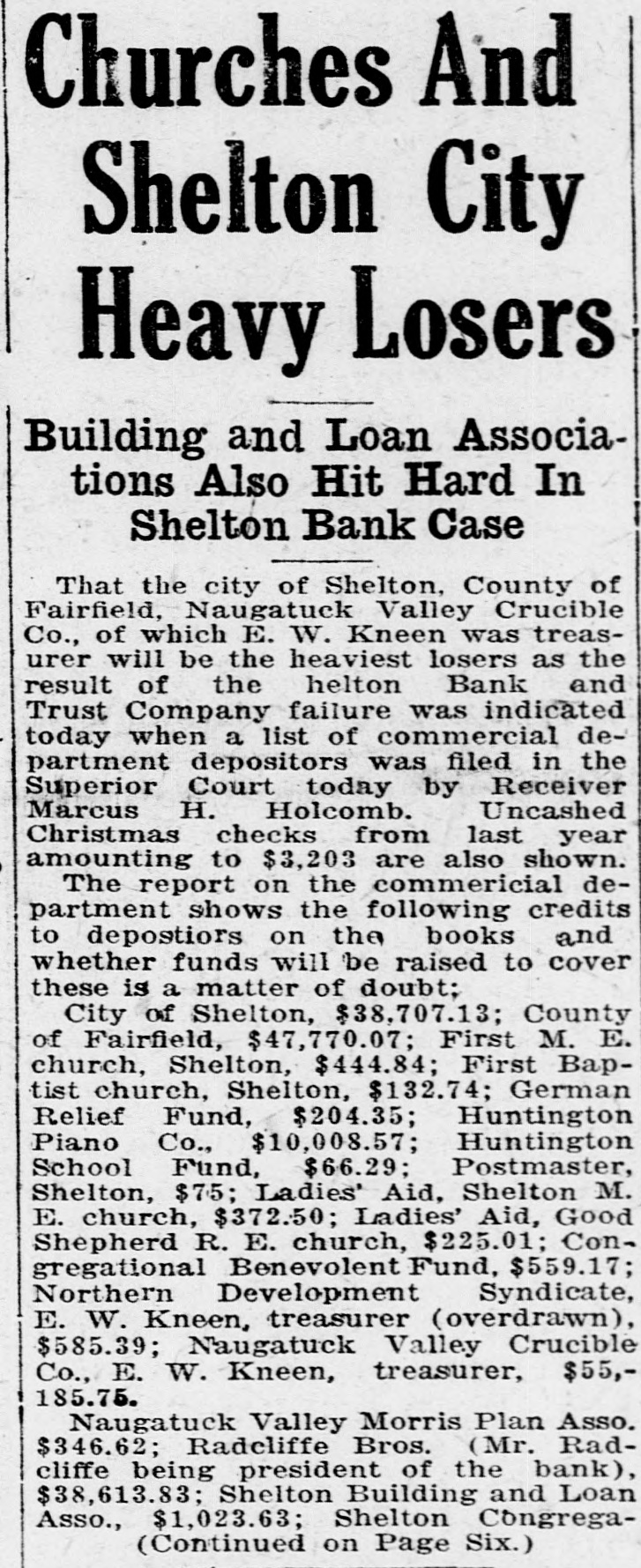

Churches And Shelton City Heavy Losers Building and Loan Associations Also Hit Hard In Shelton Bank Case That the city of Shelton, County of Fairfield, Naugatuck Valley Crucible Co., of which E. W. Kneen was treasurer will be the heaviest losers as the result of the helton Bank and Trust Company failure was indicated today when a list of commercial department depositors was filed in the Superior Court today by Receiver Marcus H. Holcomb. Uncashed Christmas checks from last year amounting to $3,203 are also shown. The report on the commericial department shows the following credits to depostiors on the books and whether funds will be raised to cover these is a matter of doubt; City of Shelton, $38,707.13; County of Fairfield, $47,770.07; First M. E. church, Shelton, $444.84; First Baptist church, Shelton, $132.74; German Relief Fund, $204.35; Huntington Piano Co., $10,008.57; Huntington School Fund, $66.29; Postmaster, Shelton, $75; Ladies' Aid, Shelton M. E. church, $372.50; Ladies' Aid, Good Shepherd R. E. church, $225.01; Congregational Benevolent Fund, $559.17; Northern Development Syndicate, E. W. Kneen, treasurer (overdrawn), $585.39; Naugatuck Valley Crucible Co., E. W. Kneen, treasurer, $55,185.75. Naugatuck Valley Morris Plan Asso. $346.62; Radeliffe Bros. (Mr. Radcliffe being president of the bank), $38,613.83; Shelton Building and Loan Asso., $1,023.63; Shelton Congrega(Continued on Page Six.)

14.

February 11, 1921

The Bridgeport Times and Evening Farmer

Bridgeport, CT

Click image to open full size in new tab

Article Text

SELL SHELTON BANK PROPERTY Governor Marcus H. Holcomb appeared before Judge John E. Keeler in the Superior court today as receiver of the defunct Shelton Bank and Trust company and was given permission to sell property of the bank in Shelton. The property in question was bought in November 1920 by Treasurer E. W. Kneen and Receiver Holcomb will realize $1,000 above the purchase price.

