Article Text

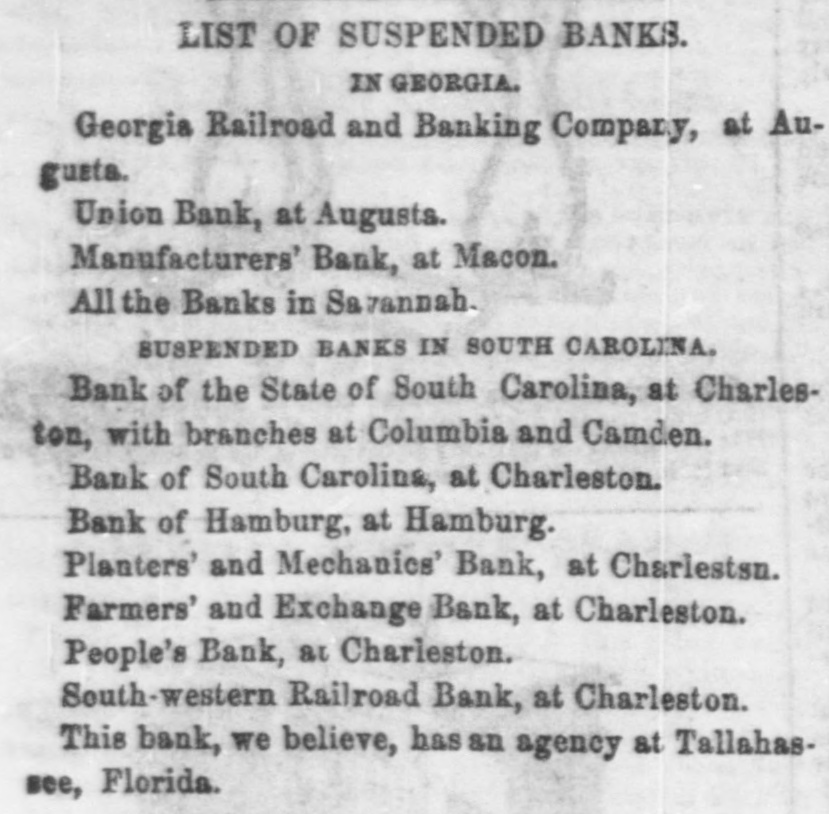

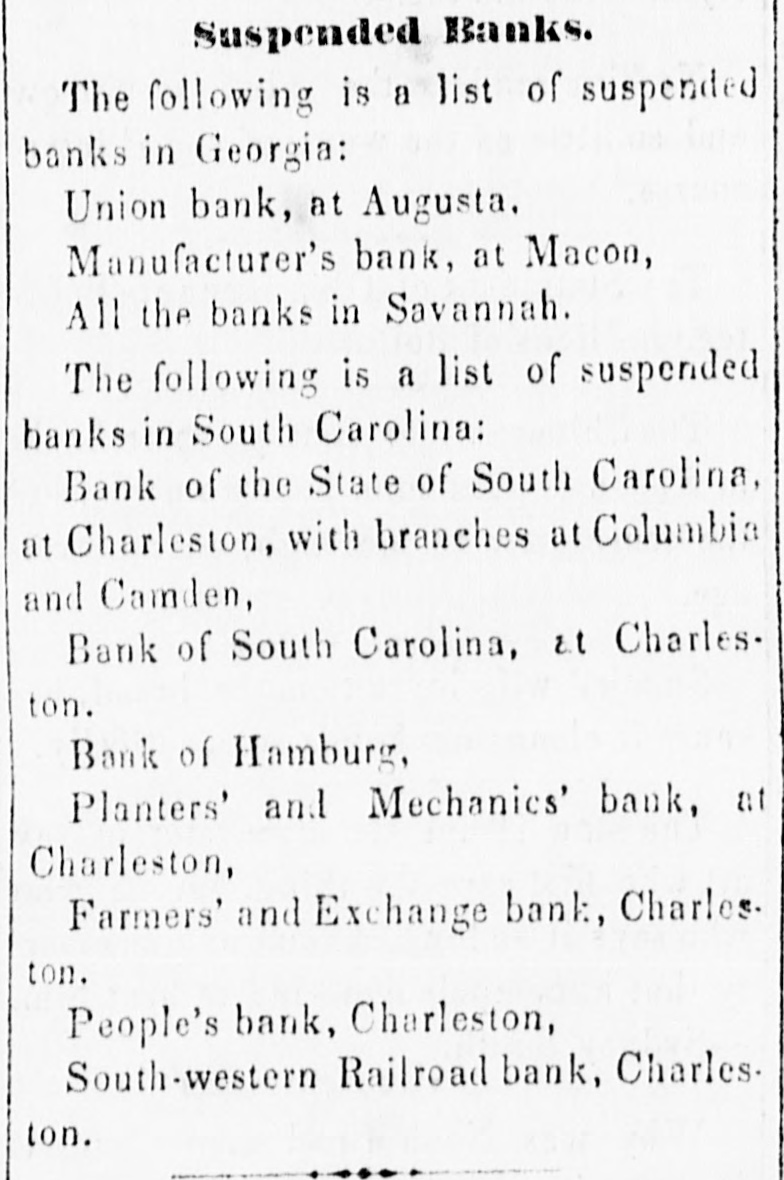

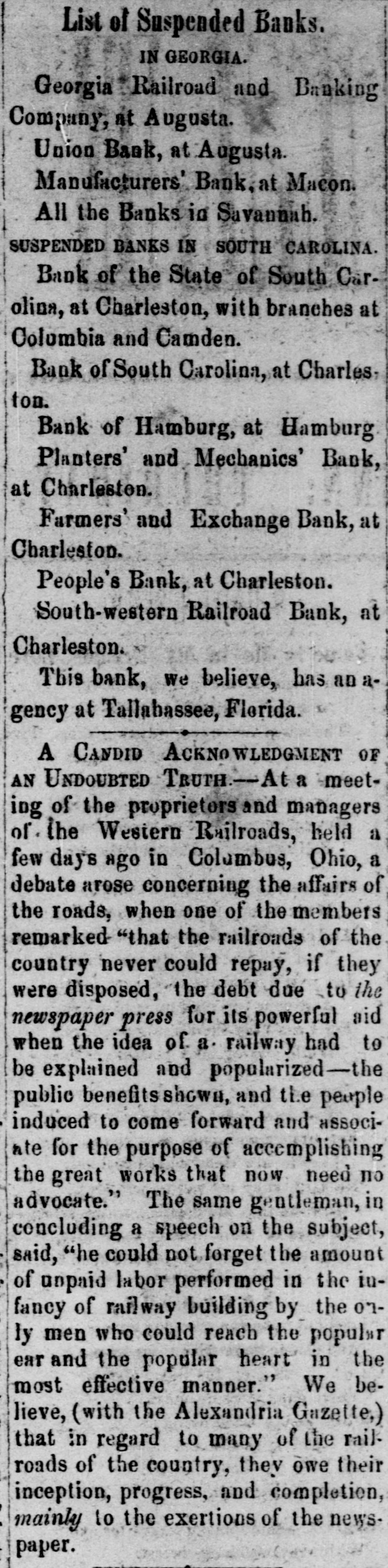

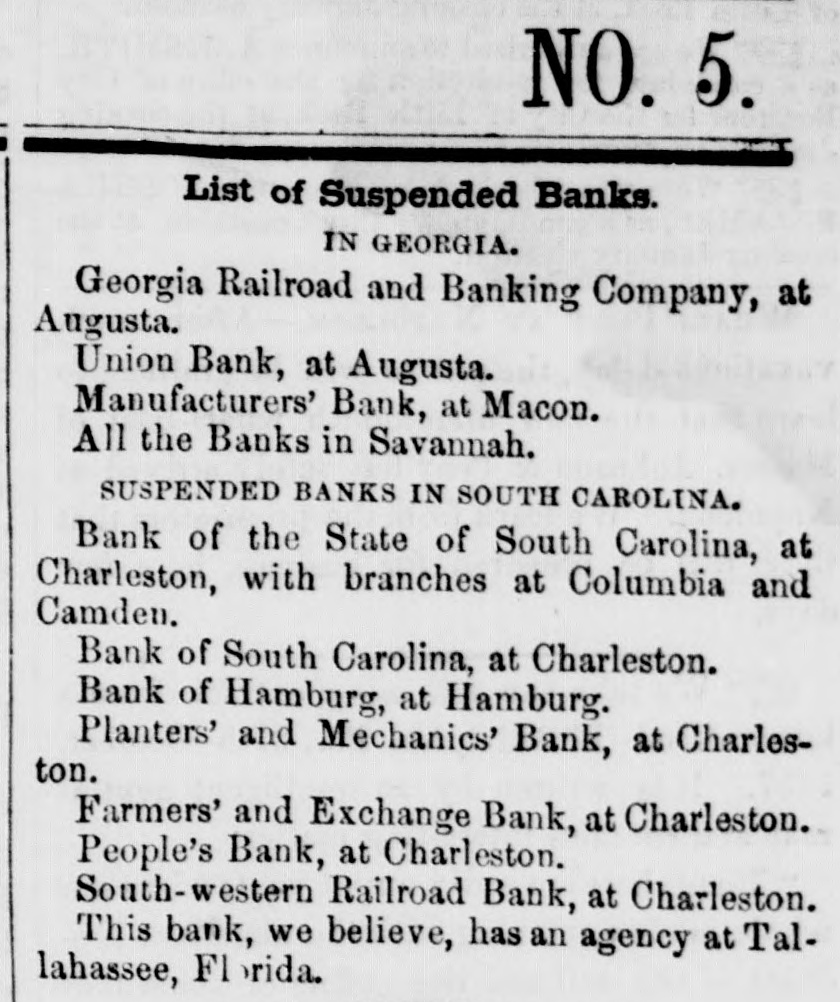

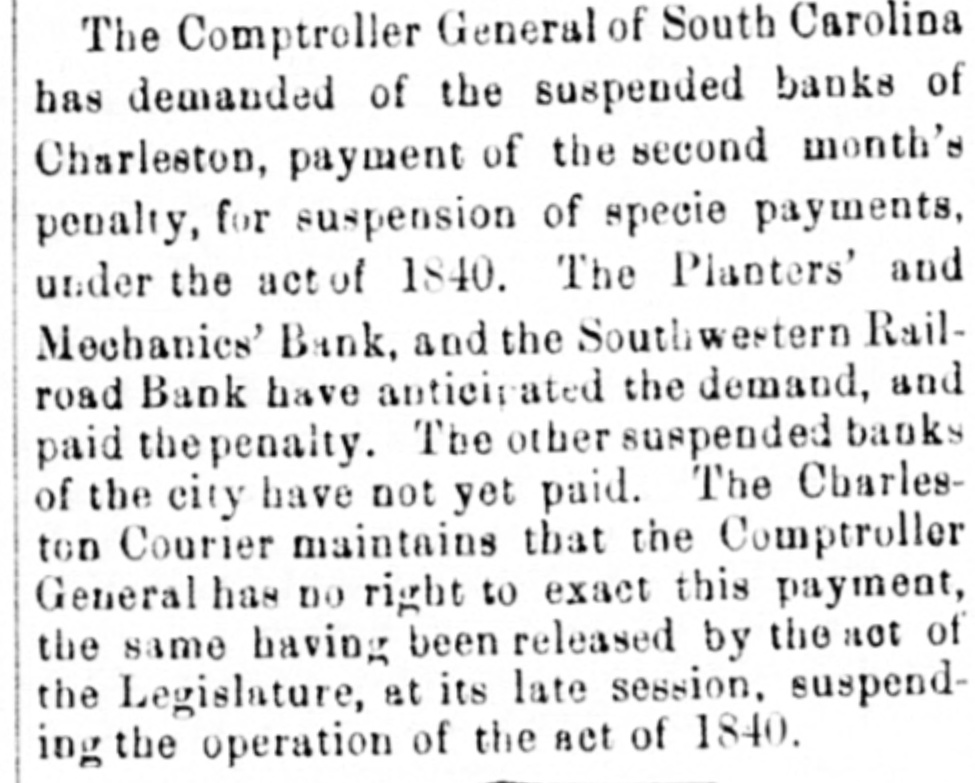

DOMESTIC INTELLIGENCE. Financial. NEW YORK, Oct. 12.-The East River Bank has suspended specie payment. NEW YORK, Oct. 12.-Corning & Co., bankers, suspended on Saturday. They are large stockholders in the Southern Bank of New Orleans. CHICAGO, Oct. 12.-Wadsworth & Co. have suspended. Assets largely exceed liabilities. NEW YORK, Oct. 12.-The Grocers' Bank has suspended. The bank contractions during the past week exceed $5,000,000. The Pratt Bank closed to-day. WASHINGTON. Oct. 12.-The U.S. stocks redeemed at the Treasury to-day amount to $3,000,000. NEW YORK, Oct. 12.-The Bowery Savings Bank has received $607,000. The entire amount redeemed amounts to $3,500,000, leaving $1,000,000 now out. NEW YORK, Oct. 12.