Article Text

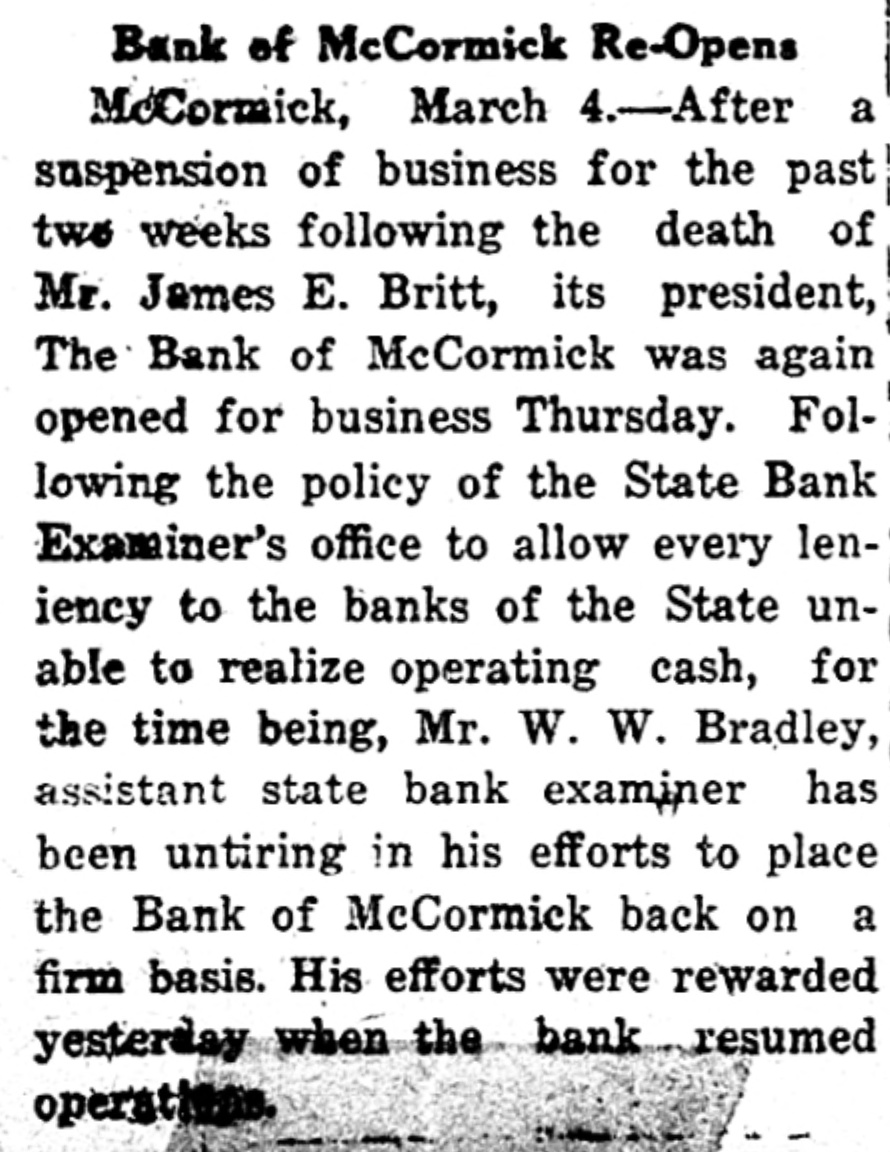

Bank of McCormick Re-Opens a McCormick, March 4.-After suspension of business for the past two weeks following the death of Mr. James E. Britt, its president, The Bank of McCormick was again opened for business Thursday. Following the policy of the State Bank Examiner's office to allow every leniency to the banks of the State unable to realize operating cash, for the time being, Mr. W. W. Bradley, assistant state bank examiner has been untiring in his efforts to place the Bank of McCormick back on a firm basis. His efforts were rewarded yesterday when the bank resumed operat