15.

February 28, 1921

The Bridgeport Times and Evening Farmer

Bridgeport, CT

Click image to open full size in new tab

Article Text

# BRIEFS

Definite steps were taken at the meeting of former members of the defunct Black Rock Country club yesterday, although the recognition of the body has been fully determined.

At the banquet of the Arab patrol, Order of the Mystic Shrine, at the Stratfield, Saturday night, George S. Beers, illustrious potentate of Pyramid Temple, was presented with a gold watch.

A pinochle and whist party will be given tomorrow night by members of the Harry W. Congdon post, American Legion, in the home on Golden Hill street.

Local delegates are attending the meeting of the Connecticut Chamber of Commerce in the Hotel Taft, New Haven, today.

With the settlement of the bonders on Edward W. Kneen, former treasurer of the Shelton Trust company, with Receiver Marcus H. Holcomb, two arrests for criminal responsibility are expected.

16.

April 19, 1921

Norwich Bulletin

Norwich, CT

Click image to open full size in new tab

Article Text

SHELTON TRUST CO. DEPOSITORS WILL NOT LOSE A CENT Hartford, April 18.- -Former Governor Marcus H. Holcomb, Clifford I. Burge, associated with the ex-governor in the work connected with the receivership of the Shelton Trust company, and George Conkin and Harold S. Drew, residents of Shelton, were at the capitol today for a conference with Bank Commissioner Everett J. Sturges on the affairs of the company and the liquidation of the bank. Governor Holcomb was asked if it were true, according to a report, that there was to be a reorganization of the bank. "I'm not interested in any reorganization. I'm concerned about the liquidation of the present bank at one hundred cents on the dollar," he replied. "The depositors will not lose anything then?" he was asked. "Not a cent," was the ex-governor's positive rejoinder.

17.

