Click image to open full size in new tab

Article Text

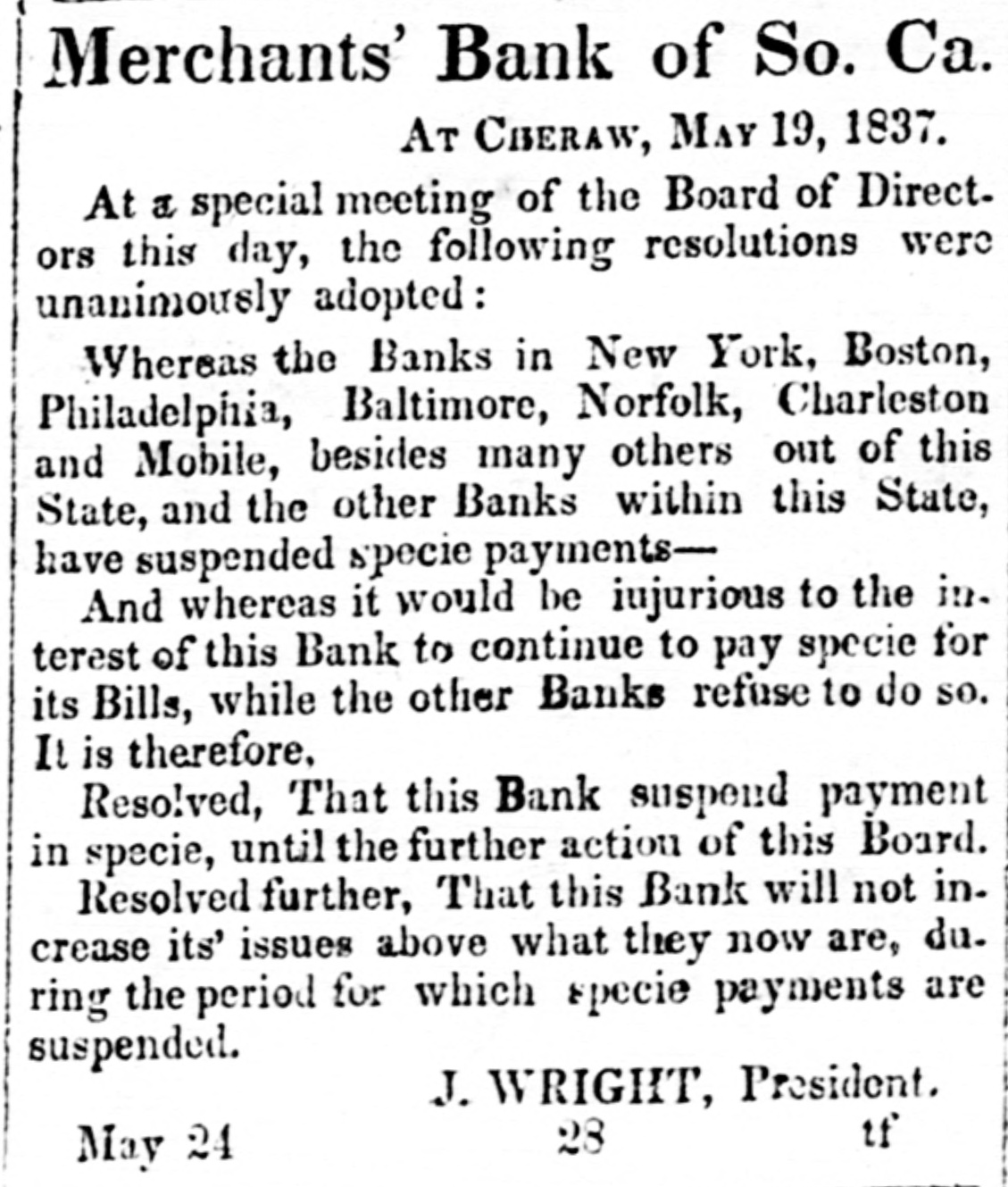

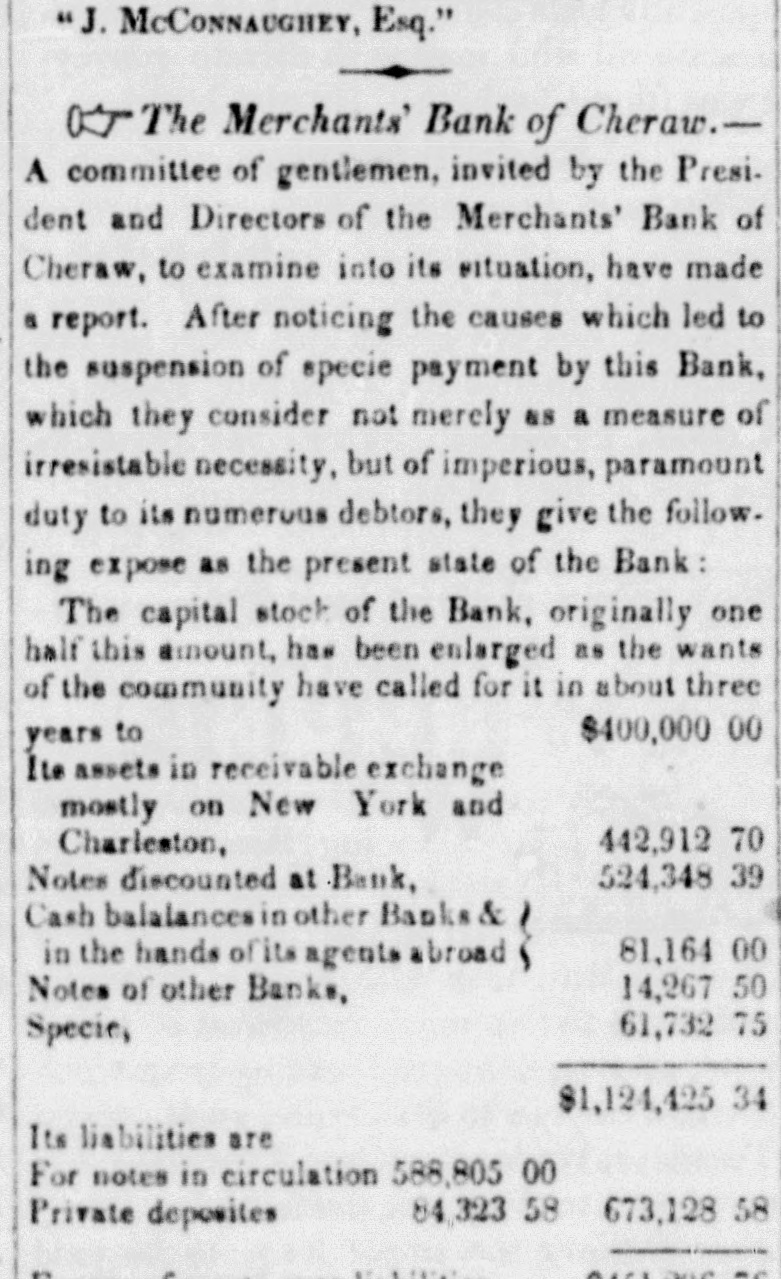

MERCHANTS BANK OF CHERAW. TO THE PRESIDENT AND DIRECTORS OF THE MERCHANTS BANK OF SOUTH CAROLINA AT CHERAW The unders gened having been invited, by a vote of your Board, to meet at your place of business, and examine into the of your our on the liabilities tion opinions under and thereon, general management, especially standing and the to resources, express Institu- recent to the for notes determination circulation, present, specie of take your payments Board, suspend, your for in occasion to offer you very briefly, our viewson this subject. We express no opiniou on the wisdom or folly first measure, as severe distress is of this those in which relief, counsels this from whole which the country adopted pecuniary involved this -on question men will differ, as their reason or their politics may dictate. It is sufficiently obvious, what must have been its effect on first has a to been resort your question to Institution it. But for gentlemen, your had you deliberation, been it never the whether a suspension of specie payment for bank notes was the whole, a discreet or a rash policy-whither this would afford adequate relief to the disease of the times, or whether its result would not prove more disastrous to the monetary system of the country, than the evil it was intended to counteractthese questions you found already decided at your hands-and decided by those tribunals to whose authority you were compelled to submit-or to pay off your liabilities and close your business. New York, from her favorable position, commercial advantages, and extraordinary facilities, in the command of means possesses as it is well known, a controling influence over the industry and as well as over the money concerns of this country.She is the Importer of all foreign articles of we or article ters consumption of make, foreign usedir payment the domestic