1.

February 27, 1933

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

WITHDRAWALS CUT BY 20 OHIO BANKS Institutions With $815,000,000 in Deposits Await Legislative Action. By the Associated Press. COLUMBUS, Ohio, February 27.Twenty Ohio Banks, all but two in Cleveland, Akron, Dayton and Ycungstown, today placed restrictions on heavy withdrawals in anticipation of emergency banking laws Gov. George White promised to offer to the current Legislature. On the basis of December 31, 1932, statements. the institutions had more than $815,000,000 in deposits and more than $1,025,000,000 in rescurces. Both in Akron and Cleveland, the banks announced future deposits would be set aside and not be placed under the restrictions. All Dayton banks closed for a three-day holiday. One Refuses to Participate. All eight of Cleveland's banks opened as usual, but six of them limited withto 5 per and a seventh, a Trust, drawals deposits, placed temporarily restriction the of Guardian cent 1 per of cent. The eighth, the National City Bank, declined to participate and announced it would conduct business on a normal basis. The six which limited withdrawals cent of deposits were the Bank, National Cleveland to American 5 per Savings Bank, Central Trust United Co., Lorain Street Savings & Trust Co., Society for Savings and Union Trust Co. While they placed no specified limit, the Union National and the Mahoning National Banks at Ycungstown announced they would restrict large and unusual withdrawals. Sufficient funds will be paid cut on demand, they said, to prevent inconvenience to customers. One Per Cent Per Month. Akron's five banks - First Central Trust Co., Firestone Park Trust & Savings Bank, the Commercial Bank & Trust Co., the Dime Savings Bank Co., and the Standard Savings Bank-restricted savings deposit withdrawals. to 1 per cent per month. "Abnormal" checking account withdrawals will not be honored under a complicated system. The four banks of Dayton-the Winters National, the Third National, the Merchants National and the Morris Plan-declared a three-day holiday under a declaration by the city commission and mayor. The Clinton Savings Bank Co., near Akron, announced it would follow the lead of Akron banks. The First American Trust Co. of Lima, Ohio, limited withdrawals to 2 per cent of deposits. There was no announced action to interrupt normal banking elsewhere in the State. Gov. White declined to divulge the nature of the proposed legislation. Manager G. A. Stephenson of the Cleveland Clearing House Association, however, said the suggested laws would "enable the superintendent of banks, with the approval of the Governor and attorney general, to stop or limit withdrawals from Ohio banks."

2.

March 14, 1933

The Akron Beacon Journal

Akron, OH

Click image to open full size in new tab

Article Text

ADDITIONAL TUESDAY

Institutions With Deposits Of Over Billion Active In 15 Cities

(Continued From Page One) most of those which remain closed temporarily to be are organized. That task already has been started by few of the larger banks denied the funds they presented problems individuals and business alike.

Provide For Loans The Cleveland arranged have industrial money frozen funds payroll poses. problem there greater due the fact that licenses withheld from the largest banks, the Union Trust and the Guardian Trust Co., whose deposits 31 as Other prepared they were for customers day they received for more than was drawn. Monday with that of an average heavy Plans of the Union and Guardian the called board of meet today Neither institution, would discuss plans further than say they hoped and place on the list of licensed

3.

March 16, 1933

The Cleveland Press

Cleveland, OH

Click image to open full size in new tab

Article Text

HELP GUARDIAN AND UNION REBUILD

Federal Action Taken to Speed Fund Release to Small Banks

TERMS ARE WEIGHED

Set Up by Invited President

By JOHN R. MARKHAM

The Press Financial Editor With reserves of hundreds of small Ohio banks tied up in the Union Trust Co. and Guardian Trust Co., representatives of the Treasury Department and Fimance Corporation are taking an active part in reorganization plans, was learned representative the R. has been called in by the group tive in plans for the reorganization of the Union Trust Co. and an examination its financial condition being made to determine just how much funds could be obtained from the federal government. House, president of the Guardian Trust Co.: in statement today said the bank's special committee on reorganization had been devoting constant attention to development of plans, but new national and state legislation made progress difficult. Definite plans for reorganization will not be announced these are clearly he said. Officials of both banks have been assured that the national administration the fate of many small Ohio banks is tied up with and possible for Currency Meanwhile, was reported at the Cleveland Federal Reserve Bank that there had been no call for the new currency authorised by emergency banking act. from banks which had reopened fully in Ohio. Nine Ohio banks were included in list which the Reserve Bank here authorized to reopen today. "For some time special committee of the board of directors of the Guardian Trust Co. has been devoting attention to the development of plan for reorganization of the bank in whatever manner is best designed to preserve the interests of its depositors and customers, said Mr. House. "This committee has the unanimous support of the board direcLOTS and the executive officers of the fully aware of the desirability of prompt action and is proceeding rapidly as possible with the of its legal counsel, but the present time number of new laws which have been passed, both Washing ton and Columbus, together with banking bills pending in the Legislature, make progress especially difficult, Waits Study of New Laws

"The committee will not announce definite plans for reorganization until these new laws can be clearly understood. 'Pending adoption of definite plan, the committee refraining from public of the details of its progress. Recent experience in other cities that premature reof banks do real harm to community Such statements lead the public to expect certain results which later fail to materialize 'When the plan is formally its full performance will have been in vance its publication. In the meantime. with the full "support of the officers and directors of the bank and with the advice assistance of many of its leading shareholders and depositors. the committee is proceeding in its work and cautiously under the advice of its legal Union Trust directors held meeting yesterday and heard terms under Turn to Page 10 THE WEATHER

4.

March 25, 1933

The Cincinnati Enquirer

Cincinnati, OH

Click image to open full size in new tab

Article Text

DEPOSITORS

Granted Major Voice

On Reorganization Committee Of Cleveland Bank-Two Pay Off R. C. Loans.

Cleveland, Ohio, March -President Harold H. Burton, the Reorganization Committee of the Guardian Trust Company, today announced that depositors of the bank had been majority on the committee. The committee's membership was increased from six eight the additions today of Auxiliary Bishop James A. McFadden, of the Catholic Diocese of Cleveland, George W. Grill, Assistant School Superintendent of Lakewood, suburb. Five of the committeemen represent depositors, two represent Directors and stockholders, one represents the stockholders. Union Trust Company and the Guardian Trust Company, neither of which has been operating normal basis the national crisis, both been cutting expenses drastically in anticipation of reorganization arrangement shortly. The Union Trust has dismissed of its 957 employees recently, cut salaries deeply. tion announced today that Union Trust closing branches. Meanwhile, the Cleveland Trust Company, which reopened with eral other banks Federal license after the crisis, announced today repaid loan of 800,000 Finance Corporation. Simultaneously the Central National Bank, 100 cent operative, said repaid obligation to the corporation of $1,100,000. This repayment wiped out the total indebtedness of both banks the corporation.

5.

March 30, 1933

Pittsburgh Sun-Telegraph

Pittsburgh, PA

Click image to open full size in new tab

Article Text

BANK-MARKET PROBE ASKED

WASHINGTON M 30. INS Asking that the records of Cleveland brokers be subpenaed to "see whether bank depositors' funds had been speculated with,' Rep. Young Dem.) of Ohio, today supported the demand for investigation of the conduct of banks in the larger cities Young joined Rep Sweeney (Dem. Ohio. urged the Senate stock market investigating to inquire particularly into the affairs of the Union and Guardian Trust Companies of Cleveland.

