Click image to open full size in new tab

Article Text

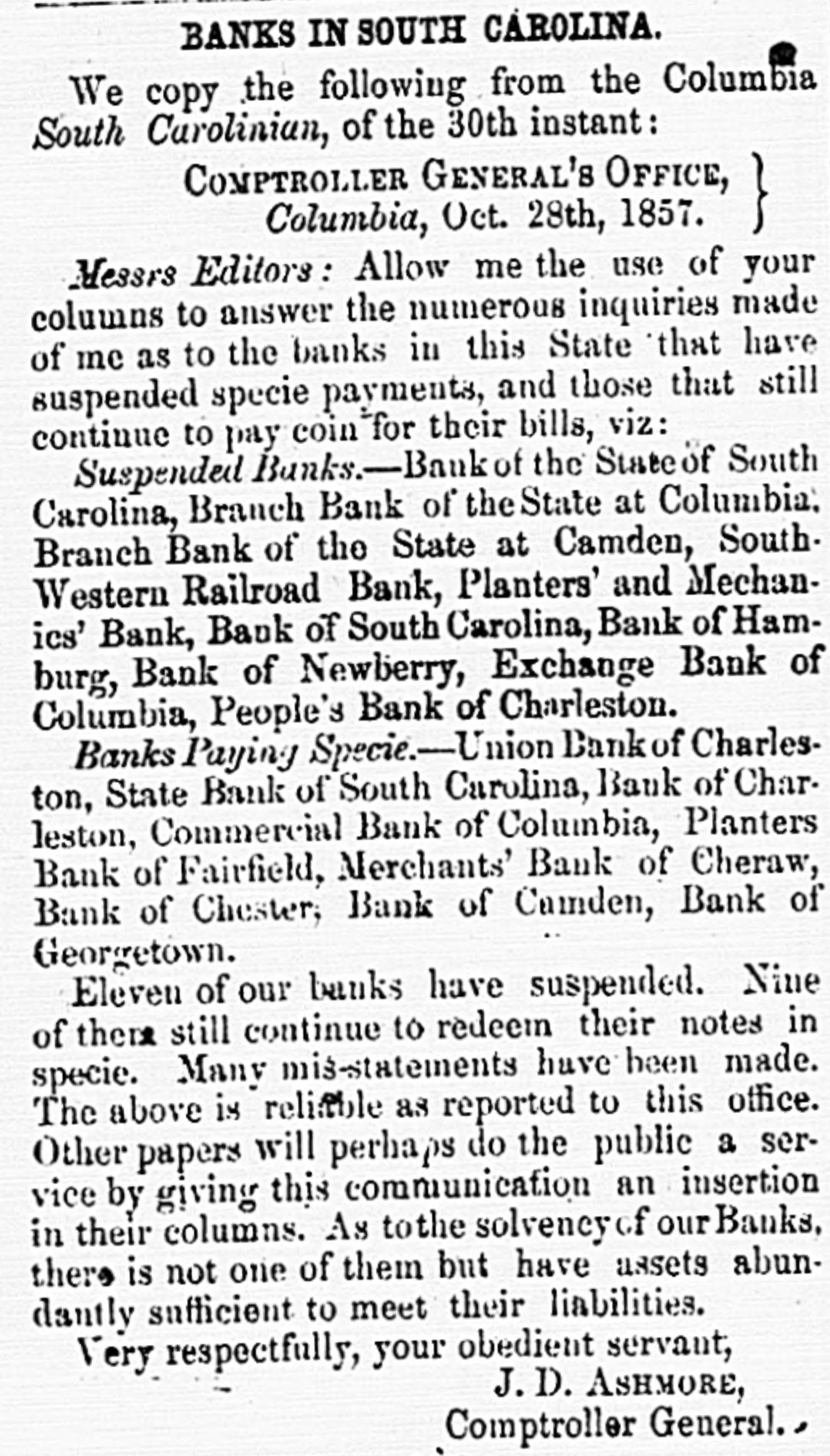

Scraps & Facts. A singular marriage lately took place in Wilkes county, N. C. A man named Holloway married his step mother, the second wife, the widow of his own father ! She had six children, three of them by his father, and three by himself; and having nine children of his own, the couple set up housekeeping with 15 children. The Carolinian in a paragraph in regard to the Methodist College, says This edifice is nearly completed. It will furnish, educational facilities which many, no doubt, will immediately avail themselve of. Under the patronage of the large and influential body of Methodists, it must succeed as an institution of learning. It is stated, "by authority," that a new fashion is about to be introduced by the ladies of Buffalo-no less in fact than an immense calash, which is to be attached to the waists of the dear creatures, to be raised and lowered at pleasure, like the top of a buggy. Buffalopapers frantically ask, "what next ?" The Carolinian says that the work on the State House is progressing with all possible rapidity under its present efficient management. The basement story is nearly completed, and makes a beautiful appearance. The masonry within-the bricks being. very fine-is unusually firm and substantial in appearance. When completed, it will be a most imposing structure. - L. F. Fowler, who was recently tried at Union Court, on a charge of negro stealing, and acquitted, and also charged with felony in Georgia, made his escape from Mr. Washington, who had him in charge on way to Georgia, on the 12th ult., by jumping out of the car window, at Lewisville, on the S. C. Rail Road, leaving his handcuffs and chain in the car. The band-bill states that it is believed he received assistance in Columbia which enabled him to escape. The Postmaster General has made an order that all Postmasters whose compensation exceeds twelve dollars and fifty cents per quarters shall be supplied with wrapping paper, twine and sealing wax for the use of their offices by the Post Offices Department, and the rule adopted March 12, 1855, has been repealed. All Postmasters whose com pensation is less than twelve dollars and fifty cents per quarter can purchase, for the use of their offices, a reasonable amount of these articles, provided the net proceeds is not less than