south-at for almost manufacture her every counused in our country-and at her counters, we receive the money for our Cotton, Rice, and Tobacco, itsstaple products-in whatever material she pays we can pay and in no other. The banks of this city first adopted the suspension of specie payments as a measure of relief from'their pecunery embarrasments, which was succeeded almost immediately, though in some instances with reluctance, by the banks of Boston, Philadelphia, Baltimore, Norfolk, Charleston, Mobile, and, in due time, by every other Th se were you ed to your bank facts resolution, in the before State do of likewise. South when you Carolina. Indeed adoptgentlemen we are at a loss to perceive how you could have done otherwise, with a decent regard to your own characters as prudent men, or without a flagrant breach of trust to the stockholders you represent-And it appears to us that the whole South must yield to the same necessity which presses upou you. It requirs little forcast to discern that if any portion of it has not vet adopted this measure it will be compelled to do'so or stop its business. New York refuses to pay us a dollar in coin for our Cotton, mest of which finds its way to her market, and of which she is the purchaser or paymaster. Charleston follows her example, and says to the back country, you must not look to us-but these are he sources from which you have hitherto procured vour metals, and being so cut off. you must look elsewhere. It is very plain you cannot redeem your notes in specie and receive your payments in paper. and it is equally obvious that the only alternative left you is to say to your country debtors pay us in specie for your notes. The laws of the country would compel them to do so, the bank might have required it. and sold their property to have enforced it. Now gentlemen had the bank assumed this possition, the sweeping and hopeless ruin in which it would have involved all its debtors can neither be portrayed or imagined-their