WASHINGTON M AP government today had agreed to lay down dollar for dollar with Cleveland citizens in opening new national bank there to replace the Union Trust. the city's second largest bank committee representing Cleveland banking interests headed by R Kraus chairman of the board of the Union Trust reached satisfactory terms with the Reconstruction Corporation after day conference yesterday

6.

April 4, 1933

The Plain Dealer

Cleveland, OH

Click image to open full size in new tab

Article Text

Time to Face Facts.

It should not be necessary for the conciliation bureau of the Department of Labor to take hand in Cleveland's movie deadlock this ought be tended to by the parties directly in dispute. How there no other way to get the houses open, the federal agency will be justified intervening has the point of easy The dispute passed erance. The issues between employers and serious to block ployes not peace. The welfare of dozen stage hands not important enough permitted indefinitely to thousands of moviegoers from their keep many favorite time to face facts in the controversy that the movie houses tight for more than two weeks One the facts that the unions volved maintained and are still maintaining attitude that makes peace for the ment impossible. They put selfish interest above the welfare Until they abandon shortcommunity attitude agreement that sighted and the tie-up is virtually impossible Suburban movies outside the Greater Cleveland district are showing to capacity audiences. Other attractions are doing their supply the tertainment which the movie houses should be ing way another the community being penalized terms real money for the breakdown most popular amusement the conciliation bureau be called in if essary to bring movie peace to Cleveland Better the matter attended home The unions will best serve their own ultimate interest with the interests the by adopting attitude more in keeping with their obligations to the community whose good supports them. This should be the first toward peace. to Washington.

Harold the Guardian Trust committee representing that bank submit the government today plan upon they hope secure national charter presumed that outline the similar approved last week for the Trust siderable government subscription the stock of the bank hoped that the committee has that appeal the government and that the government representatives be liberal dealing the committee prudence and consideration of the public interest permit. And hoped prompt decision reached For week more depositors the Guardian have impatient and have demanded to know what progress being made toward reorganization when they would access to part of their funds Symptomatic of the attitude depositors toward the handling of this the demand made depositors committee state secretary of commerce and the superin tendent of banks President Burton has opposed the appointment of conservator for the Guardian on the ground that case today might be prejudiced such action This argument against conservator will not run more than another day two. The government will have the full plan submitted the local group Its decision will hardly affected by anything the state may deem desirable and the public would be reasonable to expect then that White will put conservators Union and Guardian banks before the end the week means of assuring depositors that their interests being amply protected, and that the liquidating their slow assets will held minimum. three weeks depositors of the Guardian waited for weeks they have cent of their funds. This per

7.

April 6, 1933

The Plain Dealer

Cleveland, OH

Click image to open full size in new tab

Article Text

Unassailable Guardian Offi- cers to Help Run New

Bank, Burton Says in Statement.

UNION AND GUARDIAN

CONSERVATORS COMING

Appointments Are Up To- day; New Bank May Take

Trust Business.

BY WALKER BUEL. Plain Dealer Bureau. 611 Albee Bldg Payment of 20 per cent. their deposits depositors the Guardian Trust Co. made possible by loan nearly $9,000,000 from the and arrangement with proposed First tional Bank is provided plan for liquidation the Guarannounced tonight. The Union Trust Co., succeeded by the First National "Substantial qualified and employes the Guardian employed by the First National Bank, Harold Burpresident the adding and officers must. the approval the and accepted who regarded sponsible for any actions the bank which will justify criticism of them. has also been stated that none of the officers directors be permitted to be indebted to the new bank to carrying any questionable loans at the

Approves Program.

Believing interests depositors of institutions and the community will be served best by having strong bank succeed the two be liquidated. after two conferences here representatives both institutions. tonight approved program The Finance Corp its to the bank added already loaned. brings the Guardian indebtedness to The Guardian obtain by transfer of liquid the new national bank, which will the old institution 100 per cent. credit for them. This provides total of $18,074,000 The Guardian's general deposits total $66,000,000. to meet which there hand, announced cash, added the and the retirement of Federal ReBank stock for produces which the entire possible to obtain this time, Burton

Cent. Payment.

Out this total will be made the of 20 per cent. deposits which will release to Guardian depositors through the bank Other immediate (Continued on Page Column 2)

8.

April 6, 1933

The Plain Dealer

Cleveland, OH

Click image to open full size in new tab

Article Text

Burton Explains Plan for Guardian.

Plain Dealer Bureau Bldg Following the explanation the plan for the Guardian Trust Co. prepared and issued tonight by President Harold Burton plan approved today by the Corp. the Guardian Trust Co. case has three principal purposes: "1-To protect fully the rights of depositors provide cash for large first payment depositors as help establish in Cleveland and perfectly sound national bank, enough serve the needs of this and entirely secure that the government itself fled in taking one-half interest in its (At this point the statement committee members and public ficials have worked on reorganiplans.)

Determinations Reached.

"The determinations reached after full consideration the outstanding obligations of heavy the bank and of limited resources, which had been drained by about in the eighteen available source funds in substantial quantity at this (Continued Page 12, Column

9.

April 14, 1933

The Cleveland Press

Cleveland, OH

Click image to open full size in new tab

Article Text

PLANS ALTERED TO SPEED CITY BANK PROJECT

National Regulations on Loans Had Been Seen Block ing Deal

(Continued From Page One) torship will be the that part the assets the are the will the duty liquidators and file inventory the bank, Director Tangeman said.

Wants Loans Revealed

"Status the banks now the same they going banks.' he said. That will their staus which will when part of the sold and the bank. "Until that time arrives the department would the criminal sections the law But when arrive, not only this but wants the made public. certainly my strong relative loans all other ditions the public that light day will shine into recesses the bank's records, concluded. his address, brought the the fact made banks some the directors. no "Whether these loans were properly made must be full consideration of the facts,' the officers or directors things which they should not done, depositors perfect right to pursue them Loans of officers directors not illegal, by board Mr. Cannon said he had thoroughly investigated the Kraus, chairman of the board the Union Co., who to be president of the new bank.

Gives Kraus Clear Bill owes no money to the and was Mr. on Mr. the the liability and doubt he the Union Co. whenever the liability expect to pay

Union Trust Co. capitalized the collected double Discussing in Cannon allowed receive the judgment of directors best qualified to do particular job

Hints at Commissions of banks have come under fire in recent investigations. Gov. George White hinted commissions paid bank officers in directing conservators of the Union Guardian find whether officer the banks any improper profits "Mr. dealing corporations firms. the law firm of Tolles. Hogsett Ginn counsel for Union charges Trust the and sociation has to pointment Dougherty cluded. counsel for tor was Tolles, Hogsett Ginn until cently. "The bank will run ecoMr. Cannon Salaries in the Union Union Trust the Guardian Trust revealed, although Ira Fulton superintendent conservators recently to give him this information National will have but funds will be invested in the stock of bank. funds be kept separate and apart will not mingled the depositors' money, said.

