Click image to open full size in new tab

Article Text

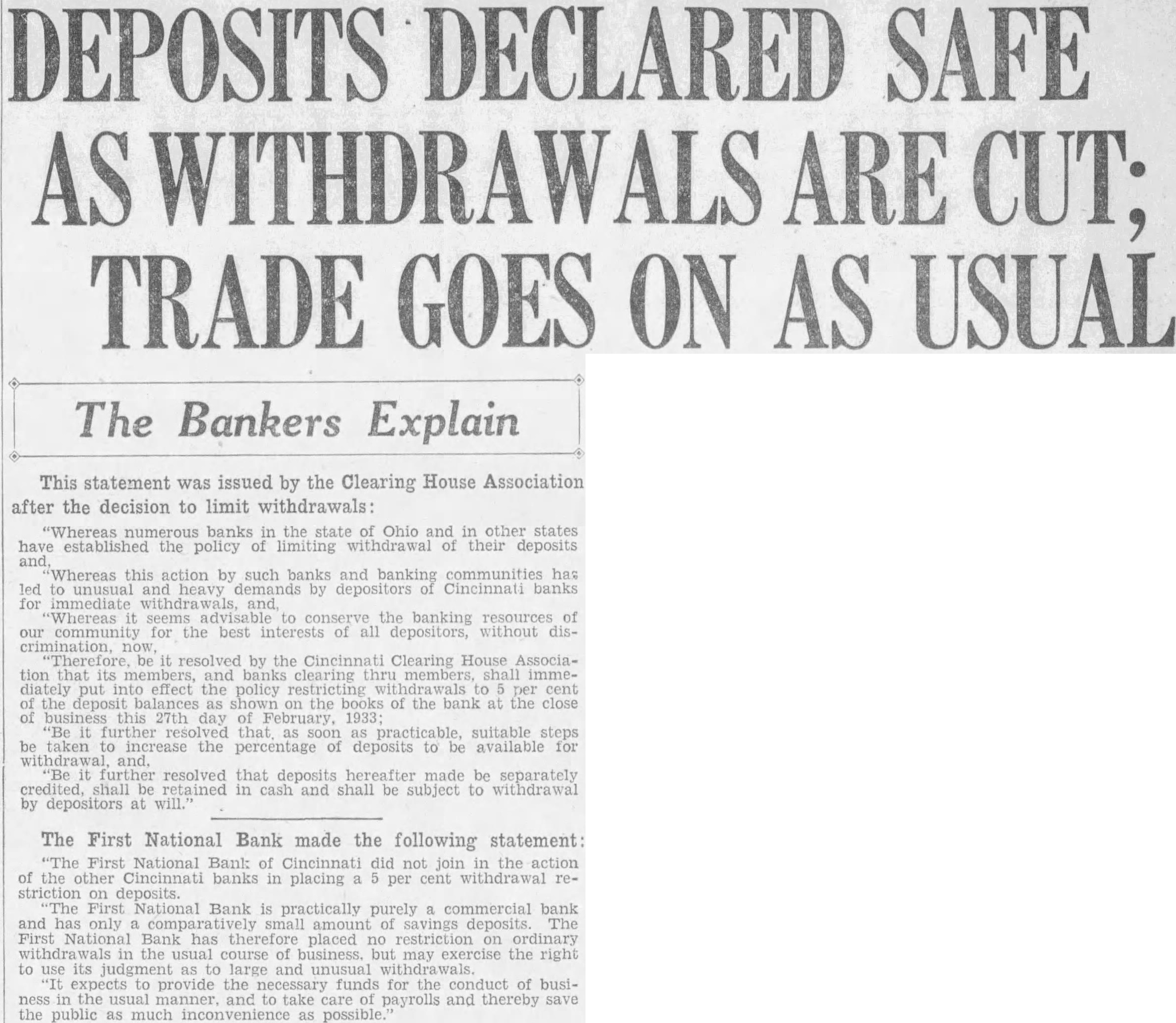

New Accounts, Opened From Now On, Will Not Be Subject to 5 Per Cent Limit, Banking Officials Explain

FIRST NATIONAL IS NOT AFFECTED

Action Taken by Clearing House Associa- tion After Situation in Other Parts of State Causes Uneasiness

There was but one topic of conversation in Cincinnati today. All banks but one had put into effect a ruling made at midnight, limiting withdrawals on checking and savings accounts to five per cent per month on deposits. Thousands of citizens, unable to grasp the meaning of the epochal financial decision, thronged banks learn first hand what all to at it meant. Altho the ruling applied only to Clearing Association members, with the sole of the First Bank, other Hamilton-co banks, which clear thru belonging to the association, also are affected. The exception to the ruling, the First National, felt the inasmuch as it does an almost entirely commercial business, would not be necessary join the other banks in making withdrawal restrictions. Speedy Adjustment Seen

Bankers believe business quickly will adjust itself to the new conditions as make apparent. The first need, the bankers agree, in keeping business running is provide facilities for full payroll payments. E. Edwards, president of the Fifth Third Union Trust Co., said Tuesday he did not anticipate many firms will be unable to pay their employes in full. He explained that new deposits will not be subject to the per cent limitation and that these, with the per cent withdrawals allowed on money now in the bank, will be sufficient to meet payrolls most It was learned that firms large on deposit, but with insufficient amounts to meet will be loans. Special allowances, as far practicable, will be made to give demands for payrolls preference, bankers indicated. Mr. Edwards said he anticipates no decrease in the amount of new deposits, emphasizing the fact that money now safer in the banks before. The the he requires that the banks hold the deposits in cash or in erty Bonds.