-The weekly bank statement shows an increase in specie of $76,000. Decrease of loans $4,180,000. Decrease of circulation $392,000. Decrease in deposits $4,677,000. AUGUSTA, Oct. 12.-The Southwestern Railroad Bank and Bank of South Carolina, at Charleston, both suspended this morning. There is a run on all the other Charleston banks. CLEVELAND, Oct. 12.-The Cuyahoga Steam Furnace Company has assigned. SOUTH-WEST PASS, Oct. 12.-The pilot-boat Cornelia, Capt. Chism, from Boston in sixteen days, (via Key West,) has arrived. British Consul at New York. NEW YORK, Oct. 12.-Ed.N. Archibald is appointed British Consul for this port. Death of G. W. P. Custis. NEW YORK, Oct. 12.-George Washington Parke Custis died at Arlington, Va., yesterday. Kansas News. ST. LOUIS, Oct. 12.-The Leavenworth Herald of the 7th says that large numbers of armed men came from Nebraska and voted the free State ticket. The Democrats claim both branches of the Legislature. Frize Fight. BUFFALO, Oct. 12.-At the prize fight between Lazarus and Hannegan, after one hundred and twenty rounds, occupying two hours and fifty-eight minutes, the stakes were withdrawn, neither conquering. Domestic Markets. CINCINNATI, Oct. 12.-Flour dull and unchanged. Whisky 15c. Wheat 80 to 90c. Oats 30. NEW YORK, Oct. 12.-Cotton is quiet. Flour dull. Wheat firm. Corn and Lard heavy. Mess Pork 22 to 30c. Whisky 20 to 21c. River Intelligence. VICKSBURG, Oct. 12.-The Uncle Sam passed down at 10 A. M., the St. Nicholas and Choctaw at noon, the Powell at 1. Rainbowat 5, Adriatic at 9, and Belfast at 10 P. M. Sunday. VICKSBURG, Oct. 12.-The Jno. Briggs passed down at 10 A. M., and the McRae at 1 o'clock, P. M. S