Reveal Trust Deposits

The Union Trust Co. had $5,059.trust deposits trust deposits took Figures for the were estate trust deposits and trust deposits. Discussing possible illegal action officers the old banks, Mr. Cannon said the of the would not prevent any individual from taking whatever tion was necessary. against them in the courts. He expressed the belief the present would money than any course knew of. This will and $60,000,000 the two closed banks, not ideal,' he ted, others to do. must failure you not plain. was submitted and you failed talk pointed out that 200,000 had the banks, that than Community and charitable funds were tied up and that nearly unit in the county affected by their closing.

Depositors' Plan Due the plan being worked out the three closed with the Don Loftus, of the the plan being whipped into final alike stockholders and employees of closed reported of the tures the proposal called for 100 to depositors with than Yesterday Oscar Cox, conthe Union Trust the appointment James Rogan Austin, the jection to the appointment Dougherty counsel for the Co. "Mr. estimable gentlelawyer, his record in similar capacity the of the Realty and Savings Loan where he was one charges for such shared the disburse$368,000 above which cost including all other taxed against the depositors with counsel, total of $1,060,000." conThe committee, in renewing its objection to Mr. evidence that his former law firm Tolles. Hogsett Ginn had been counsel well advisers for the Trust Co. Cases The name Luther Day, attoradded today to those ported to be under for Daniel Morgan. city also conferred Mr. Cox yesterday John Bricker no further made until after his return Columbus from next Wednesday

10.

April 27, 1933

The Dayton Herald

Dayton, OH

Click image to open full size in new tab

Article Text

GOVERNMENT IN AND PUTS STOP TO 'RUN' ON BANK

Depositors at Cleveland Are Quieted After False Rumors Precipitate Flurry.

FEDERAL AUTHORITIES

GO AFTER CRIMINALS

Perpetrators of Unfounded Reports Sought After All Demands Are Met.

CLEVELAND. O., April

-Cleveland's licensed banks were "backed the limit" today by the federal government.

Aroused three-day run the Cleveland Trust company, the city's largest bank, federal authoriannounced that secret service ties in the city in operatives were attempt to trace down perperators of malicious rumors which caused the withdrawals. the Cleveland Simultaneously, Federal Reserve bank issued formal statement, signed by Gov. Fancher of this Federal Reserve out that the district, pointing Cleveland Trust and other licensed banks were allowed to reopen "only after careful determination of their condition proved them to be sound. DRAMATIC CLIMAX.

The run on the Cleveland Trust its 59 branches came to dramatic climax late yesterday when Harris Creech. president, appeared in lobby crowded with depositors, announced that every person would be paid in full, and that the bank would be kept open two extra hours to accommodate anyone wishing withdraw money. The Cleveland Trust company one of the first in this vicinity to obtain license to reopen after the recent banking holiday. Just prior to the closing of all banks, the trust company had placed bales of money in plain view in the lobby, assuring all depositors there was plenty of cash to pay everyone in full.

FEARS ALLAYED.

President Creech's dramatic appearance before the depositors yesterday had the effect of restoring confidence among depositors, and only handfull were in the lobby when the bank finally closed The statement of Gov. Fancher of the Federal Reserve, said: "Anxiety concerning deposits licensed banks in Cleveland is warranted. These banks were censed and reopened after careful determination of their condition. They are sound and they have and will continue to have the full support of the Federal Reserve bank.' The run on the Cleveland Trust and its branches came while officials of the Union Trust and Guardian Trust, the city's second and third largest were working reorganization plans which will allow the institutions to reopen. Sale of common stock in new tional bank to succeed both Union and Guardian now underway.

11.

July 13, 1933

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

SEEK "SMART MONEY" IN GUARDIAN TRUST Whether Probers Determining Withdrawals Coincided With R. F. C. Loans to Bank. By the Associated Press. CLEVELAND, July 13.-A hunt for "smart money" withdrawn from the Guardian Trust Co. in the year preceding its closing last March was started today on order of the State Senate Committee investigating the institution's failure. While the committee itself is in adjournment until next Tuesday, a group of accountants will inspect the bank's books to determine if any depositors withdrew money through receipt of "inside" information regarding the bank's condition. The accountants were asked to determine who withdrew large sums of money in the months preceeding the closing and whether the withdrawals coincided with the receipt by the bank of loans from the Reconstruction Finance Corporation and the Federal Reserve Bank.

12.

July 19, 1933

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

BOWERS WILL URGE GUARDIANTRUST CO. FREEDOM FOR FIVE SET UP EXPLAINED Cleveland Bank Controlled 26 Settlement of Mallorca Case Subsidiaries, State Probers Sought Through Talk Are Told. With Premier. By the Associated Press. By the Associated Press. CLEVELAND, July 19.-A puzzling MADRID, July 19.-United States financial story of interwoven subsidiaries Ambassador Claude G. Bowers expects today was offered the State Senate to confer tomorrow with Manuel Azana, Committee that already has heard how officers, stockholders and directors of Spanish premier and war minister, the Guardian Trust Co. withdrew $2,about the case of five Americans who 180,493 in the 10 days before the bank have been held in jail in Palma, Malclosed in February. The Guardian, third largest of Clevelorca, more than a month, and a setland's banks until its failure five months tlement is expected. ago, had 26 subsidiaries. Attorney ArNo formal charges have been made, thur A. Miller alleges some became little more than waste basket enterprises but officials explained the caes is one into which the bank's losses could be for the military department, since the thrown. civil guard the Americans allegedly atDefends Borrowing. tacked in a cafe is a member of the Meanwhile, E. R. Fancher, governor of the Cleveland Federal Reserve Bank, military organization. commented briefly on the startling disBowers advised the Spanish foreign closure yesterday that he and George minister that unless the Americans De Camp, a former chairman of the Federal Reserve Bank Board, borrowed were tried or released on bail the case money from the bank. might result in unpleasant publicity. "I see no reason," he said, "why I Those held are Mr. and Mrs. Clinton should not borrow money from a bank just as any one else might. I think the B. Lockwood of West Springfield, Mass.; only statement necessary from me is Rutherford Fullerton of Columbus, that I did make the loan and that I did Ohio: Roderick F. Mead of New York pay it in full." and Edmund W. Blodgett of Stamford, He laughed, but made no comment, Conn. when told the card on which the bank (The State Department in Washingkept a record of his loan bore a notaton ordered Claude Dawson, American tion by A. B. Cook, former Guardian vice president, saying: "Because of Mr. consul general at Barcelona, to go to Palma immediately to help the AmeriFancher's position with the Federal Reserve Bank we cannot press for paycans. Dawson on a previous trip was ment." unable to induce Spanish authorities to De Camp could not be reached for bring them to trial. Bowers also has comment. He still owes $29,000 on loans made representations before in the case. dating back to 1930. (Acting Secretary of State Phillips for the second time yesterday asked $663,410 Withdrawn. Ambassador Cardenas of Spain for A. H. Ganger, an accountant, testiprompt action in the case. Mr. Phillips fied that $663,410 were withdrawn by J. expressed deep concern and the AmArthur House, the bank's president, or bassador said he would advise his govby agencies in which he was president ernment of the American Government's between January 1 and February 25. attitude.) Irving Silbert, another accountant, Feeling. meanwhile, ran high in some testified Thomas E. Monka, a vice presquarters because of a magazine article ident. had a balance of more than $12,written by Theodor Pratt, an American, 000 on January 15 but when the deposits who came from Pollensa yesterday to were frozen on February 25 had but Palma guarded by an official escort. $439.41. Two accounts by H. P. McInSeveral cafe brawls have occurred. tosh, sr., former chairman, fell from $14,011 in 1932 to $523.19 on FebruINCIDENT IS THIRD CLASH. ary 27.

