Click image to open full size in new tab

Article Text

able yield of 14,435 bales. Port receipts 2,327, for season 8,594,825, last season 9,484,455. Exports 3,872, for season 4,425,027. Last season 7,704,132. Port stocks 1,684,710, last year 785,921. Combined shipboard stocks at New Orleans, Galveston and Houston 66,111, last year 55,171. Spot sales at southern markets 1,695, last year 2,318.

NEW YORK NEW YORK, June 28 (P)-Cotton was quiet here today but showed a generally steady undertone on week-end covering which seemed to be promoted by prospects for continued hot weather in the south, and relatively steady Liverpool cables. July contracts sold up to 13.60 and closed at 13.59, while the new October advanced to 13.06 and closed at 13.02, with the general market closing steady at net advances of 6 to 9 points. The opening was steady at an advance of 6 points to a decline of 4 points, near months being higher on the better cables while there was some liquidation in the later deliveries. The selling was limited, however, and after the initial offerings had been absorbed on setbacks of two or three points, the market steadied up on a moderate demand. This was attributed largely to covering, but there may have been some local buying late in the morning on the prospect for continued high temperatures in the western belt. The old October contract advanced to 13.31 and the new December to 13.22, with the more active months showing net advances of about 6 to 12 points at the best. Closing quotations were a few points off under realizing on gome positions. A few reports were said to be reaching the market here from the southwest referring to unfavorable effects of recent high temperatures on the plant, while there seemed little prospect of anything more than possible showers in central belt sections next week so far as indicated by the week-end forecast. Reports of a steadier tone in the stock market may have been a contributing factor on the late morning upturn in cotton but trading was not active and some brokers atributed the fluctuations chiefly to the usual week-end evening up of accounts. Cables received here from Liverpool said there had been continental buying together with covering and end-month trade calling in that market but reported that the sales of cotton cloths and yarns were unimportant with buyers cautious. The amount of cotton on shipboard awaiting clearance, at the end of the week was estimated at 67,000 bales against 60,742 last year. A private crop report was issued placing the decrease in acreage at 3.3 percent, the condition at 71 percent and the indicated yield at 14,435,000 bales.