April 22, 1921

The Bridgeport Times and Evening Farmer

Bridgeport, CT

Click image to open full size in new tab

Article Text

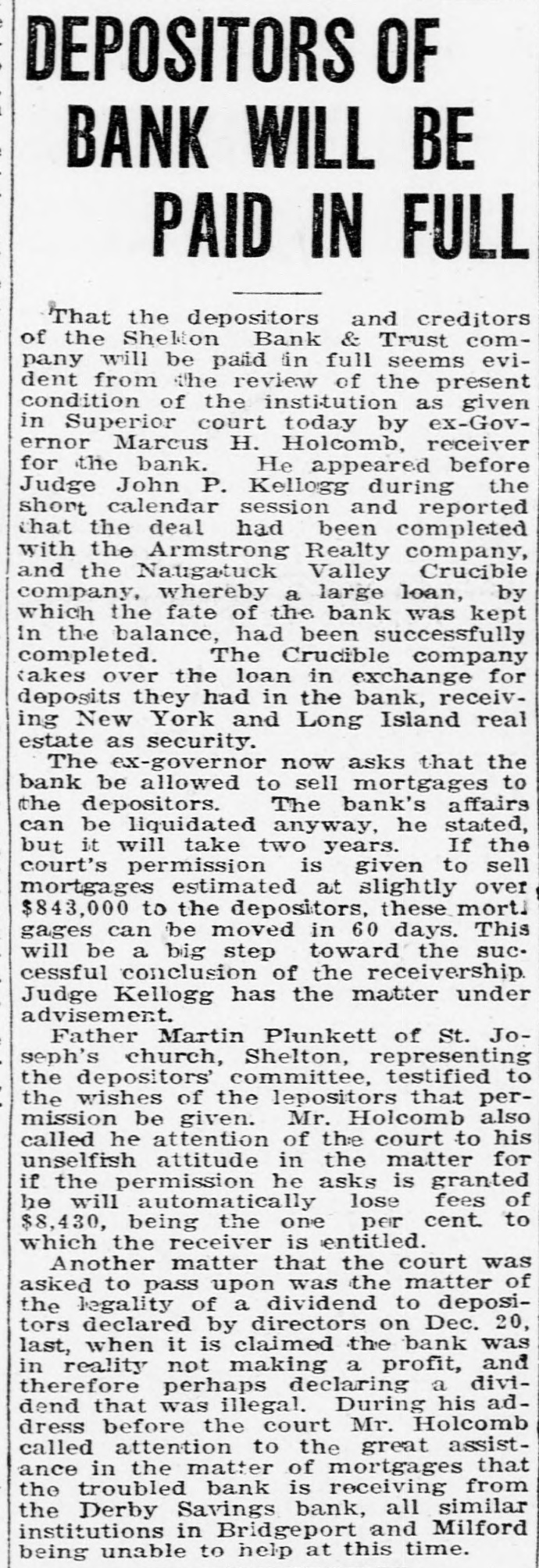

DEPOSITORS OF BANK WILL BE PAID IN FULL That the depositors and creditors of the Shelton Bank & Trust company will be paid in full seems evident from the review of the present condition of the institution as given in Superior court today by ex-Governor Marcus H. Holcomb, receiver for the bank. He appeared before Judge John P. Kellogg during the short calendar session and reported that the deal had been completed with the Armstrong Realty company, and the Naugatuck Valley Crucible company, whereby a large loan, by which the fate of the bank was kept in the balance, had been successfully completed. The Crucible company takes over the loan in exchange for deposits they had in the bank, receiving New York and Long Island real estate as security. The ex-governor now asks that the bank be allowed to sell mortgages to the depositors. The bank's affairs can be liquidated anyway, he stated, but it will take two years. If the court's permission is given to sell mortgages estimated at slightly over $843,000 to the depositors, these mort. gages can be moved in 60 days. This will be a big step toward the successful conclusion of the receivership. Judge Kellogg has the matter under advisement. Father Martin Plunkett of St. Joseph's church, Shelton, representing the depositors' committee, testified to the wishes of the lepositors that permission be given. Mr. Holcomb also called he attention of the court to his unselfish attitude in the matter for if the permission he asks is granted he will automatically lose fees of $8,430, being the one per cent. to which the receiver is entitled. Another matter that the court was asked to pass upon was the matter of the legality of a dividend to depositors declared by directors on Dec. 20, last, when it is claimed the bank was in reality not making a profit, and therefore perhaps declaring a dividend that was illegal. During his address before the court Mr. Holcomb called attention to the great assistance in the matter of mortgages that the troubled bank is receiving from the Derby Savings bank, all similar institutions in Bridgeport and Milford being unable to help at this time.

18.