13.

July 19, 1933

St. Joseph News-Press

St. Joseph, MO

Click image to open full size in new tab

Article Text

RUN ON

Guardian Trust of Cleveland "Raided" by Officers.

More Than $2,000,000 Withdrawn Before Firm Closed, Inquiry

$2,000,000 the Guardian Trust Company by the and stockholders short time before closed, the state special banking told This presented by Ganger, an vestigation, the heels statement Irving Silbert, countant. that bank loaned money and one high official the Cleveland Federal Reserve Silbert Fancher, govFederal Reserve Bank, and George Decamp, former chairfrom the Guardian. Fancher's made jointly with director the Guardian. amounted loans time totaled $40,000. the witness said.

14.

July 23, 1933

The Plain Dealer

Cleveland, OH

Click image to open full size in new tab

Article Text

ASSERTS BANKER SAID, 'NO DANGER'

Fraser Deposition Tells of Officer's Assurance Before Closing.

(Continued From First Page) in taking second deposition from who wanted to volunteer some additional information Fraser is working in New York. At the conclusion of his first deposition he said:

"Nothing to Conceal." "I haven't thing to conceal All did to lose Add that was to your statement My wife has on deposit in the Guardian Trust Co. than She deposited money which gave her on Satur day the last day the bank open $150 am entirely broke and am considering hankruptcy as relief from my owe the dian Trust Co. some money have given them everything have, inmy interest in the cluding my life pension stock that purchased in the Guardian at present cannot pay no motive myself one of those who have punished Fraser testified that he made the first deposition at request because his had been brought into the hearings before the Senate regarding the banking transaction in which by the sinking resenting the of Cleveland to the fund city Irving Trust Co. of New York- had been included in the bank's deposits for Sept. 30. 1932. as check in process collection, for the purpose of bolstering the deposits Fraser testified by deposition that he knew nothing whatever of this transaction and that he did not be lieve such transaction could have taken place. Names Vice President that amount was as an official check outstand when in there was no ing official check and sequently included the total deposits of that date. who would be responsible for that change? vice president in charge of the bank. ing Would anyone else have thority to order that? would all go through Mr Purdon Q -Could the orders come from somebody higher up. anybody higher than Mr. Purdon? House Robinson That would go Mr. Purdon of those three men no one in the bank would have the thority order those changes made? Right Fraser volunteered the information that at one time 1932 he asked the city of Cleveland for sinking fund payment of about 000.000 or days ahead of time Why did you want it ahead of time? Because we wanted to make good showing Q-On your statement? Fraser said the city was paid in. terest the few extra days the bank had the money last week the tellers and employes were telling that It was perfectly safe to deposit funds the Guardian Trust Co.? and told you to tell the that? House and Mr. Robinson direction House and Robinson How they indicate to you that they wanted that my case asked there any danger in that sponsible for a large amount of de. posits mentioned one particular case said man has deposit here. He thinks he on ought to draw of it. been telling him there is no danger Am in continuing him He ly there is no danger Fraser said this conversation took 24. The last day the place was open unrestricted basis was Fraser testified that for number years the loans passed through his for the purpose of ing the collateral and paying out the after they had been approved by House

House Passed on All Loans. there be some notation House on all of those that passed through? Every Fraser asked about a deal in which the Headland Lumber Co. borrowed approximately from the bank and the Cleveland Storage Co. got the contract for stor lumber owned the lumber ing He testified that Frank company Roehl, president of the storage com was the of House's stepson. The was made the lumber company on the of warehouse receipts for the lumber which the collateral security Fraser was discovered that somebody had falsified the record and they did not have as much lumber as the receipts stated they had? think that is the case Do whether you would be party that am he was think Frank Roehl would be think he was party guilty of respect? not seeing that the lumber there before he issued the waredo you also think he guilty of in trying to get the business? think Q-In other was pretty darn anxious to that business which would amount to large profit for him? would say that is fair.

Got Business After the Loan rate he did not get the any storage until after the loan made? of course not. But don't think that he originated the idea the Guardian making the loan and him putting it in storage. I think the do you mean by the verse? think the Guardian originated the loan. Then to be secured put this in charge of the just Cleveland Storage That is the went That is what think other words, they throwing toward the Cleve land Storage Co. they had to throw It to somebody don't think should be inferred that the Guardian did any. thing except attempt in this case the loan they made by being sure that the lumber was in storage Fraser testified that H P. McIn vice of the bank tosh, interested the Co. which made some appraisals for the bank, including the Hotel Hollenden

Fraser said he suspected McIntosh was "heavily interested' the company "because hanging around his office and ways Harry Robinson's office Fraser also said he thought House interested in the company Life insurance policies were writ. ten some the large and these policies went to favored because they favored the agents think Q did they favor the Guard Trust Co.? directing life trusts to the trust department Fraser was asked whether Monks ever talked him about his the Ohio directly, just by inferFraser said Monks' expenses when lobbying were paid by the Ohio Bankers know Senator W. A you know Q he have any connection with much Q-What do mean, he was very they called each other by their first they associated in any business deal together? that know of you know about that DeYou know Tom Monks in that company sounds very familiar know owes the bank considerable money? A.-Not that -Under what name does it owe

Holding Co. -That is Tom Monks company?

Bonus Funds Secret.

Fraser testified regarding the bonus funds paid by the bank He said the executive committee voted a lump sum Christmas present and no one knew who got it except House Why did you think it was kept secret? was House's way of getting Q-His what? A.-His big end Q-His big end of what? A.-His big end of that money. about Robinson Didn't he help run the bank? ball with is that not only played ball but some extent dominated him. what extent? more learned man than learned in what? A.-More learned in do mean by that? the use of quibbling about my opinion of him? don' like Q don't you like him?

Interested in Hollenden

-Because thought his judg ment was rotten and had seen so many things he was interested go wrong What were some of the things Robinson was interested in? Hollenden was his proposition -Did he make profit personally? A.-I don't think Fraser asked describe the method by which the State Banking Department made an examination of the bank He said the bank examiners were interested principally in seeing that the listed for loans in the of the bank and that was seldom any effort was to appraise the collateral

15.

July 27, 1933

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

State Senate's Bank Investigating Committee, but later his voice broke and tears came to his face. Loans Amply Secured. He insisted his salary and those of other high officials were set by the bank's Executive Committee, bearing in mind the institution's many prosperous years. His salary was raised to $90,000 in 1928, he said, but in 1932 he took a cut of more than 50 per cent. Likewise he maintained . that large loans made to him were amply secured and that the collateral he gave eventually would fully cover them. Tracing the decline in Guardian deposits from the end of December, 1930, of $157,000,000 to $81,000,000 on February 27-the day it limited withdrawals to 1 per cent-he listed a number of causes. Among them, he said, were the difficulties of other banks in Northern Ohio and the need for finances by large Cleveland industries, finally reaching a climax with the Michigan banking holiday. White Declined to Act. Gov. George White, he said, was urged to declare a similar banking

16.

