Article Text

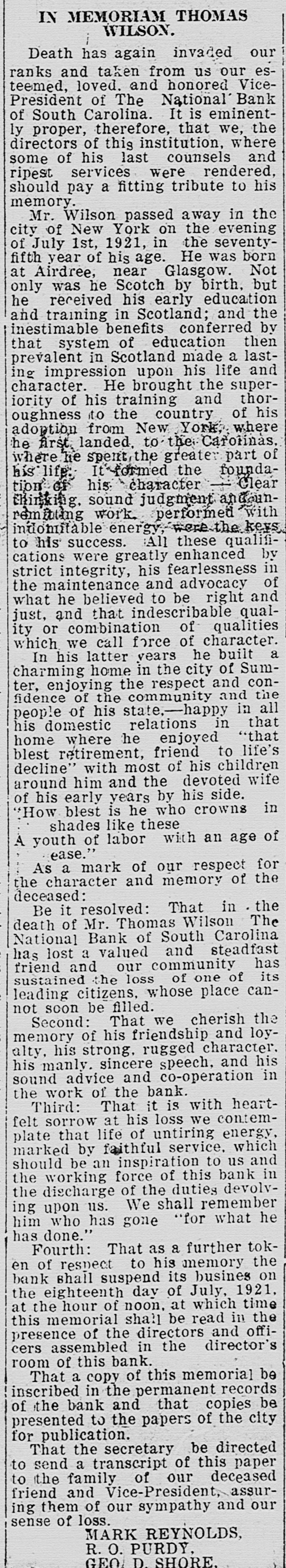

IN MEMORIAM THOMAS WILSON. Death has again invaded our ranks and taken from us our esteemed, loved. and honored VicePresident of The National Bank of South Carolina. It is eminently proper, therefore, that we, the directors of this institution, where some of his last counsels and ripest services were rendered, should pay a fitting tribute to his memory. Mr. Wilson passed away in the city of New York on the evening of July 1st, 1921, in the seventyfifth year of his age. He was born at Airdree, near Glasgow. Not only was he Scotch by birth, but he received his early education and training in Scotland; and the inestimable benefits conferred by that system of education then prevalent in Scotland made a lasting impression upon his life and character. He brought the superiority of his training and thoroughness to the country of his adoption from New York where he first landed, to the Carolinas. where he spent the greater part of his life: It formed the foundation GF his character Clear thinking, sound judgement andounremitting work. performed with indomitable energy, were the keys to his success. :All these qualifications were greatly enhanced by strict integrity, his fearlessness in the maintenance and advocacy of what he believed to be right and just, and that indescribable quality or combination of qualities which we call force of character. In his latter years he built a charming home in the city of Sumter, enjoying the respect and confidence of the community and the people of his state,-happy in all his domestic relations in that home where he enjoyed "that blest retirement, friend to life's decline" with most of his children around him and the devoted wife of his early years by his side. How blest is he who crowns in shades like these A youth of labor with an age of ease. As a mark of our respect for the character and memory of the deceased: Be it resolved: That in the death of Mr. Thomas Wilson The National Bank of South Carolina has lost a valued and steadfast friend and our community has sustained the loss of one of its leading citizens, whose place cannot soon be filled. Second: That we cherish the memory of his friendship and loyalty, his strong, rugged character. his manly. sincere speech, and his sound advice and co-operation in the work of the bank. Third: That it is with heartfelt sorrow at his loss we contemplate that life of untiring energy, marked by faithful service. which should be an inspiration to us and the working force of this bank in the discharge of the duties devolving upon us. We shall remember him who has gone "for what he has done." Fourth: That as a further token of respect to his memory the bank shall suspend its busines on the eighteenth day of July, 1921. at the hour of noon, at which time this memorial shall be read in the presence of the directors and officers assembled in the director's room of this bank. That a copy of this memorial be inscribed in the permanent records of the bank and that copies be presented to the papers of the city for publication. That the secretary be directed to send a transcript of this paper to the family of our deceased friend and Vice-President, assuring them of our sympathy and our sense of loss. MARK REYNOLDS, R. O. PURDY. GEOLDSHORE.