Article Text

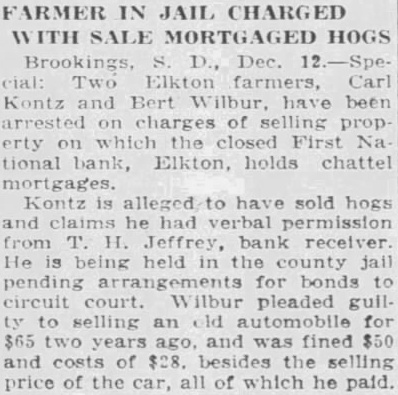

FARMER IN JAIL CHARGED WITH SALE MORTGAGED HOGS Brookings, D., Dec. 12.-SpeTwo Elkton Carl Kontz and Bert ilbur have been arrested on charges of selling prop erty on which the closed First Na tional bank, Elkton, holds chattel mortgages. Kontz is alleged to have sold hogs and claims he had verbal permission from T. H. Jeffrey, bank receiver He is being held in the county jail pending arrangements for bonds to circuit court Wilbur pleaded gull ty to selling an old automobile for $65 two years ago, and was fined $50 and costs of $28. besides the selling price of the car, all of which he paid.