July 30, 1933

The Plain Dealer

Cleveland, OH

Click image to open full size in new tab

Article Text

DEPOSITORS SLOW OCLAIM CHECKS

Only 6,036 Go to Banks in Full Day; Half of Dividends Unpaid.

Union and Guardian Trust The continued to pay off Cos. yesterday larger depositors as they gave to 6,036 persons, the out smallest which has appeared since the began. total at the of The payment business including the mailed out ago smaller whose balances than is half the which to be Of this 30,611 larger deposithe Union received tors and larger depositors the Guardian have received 802.

It was learned yesterday that the State Banking Department audit made five weeks before the Union on restricted basis last February pronounced the bank After this audit was approximately in in runs on the The chief significance of this was hope that Union to sufficient to provide assets several liquidating dividends after the loans made to by the Finance Corp. have been paid off and its assets are released. Ira J. Fulton, state superintendent banks, said yesterday that while he did not have the exact figures, the average paid out by liquidated banks of the larger class Ohio had been above 50 per cent. Fulton pointed out, however, that the solvency of the Union early in the year did not mean that it would necessarily pay 100 per cent., even in rising markets. bank goes into liquidaFulton said, assets are immediately depreciated consideraOne example of such depreciais the lessened value of ing houses and other bank property."

Probe Union Tomorrow.

Edward investigator for the Ohio Senate special bank investigating which last completed its hearings on the causes start his work the Union Trust tomorrow Falkenstein said he did not plan take assistants in with him but wanted to learn how the Union was set up. After he has made himself familiar with the general scheme of the he probably have accountants to aid gathering material Arthur attorney, who headed the Cuyahoga County Bar Association investigation into the Guardian, announced that the Cuyahoga Bar committee, aided by ac. and large group law. yers would begin immediately the drafting of new banking code for Ohio, which it expects to present to the Legislature. Miller also said he at to set forth additional facts concerning the Guardian be placed in the Senate committee record, which he will probably some rebuttal material with planations given the witness stand Arthur House former Guardian president. and Harry C. Robinson. former senior vice president of the bank.

17.

August 4, 1933

The Cleveland Press

Cleveland, OH

Click image to open full size in new tab

Article Text

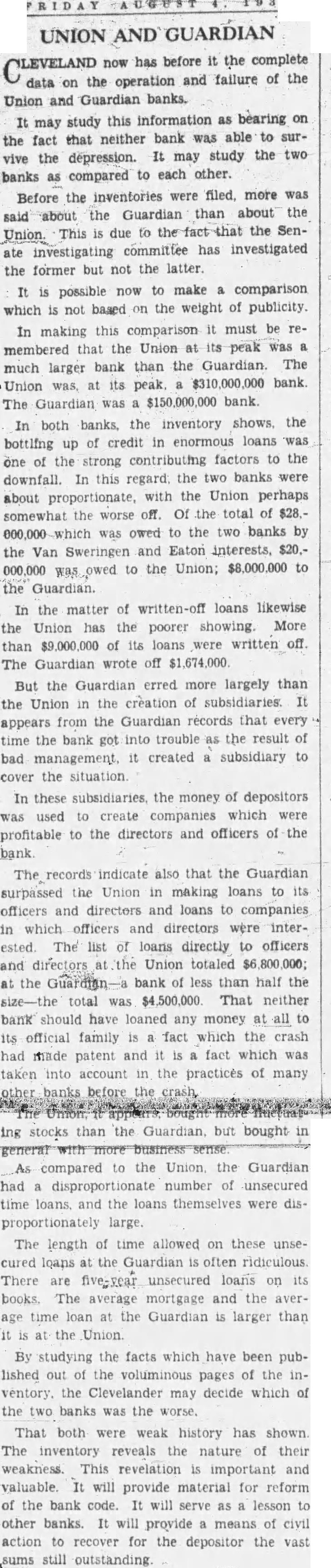

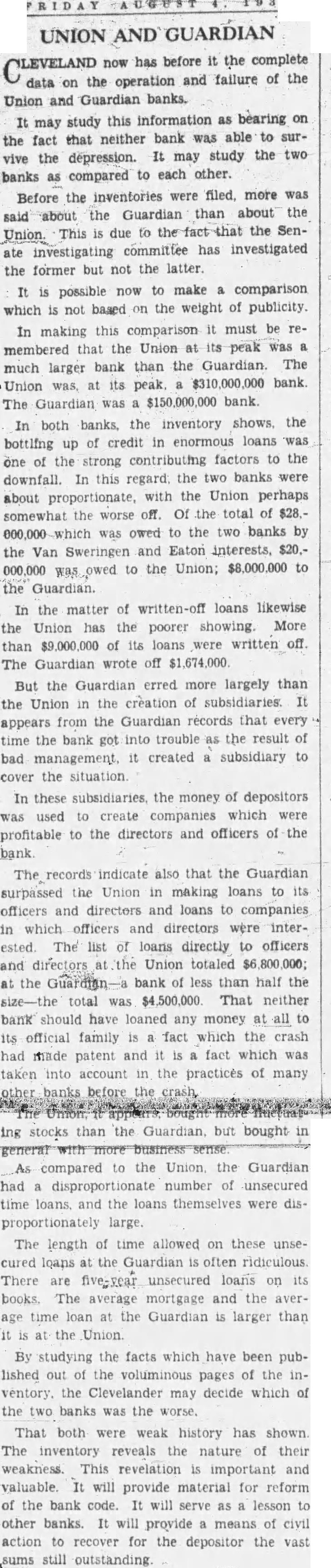

UNION AND GUARDIAN now has before the complete and failure of the on the operation Union and Guardian banks. may study this information as bearing on the fact that neither bank was able to surmay study the two vive the depression. banks compared to each other.

Before the inventories were filed. more was the Guardian than about the that the SenUnion. This committee has investigated ate investigating the former but not the latter. possible now to make comparison which not based the weight of publicity.

In making this comparison must be membered that the Union peak was much larger bank than the Guardian The Union peak. $310,000,000 bank The Guardian $150,000,000 bank In both banks the inventory shows. the bottling up of credit enormous loans was one the strong factors to the downfall. this regard the two banks were about proportionate, with the Union perhaps somewhat the worse off. Of the total was owed the two banks the Van and Eaton $20.000,000 was owed to the Union; $8,000,000 to the Guardian.

In the matter of written-off loans likewise the Union has the poorer showing More than $9,000,000 of loans written off The Guardian wrote off $1,674,000 But the erred largely than the Union the creation of subsidiaries. appears from the Guardian that every bank got into trouble the result of bad management. created subsidiary to cover the situation

In these subsidiaries, the money of depositors used create companies which profitable to the directors and officers of the bank

The records indicate also that the Guardian Union loans to its officers and directors and loans to companies in which officers directors were interested The list loans directly to officers directors Union totaled the bank less than half the total $4,500,000. That neither bank should have loaned any money all to official family fact which the crash made patent and fact which was account the practices of many compared the Union the Guardian had disproportionate number unsecured loans the loans themselves were disproportionately large.

