Click image to open full size in new tab

Article Text

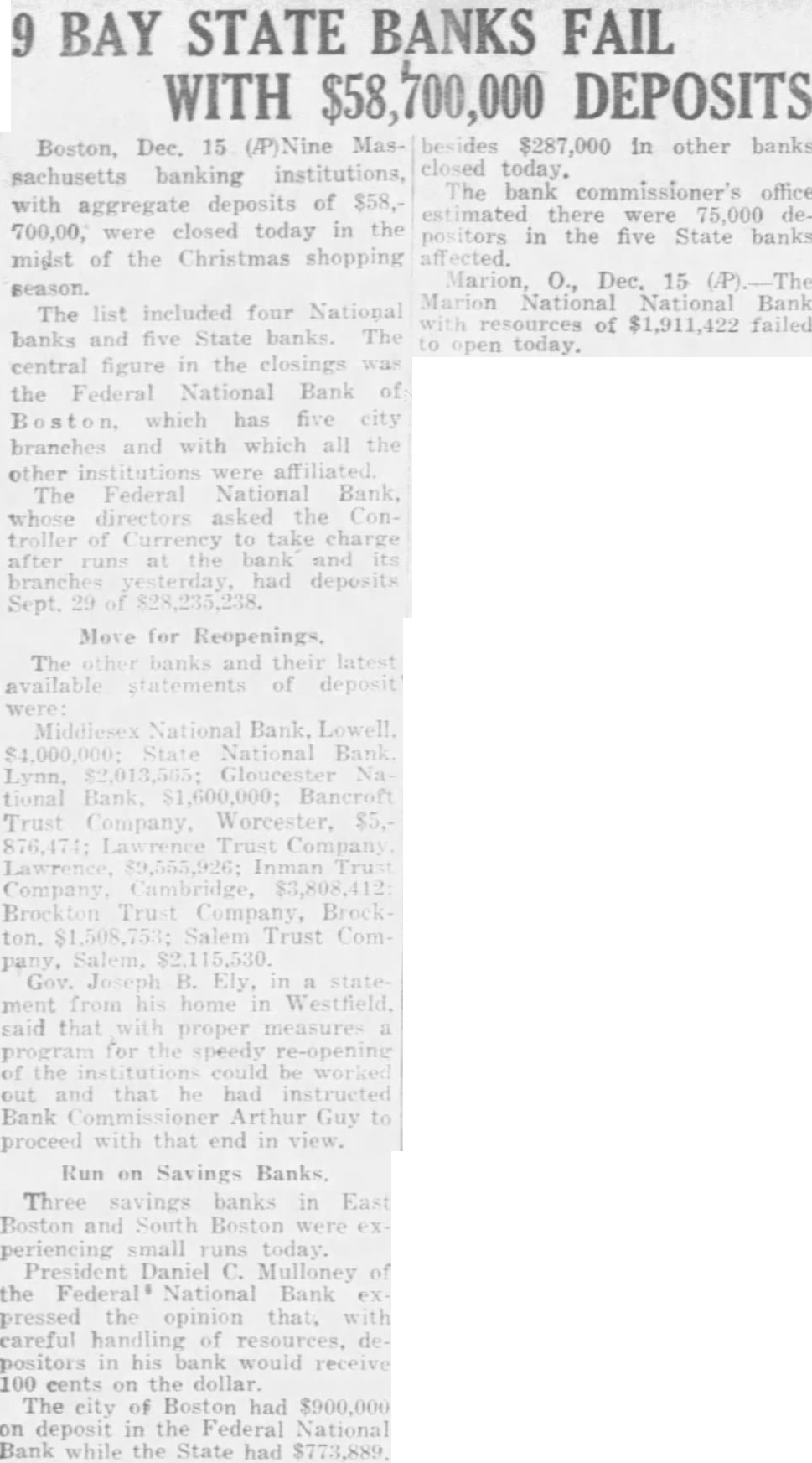

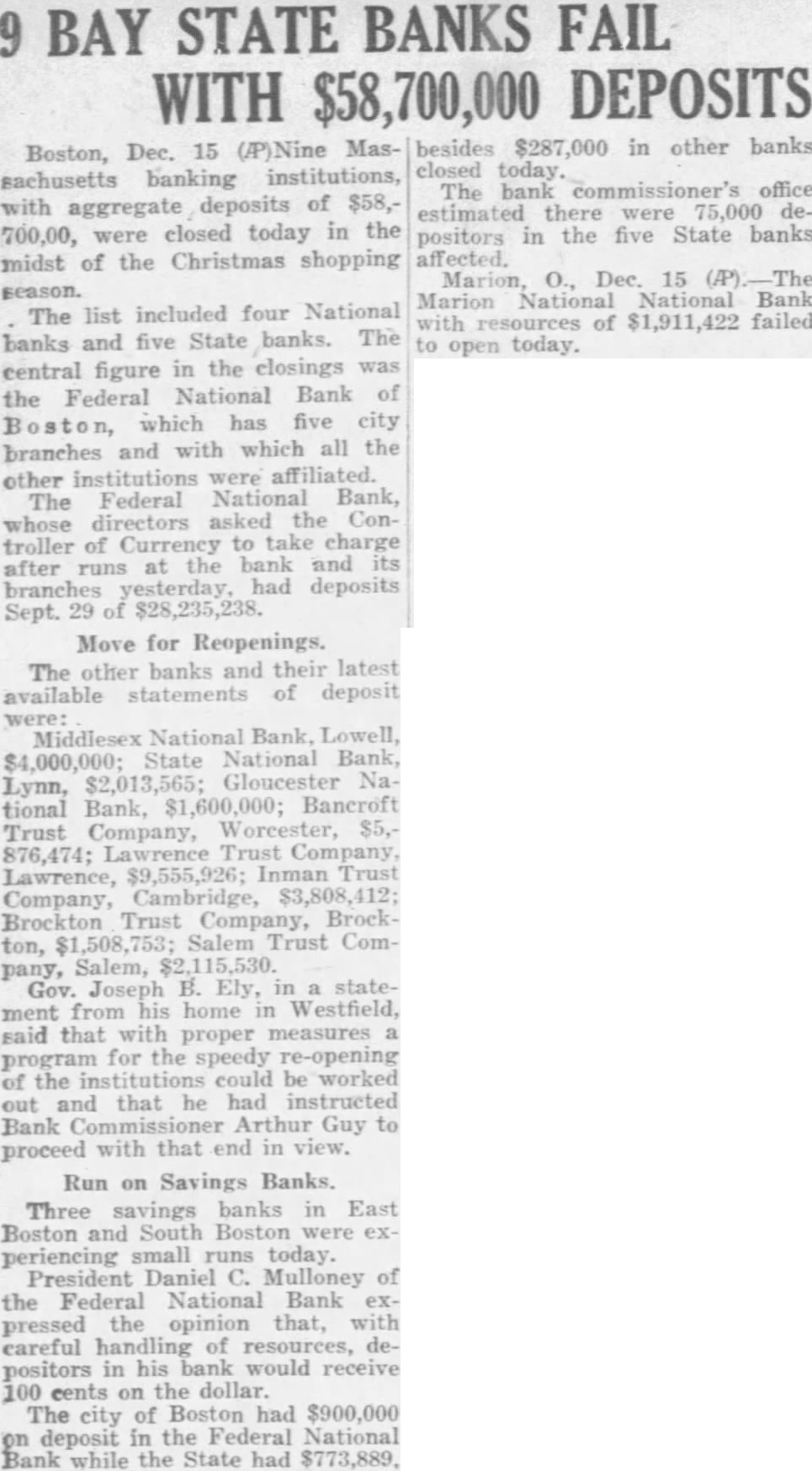

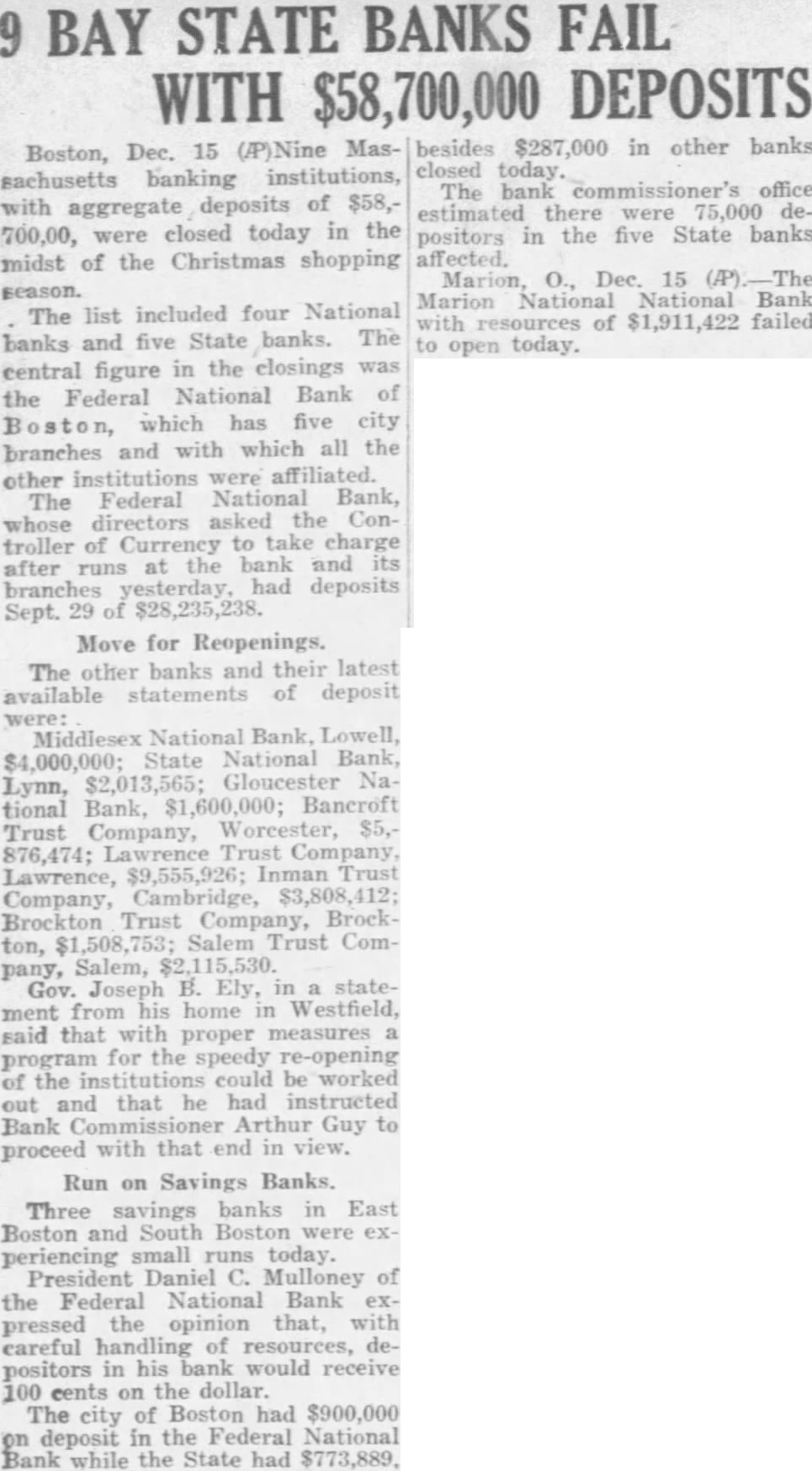

9 BAY STATE BANKS FAIL WITH $58,700,000 DEPOSITS

Boston, Dec. 15 (/P)Nine Massachusetts banking institutions, with aggregate deposits of $58,700,00, were closed today in the midst of the Christmas shopping season. The list included four National banks and five State banks. The central figure in the closings was the Federal National Bank of Boston, which has five city branches and with which all the other institutions were affiliated. The Federal National Bank, whose directors asked the Controller of Currency to take charge after runs at the bank and its branches yesterday, had deposits Sept. 29 of $28,235,238.

Move for Reopenings.

The other banks and their latest available statements of deposit were: Middlesex National Bank, Lowell, $4,000,000; State National Bank, Lynn, $2,013,565; Gloucester National Bank, $1,600,000; Bancroft Trust Company, Worcester, $5,876,474; Lawrence Trust Company, Lawrence, $9,555,926; Inman Trust Company, Cambridge, $3,808,412; Brockton Trust Company, Brockton, $1,508,753; Salem Trust Company, Salem, $2,115,530. Gov. Joseph B. Ely, in a statement from his home in Westfield, said that with proper measures a program for the speedy re-opening of the institutions could be worked out and that he had instructed Bank Commissioner Arthur Guy to proceed with that end in view.

Run on Savings Banks.

Three savings banks in East Boston and South Boston were experiencing small runs today. President Daniel C. Mulloney of the Federal National Bank expressed the opinion that, with careful handling of resources, depositors in his bank would receive 100 cents on the dollar. The city of Boston had $900,000 on deposit in the Federal National Bank while the State had $773,889. besides $287,000 in other banks closed today. The bank commissioner's office estimated there were 75,000 depositors in the five State banks affected. Marion, 0., Dec. 15 (A).-The Marion National National Bank with resources of $1,911,422 failed to open today.