April 23, 1921

Norwich Bulletin

Norwich, CT

Click image to open full size in new tab

Article Text

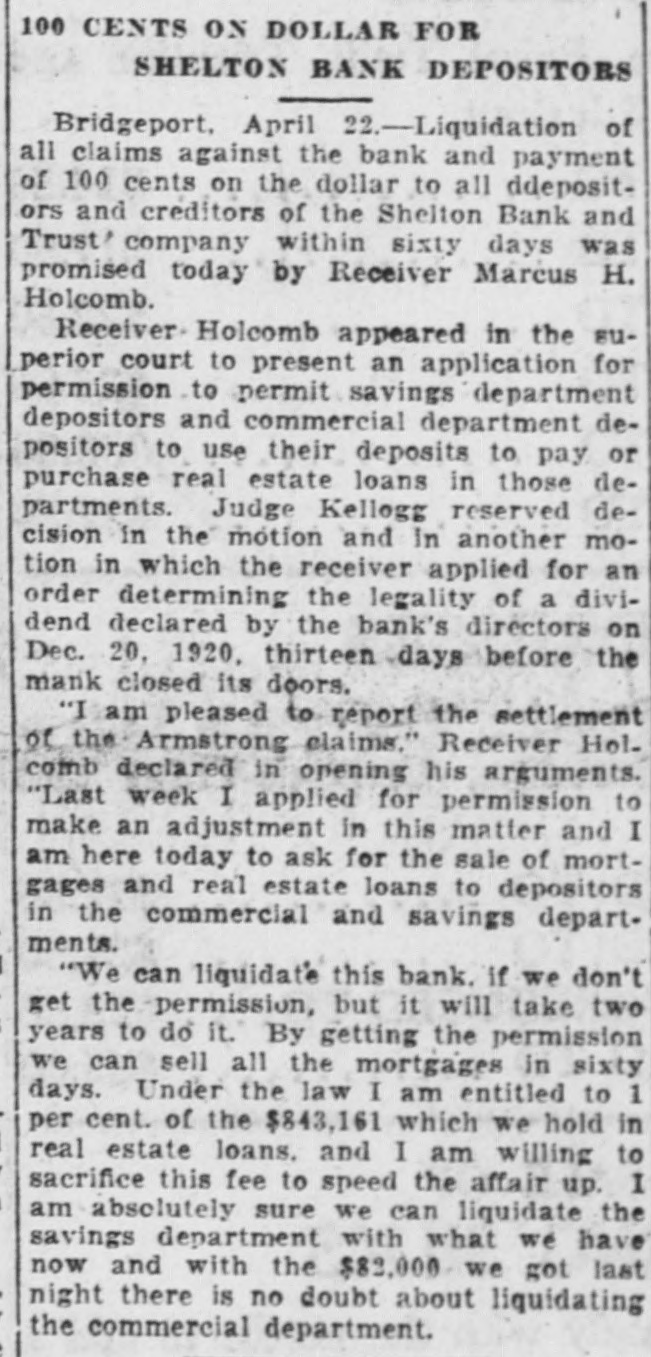

100 CENTS ON DOLLAR FOR SHELTON BANK DEPOSITORS Bridgeport, April 22.-Liquidation of all claims against the bank and payment of 100 cents on the dollar to all ddepositors and creditors of the Shelton Bank and Trust' company within sixty days was promised today by Receiver Marcus H. Holcomb. Receiver Holcomb appeared in the superior court to present an application for permission to permit savings department depositors and commercial department depositors to use their deposits to pay or purchase real estate loans in those departments. Judge Kellogg reserved decision in the motion and In another motion in which the receiver applied for an order determining the legality of a dividend declared by the bank's directors on Dec. 20. 1920, thirteen days before the mank closed its doors. "I am pleased to report the settlement of the Armstrong claims." Receiver Holcomb declared in opening his arguments. "Last week I applied for permission to make an adjustment in this matter and I am here today to ask for the sale of mortgages and real estate loans to depositors in the commercial and savings depart. ments. "We can liquidate this bank. if we don't get the-permission, but it will take two years to do it. By getting the permission we can sell all the mortgages in sixty days. Under the law I am entitled to 1 per cent. of the $843,161 which we hold in real estate loans. and I am willing to sacrifice this fee to speed the affair up. I am absolutely sure we can liquidate the savings department with what we have now and with the $82,000 we got last night there is no doubt about liquidating the commercial department.