The length of time allowed these unsecured the There five-year unsecured loans books. The average mortgage and the average the Guardian larger than the Union

By studying the facts which have been published out the voluminous pages the ventory the Clevelander may decide which the two banks was the

That both were history has shown inventory reveals nature their weakness This revelation important valuable will provide material for reform of the bank will serve lesson to other banks will provide of civil action recover for the depositor the vast still outstanding

18.

August 15, 1933

The Plain Dealer

Cleveland, OH

Click image to open full size in new tab

Article Text

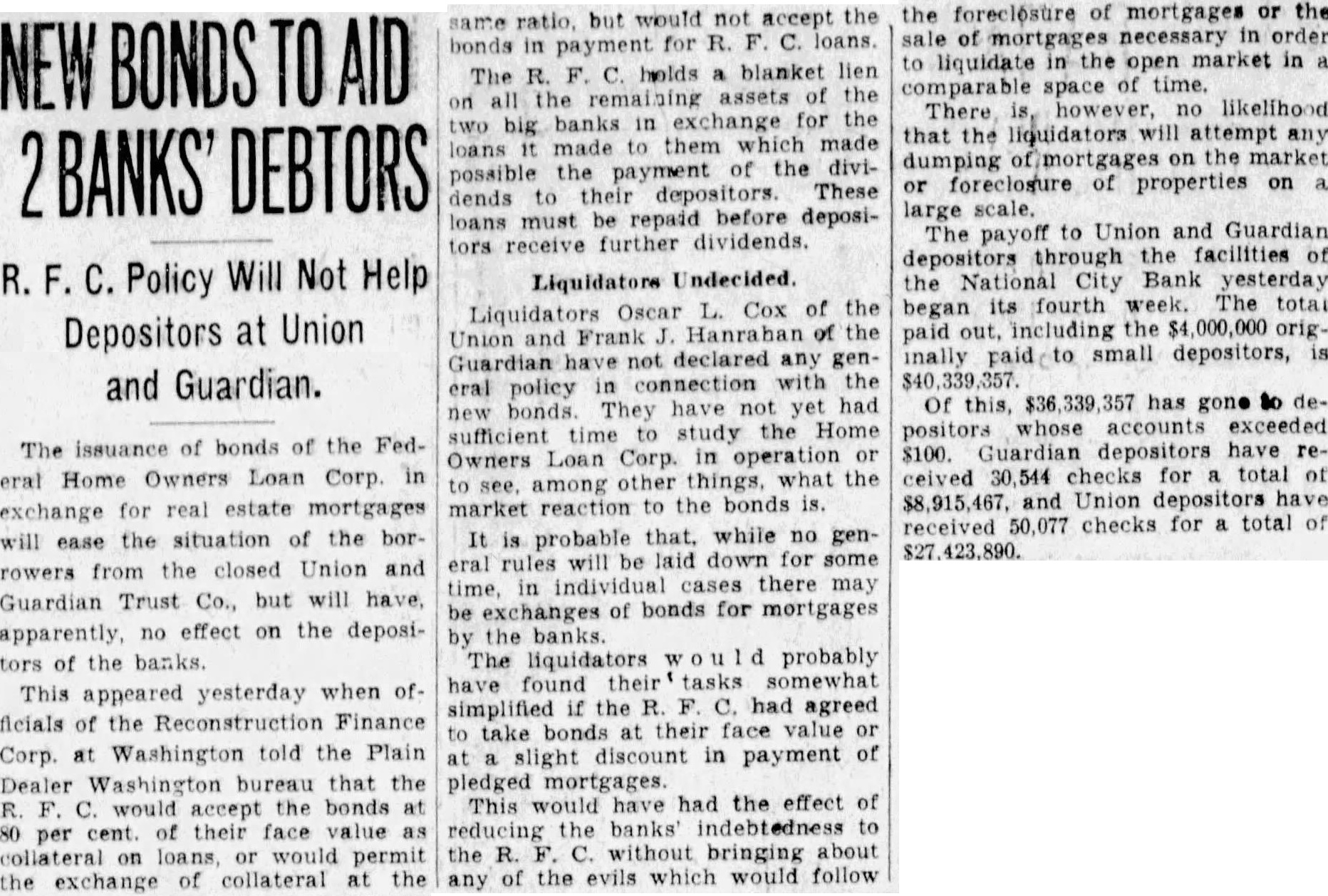

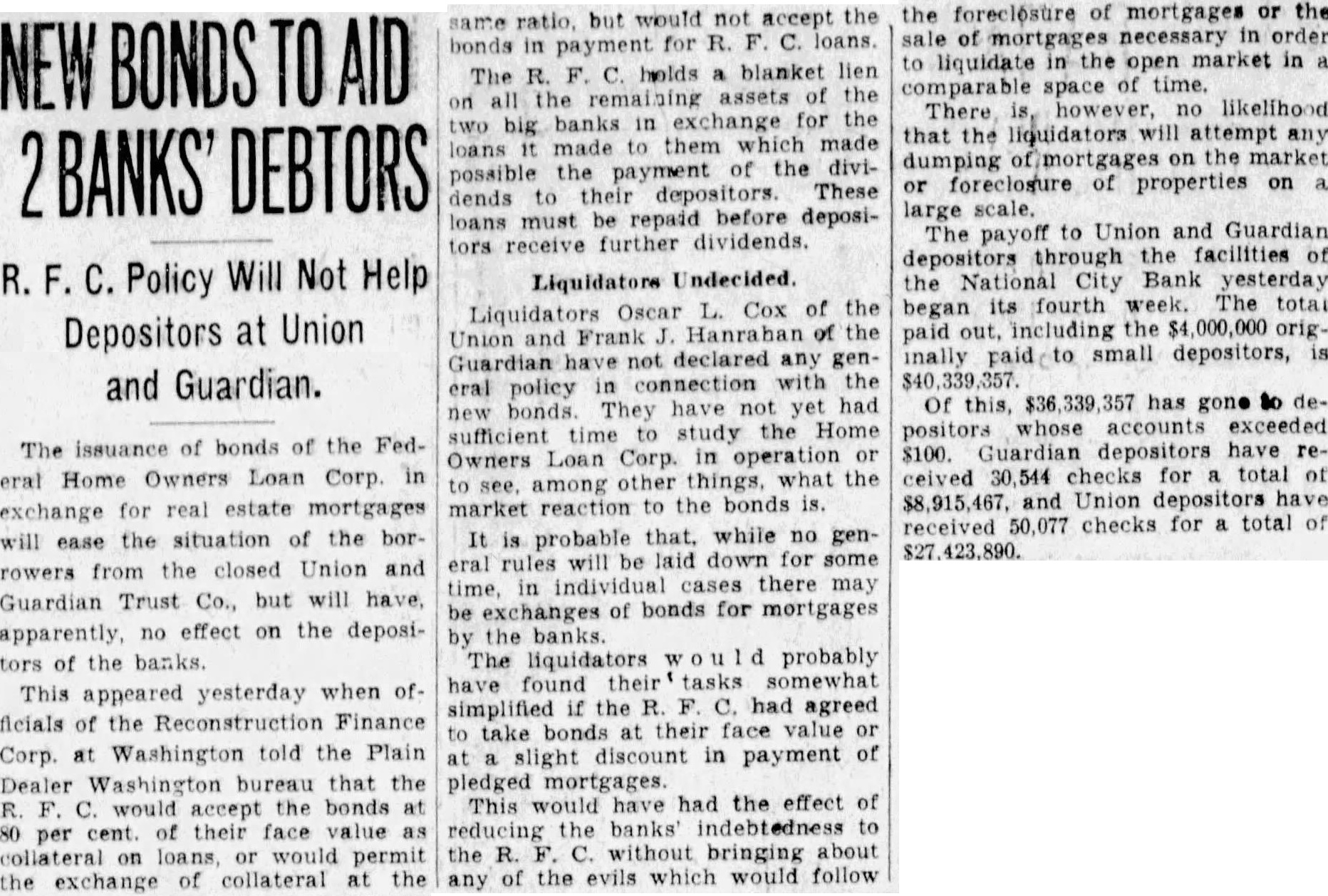

NEW BONDS TO AID 2 BANKS' DEBTORS

R. F. C. Policy Will Not Help Depositors at Union and Guardian.

The issuance of bonds of the Federal Home Owners Loan Corp. in exchange for real estate mortgages will the situation of the borrowers from the closed Union and Guardian Trust Co., but will have apparently. no effect on the depositors the banks This appeared yesterday when officials of the Reconstruction Finance Corp. at Washington told the Plain Dealer Washington bureau that the R. F. would accept the bonds at 80 per cent their face value as collateral on loans, would permit the exchange of collateral at the same ratio, but would not accept the bonds in payment for R. F. C. loans The R. F. C. holds blanket lien on all the remaining assets of the two big banks in exchange for the loans it made to them which made possible the payment of the dividends to their depositors These loans must be repaid before depositors receive further dividends

Liquidators Undecided

Liquidators Oscar L. Cox of the Union and Hanraban of the Guardian have not declared any general policy in connection with the new bonds. They have not yet had sufficient time to study the Home Owners Loan Corp. in operation or see. among other things, what the market reaction to the bonds is. It is probable that, while no general rules be laid down for some time, in individual cases there may be exchanges of bonds for mortgages by the banks The liquidators probably have found their tasks somewhat simplified if the F. C. had agreed to take bonds at their face or at slight discount in payment of pledged mortgages This would have had the effect of reducing the banks' indebtedness to the R. without bringing about any of the evils which would follow the foreclosure of mortgages or the sale of mortgages necessary in order to liquidate in the open market in comparable space of time. There however likelihood that the liquidators will attempt any dumping of mortgages on the market or foreclosure of properties on a large scale. The payoff to Union and Guardian depositors through the facilities of the National City Bank yesterday began its fourth week. The total paid out including the $4 000,000 originally paid to small depositors, is Of this, has gone to depositors whose accounts exceeded $100. Guardian depositors have received 30,544 checks for total of $8,915,467, and Union depositors have received 50,077 checks for total of $27,423,890.

19.

August 23, 1933

Pittsburgh Sun-Telegraph

Pittsburgh, PA

Click image to open full size in new tab

Article Text

Cleveland Bank Face Probe Closings

CLEVELAND United States District Attorney Emerich today nounced an investigation of the closed Union Trust Company and Guardian Trust Company would soon United States Department of

20.

