Article Text

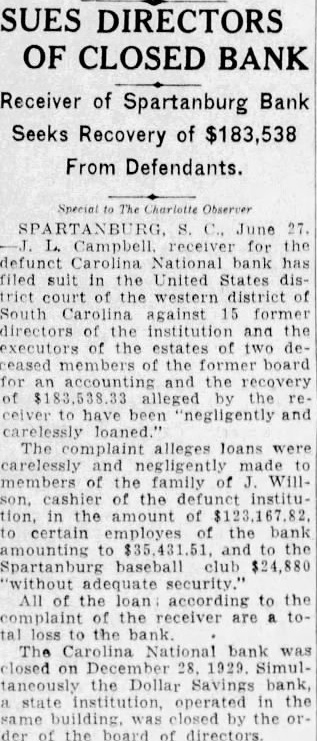

SUES DIRECTORS OF CLOSED BANK Receiver of Spartanburg Bank Seeks Recovery of $183,538 From Defendants. Charlotte Observer Campbell. for the defunct Carolina National bank filed sult in the United States district court of the western district of South Carolina against 15 former directors the institution and the executors of the estates of two deceased members the board for accounting and the recovery of $183,538.33 alleged the ceiver been "negligently and carelessly loaned." The complaint alleges loans were carelessly and negligently made members of the family of Willcashier of the defunct institution, in the amount of to certain employes the bank amounting $35,431 and to the Spartanburg baseball club $24,880 "without adequate security." All of the loan: according to the complaint of the receiver are tal the bank. The Carolina National bank was closed on December 28, 1929 Simultaneously the Dollar Savings bank, state operated in the closed by the or. der of the board of directors