19.

June 24, 1921

The Bridgeport Times and Evening Farmer

Bridgeport, CT

Click image to open full size in new tab

Article Text

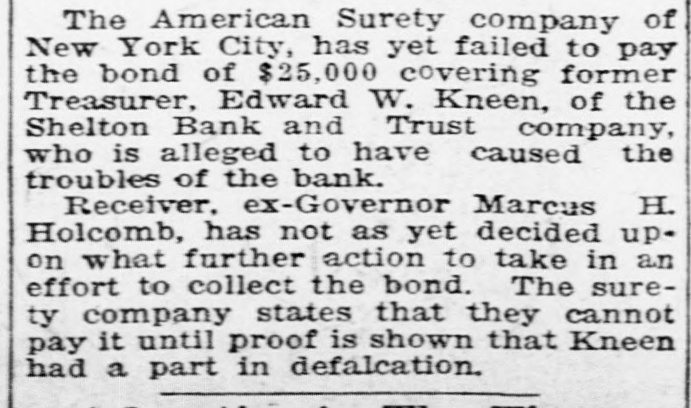

The American Surety company of New York City, has yet failed to pay the bond of $25,000 covering former Treasurer, Edward W. Kneen, of the Shelton Bank and Trust company, who is alleged to have caused the troubles of the bank. Receiver. ex-Governor Marcus H. Holcomb, has not as yet decided upon what further action to take in an effort to collect the bond. The surety company states that they cannot pay it until proof is shown that Kneen had a part in defalcation.

20.