twenty dollars per year. We have a few further particulars of Brigham Young's threat. Capt. Van Vlieat, Government Agent at Palmetto, Kansas, has just returned from Salt Lake. He reports that the Mormons refused to permit the United States troops to enter the city, and that Gov. Young publicly declares that he will burn the prairies, and thus deprive the animals of the expedition of subsistence, and burn his own city, if necessary, before he will submit to demand of the government. The report of the murder of surveying companies by Indians are contradicted.-Charleston Standard. We learn from the Charleston papers, that the following only are the suspended Banks. Bank of the State of South Carolina, Branch Bank of the State at Columbia, Planters' Bank of Fairfield, Branch Bank of the State at Camden, South Western Rail Road Bank, Planters' and Mechanics' Bank, Bank of South Carolina, Farmers' and Exchange Bank of Charleston, Bank of Hamburg, Bank of Newberry, Exchange Bank of Columbia, Peoples' Bank of Charleston. And we learn from the same source that the following are the Banks paying specie: Union Bank of Charleston, State Bank of South Carolina, Bank of Charleston, Commercial Bank of Columbia, Merchants' Bank of Cheraw, Bank of Chester, Bank of Camden, Bank of Georgetown. The steamer Baltic brought from Liverpool £72,000, (363,465.) The day before the Baltic sailed, it had been ascertained that £270,000 more, (1,350,000,) just received by the Red Jacket, from Australia, had been taken up for the United States. This amount has, it is said, arrived by the Persia. The California steamer now due will add $1,500,000, making the large aggregate of $3,213,495. When the hoarders, large and small, perceive that English capitalists are sending gold in large amounts to be invested in our low-priced, well secured, paying stocks, and in the purchase of our equally depressed produce, the firmness of their grasp on their money bags will become relaxed, and they will hasten to place their hoarded treasure again in the keeping of the Charleston Evening News. We saw yesterday a letter from the eminent house of Cuddy, Brown and Co., of New Orleans, to one of their correspondents in this county, proposing to send a cargo of cotton direct to Liverpool, for account of the producers. We understand that Mr. Shepherd Brown, the head of the house, proposes to go to Liverpool himself for the