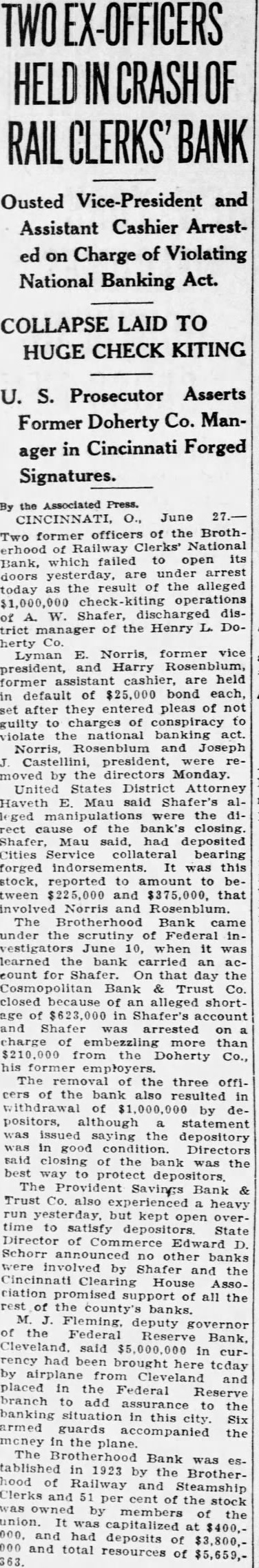

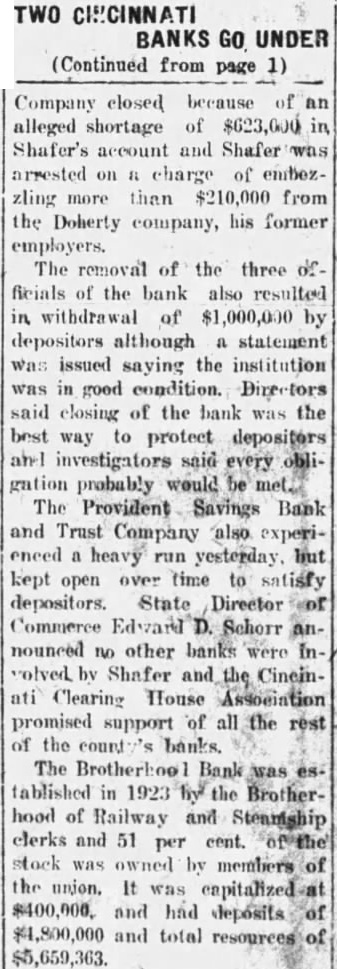

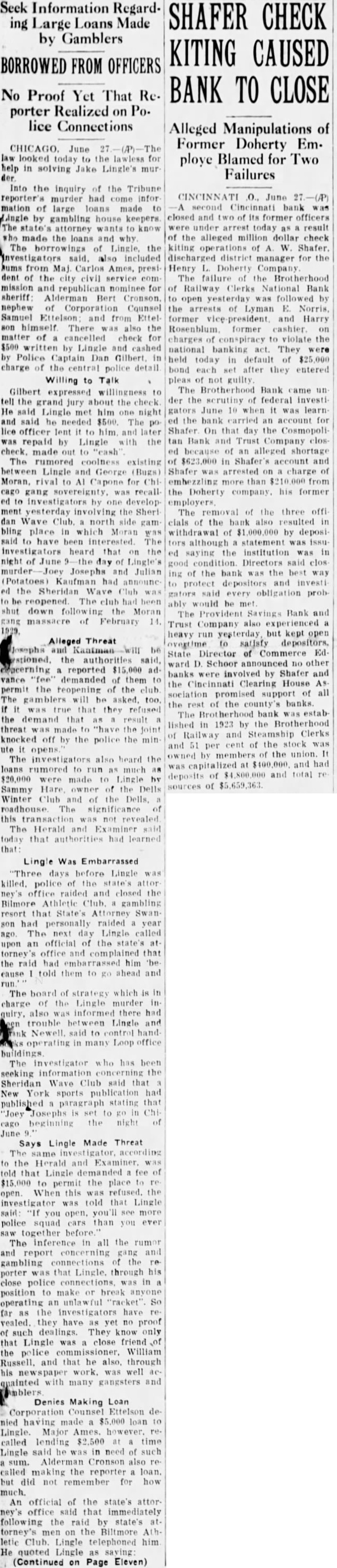

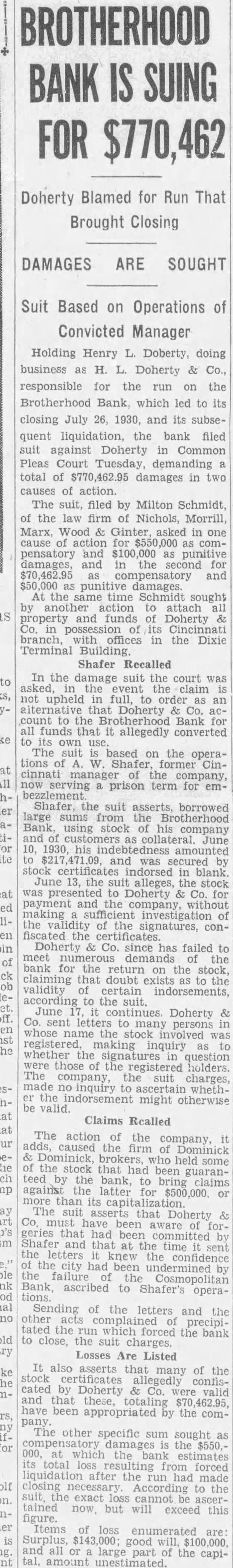

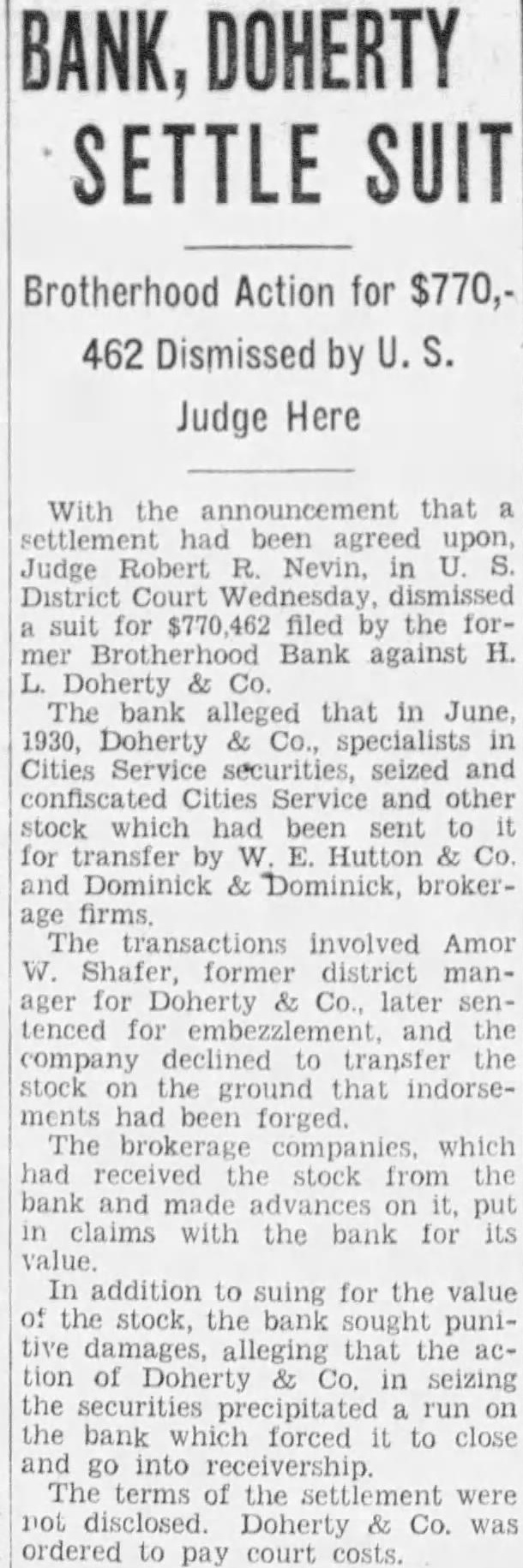

William Taylor, Cleveland, federal bank examiner, recently completed an audit of the Brotherhood Bank and on last Monday two changes were made in the official personnel of the bank shortly after directors said the institution was in sound condition. Michael G. Heintz was named vice president succeeding Lyman Norris, resigned and William L. Luebbe, was appointed assistant cashier in place of Harry Rosenblum who also resigned. Closing of the Brotherhood Bank came sixteen days after another Cincinnati bank, the Cosmopolitan Bank and Trust Company was forced to close on account of the $1,000,000 speculations of A. W. Shafer, former district manager of the H. L. Doherty Company. The Brotherhood Bank recently announced it had increased its rate of interest paid on deposits from four to five per cent. Million Withdrawn Deposits at the bank were said to total $4,800,000 and after the change in officials was made Monday the board of directors said depositors withdrew over $1,000,000. The unusually heavy withdrawal was the reason given by the directors for closing the bank. They said they voted to shut down the bank and place the assets in the hands of the controller of currency for liquidation. U. S. District Attorney Haventh E. Mau said that Taylor and I. J. Fulton, another Cleveland national bank examiner, had been in conference with him concerning the banks affairs for two weeks. J. J. Castillini is president. The majority of the bank's stock is owned by the Brotherhood of Railway and Steamship Clerks, freight handlers, express and station employes, of which there are

120,000 members in the United States. The bank was established at a convention of the brotherhood held at Dallas, Texas in 1922. The local building was constructed immediately and opened its doors in 1923. Many labor unions were said to have deposits in the bank.

Receiver Named WASHINGTON, June 26. (AP) J. W. Pole, comptroller of the currency, appointed Ira Fulton, a National bank examiner, today as receiver for the Brotherhood of Railway Clerks bank which closed its doors in Cincinnati.