July 26, 1921

Norwich Bulletin

Norwich, CT

Click image to open full size in new tab

Article Text

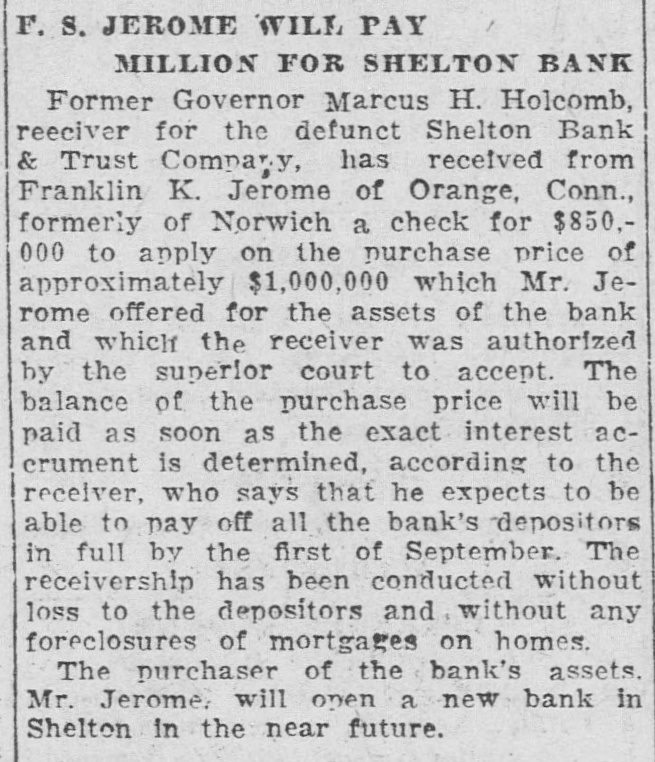

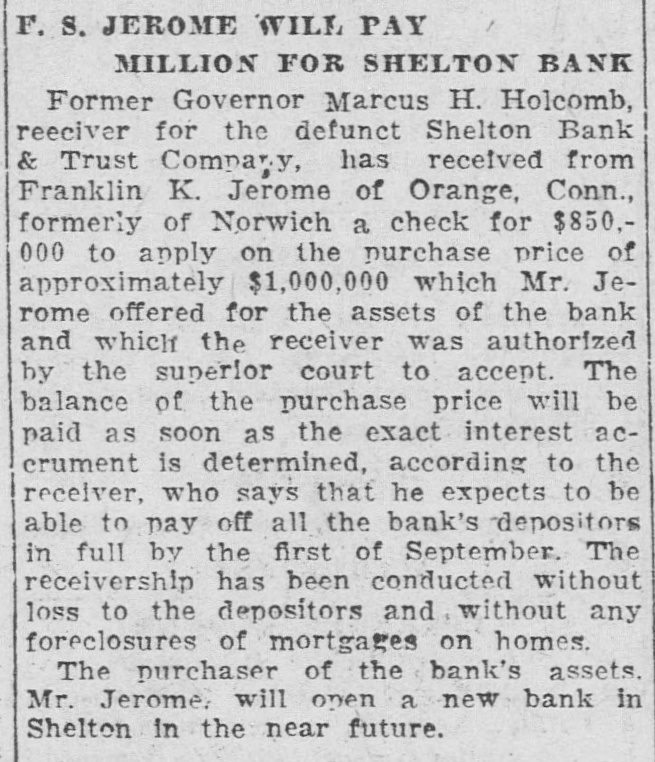

F. S. JEROME WILL PAY MILLION FOR SHELTON BANK Former Governor Marcus H. Holcomb, reeciver for the defunct Shelton Bank & Trust Company, has received from Franklin K. Jerome of Orange, Conn., formerly of Norwich a check for $850,000 to apply on the purchase price of approximately $1,000,000 which Mr. Jerome offered for the assets of the bank and which the receiver was authorized by the superior court to accept. The balance of the purchase price will be paid as soon as the exact interest accrument is determined, according to the receiver, who says that he expects to be able to pay off all the bank's depositors in full by the first of September. The receivership has been conducted without loss to the depositors and without any foreclosures of mortgages on homes. The purchaser of the bank's assets. Mr. Jerome. will open a new bank in Shelton in the near future.

21.

