Click image to open full size in new tab

Article Text

DECISION IN TRUST FUND LITIGATION

Supreme Court Rules That Mingling Trust Funds With Other Bank Funds Is Not Breach of Trust

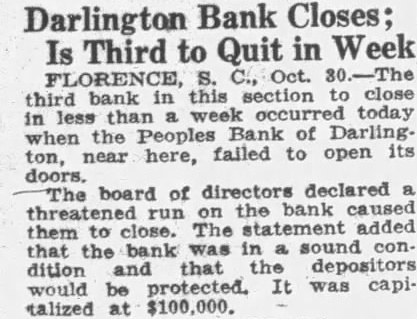

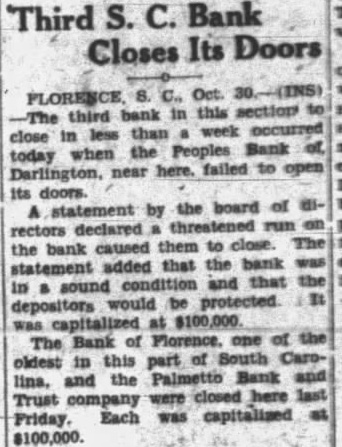

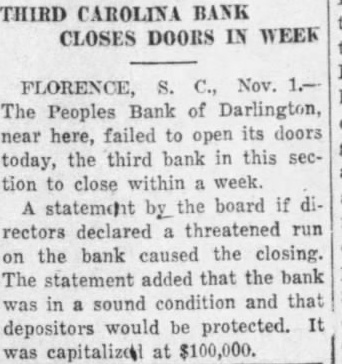

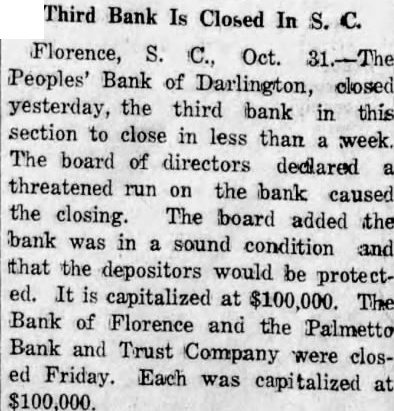

Columbia, July funds received trust by bank and mingled other bank funds. does not constitute trust in event of the bank's failure and the estate preferential claim other depositors, the preme court ruled in an important majority opinion today. The opinion, first ruling by the court on phases of 1930 statute, regarded highly portant view of the number estates now tied in closed banks. Written by Associate Justice Bonham, opinion curred by Chief Justice Blease and Associate Justice Stabler Associate Justice Carter dissented Although pointing the law "if executor, administrator, guardian trustee mingle the funds the estate his own and ensue the the fiduciary good from his funds, the court ruled bank receiver not required to pay estate ahead of creditors depositors where there is no breach of trust. The court reversed the decision of Judge Dennis from Darlington county, Donald Michie, against the Peoples Bank lington Brasington, ceiver, appellants. When Michie, of Darling ton. died in 1928 the Peoples Bank of Darlington made his executor closed in October 30, 1928, and Brasington was made receiver. The Michie estate credited with $6,310.17 on the bank's books. Brasington, ceiver, resigned bank executor of the estate and appointed Donald Michie administrator cum testamento annexo. He then administrator dividends The administrator claimed the bank executor held funds for the estate and by mingling the bank's funds funds the estate, committed breach of trust and estate and over general crediand When Michie entered the courts, Judge Dennis general" upheld his contentions. And the receiver appealed In his dissenting opinion, Justice merely said briefly he cepted Judge Dennis' interpretation the law in the