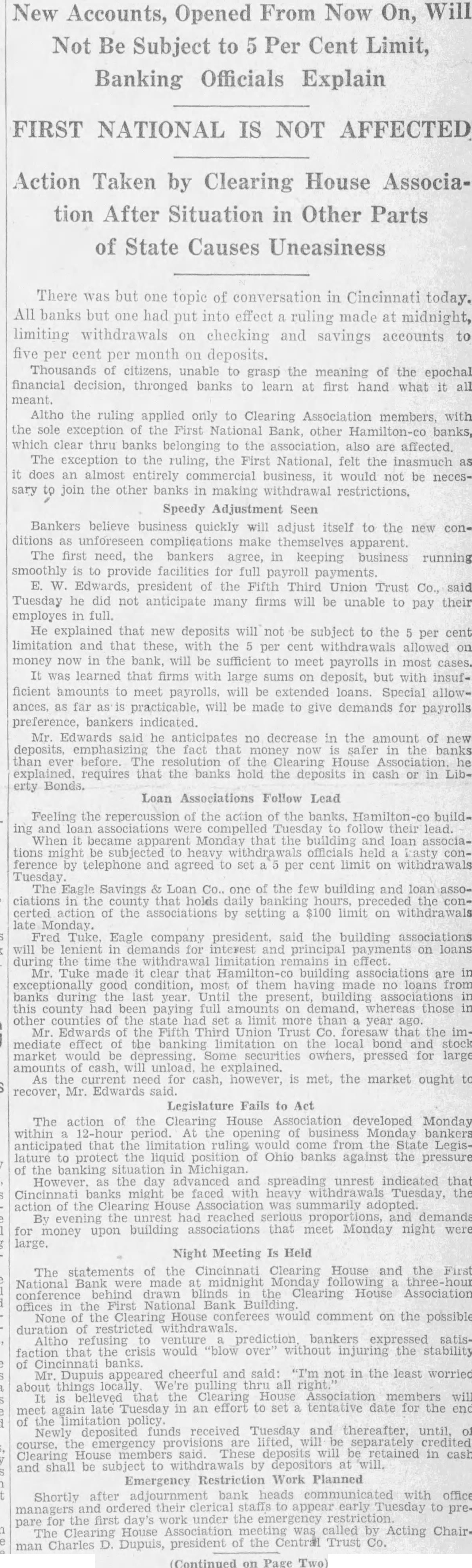

Loan Associations Follow Lead

Feeling the repercussion of the action of the banks. Hamilton-co building and their When Monday that the and loan associations be to heavy officials held conference by telephone and agreed to set per cent limit on withdrawals Tuesday. The Eagle Savings & Loan Co. one of the few building and loan associations in the county that holds daily banking the concerted action of the associations by setting a $100 limit on withdrawals Tuke, Eagle company president, said the building associations will be lenient interest payments on loans during the the limitation effect. Mr. Tuke made clear Hamilton-c building associations are in exceptionally good condition, them having made no loans from banks during the last year. Until the building associations this county paying full on demand, those the than year Mr. Edwards the Third Union Trust that the mediate effect the banking limitation local bond and stock market would be depressing Some owners, pressed for large amounts cash, explained. As the current need for cash, however, is met, the market ought to recover, Mr. Edwards

Legislature Fails to Act The action of the Clearing House developed Monday within period. At opening of Monday bankers anticipated that the ruling Legislature to liquid position of Ohio banks against the pressure of the banking the day advanced and spreading unrest indicated that Cincinnati faced with heavy Tuesday, the action of the House Association was summarily adopted. By evening the unrest had reached serious demands for money upon building associations that meet Monday night were large.

Night Meeting Is Held

The statements of the Cincinnati Clearing House and the First National Bank made drawn blinds Clearing House Association offices in First National Bank None House would comment on the possible restricted withdrawals. Altho refusing venture prediction bankers satisfaction that the would "blow over' without injuring the stability of banks. Dupuis cheerful and said: in the least worried about pulling thru It is that the Clearing House Association members will late Tuesday in an effort to set tentative date for the end of the funds received Tuesday and thereafter, until, of lifted, separately Clearing said. deposits retained in cash and shall be to withdrawals by depositors will. Emergency Restriction Work Planned after adjournment bank heads with office Shortly their clerical appear early Tuesday to for the first day's work under the The Clearing House Association Acting ChairCharles D. Dupuis, president the Central Trust Co. man

(Continued on Page Two)