November 8, 1933

The Cincinnati Enquirer

Cincinnati, OH

Click image to open full size in new tab

Article Text

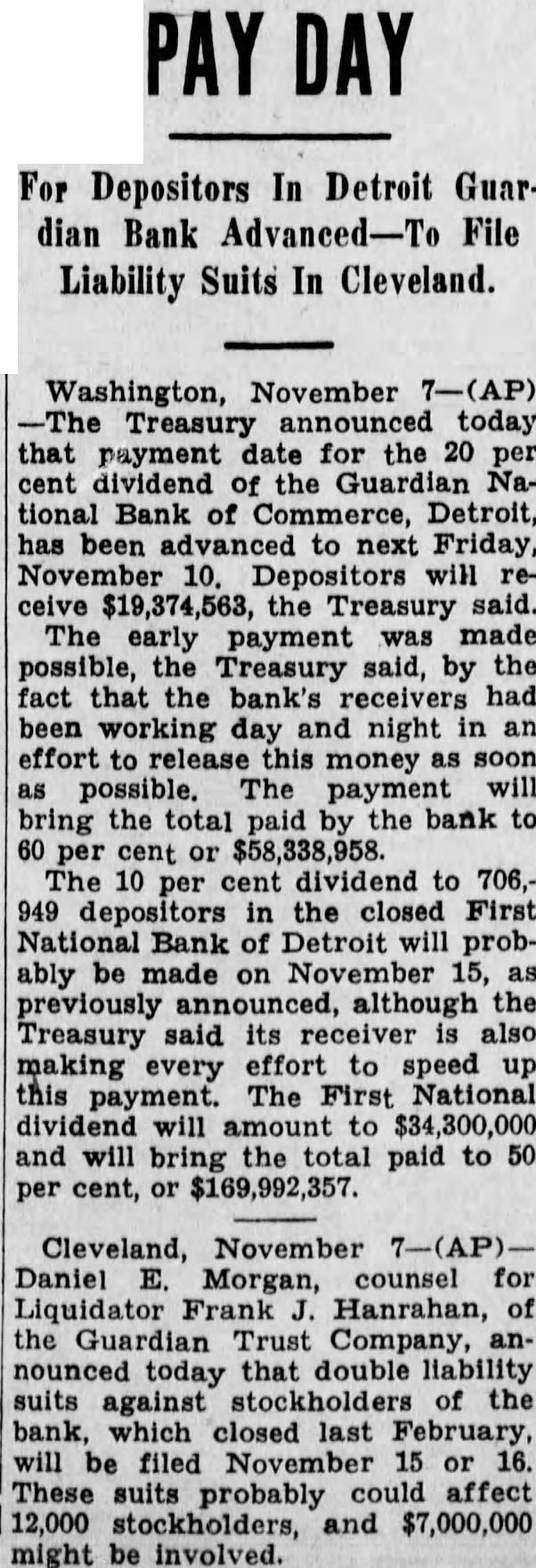

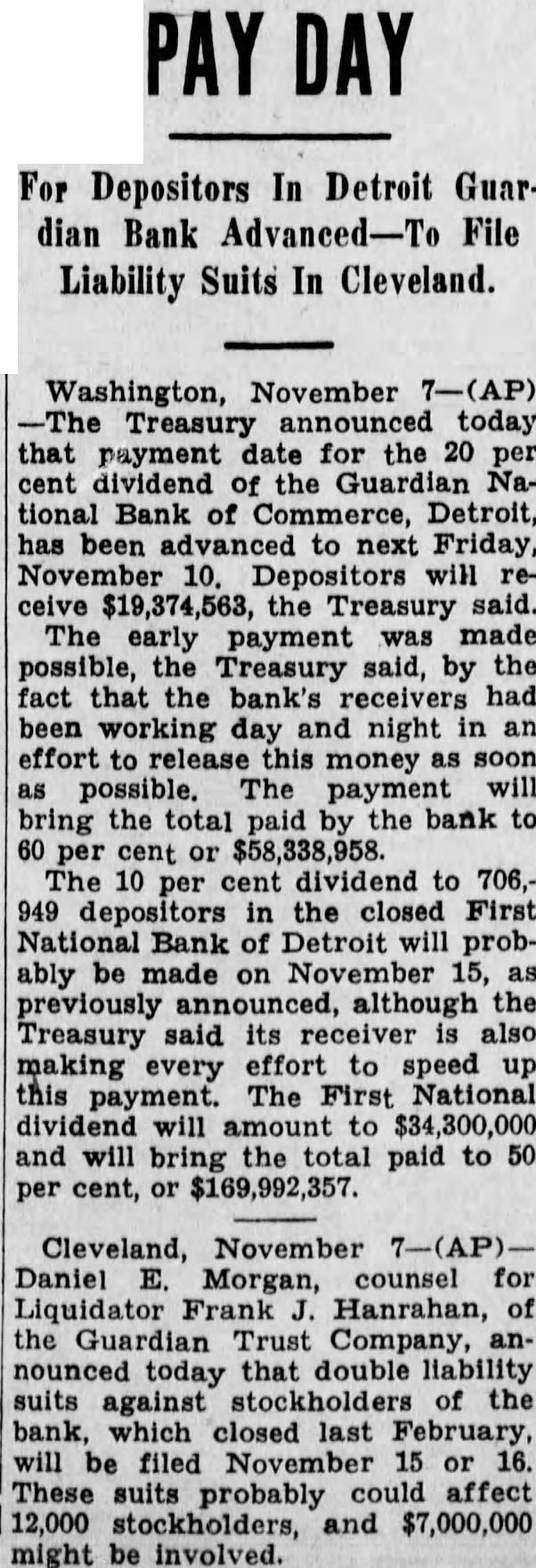

PAY

For Depositors In Detroit Guardian Bank Advanced-To File Liability Suits In Cleveland.

Washington, November 7-(AP) Treasury announced today that payment date for the 20 cent dividend of the Guardian National Bank of Commerce, Detroit, has been advanced to next Friday, November Depositors will receive $19,374,563, the Treasury said. The early payment was made possible, the Treasury said, by the fact that the bank's receivers had been working day and night in an effort release this money soon possible. The will payment bring the total paid the bank to or $58,338,958. The per cent dividend to 706,949 the closed First National Bank of Detroit will probably be made on November 15, previously although the Treasury said its receiver also making every effort to speed up this payment. The First National dividend will amount to $34,300,000 and will bring the total paid to 50 per cent, or $169,992,357.

Cleveland, November 7-(AP)Daniel Morgan, counsel for Liquidator Frank Hanrahan, of the Guardian Trust Company, announced today that double liability suits against stockholders of the bank, which closed last February will be filed November 16. These suits probably could affect 12,000 stockholders, and $7,000,000 might be involved.

21.

November 14, 1933

The Cincinnati Enquirer

Cincinnati, OH

Click image to open full size in new tab

Article Text

BANK RELIEF IS PLANNED.

C. State Manager To Make Survey Of Frozen Loans.

Cleveland, November Henry Brunner, State Manager Home Owners' Loan Association, today took steps toward helphome ownbanks with frozen assets and depositors whose funds have tied up many months. Brunner announced that survey on homes held by closed and restricted banks, including the Union and Guardian banks Cleveland, would immediately view having the trade them for bonds the relief Build. and loan associations also will Those bonds, in turn, would be turned the Finance for fresh cash loans per cent of the value the bonds permit the banks portion the money they $182,000,000 been fixed the figure now held financial the state in the Much of the mortgage collateral held by Ohio banks in Washington already, held as security for loans. Columbus, Brunner said that bonds ought not dumped any time, this would defeat the whole the movement.

22.

March 20, 1934

The Cincinnati Enquirer

Cincinnati, OH

Click image to open full size in new tab

Article Text

C. CARR APPOINTED

Counsel To Liquidator Of Guardian-D. E. Morgan Resigns.

Ohio, March resignation Daniel Mor. special counsel the liquidator of the Trust Cleveland, and appointment Charles Carr his announced today by John Bricker Carr representing the bank liquida affairs the last two and He looking and Akron situation became acute was that where has Morgan, letter resigna "Owing the fact that shall unable the position under importance hereby Morgan is be can the tion for the belief that this resign.

23.

May 10, 1934

St. Joseph Gazette

St. Joseph, MO

Click image to open full size in new tab

Article Text

SIX INDICTED AT CLEVELAND

