Click image to open full size in new tab

Article Text

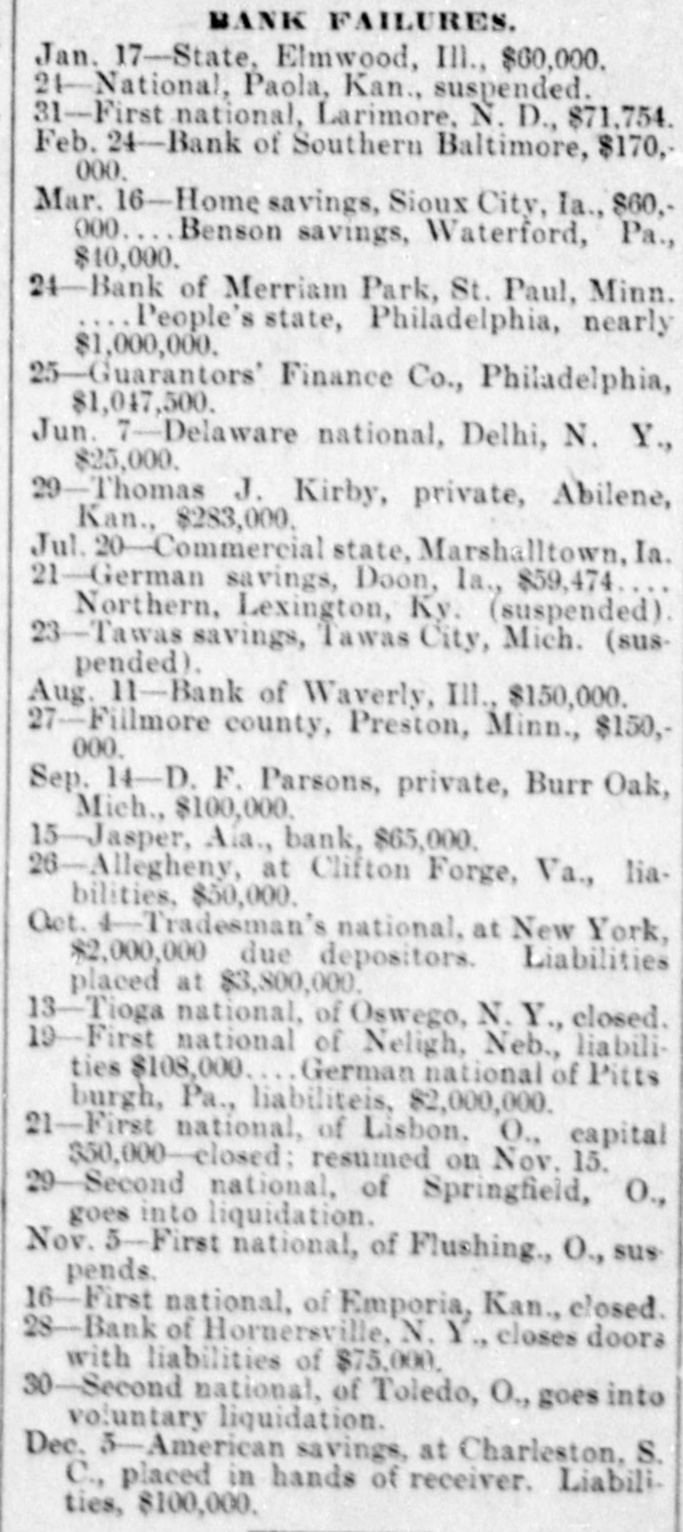

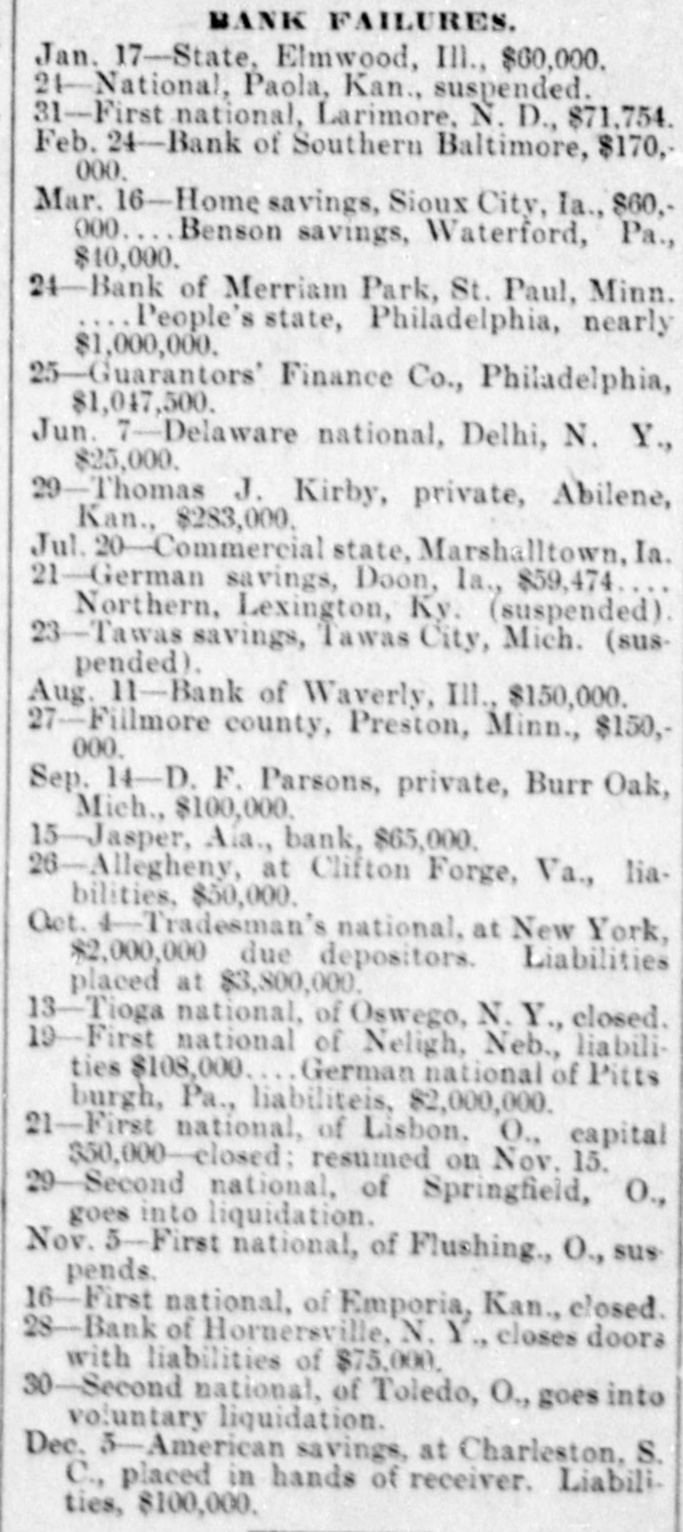

BANK FAILURES. Jan. 17-State, Elmwood, Ill. $60,000. 21-National, Paola, Kan., suspended. 31 - -First national, Larimore, N. D., $71,754. Feb. 24 Bank of Southern Baltimore, $170, 000. Mar. 16-Home savings, Sioux City, Ia. $60.000 Benson savings, Waterford, Pa., $10,000. 24 Bank of Merriam Park, St. Paul, Minn. People's state, Philadelphia, nearly $1,000,000. 25 Guarantors' Finance Co., Philadelphia, $1,047,500. Jun. 7-Delaware national, Delhi, N. Y., $25,000. 29 - -Thomas J. Kirby, private, Abilene, Kan., $283,000. Jul. :20-Commercialstate, Marshalltown, Ia. 21-German savings, Doon, la., $59,474 Northern, Lexington, Ky. (suspended) 23 Tawas savings, Tawas City, Mich. (suspended). Aug. 11-Bank of Waverly, Ill $150,000. 27-Fillmore county, Preston, Minn., $150,000. Sep. 14-D. F. Parsons, private, Burr Oak, Mich., $100,000. 15-Jasper, Aia. bank, $65,000. 26 3-Allegheny, at Clifton Forge, Va., liabilities, $50,000. Oct. 4-Tradesman's national, at New York, $2,000,000 due depositors. Liabilities placed at $3,800,000. 13-Tioga national, of Oswego, N. Y., closed. 10 -First national of Neligh, Neb., liabilities $108,000 German national of Pitts burgh, Pa., liabiliteis, $2,000,000. 21 - -First national, of Lisbon. O., capital $50,000- closed: resumed on Nov. 15. 29 Second national, of Springfield, O., goes into liquidation. Nov. 5 -First national, of Flushing., O., sus pends. -First national, of Emporia, Kan. closed. 28 Bank of Hornersville, N. Y., closes doora with liabilities of $75,000. 30 Second national, of Toledo, O., goes into voluntary liquidation. Dec. 5-American savings, at Charleston, S. C., placed in hands of receiver. Liabilities, $100,000.