lands, their slaves, and every portion of their estates, and would have become the property of the bank at morely nominal prices, leaving them not only pennyless but with balances against them, which in most cases it would have been imposible for them ever to have paid. Under this view of the subject gentlemen we regard the late determination of your Board to suspend for the present specie payments for your notes, not merely as a measure of irresistable necessity but of imperious, paramount duty to your numerous debtors, which as a class, we believe to embrace as much solid capital, industry and thrift, as can be found among the same number of debtors in any bank in any state. Havingshown then, that without regard to the state of its own finances, and not merely, nor mainly to promote its own convenience, the Bank has been compelled by a necessity beyond its control. to suspend the customary payment of its notes,- that this necessity has in this case, ,assumed to higher obligation of imperative duty-that even if it held the most undoubted security for a million of dollars, and owed but one tenth of that sum, this necessity and this duty would have demanded the course it has adopted-it next became a question of our enquiry, is the Public safe? What are the means of the Bank ? How are its funds invested-are they adequate to the discharge of its liabilities and can they be made available. in any other shape, than that of gold and silver bullion to the payment of its debts. And in pursuing this branch of our investigationswe have not rested in the general statement, that more is due to it in dollars & cents than it owes, but we traced its funds to their numerous depositaries and determined for ourselves the safety and security of these depositaries. And we deem it a duty to the immediate officers of the Bank to state here, that they promptly and cheerfully afforded us every desired facility in the conduct of this examination-in the production of books, papers, let-