Joseph R. Nutt Among Those Accused in Collapse of Two Banks.

Joseph R. Nutt. former trea .irer of may the Republican national committee, four other bankers and former county official were med by federal grand jury today in indictments year's investigation of the collapse of two large Cleveland banks. The indictments accuse Nutt and the others of making false financial statements and using the mails to promote schemes of fraud. They are based on alleged "windowdressing' of statements of the condition of the Union Trust Company and the Guardian Trust Company in liquidation. Two indictments nai ing Nutt: former board chairman, and Wilbur M. Baldwin, former president of the Union. involve the sale and resale of $10,000,000 in Liberty Fonds owned by the Van Sweringen Corporation and placed with J. P. Morgan & Co. for safe keeping. J. Arthur House. to mer president, and A. R. Fraser and Harry C. Robinson, former vice-presidents. of the Guardian, were indicted along with Alex Bernstein, former county treasurer on charge: arising from an alleged $2,000,000 "windew dressing' of the Guardian bank with county funds. Robinson. alone of the six, was not charged with making lae fi. nancial statement, u. was named in five counts of using the mails to East defraud. None would ke imme10 diate comment. Pleas of not guilty were entered for Nutt and Baldwin in federal court this afternoon. They were released under $5,000 bond each. Emerich B. Freed United States district attorney, said that the grand jury will reconvene within a month to pursue further its investigation of the affairs of both banks

24.

September 6, 1934

The Plain Dealer

Cleveland, OH

Click image to open full size in new tab

Article Text

Berea's Banks Again Open for Business

Berea's two banks reopened for business yesterday, but there was no rush to claim the 350,000 which the openings made available to residents of the Cleveland suburb. Instead, the banks picked up the course of normal business interrupted by the bank panic of February, 1933, with the added protection of federal deposit insurance. W. H. Ames, president of the Commercial & Savings Bank, reported that his institution opened with $740,000 of deposit accounts distributed among 3,500 individuals and firms and that the day's total withdrawals only $11,078. against deposits of 120-a net increase of for the day. Of the depositors of $100 and less who received 100 per cent. of their deposits in the form of credits at the revived bank. only 51 withdrew their cash, while 39 other depositors drew all portion of the 60 per cent. made available to them. The Bank of Berea Co., with 4,800 deposit accounts, aggregating $1,032,945 paid out $16,012 to 78 depositors on withdrawals and received in new deposits total of $13,015.

Of the withdrawals 41 were by depositors of $50 and under whose accounts were paid in full. Both bank presidents said things had been resumed "as if nothing had ever happened to interrupt the normal Klossner, assistant chief examiner of the Reconstruction Finance Corp., had returned to Washington yesterday after conferences with liquidators of the Guardian Trust Co. and Union Trust Co. concerning the detailed arrangements for reappraisal of their assets.