September 28, 1921

Norwich Bulletin

Norwich, CT

Click image to open full size in new tab

Article Text

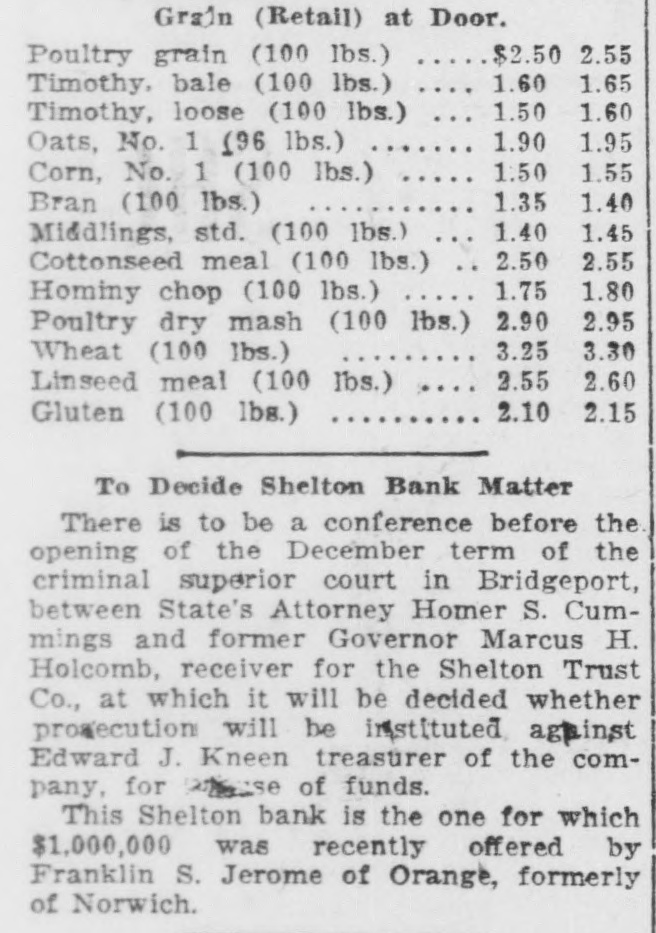

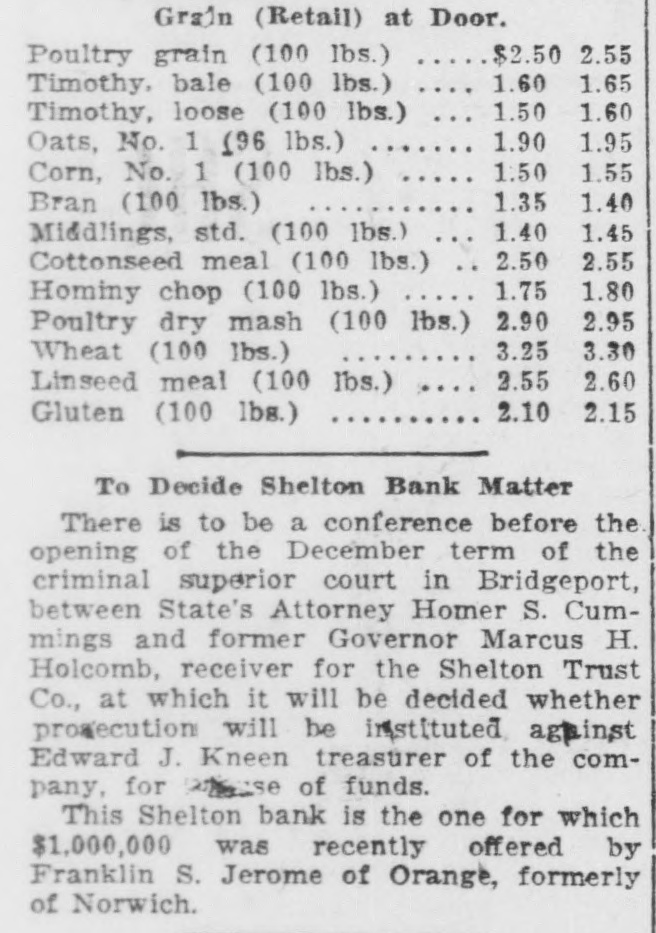

Grain (Retail) at Door. $2.50 2.55 Poultry grain (100 lbs.) 1.60 1.65 Timothy, bale (100 lbs.) 1.50 1.60 Timothy, loose (100 lbs.) 1.90 1.95 Oats, No. 1 (96 lbs.) 1.50 1.55 Corn, No. 1 (100 lbs.) 1.35 1.40 Bran (100 lbs.) 1.40 1.45 Middlings, std. (100 lbs.) 2.50 2.55 Cottonseed meal (100 lbs.) 1.75 1.80 Hominy chop (100 lbs.) 2.90 2.95 Poultry dry mash (100 lbs.) 3.25 3.30 Wheat (100 lbs.) 2.55 2.60 Linseed meal (100 lbs.) 2.10 2.15 Gluten (100 lbs.) To Decide Shelton Bank Matter There is to be a conference before the opening of the December term of the criminal superior court in Bridgeport, between State's Attorney Homer S. Cummings and former Governor Marcus H. Holcomb, receiver for the Shelton Trust Co., at which it will be decided whether protecution will be instituted against Edward J. Kneen treasurer of the company, for whose of funds. This Shelton bank is the one for which $1,000,000 was recently offered by Franklin S. Jerome of Orange, formerly of Norwich.